Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

-

Watch Out for Scammers!

Make sure the person you're messaging is trusted and do not use PayPal Friends & Family for your purchase, this is a common tactic for scammers. Keep safe!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Reloading Equipment Primers for sale!

- Thread starter Mikey1884

- Start date

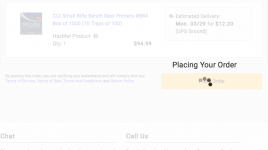

Cci militarylarge rifle and small rifle BR4’s currently up foe grabs on midway 11:55 EST

Always get stuck here

Attachments

I'm insane so I kept clicking. Finally got - "your cart is empty" Then I got a notice it was processing!

I would love to see the analytics on these sites when shit like this happens. A sudden influx of a half a million people all clicking on the same thing at the same time...crazy.

On the bright side, I'm seeing availability of primers more regularly so that means we are through the worst of it. I'll continue to wait and by mid to late summer, hopefully be back to being able to buy 5k or more at a time.

On the bright side, I'm seeing availability of primers more regularly so that means we are through the worst of it. I'll continue to wait and by mid to late summer, hopefully be back to being able to buy 5k or more at a time.

Keep in mind we’re likely competing against an army of automated buying programs. Same reason it took me a couple months trying to get my kids a Nintendo switch

G

Got a pack and some Hornady 140’s.Winchester #41s are still in stock

Last edited:

Good catch. Yes, they were HPBTs.I don't think they are eld's

my screen took forever loading and just kept saying "error" finally just walked away and got back to work. just checked my emails and my order was processed even though all i ever got was error screens. so i guess i have a brick on the way.

I like it. It is unfortunate for those that really need them but it's a good thing for the market as it will stop people from hoarding or price gouging on the open market.What a joke br4=$95

Yeah it's great, the shops get to gouge instead of the resellers....I like it. It is unfortunate for those that really need them but it's a good thing for the market as it will stop people from hoarding or price gouging on the open market.

That's like saying it's nice to get fucked with someone else's dick every now and then

No not good for the market as long as people are willing to pay huge money to get brick, people will gladly buy at 95 and sell for 200-300. Market will auto tune itself when people stop overpaying.I like it. It is unfortunate for those that really need them but it's a good thing for the market as it will stop people from hoarding or price gouging on the open market.

This comment made my Friday as it was a shitty day...Thanks for the laughYeah it's great, the shops get to gouge instead of the resellers....

That's like saying it's nice to get fucked with someone else's dick every now and then

What makes you think people will stop overpaying?No not good for the market as long as people are willing to pay huge money to get brick, people will gladly buy at 95 and sell for 200-300. Market will auto tune itself when people stop overpaying.

How does it stop “price gauging on the open market”? Near as I can tell it only increases the resellers purchase price. And in turn, the end user’s purchase price.I like it. It is unfortunate for those that really need them but it's a good thing for the market as it will stop people from hoarding or price gouging on the open market.

But, I will readily admit that advanced economics is not my wheel house. Not even close.

Goberment money printer going Brrrrrrr. I like how people cry about 100bux for 1k primers, when they are now paying 100bux more a month to fill their trucks gas tanks!

Shit 1/2 inch OSB is 55 a sheet and everything we have is spoken for thanks to the new EPA rules on the resin they use. "Once a government realizes there is power in shortages they will create more shortages".

It is the law of supply and demand. There are only two ways to reduce the price.

Increase the supply. More people selling more components and ammo.

Decrease the demand.

Demand is the big problem these days.

The democrats aka Socialists are driving demand way up.

The .gov seems to be on another big buying spree, anyone that expects riots in their neighborhood buys in desperation and anyone that can feel the building pressure that will bring a revolution is getting ready while they can. The smart people bought when ammo was cheap and are already ready.

Of course most of us just want to shoot our usual several thousands of rounds per year.

Another way demand is decreased is where everyone limits out their credit cards paying the stupid prices.

The outrageous prices are not the cause but only a symptom of the problem caused by the Socialists.

If the Socialists weren't so stupid they would realize there is no way in hell they can succeed but they only listen to themselves and think they are destined to turn America into a commie paradise.

Back to more a personal reality, A DHL truck just delivered another order from MP molds in Slovenia! Life is good!

Increase the supply. More people selling more components and ammo.

Decrease the demand.

Demand is the big problem these days.

The democrats aka Socialists are driving demand way up.

The .gov seems to be on another big buying spree, anyone that expects riots in their neighborhood buys in desperation and anyone that can feel the building pressure that will bring a revolution is getting ready while they can. The smart people bought when ammo was cheap and are already ready.

Of course most of us just want to shoot our usual several thousands of rounds per year.

Another way demand is decreased is where everyone limits out their credit cards paying the stupid prices.

The outrageous prices are not the cause but only a symptom of the problem caused by the Socialists.

If the Socialists weren't so stupid they would realize there is no way in hell they can succeed but they only listen to themselves and think they are destined to turn America into a commie paradise.

Back to more a personal reality, A DHL truck just delivered another order from MP molds in Slovenia! Life is good!

Shit 1/2 inch OSB is 55 a sheet and everything we have is spoken for thanks to the new EPA rules on the resin they use. "Once a government realizes there is power in shortages they will create more shortages".

shit you dont think they already know that there is power in shortages? They know

I don't disagree with anything you've said, and I think most folks on this forum have a decent handle on supply and demand. But the uncool aspect of this is Midway's rather unique response as compare to Brownell's, Graft's, Natchez, Scheel's, and [insert name of other large and typically reputable dealer of reloading supplies]. None--zero--zip--nada of the other listed shops have jacked up prices in the same manner as Midway. Prices have risen very slightly per 1k for the other outfits, which blows the notion that distributor pricing is causing Midway to double its prior pricing. All the other major shops have been dropping primers for reasonable rates (you have to be super diligent and they sell out very quickly--but I've personally bought multiple times from all of them in the past few months). This severely hampers the argument that Midway's goal in doubling (or more with the 1 box limit and shipping fees) the cost of primers, bullets, and other components is to help the market correct (i.e., set prices so high as to make reselling problematic). One has to assume Midway knows none of its closest competitors are following suit (PowderValley is close). And anyone with a reasonable grasp on economics also knows that if all retailer start following Midway's lead and double+ their margins . . . the end result will simply be an exponential increase in prices on the secondary market (i.e., GB, locally, and here).It is the law of supply and demand. There are only two ways to reduce the price.

Increase the supply. More people selling more components and ammo.

Decrease the demand.

Demand is the big problem these days.

The democrats aka Socialists are driving demand way up.

The .gov seems to be on another big buying spree, anyone that expects riots in their neighborhood buys in desperation and anyone that can feel the building pressure that will bring a revolution is getting ready while they can. The smart people bought when ammo was cheap and are already ready.

Of course most of us just want to shoot our usual several thousands of rounds per year.

Another way demand is decreased is where everyone limits out their credit cards paying the stupid prices.

The outrageous prices are not the cause but only a symptom of the problem caused by the Socialists.

If the Socialists weren't so stupid they would realize there is no way in hell they can succeed but they only listen to themselves and think they are destined to turn America into a commie paradise.

Back to more a personal reality, A DHL truck just delivered another order from MP molds in Slovenia! Life is good!

I'm a lifelong Missourian and like to support Missouri-based businesses. For now, that means Grafts will be getting my business whenever possible. Mr. Potterfield (estimated net worth in excess of $300 million) doesn't need to abuse his customer base or promote further inflation in the component market to make a living.

One way of looking at the situation with Midway is: It it what it is.

When a supply chain is stressed like this we can see the differences between dealers that we may not have known about before and I for one have learned who we should be loyal to in the future. While midway has not sunk to the level of total scumbags like cheaper than dirt they have self identified as something I would perfer not to mess with in the future.

When a supply chain is stressed like this we can see the differences between dealers that we may not have known about before and I for one have learned who we should be loyal to in the future. While midway has not sunk to the level of total scumbags like cheaper than dirt they have self identified as something I would perfer not to mess with in the future.

"It is what it is," while a catchy phrase, is a meaningless phrase. It's used all too often as a defeatist phrase. Applied uniformly, it's a good way to be steamrolled by life and dismiss the notion that your actions can alter the reality around you.One way of looking at the situation with Midway is: It it what it is.

Not an indictment of you, Bob2650 (you seem to continue by saying you will do something to possibly affect change), I'm just not a fan of that phrase generally (though it can have application in certain instances were we have no power to alter prior events and their ultimate effects).

Yes, Midway is something I can not change except by not buying much from them and it has been more than a couple of years since I made an order so my ultimate action is more or less inconsequential to them. Therefore I used my defeatist phrase.

In my messed up little world "It is what it is" was a phrase used by a mid level manager, Officer or Senior NCO to pass on orders from above to men who recognized the order as foolish. This phrase communicates to the lower ranks that the manager doesn't like it either but can't do anything about it. Now that I think about it too much it does seem inappropriate for the situation.

In my messed up little world "It is what it is" was a phrase used by a mid level manager, Officer or Senior NCO to pass on orders from above to men who recognized the order as foolish. This phrase communicates to the lower ranks that the manager doesn't like it either but can't do anything about it. Now that I think about it too much it does seem inappropriate for the situation.

Similar threads

Reloading Equipment

Primers for sale Central MS

- Replies

- 1

- Views

- 194

Reloading Equipment

SOLD Dillion 550 w/lots of extras

- Replies

- 3

- Views

- 358

Reloading Equipment

[CO] Federal Primers (GM210M, GM205M, 210) & 8lbs IMR 8208 XBR

- Replies

- 3

- Views

- 268

- Replies

- 4

- Views

- 221