Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Inflation.......... ?

- Thread starter Hobo Hilton

- Start date

There have been times when I chased a mirage and it paid off...Always buying the S&P 500 pays off again.

You have done well.

Inflation is now the norm. Plan ahead, adapt.

Consumers increasingly doubt the Federal Reserve can achieve its inflation goals anytime soon, according to a survey Monday from the New York Federal Reserve.

While the outlook over the next year was unchanged at 3%, that wasn’t the case for the longer term. At the three-year range, expectations rose 0.3 percentage point to 2.7%, while the five-year outlook jumped even more, up 0.4 percentage point to 2.9%.

All three are well ahead of the Fed’s 2% goal for 12-month inflation, indicating the central bank may need to keep policy tighter for longer. Economists and policymakers consider expectations as a key factor in viewing the path of inflation, so the Survey of Consumer Expectations for February could be bad news.

www.cnbc.com

www.cnbc.com

Consumers increasingly doubt the Federal Reserve can achieve its inflation goals anytime soon, according to a survey Monday from the New York Federal Reserve.

While the outlook over the next year was unchanged at 3%, that wasn’t the case for the longer term. At the three-year range, expectations rose 0.3 percentage point to 2.7%, while the five-year outlook jumped even more, up 0.4 percentage point to 2.9%.

All three are well ahead of the Fed’s 2% goal for 12-month inflation, indicating the central bank may need to keep policy tighter for longer. Economists and policymakers consider expectations as a key factor in viewing the path of inflation, so the Survey of Consumer Expectations for February could be bad news.

Long-term inflation expectations rise, spelling possible trouble for the Fed, survey shows

At the three-year range, expectations rose 0.3 percentage point to 2.7%, while the five-year outlook jumped even more, up 0.4 percentage point to 2.9%.

American's don't trust the US Government. Here is one more reason not to trust.

Inflation is much higher than what the Government is reporting. They artificially hold down the inflation numbers in order to save their ass.

My personal inflation rate is 20% / year. I'll choose to believe my numbers rather than theirs.

www.cnbc.com

www.cnbc.com

Inflation is much higher than what the Government is reporting. They artificially hold down the inflation numbers in order to save their ass.

My personal inflation rate is 20% / year. I'll choose to believe my numbers rather than theirs.

Consumer prices rose 0.4% in February and 3.2% from a year ago

Inflation rose again in February, keeping the Fed on course to wait at least until the summer before starting to lower interest rates.

https://www.shadowstats.com/ now offline ofcourse was really good source of more accurate and realistic numbers...

But as far as inflation goes best corrective factor to .gov data to use is 3 or 4. Whatever print there is multiply by at least 3 and you get real number on the low end.

But as far as inflation goes best corrective factor to .gov data to use is 3 or 4. Whatever print there is multiply by at least 3 and you get real number on the low end.

mines around 30-40%. Food and gas are my big budget items.American's don't trust the US Government. Here is one more reason not to trust.

Inflation is much higher than what the Government is reporting. They artificially hold down the inflation numbers in order to save their ass.

My personal inflation rate is 20% / year. I'll choose to believe my numbers rather than theirs.

Consumer prices rose 0.4% in February and 3.2% from a year ago

Inflation rose again in February, keeping the Fed on course to wait at least until the summer before starting to lower interest rates.www.cnbc.com

mortgage hasn't changed; utilities have increased by 10%

think most here could fix most inflation,some of this addresses restoring liberty and protecting the future

shut down 80% of the alphabets ,budget,staffing and reach.

reduce the few left to 40% of the above areas.

bring all military home from europe,africa and drastic reducion of our military presence in mid east and asia.

toss all resources needed at the re establishment of energy independence. ( reduce interference with private sector)

apply radical means testing for any "entitlement": wic,adc,medicaid,title 8,welfare

revert food stamps back to "commodity" food giveaways.

leave UN and expel all of it's parts. confiscate any resources it has in US.

end anything resembling "green new deal" ideas

end any further use of AI or AI research. make doing either a capital offense.

end germ warfare research. make continuing it a capital offense.

return voting to 1 election day.

close the fed and do a forensic accounting of all of it's actions. making sure no elite players run with the money.

return to gold standard.

close the border and set up it's protection (mines,razor wire,fence, auto weapons) stop all immigration until some standards that help america can be determined.

expel. 100% of illegals no matter how long here,from where and why they came.

same applies to the political sanctuary scammers.

protect the grid.

i do know that trying to implement all or even a part of these would lead to a huge uprising and civil war. the deep state is not going down quietly.

shut down 80% of the alphabets ,budget,staffing and reach.

reduce the few left to 40% of the above areas.

bring all military home from europe,africa and drastic reducion of our military presence in mid east and asia.

toss all resources needed at the re establishment of energy independence. ( reduce interference with private sector)

apply radical means testing for any "entitlement": wic,adc,medicaid,title 8,welfare

revert food stamps back to "commodity" food giveaways.

leave UN and expel all of it's parts. confiscate any resources it has in US.

end anything resembling "green new deal" ideas

end any further use of AI or AI research. make doing either a capital offense.

end germ warfare research. make continuing it a capital offense.

return voting to 1 election day.

close the fed and do a forensic accounting of all of it's actions. making sure no elite players run with the money.

return to gold standard.

close the border and set up it's protection (mines,razor wire,fence, auto weapons) stop all immigration until some standards that help america can be determined.

expel. 100% of illegals no matter how long here,from where and why they came.

same applies to the political sanctuary scammers.

protect the grid.

i do know that trying to implement all or even a part of these would lead to a huge uprising and civil war. the deep state is not going down quietly.

How it Started... How it's Going: Inflation under Biden drives up costs for bread, butter, chicken

An examination of the prices of butter, boneless chicken breast, white bread and sugar shows how grocery store items are more expensive because of inflation.

Stubborn inflation is a problem for the Fed

It's getting rough out there; when people can't afford a dollar store

www.newsnationnow.com

www.newsnationnow.com

Dollar Tree, Family Dollar to close 1,000 stores

The discount retailer is looking to improve profitability

More to come. I was in Missoula, MT today picking up supplies at several different locations. Lots and lots of new construction (apartments, single family homes, small commercial buildings). I traveled and worked all over America so I have witnessed growth. As I traveled today, the thing that jumped out was this.... There is no giant industrial "anchor" industry. All of the timber related operations have gone out of business. Mining was a dirty business so there is no mining. No refinery or large energy related industry. Farming and cattle have been pushed way away from the city. There is a University, a newly expanded airport and the US Forest Service Headquarters.....It's getting rough out there; when people can't afford a dollar store

Dollar Tree, Family Dollar to close 1,000 stores

The discount retailer is looking to improve profitabilitywww.newsnationnow.com

Every new project is driven by "consumer consumption"... New people showing up every day to do less skilled work while living in a shoe box in a city... Hospitals / health care is consumer driven. New car sales are consumer driven.

Until inflation is reversed, this is like caged rats feeding on one another until they are all eaten up. I see this through out the Bitterroot Valley. Missoula is surrounded by bedroom communities.

America is now "producing" very little. Unsustainable.

Hmmmm.... "Troublesome". I guess that's another way to put it. How far will I get at the grocery store telling them I don't have enough money to pay for my groceries... Troublesome...

Wholesale prices accelerated at a faster than expected pace in February, another reminder that inflation remains a troublesome issue for the U.S. economy.

www.cnbc.com

www.cnbc.com

Wholesale prices accelerated at a faster than expected pace in February, another reminder that inflation remains a troublesome issue for the U.S. economy.

Wholesale inflation rose 0.6% in February, more than expected

The producer price index for February was expected to increase 0.3%, according to the Dow Jones consensus estimate.

Government driven growth.More to come. I was in Missoula, MT today picking up supplies at several different locations. Lots and lots of new construction (apartments, single family homes, small commercial buildings). I traveled and worked all over America so I have witnessed growth. As I traveled today, the thing that jumped out was this.... There is no giant industrial "anchor" industry. All of the timber related operations have gone out of business. Mining was a dirty business so there is no mining. No refinery or large energy related industry. Farming and cattle have been pushed way away from the city. There is a University, a newly expanded airport and the US Forest Service Headquarters.....

Every new project is driven by "consumer consumption"... New people showing up every day to do less skilled work while living in a shoe box in a city... Hospitals / health care is consumer driven. New car sales are consumer driven.

Until inflation is reversed, this is like caged rats feeding on one another until they are all eaten up. I see this through out the Bitterroot Valley. Missoula is surrounded by bedroom communities.

America is now "producing" very little. Unsustainable.

been saying for many years, gov is letting in illegals to drive construction industry... Housing is about the only thing that's 'made' here. If you get rid of the illegals and NON native born, the housing prices will drop and people would be able to pursue the 'American' dream.

Where is this rate coming from?

Just curious

Car insurance costs are up 21%—but this is ‘the worst thing to do’ if you’re looking for ways to save

Car insurance costs are up 21%—but this is 'the worst thing to do' if you're looking for ways to save

Car insurance was the biggest upward mover in Tuesday's inflation report. Experts say you can make moves to keep your premium down.

same place Joe pulls his numbers from..... LOLCar insurance costs are up 21%—but this is ‘the worst thing to do’ if you’re looking for ways to save

Car insurance costs are up 21%—but this is 'the worst thing to do' if you're looking for ways to save

Car insurance was the biggest upward mover in Tuesday's inflation report. Experts say you can make moves to keep your premium down.www.cnbc.com

Pulling my own numbers from my reality budget.same place Joe pulls his numbers from..... LOL

When talking to other's, it's easy to see who is drinking the Cool Aid.

FED Reserve is still "circling the airport", hoping for a soft landing.

Jerome says more inflation is needed to tame inflation....

https://www.cnbc.com/2024/03/18/how-the-federal-reserves-next-move-impacts-your-money.html

Jerome says more inflation is needed to tame inflation....

https://www.cnbc.com/2024/03/18/how-the-federal-reserves-next-move-impacts-your-money.html

There have always been American's living pay check to pay check... Now there are more in that boat.

A majority of Americans say they can’t afford a $1,000 emergency expense, a recent report from Bankrate finds.

Only 44% of Americans surveyed said they could use their savings to pay for an unexpected expense, instead opting to put it on a credit card or borrow cash from family or friends.

www.cnbc.com

www.cnbc.com

A majority of Americans say they can’t afford a $1,000 emergency expense, a recent report from Bankrate finds.

Only 44% of Americans surveyed said they could use their savings to pay for an unexpected expense, instead opting to put it on a credit card or borrow cash from family or friends.

56% of Americans can't afford a $1,000 emergency expense: We are 'living in a paycheck-to-paycheck nation,' money expert says

The current economic environment is ideal for shopping around for high-yield savings products and building your emergency savings.

The rise in the GDP is nothing more than inflation. Paying more USD's for the exact same item. The buying power of the USD continues to decrease.

However, the projected change in real GDP for 2024 was 2.1% in the March projection, up from 1.4% in December. Core PCE inflation projections also ticked up, to 2.6% from 2.4%.

However, the projected change in real GDP for 2024 was 2.1% in the March projection, up from 1.4% in December. Core PCE inflation projections also ticked up, to 2.6% from 2.4%.

Why auto insurance rates are skyrocketing in the U.S.

The average annual premium for full coverage auto insurance in the U.S. rose 26% from 2023 to 2024, according to Bankrate.

Inflation = Make more money, spend more money.

The result is that US wages for fully in-office roles are surging. According to ZipRecruiter data, seen by the BBC, companies were offering on average $82,037 (£64,562) for fully in-person roles by March 2024 – an increase of more than 33% versus 2023 ($59,085; £46,499). The trend is cross-sector: compared to hybrid ($59,992; £47,211) and fully remote ($75,327; £64,320) roles, workers appear to be more likely to increase their salaries by returning to pre-pandemic office schedules.

www.bbc.com

www.bbc.com

The result is that US wages for fully in-office roles are surging. According to ZipRecruiter data, seen by the BBC, companies were offering on average $82,037 (£64,562) for fully in-person roles by March 2024 – an increase of more than 33% versus 2023 ($59,085; £46,499). The trend is cross-sector: compared to hybrid ($59,992; £47,211) and fully remote ($75,327; £64,320) roles, workers appear to be more likely to increase their salaries by returning to pre-pandemic office schedules.

US salaries are surging for fully in-office jobs

Bosses want their workers back on-site on a more permanent basis. They're willing to pay a premium to do so.

most bosses aren't happy unless they can see their serfsInflation = Make more money, spend more money.

The result is that US wages for fully in-office roles are surging. According to ZipRecruiter data, seen by the BBC, companies were offering on average $82,037 (£64,562) for fully in-person roles by March 2024 – an increase of more than 33% versus 2023 ($59,085; £46,499). The trend is cross-sector: compared to hybrid ($59,992; £47,211) and fully remote ($75,327; £64,320) roles, workers appear to be more likely to increase their salaries by returning to pre-pandemic office schedules.

US salaries are surging for fully in-office jobs

Bosses want their workers back on-site on a more permanent basis. They're willing to pay a premium to do so.www.bbc.com

I doubt it's from the increased break ins and thefts

Why auto insurance rates are skyrocketing in the U.S.

The average annual premium for full coverage auto insurance in the U.S. rose 26% from 2023 to 2024, according to Bankrate.www.cnbc.com

inflation

illegals

other car owners with no insurance

Any reason will do....I doubt it's from the increased break ins and thefts

inflation

illegals

other car owners with no insurance

It's just business.... It always has been.most bosses aren't happy unless they can see their serfs

The wording has been chosen very carefully. Makes it sound like the Government is doing you a favor and letting you live in a box. This problem was created by "The Government". Again, an excellent example of the Government trying to correct a problem it created.

Inflation marches on.

_________

The new approach utilizes "new methodologies for calculating and updating the program's limits," which were part of a final rule published on Feb. 29, FHA explained in a press statement.

www.foxbusiness.com

www.foxbusiness.com

Inflation marches on.

_________

FHA raises loan limits for manufactured housing for the first time in 15 years

Treasury also eases access to unused COVID-19 funds for affordable housing

The FHA said the increase better reflects today's market prices for manufactured homes and should encourage more lenders to offer loans to homebuyers seeking to purchase manufactured homes, also known as mobile homes, and the lots on which they sit. This is the first update to the Title I program loan limits since 2008 and is part of President Joe Biden's push to increase the supply and use of manufactured homes as an affordable housing option.The new approach utilizes "new methodologies for calculating and updating the program's limits," which were part of a final rule published on Feb. 29, FHA explained in a press statement.

FHA raises loan limits for manufactured housing for the first time in 15 years

HUD has raised the loan limits for manufactured housing to align with prices today.

So you can borrow more to live in a trailer that goes down in value . . . makes zero financial sense to borrow a large amount of money for a depreciating asset.

Effective for FHA case numbers assigned on or after March 29, 2024, the new nationwide Title I Manufactured Home Loan Program loan limits are as follows:

Effective for FHA case numbers assigned on or after March 29, 2024, the new nationwide Title I Manufactured Home Loan Program loan limits are as follows:

- Combination Loan (Single-section), $148,909

- Combination Loan (Multi-section), $237,096

- Manufactured Home Loan (Single-section), $105,532

- Manufactured Home Loan (Multi-section), $193,719

- Manufactured Home Lot Loan, $43,377

Housing for the illegals. Money for the Investment Bankers. Opportunity for the slum lords operating run down mobile home parks...So you can borrow more to live in a trailer that goes down in value . . . makes zero financial sense to borrow a large amount of money for a depreciating asset.

Effective for FHA case numbers assigned on or after March 29, 2024, the new nationwide Title I Manufactured Home Loan Program loan limits are as follows:

So, I can borrow almost a quarter million for a doublewide trailer. This makes for brilliant financial genius handling of finances, right? Anybody want to guess at what that double wide will be worth after twenty years and 32 days, which is the maximum term for insured loss to lender under Title 1?

- Combination Loan (Single-section), $148,909

- Combination Loan (Multi-section), $237,096

- Manufactured Home Loan (Single-section), $105,532

- Manufactured Home Loan (Multi-section), $193,719

- Manufactured Home Lot Loan, $43,377

$$$ opportunity for shit hole cities to cash in on "urban renewal".... Your taxpayers dollar at work.

This is the Goose that laid the Golden Egg for many. What's not to like ?

It's all good, the government will cover it. They're here to help!!So you can borrow more to live in a trailer that goes down in value . . . makes zero financial sense to borrow a large amount of money for a depreciating asset.

Effective for FHA case numbers assigned on or after March 29, 2024, the new nationwide Title I Manufactured Home Loan Program loan limits are as follows:

So, I can borrow almost a quarter million for a doublewide trailer. This makes for brilliant financial genius handling of finances, right? Anybody want to guess at what that double wide will be worth after twenty years and 32 days, which is the maximum term for insured loss to lender under Title 1?

- Combination Loan (Single-section), $148,909

- Combination Loan (Multi-section), $237,096

- Manufactured Home Loan (Single-section), $105,532

- Manufactured Home Loan (Multi-section), $193,719

- Manufactured Home Lot Loan, $43,377

Question:

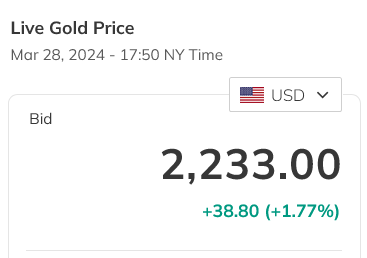

A month ago gold was at $2025 / ounce. Today it's about $2200 / ounce. Is that due to inflation ?

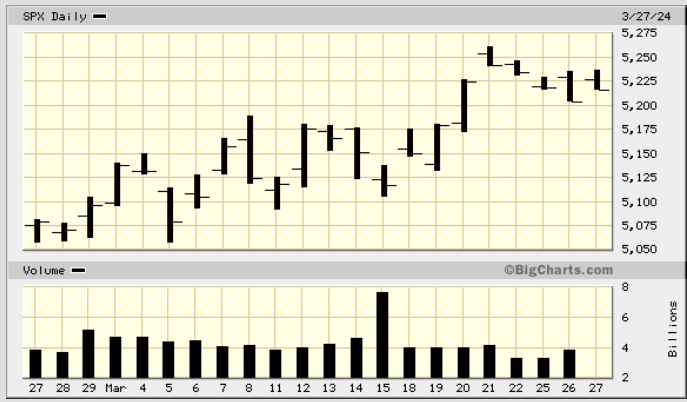

A month ago the SPX was at 5075. Today it is about 5220. Is that due to inflation?

If the answer is yes.... Then all everyone is doing is investing in inflation. No / Yes ?

A month ago gold was at $2025 / ounce. Today it's about $2200 / ounce. Is that due to inflation ?

A month ago the SPX was at 5075. Today it is about 5220. Is that due to inflation?

If the answer is yes.... Then all everyone is doing is investing in inflation. No / Yes ?

gold is used to hedge against inflation. 'protects' your assests.Question:

A month ago gold was at $2025 / ounce. Today it's about $2200 / ounce. Is that due to inflation ?

View attachment 8382598

A month ago the SPX was at 5075. Today it is about 5220. Is that due to inflation?

View attachment 8382606

If the answer is yes.... Then all everyone is doing is investing in inflation. No / Yes ?

gold increasing, just shows that people believe, hell yea, there's inflation, and they don't trust the stock market.

^ exactly

An ounce of gold still has about the same value vs other durable goods as it did a month, a year…hell,100 years ago.

The value of the comparative currency, in this case the US dollar, has dropped 10% in about a month.

An ounce of gold still has about the same value vs other durable goods as it did a month, a year…hell,100 years ago.

The value of the comparative currency, in this case the US dollar, has dropped 10% in about a month.

It's become a damn foot race. Like a hound and fox... The hound is inflation and the fox is gold / stocks.gold is used to hedge against inflation. 'protects' your assests.

gold increasing, just shows that people believe, hell yea, there's inflation, and they don't trust the stock market.

Try to invest in something that will out run the hound.

Working 40 hours and putting some money in the bank is a losing proposition.

Unsustainable

LOL, Inflation causing things to cost more, *SOME wages to rise (employers have to pay more to get decent help) which in turn, raises the prices of everything, which in turn feeds inflation, which causes employers to raise prices.

"BlackRock’s Fink: Inflation Will Be Sticky, But That’ll ‘Help’ Since Wages Are Rising"

” BlackRock CEO Larry Fink said that he thinks “we’re going to have higher inflation than most people believe, and much of that is going to help those people who are worried. Wage inflation is continuing. Food inflation has moderated in the last six to 12 months.” But we failed to account for how bad it was in late 2022 and early 2023.My "Fixed Income" is not inflating.LOL, Inflation causing things to cost more, *SOME wages to rise (employers have to pay more to get decent help) which in turn, raises the prices of everything, which in turn feeds inflation, which causes employers to raise prices.

"BlackRock’s Fink: Inflation Will Be Sticky, But That’ll ‘Help’ Since Wages Are Rising"

” BlackRock CEO Larry Fink said that he thinks “we’re going to have higher inflation than most people believe, and much of that is going to help those people who are worried. Wage inflation is continuing. Food inflation has moderated in the last six to 12 months.” But we failed to account for how bad it was in late 2022 and early 2023.

Recent data shows inflation is marching on.

NEW YORK, March 27 (Reuters) - Recent disappointing inflation data affirms the case for the U.S. Federal Reserve to hold off on cutting its short-term interest rate target, Fed Governor Christopher Waller said on Wednesday, but he did not rule out trimming rates later in the year.

"There is no rush to cut the policy rate" right now, Waller said in a speech at an Economic Club of New York gathering. Recent data "tells me that it is prudent to hold this rate at its current restrictive stance perhaps for longer than previously thought to help keep inflation on a sustainable trajectory toward 2%."

Rate cuts are not off the table, however, Waller said, noting that further progress expected on lowering inflation "will make it appropriate" for the Fed "to begin reducing the target range for the federal funds rate this year."

NEW YORK, March 27 (Reuters) - Recent disappointing inflation data affirms the case for the U.S. Federal Reserve to hold off on cutting its short-term interest rate target, Fed Governor Christopher Waller said on Wednesday, but he did not rule out trimming rates later in the year.

"There is no rush to cut the policy rate" right now, Waller said in a speech at an Economic Club of New York gathering. Recent data "tells me that it is prudent to hold this rate at its current restrictive stance perhaps for longer than previously thought to help keep inflation on a sustainable trajectory toward 2%."

Rate cuts are not off the table, however, Waller said, noting that further progress expected on lowering inflation "will make it appropriate" for the Fed "to begin reducing the target range for the federal funds rate this year."

A short explanation of inflation and how a country runs on "debt" :

"I can't explain the rates going up or down – that's not my bailiwick. But what I can explain is if rates go down, just another percentage point, that's what I'm hoping for, prices are going to go through the roof," The Corcoran Group founder and "Shark Tank" investor Barbara Corcoran said in a wide-ranging interview on "Cavuto: Coast to Coast" Wednesday.

www.foxbusiness.com

www.foxbusiness.com

"I can't explain the rates going up or down – that's not my bailiwick. But what I can explain is if rates go down, just another percentage point, that's what I'm hoping for, prices are going to go through the roof," The Corcoran Group founder and "Shark Tank" investor Barbara Corcoran said in a wide-ranging interview on "Cavuto: Coast to Coast" Wednesday.

'Shark Tank' star Barbara Corcoran reveals when housing prices ‘will go through the roof’

Once Fed rates reach 6% low, Barbara Corcoran predicts home prices will skyrocket because "everybody's going to charge the market" to "come out and buy."

Well, duh.

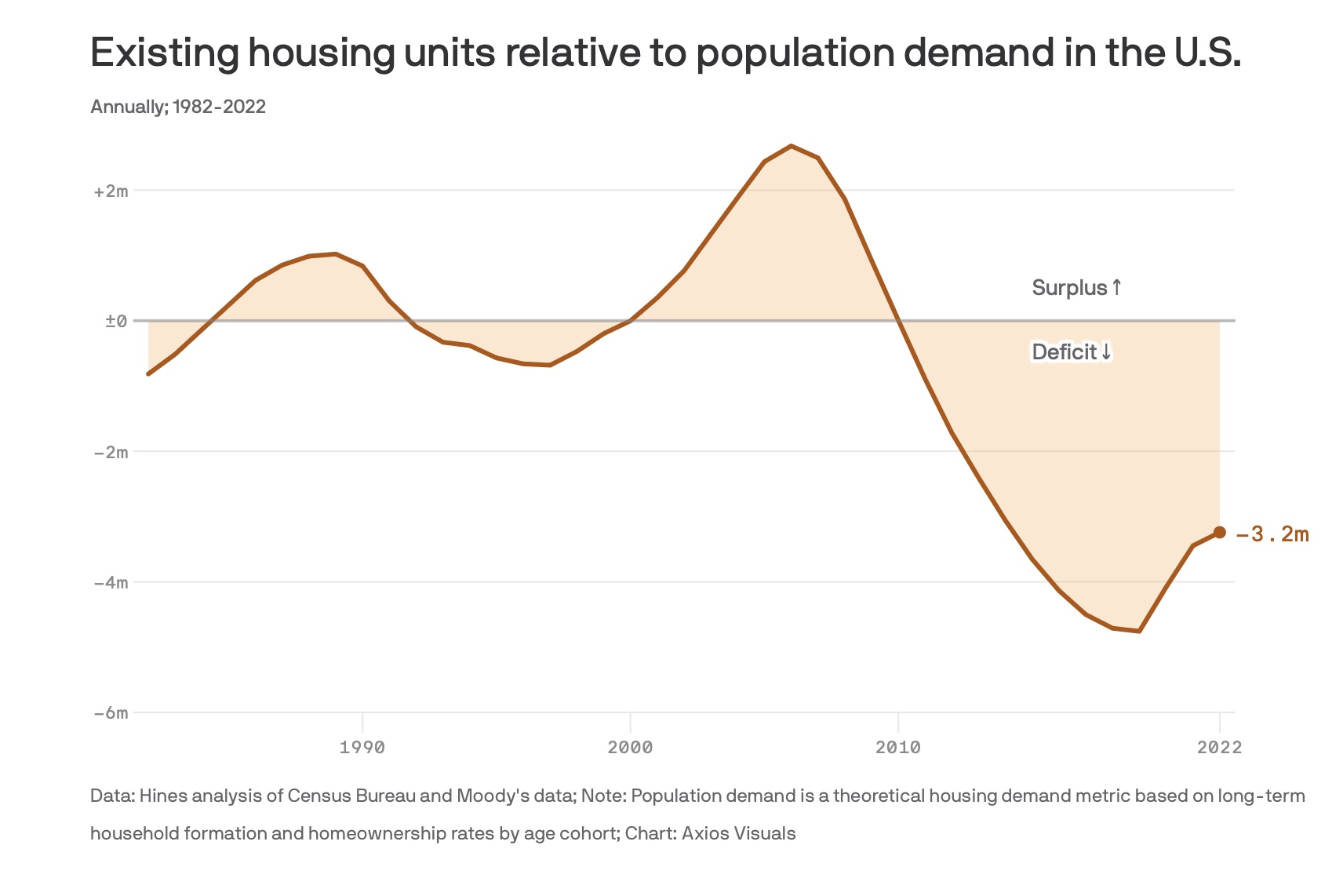

Housing prices are simple supply and demand, just like every other price.

If you lower the cost of borrowing, and make money more easily available to borrow to buy, well, that is going to increase demand. If supply does not change, then prices go up.

Why do we think supply and demand does not apply to housing?

Housing prices are simple supply and demand, just like every other price.

If you lower the cost of borrowing, and make money more easily available to borrow to buy, well, that is going to increase demand. If supply does not change, then prices go up.

Why do we think supply and demand does not apply to housing?

Impossible to calculate how much the US Government "dabbles" in housing.Well, duh.

Housing prices are simple supply and demand, just like every other price.

View attachment 8383445

If you lower the cost of borrowing, and make money more easily available to borrow to buy, well, that is going to increase demand. If supply does not change, then prices go up.

Why do we think supply and demand does not apply to housing?

FHA, Section 8, housing for the illegals, prisons, bail out of the S&L crash / Resolution Trust corporation, Save the children, military housing, etc, etc

A wild guess ... The "Government" in one form or another puts a roof over the heads of 25% of the people in America.\

Could be more than that worldwide.

________________________________

There were a total of 9.17 million people in subsidized public housing in the US in 2021, a decrease of 1.8% or 168,267 people from 2020. Department of Housing and Urban Development.

US population statistics, charts, and trends | USAFacts

From immigration, to infrastructure, to political trends, get clear, easy-to-understand insights and government data for all your questions on US population and society.

Last edited:

There has been some research done showing that many of the homes have been purchased by investors So many of the homes have been taken off the market. However, they are upside down and have begun to start selling. In many markets the prices of homes are coming down, some drastically. But coming down from the high doesn’t mean discount prices. we aren’t to that point in the recession yet.Well, duh.

Housing prices are simple supply and demand, just like every other price.

View attachment 8383445

If you lower the cost of borrowing, and make money more easily available to borrow to buy, well, that is going to increase demand. If supply does not change, then prices go up.

Why do we think supply and demand does not apply to housing?

Housing prices can fall 50% and the majority of people who bought before 2021 will still have equity.

When oil and gold both jump up more than 2% in a day.......... These prices are not coming down.

They are still headed up. Once they top, they may drop a little but never back to pre-pandemic levels.

The national median existing-home price for all housing types reached $384,500

For today, Thursday, March 28, 2024, the current average 30-year fixed mortgage interest rate is 6.91%,

They are still headed up. Once they top, they may drop a little but never back to pre-pandemic levels.

The national median existing-home price for all housing types reached $384,500

For today, Thursday, March 28, 2024, the current average 30-year fixed mortgage interest rate is 6.91%,

| WTI Crude • | 83.17 | +1.82 | +2.24% |

Last edited:

In January, 2021 the FED Reserve should have raised the interest rate to 10%.

It took 2 years for Paul Volcker to tame inflation (1980 - 1983).

Now, here we are, 3 years down the road and inflation has not been licked. The value of the USD continues to fall and the national debt is out of control.

US inflation, which peaked at 14.8 percent in March 1980, fell below 3 percent by 1983.[25][3] The Federal Reserve board led by Volcker raised the federal funds rate, which had averaged 11.2% in 1979, to a peak of 20% in June 1981. The prime rate rose to 21.5% in 1981 as well, which helped lead to the 1980–1982 recession,[26] in which the national unemployment rate rose to over 10%. In addition to the rises in key interest rates, the so-called 'Volcker shock' included monetarist-inspired policies, such as monetary targeting.

en.wikipedia.org

en.wikipedia.org

It took 2 years for Paul Volcker to tame inflation (1980 - 1983).

Now, here we are, 3 years down the road and inflation has not been licked. The value of the USD continues to fall and the national debt is out of control.

US inflation, which peaked at 14.8 percent in March 1980, fell below 3 percent by 1983.[25][3] The Federal Reserve board led by Volcker raised the federal funds rate, which had averaged 11.2% in 1979, to a peak of 20% in June 1981. The prime rate rose to 21.5% in 1981 as well, which helped lead to the 1980–1982 recession,[26] in which the national unemployment rate rose to over 10%. In addition to the rises in key interest rates, the so-called 'Volcker shock' included monetarist-inspired policies, such as monetary targeting.

Paul Volcker - Wikipedia

I agree 100% and wish JPow (J. Powell) would have kicked it to 20% off the bat. There is still too much money out there. I have seen minimal slow down in spending in certain income brackets, and I’m 100% certain they’re living off of easily available debt.In January, 2021 the FED Reserve should have raised the interest rate to 10%.

It took 2 years for Paul Volcker to tame inflation (1980 - 1983).

Now, here we are, 3 years down the road and inflation has not been licked. The value of the USD continues to fall and the national debt is out of control.

US inflation, which peaked at 14.8 percent in March 1980, fell below 3 percent by 1983.[25][3] The Federal Reserve board led by Volcker raised the federal funds rate, which had averaged 11.2% in 1979, to a peak of 20% in June 1981. The prime rate rose to 21.5% in 1981 as well, which helped lead to the 1980–1982 recession,[26] in which the national unemployment rate rose to over 10%. In addition to the rises in key interest rates, the so-called 'Volcker shock' included monetarist-inspired policies, such as monetary targeting.

Paul Volcker - Wikipedia

en.wikipedia.org

WASHINGTON, March 29 (Reuters) - U.S. prices increased moderately in February and the cost of services outside housing slowed considerably, keeping a June interest rate cut from the Federal Reserve on the table.

The personal consumption expenditures (PCE) price index rose 0.3% last month, the Commerce Department's Bureau of Economic Analysis said on Friday. Data for January was revised higher to show the PCE price index climbing 0.4% instead of 0.3% as previously reported.

In the 12 months through February, PCE inflation advanced 2.5% after increasing 2.4% in January. Economists polled by Reuters had forecast the PCE price index gaining 0.4% on the month and rising 2.5% year-on-year.

The personal consumption expenditures (PCE) price index rose 0.3% last month, the Commerce Department's Bureau of Economic Analysis said on Friday. Data for January was revised higher to show the PCE price index climbing 0.4% instead of 0.3% as previously reported.

In the 12 months through February, PCE inflation advanced 2.5% after increasing 2.4% in January. Economists polled by Reuters had forecast the PCE price index gaining 0.4% on the month and rising 2.5% year-on-year.

What we are experiencing is not an accident or just bad management. This is part of the concerted effort by the nwo to destroy western society. The plan is going great. Most refuse to admit the scale and stated goals at work here.In January, 2021 the FED Reserve should have raised the interest rate to 10%.

It took 2 years for Paul Volcker to tame inflation (1980 - 1983).

Now, here we are, 3 years down the road and inflation has not been licked. The value of the USD continues to fall and the national debt is out of control.

US inflation, which peaked at 14.8 percent in March 1980, fell below 3 percent by 1983.[25][3] The Federal Reserve board led by Volcker raised the federal funds rate, which had averaged 11.2% in 1979, to a peak of 20% in June 1981. The prime rate rose to 21.5% in 1981 as well, which helped lead to the 1980–1982 recession,[26] in which the national unemployment rate rose to over 10%. In addition to the rises in key interest rates, the so-called 'Volcker shock' included monetarist-inspired policies, such as monetary targeting.

Paul Volcker - Wikipedia

en.wikipedia.org

When Volcker made that move, I was in my early 30's, married, 2 children, mortgage and running my on small business. He moved so quick, the average middle class, working, blue collar community suffered very little. Some of us did well since the banks were paying a nice interest rate on the money we had in savings. In looking back it was just a blip on my radar. Nothing as financially severe as the S&L Crash or the "Great Recession".I agree 100% and wish JPow (J. Powell) would have kicked it to 20% off the bat. There is still too much money out there. I have seen minimal slow down in spending in certain income brackets, and I’m 100% certain they’re living off of easily available debt.

Agreed, it was a different time in America.

The Great Recession and recent Covid blip in March 2020 were great opportunities for people if they took advantage. Then the pretty decent drop from 2022-October 2023 were decent buying opportunities, at least for stonks.

I’m still laughing at all the low IQ bears who didn’t buy the S&P 500 in the $300’s and low $400’s just 6 months ago.

As for real estate, yeah, people are pretty much fucked on that for the foreseeable future, and I’ve stopped considering it altogether.

Might do some commodities speculation, but that’s always high risk. Except for oil. That’s pretty clockwork.

I’m still laughing at all the low IQ bears who didn’t buy the S&P 500 in the $300’s and low $400’s just 6 months ago.

As for real estate, yeah, people are pretty much fucked on that for the foreseeable future, and I’ve stopped considering it altogether.

Might do some commodities speculation, but that’s always high risk. Except for oil. That’s pretty clockwork.

Similar threads

- Replies

- 2

- Views

- 268

- Replies

- 10

- Views

- 552

- Replies

- 152

- Views

- 6K