Are you saying you have faith in the FED and they are going to get America out of this mess ?

I want to hear their plan to reduce the national debt.

I said only what I said, which does not resemble in any way what you are asking.

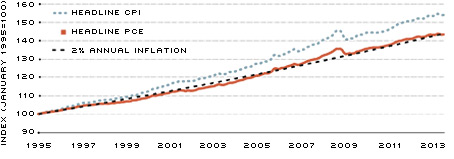

I am merely commenting on the media constantly writing articles citing CPI inflation and then mentioning the Fed and interest rates. The Fed does not use CPI for inflation. It uses PCE. So writing:

That rate is seen as likely to come in between 3.2% and 3.4%, starting with next Wednesday’s data for March and stretching through the August release of July’s CPI figures to extend the current nine-month streak of readings at or above 3%

It is completely useless information. In fact, it is worse than useless, because it is misleading. If you are sitting here thinking, wow, we are a point and a half (1.5%) above the Fed's target rate, you are probably wondering why the Fed is holding steady. Why are they not raising rates?

Here is why: The Fed uses PCE, which is 2.5%.

So the Fed, when it is analyzing the inflation situation, is thinking, inflation is not only coming down, but is only one half of a point (0.5%) above our target.

Do you see how different those two things are?

Nevertheless, every article I read about "what is the Fed going to do?" cites CPI.

This has nothing to do with "faith" in anybody and more to do with a huge public misconception driven by misleading financial reporting. That is all.

And it may be unintentional, that is, all of these reporters are just that ignorant, but if you are reporting on financial matters, you ought to at least have a grasp of the very

basic issues. The actual measure of inflation being utilized for what you are reporting about seems to be one of those fundamental things that should be in your base of knowledge as a financial reporter.

www.zerohedge.com