Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Inflation.......... ?

- Thread starter Hobo Hilton

- Start date

Current average for a 15 year is 6.38%

Dave Ramsey says never do a 30 year.

I like Ramsey but a lot of his financial advice only applies to people who make decent money yet are irresponsible. Not too long ago there was a married couple on his show who made 150k combined and they both had ~600 credit rating and were renting a luxury condo with leased luxury cars.

Anyways re: housing-

Housing has gone crazy in price across the US so 30 year mortgages are almost guaranteed for most people if they want a house in an area that doesn't have bars on the windows. I looked at a rental house in Sun City AZ that was built during the 60s and listed for 250k dollars today. Found the records of past sales and it was 40k in the 1980s. Another one was in Scottsdale and sold for 150k in the 1990s, today it is 960k on zillow. The cheaper one is 2bd/1ba 1960s flat comp roof and the expensive one is a 3bd/3ba/3car garage tile roof type of thing with a pool.

Now going by inflation alone that 250k house should be 100k and that 960k house should be about 300k ballpark.

The only way to sustain this naturally unsustainable model is via loans and the money printing press. I wouldn't be surprised if we have 40, 50 and 60 year mortgages in the near future (or 100 year mortgages).

Eh, I did a 15 year at 2.00% - First, I could not find a way to duplicate that with a 30 year, and, second, I did not want to be in debt for three decades.Dave Ramsey Is a little off. Get a 30 year, pay it as if it were a 15. You end up paying more against principal each month and over time it makes a material difference in the real interest you pay on the loan. Also it gives cushion - if something goes sideways financially you aren’t locked in to the 15 year amount so you can flex back to the 30 year monthly amount instead of poten getting into mortgage trouble. And make sure there is no clause against prepayment.

Getting out of debt as fast as possible is Always the best option.

And the reason Dave Ramsey would never give the advice you just did is simple: 99% of folks who say that this is their plan do not follow through. They do not pay off the 30 year in 15 years.

Most folks buy too much house in comparison to their income, and they use the 30 year to buy more and then justify to themselves as they are clicking on 15 or 30 by saying they can pay it off in 15 . . . even while knowing deep down that they are lying to themselves.

I know, I know, that may not be you. I left room for maybe 1%, although I do not believe it is even 1% but some much lower number.

I like Ramsey but a lot of his financial advice only applies to people who make decent money yet are irresponsible. Not too long ago there was a married couple on his show who made 150k combined and they both had ~600 credit rating and were renting a luxury condo with leased luxury cars.

Anyways re: housing-

Housing has gone crazy in price across the US so 30 year mortgages are almost guaranteed for most people if they want a house in an area that doesn't have bars on the windows. I looked at a rental house in Sun City AZ that was built during the 60s and listed for 250k dollars today. Found the records of past sales and it was 40k in the 1980s. Another one was in Scottsdale and sold for 150k in the 1990s, today it is 960k on zillow. The cheaper one is 2bd/1ba 1960s flat comp roof and the expensive one is a 3bd/3ba/3car garage tile roof type of thing with a pool.

Now going by inflation alone that 250k house should be 100k and that 960k house should be about 300k ballpark.

The only way to sustain this naturally unsustainable model is via loans and the money printing press. I wouldn't be surprised if we have 40, 50 and 60 year mortgages in the near future (or 100 year mortgages).

Yeah, well, we have a housing shortage, so, supply and demand. Of course something in short supply during a rising demand environment is going to be bid up in price. Have you looked at machine gun pricing from 1980 until today?

Also, folks are buying much bigger houses than in these earlier decades. That is just a fact. Bigger houses at younger ages cost more.

- 1920: 1,048 square feet

- 1930: 1,129

- 1940: 1,177

- 1950: 983

- 1960: 1,289

- 1970: 1,500

- 1980: 1,740

- 1990: 2,080

- 2000: 2,266

- 2010: 2,392

- 2014: 2,657

So, the 60s, when folks had more kids but in 1960 they lived in 1,289 square feet, but today with less kids everybody needs 2700 . . . well, that is going to contribute to homes being more expensive, too.

And of course we need multiple Tvs and electronics and multiple cars and multiple bathrooms and so on . . .

Last edited:

If they don’t have the discipline to do something that simple that favors them then they have other problems. Those base issues will evidence themselves in other facets of their lives. That is on them.Eh, I did a 15 year at 2.00% - First, I could not find a way to duplicate that with a 30 year, and, second, I did not want to be in debt for three decades.

And the reason Dave Ramsey would never give the advice you just did is simple: 99% of folks who say that this is their plan do not follow through. They do not pay off the 30 year in 15 years.

Most folks buy too much house in comparison to their income, and they use the 30 year to buy more and then justify to themselves as they are clicking on 15 or 30 by saying they can pay it off in 15 . . . even while knowing deep down that they are lying to themselves.

I know, I know, that may not be you. I left room for maybe 1%, although I do not believe it is even 1% but some much lower number.

Didn't need a lot of house when you spent most of your time outside working on the farmYeah, well, we have a housing shortage, so, supply and demand. Of course something in short supply during a rising demand environment is going to be bid up in price. Have you looked at matching gun pricing from 1980 until today?

Also, folks are buying much bigger houses than in these earlier decades. That is just a fact. Bigger houses at younger ages cost more.

- 1920: 1,048 square feet

- 1930: 1,129

- 1940: 1,177

- 1950: 983

- 1960: 1,289

- 1970: 1,500

- 1980: 1,740

- 1990: 2,080

- 2000: 2,266

- 2010: 2,392

- 2014: 2,657

So, the 60s, when folks had more kids but in 1960 they lived in 1,289 square feet, but today with less kids everybody needs 2700 . . . well, that is going to contribute to homes being more expensive, too.

And of course we need multiple Tvs and electronics and multiple cars and multiple bathrooms and so on . . .

Now, people spend all their time indoors.

The "Work From Home" era allowed people to find affordable 1,200 sq ft homes. That era is winding down. Those that returned to the office are making 20% + more than those that are holding out, working from home. But, many simply had enough of the big city and will scrape by to remain in smaller towns and own a home. Property tax in Montana is soaring due to the influx of people wanting a home.I would have absolutely loved to have found a 1200 sqft house in a nice neighborhood, but you can’t in the Dallas area. If you’re over 55 maybe, or willing to live in a town home. But then you’re paying $5k plus a year in HOA fees. The neighborhood we live in has 3k plus sqft homes. Most of the people are older with no kids. It is ridiculous to heat and cool that much home for 2 people, but if you don’t want your house or car broken into, I guess you deal with it.

Honestly I don't know how many of them can afford the house note. They must be getting some financial help... somewhere.

Yeah, well, we have a housing shortage, so, supply and demand.

The same house from 1965 doubled in value in 20 years and then went up by factor of 5X. That's not a natural supply/demand curve nor is it "people live in bigger houses now" or young people buy too many coffees or people work from home.

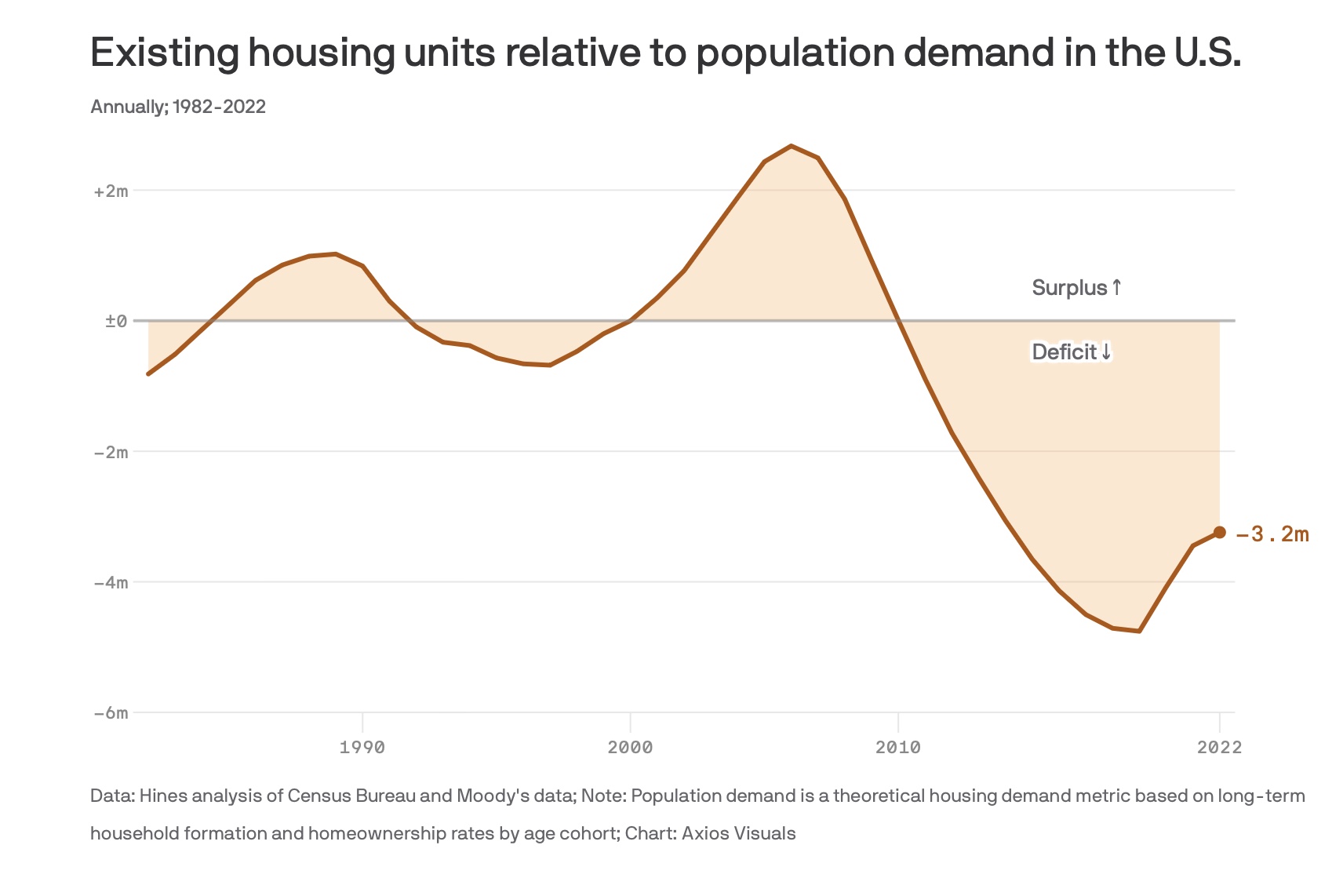

Here's a graph if you still don't follow me:

Also investment firms are buying houses via loans from the FHA. So the government is giving away your tax dollars to private entities so that they can buy houses which will be in turn rented out to your children.

We're getting fucked and because we as a nation are dumb it's only going to get worse.

Regarding your last paragraph: it’s happened because the nation likes stuff and our older, more stable values are deemed less worthy than material things. Unfortunately this includes the nuclear family.The same house from 1965 doubled in value in 20 years and then went up by factor of 5X. That's not a natural supply/demand curve nor is it "people live in bigger houses now" or young people buy too many coffees or people work from home.

Here's a graph if you still don't follow me:

View attachment 8395338

Also investment firms are buying houses via loans from the FHA. So the government is giving away your tax dollars to private entities so that they can buy houses which will be in turn rented out to your children.

We're getting fucked and because we as a nation are dumb it's only going to get worse.

Regarding your last paragraph: it’s happened because the nation likes stuff and our older, more stable values are deemed less worthy than material things. Unfortunately this includes the nuclear family.

Fixing this situation would mean doing a whole bunch of stuff that would be painful so the clown show rolls on and on.

Some event would have to "change the culture". The only event I can foresee is "suffering".Fixing this situation would mean doing a whole bunch of stuff that would be painful so the clown show rolls on and on.

The same house from 1965 doubled in value in 20 years and then went up by factor of 5X. That's not a natural supply/demand curve nor is it "people live in bigger houses now" or young people buy too many coffees or people work from home.

Here's a graph if you still don't follow me:

View attachment 8395338

Also investment firms are buying houses via loans from the FHA. So the government is giving away your tax dollars to private entities so that they can buy houses which will be in turn rented out to your children.

We're getting fucked and because we as a nation are dumb it's only going to get worse.

The same machine gun from 1990 that was 600 bucks is now $15,000! That's a factor of 25, and in a much shorter period of time.

Yes, that is supply and demand.

Like, literally, that is what it is.

The supply is low in both rental and owner occupied.

In other words, your "the evil corporations are buying up all the houses" line overlooks that the housing supply is low now compared to demand, even when you factor in the investment rental homes.

New home construction simply has not caught up. It;s not even close.

Is it this thread or another where I posted that we are 3.2 million homes short right now?

It's this thread. See post #3243.

Existing housing units relative to population demand in the United States

Supply and demand right there in an easy chart from 1980 until now.

Existing housing units relative to population demand in the United States

Supply and demand right there in an easy chart from 1980 until now.

Third repeat of this post in this thread.

Very simple economic rules at play here.

When you have a lot of something, an oversupply, and not much demand, the price goes down.

When you have a shortage of something, a reduced supply, and growing demand, the price goes up.

Right now we have a very short supply of housing and an increasing demand. So what did you expect housing prices to do?

What would you do if 15 couples were at your open house in a bidding war, offering more and more ridiculous amounts of money for your home? Stop them? Oh, no, I certainly cannot accept more than $150,000. No, oh, no, please? $475,000? No, really. What? You want to offer $525? No, just $150. That is all. $530? That's ridiculous. You, there. What are you saying? $545? For my house? But it is only worth $150! You see, my father built it in 1965 and . . . what? $560? Seriously? No, I couldn't. $150 is the price.

LOL! You would take the $560. Of course.

Supply and demand in one easy chart.

It is not hard to figure out why prices are what they are.

Yet every time I see a new development being proposed, everybody is down there at the local government protesting any building, NO, Not here! No more!

Well, you can't have it both ways.

We can pump oil, drill baby, drill, and drive the price down.

We can build, build, build, and lower the price of housing.

Or we can have a housing shortage and wonder why the price is high.

Housing starts have never recovered from the Great Recession

Very simple economic rules at play here.

When you have a lot of something, an oversupply, and not much demand, the price goes down.

When you have a shortage of something, a reduced supply, and growing demand, the price goes up.

Right now we have a very short supply of housing and an increasing demand. So what did you expect housing prices to do?

What would you do if 15 couples were at your open house in a bidding war, offering more and more ridiculous amounts of money for your home? Stop them? Oh, no, I certainly cannot accept more than $150,000. No, oh, no, please? $475,000? No, really. What? You want to offer $525? No, just $150. That is all. $530? That's ridiculous. You, there. What are you saying? $545? For my house? But it is only worth $150! You see, my father built it in 1965 and . . . what? $560? Seriously? No, I couldn't. $150 is the price.

LOL! You would take the $560. Of course.

Supply and demand in one easy chart.

It is not hard to figure out why prices are what they are.

Yet every time I see a new development being proposed, everybody is down there at the local government protesting any building, NO, Not here! No more!

Well, you can't have it both ways.

We can pump oil, drill baby, drill, and drive the price down.

We can build, build, build, and lower the price of housing.

Or we can have a housing shortage and wonder why the price is high.

Housing starts have never recovered from the Great Recession

Attachments

Inflation.......... ?

The current cost of a median-priced home has now reached a rate of increase that is twice as high as the increase in the average American household income. As the Daily Caller reports, the median monthly home payment for the month of February was $2,838, a 12% year-over-year increase. Meanwhile...

Meanwhile, back in 2009 (compare to chart above):

www.ajc.com

www.ajc.com

The two counties that managed to record more home sales in 2009 — Clayton and Walton — had disastrous years price-wise. Clayton County's sales increased 8 percent but prices plummeted 45 percent. In Walton County, where sales increased 2 percent, prices fell 24 percent, according to the 2009 report.

Data show how far values fell

Part 1 of 4Looking back, Atlanta’s 2009 housing market followed the letter of the law.Murphy’s Law.

LOL! I was having some trouble, but I finally got it. Thank you, though.Hotlink to graph...

Inflation.......... ?

The current cost of a median-priced home has now reached a rate of increase that is twice as high as the increase in the average American household income. As the Daily Caller reports, the median monthly home payment for the month of February was $2,838, a 12% year-over-year increase. Meanwhile...www.snipershide.com

Inflation: How much prices for important goods and services have risen under Biden - Washington Examiner

While annual inflation is down to more manageable levels, the compounded price increases of goods and services since Biden entered office has hurt consumers.

Unsustainable

Inflation: How much prices for important goods and services have risen under Biden - Washington Examiner

While annual inflation is down to more manageable levels, the compounded price increases of goods and services since Biden entered office has hurt consumers.www.washingtonexaminer.com

Unsustainable

It's perfectly sustainable for the people at the top who are making all the decisions, everyone else not so much.

The graph is missing house prices- in my neck of the woods, a house that in 2019 sold for $350K is now selling in the $600k ballpark. Something has to break in this 'era' so we return back to some sort of sanity.

Inflation: How much prices for important goods and services have risen under Biden - Washington Examiner

While annual inflation is down to more manageable levels, the compounded price increases of goods and services since Biden entered office has hurt consumers.www.washingtonexaminer.com

-LD

The people at the top don't realize the foundation of their empire (the working middle class) is crumbling.It's perfectly sustainable for the people at the top who are making all the decisions, everyone else not so much.

History repeating.

don't need the middle class if you goal is creating a serfdom. wage slavesThe people at the top don't realize the foundation of their empire (the working middle class) is crumbling.

History repeating.

don't need the middle class if you goal is creating a serfdom. wage slaves

-LD

You will own nothing and be happy.

If you earn enough social points, you'll get a bonus grasshopper milkshake (non-dairy)

If you earn enough social points, you'll get a bonus grasshopper milkshake (non-dairy)

Fed's Daly: absolutely no urgency to cut US interest rates

April 12 (Reuters) - San Francisco Federal Reserve President Mary Daly said on Friday there is still "a lot of work to do" to make sure inflation is on track to the Fed's 2% goal, and there is "absolutely" no urgency to cut rates."Policy's in a good place right now, and I need to be fully confident that inflation is on track to come down to 2%, which is our definition of price stability, before we would consider a rate cut," Daly said at an event at the regional Fed bank.

With the labor market strong and inflation falling more slowly than it did last year, she said, the Fed will maintain its current stance "as long as necessary" to bring down inflation.

"There's absolutely, in my mind, no urgency to adjust the policy rate," she said, echoing a sentiment also expressed by several of her colleagues this week.

mkts have 2 cuts priced in for early fall. ruh rohFed's Daly: absolutely no urgency to cut US interest rates

April 12 (Reuters) - San Francisco Federal Reserve President Mary Daly said on Friday there is still "a lot of work to do" to make sure inflation is on track to the Fed's 2% goal, and there is "absolutely" no urgency to cut rates.

"Policy's in a good place right now, and I need to be fully confident that inflation is on track to come down to 2%, which is our definition of price stability, before we would consider a rate cut," Daly said at an event at the regional Fed bank.

With the labor market strong and inflation falling more slowly than it did last year, she said, the Fed will maintain its current stance "as long as necessary" to bring down inflation.

"There's absolutely, in my mind, no urgency to adjust the policy rate," she said, echoing a sentiment also expressed by several of her colleagues this week.

And at the beginning of the year they had many more than that.mkts have 2 cuts priced in for early fall. ruh roh

never more than 3 and they were supposed to start by now. I think we don't see any this yearAnd at the beginning of the year they had many more than that.

No it was above 5. There were some extreme reports calling for 7 IIRCnever more than 3 and they were supposed to start by now. I think we don't see any this year

Futures Markets Expect 6 Rate Cuts in 2024, Versus 4 Earlier

Investors are penciling in even more cuts to interest rates following the latest news on monetary policy from the Federal Reserve. Federal Open Market Committee members updated their projections for future interest rates on Wednesday. Officials’ median estimate now calls for the federal-funds rate

“Stocks pulled back from record highs as Wall Street recalibrated its expectations to four or five rate cuts in 2024, more in line with the Fed’s own projections than the six cuts for the year traders expected in early January.“

no it wasn't, the mkts never priced more than 3. I'm in the bond mkt and there were 3 cuts priced in at .25bps each and never more.No it was above 5. There were some extreme reports calling for 7 IIRC

Futures Markets Expect 6 Rate Cuts in 2024, Versus 4 Earlier

Investors are penciling in even more cuts to interest rates following the latest news on monetary policy from the Federal Reserve. Federal Open Market Committee members updated their projections for future interest rates on Wednesday. Officials’ median estimate now calls for the federal-funds ratewww.barrons.com

“Stocks pulled back from record highs as Wall Street recalibrated its expectations to four or five rate cuts in 2024, more in line with the Fed’s own projections than the six cuts for the year traders expected in early January.“

Then you need to call Bloomberg, CNN and FoxBusiness to straighten them out.no it wasn't, the mkts never priced more than 3. I'm in the bond mkt and there were 3 cuts priced in at .25bps each and never more.

But I think you are correct that there may not be any this year. Maybe one, but It’s an election year and Powell may not be in the mood to do that. I know I wouldn’t want his job.

Last edited:

The FED Reserve is being likened to a "Play by play announcer"...never more than 3 and they were supposed to start by now. I think we don't see any this year

No clue as to what the next move is for the economy.

A fitting description.

US inflation jumps as fuel and housing costs rise

US inflation jumps as fuel and housing costs rise

Inflation was 3.5% in March, a sign that cooling has stalled and interest rate cuts may be delayed.

Buying the same stuff in March that consumers bought in February... Just paying more for it. Another report on inflation.

Retail sales increased 0.7% for the month, considerably faster than the Dow Jones consensus forecast for a 0.3% rise, according to Census Bureau data that is adjusted for seasonality but not for inflation.

Retail sales increased 0.7% for the month, considerably faster than the Dow Jones consensus forecast for a 0.3% rise, according to Census Bureau data that is adjusted for seasonality but not for inflation.

Fed's Daly: absolutely no urgency to cut US interest rates

April 12 (Reuters) - San Francisco Federal Reserve President Mary Daly said on Friday there is still "a lot of work to do" to make sure inflation is on track to the Fed's 2% goal, and there is "absolutely" no urgency to cut rates.

"Policy's in a good place right now, and I need to be fully confident that inflation is on track to come down to 2%, which is our definition of price stability, before we would consider a rate cut," Daly said at an event at the regional Fed bank.

With the labor market strong and inflation falling more slowly than it did last year, she said, the Fed will maintain its current stance "as long as necessary" to bring down inflation.

"There's absolutely, in my mind, no urgency to adjust the policy rate," she said, echoing a sentiment also expressed by several of her colleagues this week.

If they cut interest rates now they will cause another bubble.

What we actually need is a dollar collapse paired with a crash and a revaluation of assets. It is going to be the most painful thing ever for most people and businesses, but we basically need it.

All of these current conditions are a plan to dump the disaster on to the next President of the United States.If they cut interest rates now they will cause another bubble.

What we actually need is a dollar collapse paired with a crash and a revaluation of assets. It is going to be the most painful thing ever for most people and businesses, but we basically need it.

The FED Reserve is going to kick the can down the road for the remainder of 2024.

There will be much suffering both for the country and for the people.

All of these current conditions are a plan to dump the disaster on to the next President of the United States.

The FED Reserve is going to kick the can down the road for the remainder of 2024.

There will be much suffering both for the country and for the people.

Leftists and Regime Statist politicians are infamous for spreading gasoline around inside the building, lighting a delay fuse, and then walking out. The flames engulf the building while the next guy is at the helm and he takes all the blame.

I’d say we could use some deflation too.

There is no way that will happen for more than a quarter. The Fed would pull out all of the stops to prevent it.I’d say we could use some deflation too.

The FED's are running out of "stops"........ The rubber is meeting the road, as we speak.There is no way that will happen for more than a quarter. The Fed would pull out all of the stops to prevent it.

The DXY is a mirage.

What do you mean? Sparking inflation is easy, and that is all that is required to reverse deflation.

No shit

Fed Chair Powell says there has been a ‘lack of further progress’ this year on inflation

Yeah, well, checking inflation while not raising unemployment to 10%, that is a bit tougher of an ask.No shit

Fed Chair Powell says there has been a ‘lack of further progress’ this year on inflation

Another driver of inflation. Higher wages.

Make more, spend more, make more, spend more.

The problem is spending more for the same old shit people bought before the pandemic.

_______________________

More people are looking for a new job, and they have high salary expectations.

The lowest average pay people would be willing to accept a new job reached $81,822 as of March, a new series high since 2014. And it’s a big jump from November, when respondents said they’d need an offer of $73,391, on average, to take a new job.

That’s according to the Federal Reserve Bank of New York’s latest consumer expectations survey, which is fielded every four months.

For comparison, the typical full-time U.S. worker earns a median $60,000 per year, according to Labor Department data. But to live comfortably by traditional budgeting advice, the average person needs to earn upwards of $89,000 — closer to the latest data on salary expectations — according to a recent analysis from SmartAsset.

www.cnbc.com

www.cnbc.com

Make more, spend more, make more, spend more.

The problem is spending more for the same old shit people bought before the pandemic.

_______________________

More people are looking for a new job, and they have high salary expectations.

The lowest average pay people would be willing to accept a new job reached $81,822 as of March, a new series high since 2014. And it’s a big jump from November, when respondents said they’d need an offer of $73,391, on average, to take a new job.

That’s according to the Federal Reserve Bank of New York’s latest consumer expectations survey, which is fielded every four months.

For comparison, the typical full-time U.S. worker earns a median $60,000 per year, according to Labor Department data. But to live comfortably by traditional budgeting advice, the average person needs to earn upwards of $89,000 — closer to the latest data on salary expectations — according to a recent analysis from SmartAsset.

The lowest salary Americans will accept at a new job reached a record high

The share of people looking for a new job and expecting higher pay is on the rise.

People have a base line for a reason. Who wants to work 8 - 10 hours a day, and still have to rely on the Gov to survive?Another driver of inflation. Higher wages.

Make more, spend more, make more, spend more.

The problem is spending more for the same old shit people bought before the pandemic.

_______________________

More people are looking for a new job, and they have high salary expectations.

The lowest average pay people would be willing to accept a new job reached $81,822 as of March, a new series high since 2014. And it’s a big jump from November, when respondents said they’d need an offer of $73,391, on average, to take a new job.

That’s according to the Federal Reserve Bank of New York’s latest consumer expectations survey, which is fielded every four months.

For comparison, the typical full-time U.S. worker earns a median $60,000 per year, according to Labor Department data. But to live comfortably by traditional budgeting advice, the average person needs to earn upwards of $89,000 — closer to the latest data on salary expectations — according to a recent analysis from SmartAsset.

The lowest salary Americans will accept at a new job reached a record high

The share of people looking for a new job and expecting higher pay is on the rise.www.cnbc.com

Gov is creating the problem, so the Gov can get everyone on the dole.

Hell, after you come out of college, you basically need that baseline to pay of your loans.

yeah my head hurts looking at interns that are just about to graduate and want $70k/year to start ANY job.

Again, big name colleges, not people from schools you never heard of, but still $70k to start is insane, I can't offer that for an entry level job. Most graduates are like ok thanks and moving on until they get the $70k they are looking for

Must be nice to have parents paying your bills until you find the perfect job...

Again, big name colleges, not people from schools you never heard of, but still $70k to start is insane, I can't offer that for an entry level job. Most graduates are like ok thanks and moving on until they get the $70k they are looking for

Must be nice to have parents paying your bills until you find the perfect job...

Yeah, well, checking inflation while not raising unemployment to 10%, that is a bit tougher of an ask.

Over the last 2 years, NET, something like 95% of all jobs created were to foreign born workers.

Look at unemployment by citizen status and work type (professional, full-time).

The only real gains are new government jobs and contract companies working for the government programs.

Similar threads

- Replies

- 32

- Views

- 1K

- Replies

- 109

- Views

- 4K

- Replies

- 61

- Views

- 1K