Stop Trading on Congressional Knowledge Act into law in spring 2012 ,made it illegal but not for long

exactly a year later Senate and then the House passed the bill in largely empty chambers using a fast-track procedure known as unanimous consent. Making insider trading legal again

"Nobody gets results like [those of US Senators] in the financial world consistently and over the long term, any manager of a mutual fund...who regularly beats the market by as little as two percent annually is considered an investment genius."

Jan. 1, 2006 - Thomas Ferguson, PhD

"[W]e find that members of the U.S. Senate outperformed the market by almost 100 basis points [One basis point is equivalent to 1/100th of a one percent. 100 basis points are equivalent to one percent.] per month...

When we equally weight the returns of each Senator, the buy portfolio earns a compound annual rate of 28.6% on an equal-weighted basis and 31.1% on a trade-weighted basis compared to 21.3% for the market...

Cumulative abnormal returns for the portfolio of stocks bought by Senators are near zero for the calendar year prior to the date of purchase. After acquisition, the cumulative abnormal return rises over 25% within one calendar year after the purchase date. The cumulative abnormal returns for the portfolio of stocks sold by the Senators are near zero for the calendar year after the date of sale. However, these same stocks saw a cumulative abnormal positive return of 25% during the year immediately preceding the event date. These results suggest that Senators knew the appropriate times to both buy and sell their common stocks...

After being sold by Senators, stocks underperform the market by 12 basis points per month on a trade-weighted basis....Combining the buy transactions with the sell transactions in a hedged portfolio we find that Senators outperform the market by 97 basis points (nearly 1%) per month on a trade-weighted basis...

We find no reliable differences between the returns earned by Democrats and Republicans but seniority appears to be important. Senators with the least seniority (in their first Senatorial term) earn statistically higher returns than those Senators with the longest seniority (over 16 years in the Senate)."

Dec. 2004 - Alan J. Ziobrowski, PhD

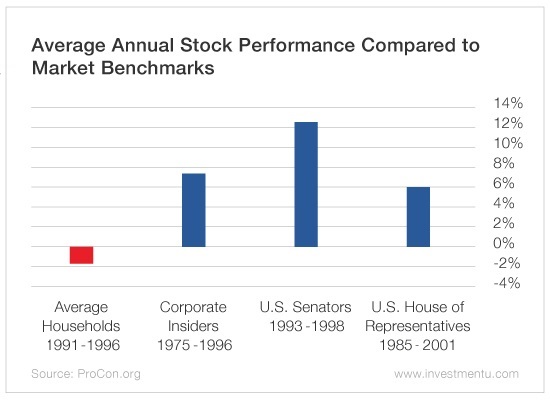

Chart shows, congressmen have historically done a lot better in the stock market than the average American household has. This suspicious outperformance is made possible by the widespread and

technically legal practice of congressional insider trading.