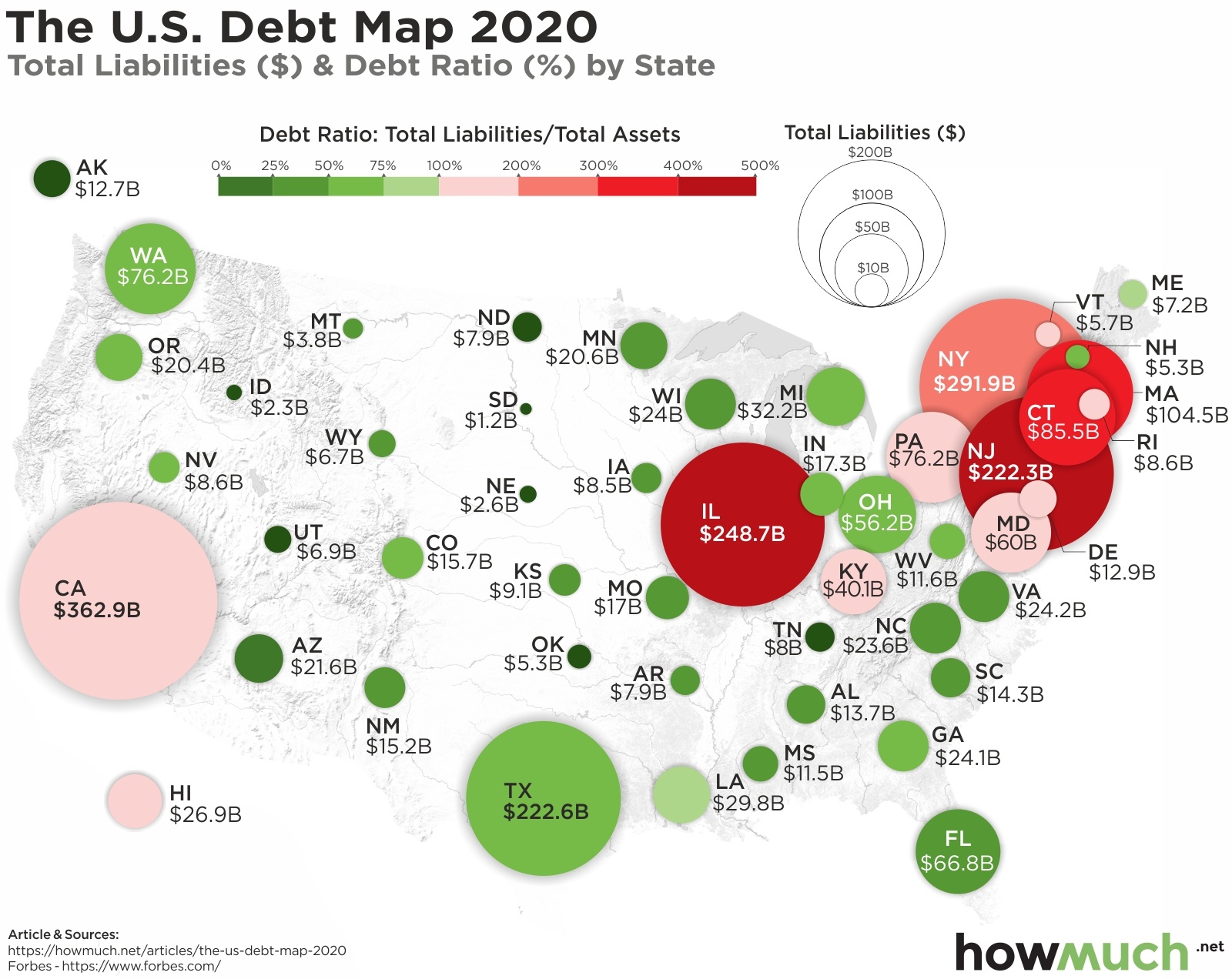

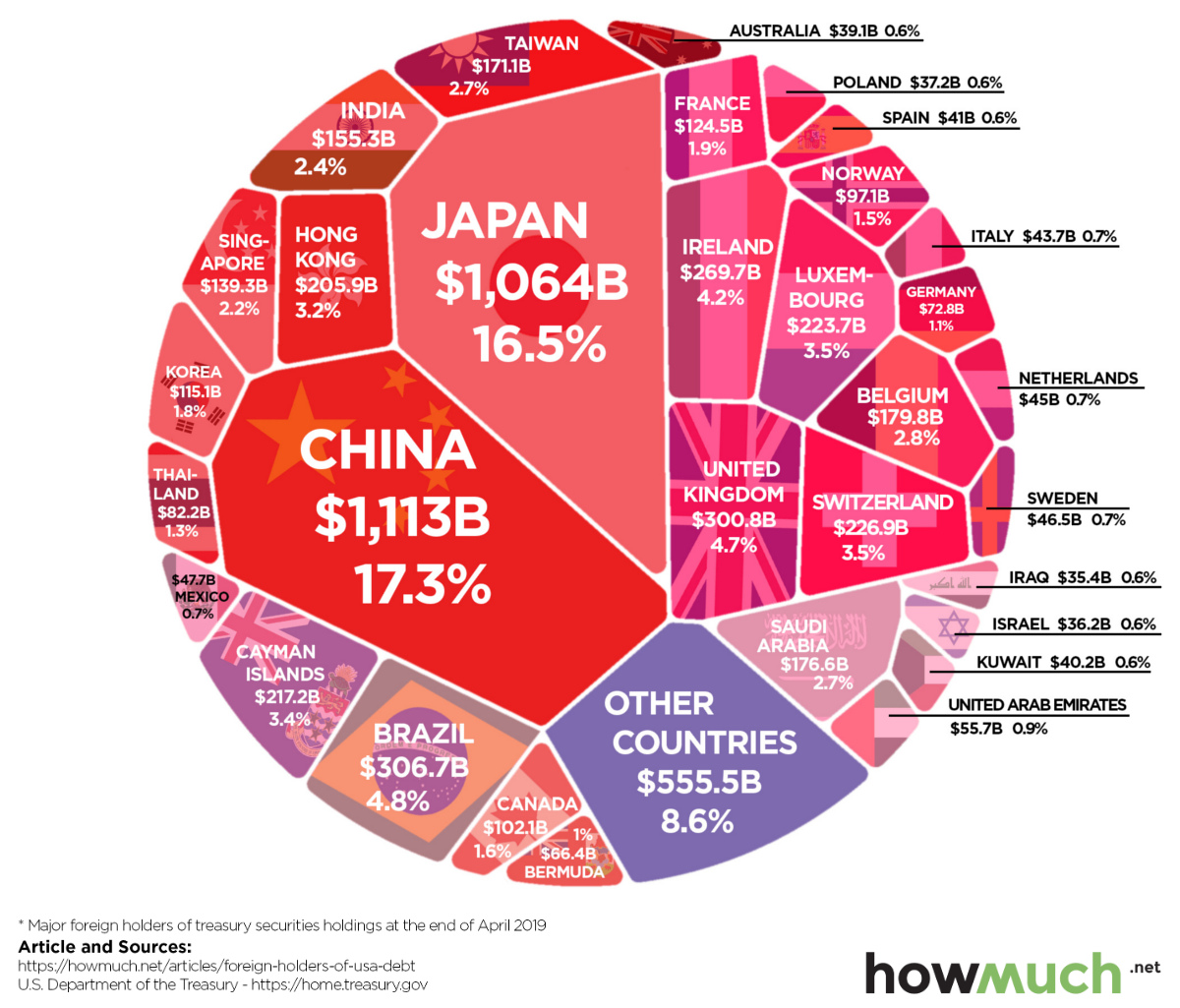

The US National Debt is $36 Trillion and climbing. Now adding to that in another year could be the $1.2 trillion in commercial real estate loans that could default in 2026.

A massive default on these loans could cause a domino effect of banks collapsing and US taxpayers picking up the bill due to loan guarantees.

Does anyone else see a problem with Trump and the Republicans getting blamed for the crisis, just in time for the mid-term elections? Add this to the fact that if the Republicans DO NOT extend the tax breaks by June/July of this year, you could see another factor weighing heavily in favor of the Democrats for the mid-term elections.

Default risk grows on $1.5 trillion in commercial real estate debt

As $2 Trillion in Property Loans Come Due, Firms Advise Lenders Turned Unintended Owners

Loan Defaults Are a Dangerous Emerging Trend, a Veteran Broker Warns

Regional Banks Grapple with Office Property Meltdown

A massive default on these loans could cause a domino effect of banks collapsing and US taxpayers picking up the bill due to loan guarantees.

Does anyone else see a problem with Trump and the Republicans getting blamed for the crisis, just in time for the mid-term elections? Add this to the fact that if the Republicans DO NOT extend the tax breaks by June/July of this year, you could see another factor weighing heavily in favor of the Democrats for the mid-term elections.

Default risk grows on $1.5 trillion in commercial real estate debt

As $2 Trillion in Property Loans Come Due, Firms Advise Lenders Turned Unintended Owners

Loan Defaults Are a Dangerous Emerging Trend, a Veteran Broker Warns

Regional Banks Grapple with Office Property Meltdown