Re: How much is a trillion?

<div class="ubbcode-block"><div class="ubbcode-header">Originally Posted By: Sharac</div><div class="ubbcode-body">The only reason you're/we're not seeing hyperinflation is due to electron funds generated being stuck in financial circles </div></div>

Actually, the biggest reason that we're not seeing hyperinflation is that credit is being destroyed at a similar rate to which the Fed is creating new money.

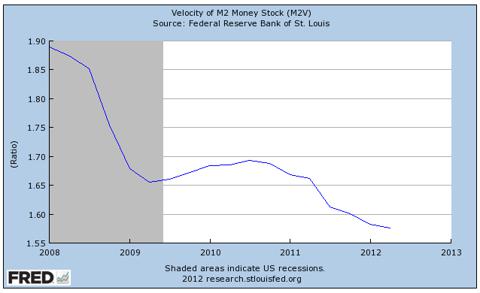

What would cause a real inflationary mess is if there was any velocity to the money in circulation, but velocity is presently very low:

If confidence ever returns and velocity increases, then the Fed will have quite the challenge in removing money in fashion that does not crush a recovery. But it would appear that we are a long ways away from that occurring.

Nothing above should be construed in such a fashion as to endorse the Fed's actions; rather, it is provided to remind people that a few trillion dollars in additional printing doesn't, in itself, guarantee hyperinflation. Indeed, one of the challenges for any investor right now is to account for the distinct possibility of asset <span style="font-style: italic">deflation</span>. Those simply trying to hang on in this economy have an additional problem in that they may expect to experience simultaneous inflation in the products and services that are required to live (food, fuel, health care, child care, education, etc.) and deflation in the assets which they hold (property and investments in traditional securities).