Increased inventories are the opposite of inflationary, but you do you.Well..... Look into your crystal ball, what does this mean?

U.S. wholesale inventories surge in May as businesses rush to keep up with strong sales

Home - Businesshala News

Businesshala is the part of journalism that tracks, records, analyzes, and interprets the business, economic and financial activities.businesshala.com

Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Inflation.......... ?

- Thread starter Hobo Hilton

- Start date

And again, I repeat, if you are sitting in this thread caterwauling about how big inflation is on the horizon because the government needs to inflate its way out of debt, then you sure as hell want to be borrowing money as well, so that you get to be on the government side of that trade.

That works right up until you run into what many of us are worried about, which is out of control inflation as the government essentially steals the value of the money you worked for in order to be able to pay off their debts, BUT income for the average working type is dropping severely and not keeping up with the rate of sudden inflation.

Many have seen their income get slashed significantly even as prices rise, which if you have a big debt amount to service and your income suddenly is cut, things get rough in a hurry.

If you take a look at how things go when there is a financial "crunch", the government tends to make sure the big bankers and big rich corporations come out okay for the most part... at the expense of the middle class getting crushed. You'll be loosing your house to the same bankers that are getting free money loans from the government to keep them afloat... guaranteed by your taxes...

I am one of those bankers (retired.) But what you are suggesting doesn't actually make sense. I understand the fear, I suppose, but it is pretty hard to imagine a world in which all prices are skyrocketing except the price of labor. In that case, who has the money to support the skyrocketing price of goods? Aliens? If there is hyperinflation, money will be very available, it will just be worthless. There is practically zero scenarios where prices are rising very quickly and there is no money anywhere.That works right up until you run into what many of us are worried about, which is out of control inflation as the government essentially steals the value of the money you worked for in order to be able to pay off their debts, BUT income for the average working type is dropping severely and not keeping up with the rate of sudden inflation.

Many have seen their income get slashed significantly even as prices rise, which if you have a big debt amount to service and your income suddenly is cut, things get rough in a hurry.

If you take a look at how things go when there is a financial "crunch", the government tends to make sure the big bankers and big rich corporations come out okay for the most part... at the expense of the middle class getting crushed. You'll be loosing your house to the same bankers that are getting free money loans from the government to keep them afloat... guaranteed by your taxes...

Things don't tend to go only one way when there is a financial crunch. We tend to think they always go the way of the last one, but it isn't the case. Different sectors and populations get hit differently, depending on the drivers of the crisis and the response. But the absolute rule is that if you have massive inflation, something that was worth a dollar yesterday is worth less than that today. And so it is for debt. When you think about historical hyperinflation, you think about Germans burning wads of money for heat, right? What you don't realize is that not only were those wads of money worthless, but they were, numerically, more than the Germans had before. Exponentially. And it is in this degraded, ubiquitous currency that you would be paying back your debt. So it really would be the best investment if you were right about inflation.

@Hobo Hilton obviously it means debt is greatest thing ever and we need more of it  . So the dollar can continue to decline and live under the false premise the dollar cannot and will not ever collapse. For the last 6,500 years every major Empire across the globe fell when certain markers were hit, currency was bastardized and perpetual conflict was the norm and debt of course......

. So the dollar can continue to decline and live under the false premise the dollar cannot and will not ever collapse. For the last 6,500 years every major Empire across the globe fell when certain markers were hit, currency was bastardized and perpetual conflict was the norm and debt of course......

I just ignore now lolIncreased inventories are the opposite of inflationary, but you do you.

I am one of those bankers (retired.) But what you are suggesting doesn't actually make sense. I understand the fear, I suppose, but it is pretty hard to imagine a world in which all prices are skyrocketing except the price of labor. In that case, who has the money to support the skyrocketing price of goods? Aliens? If there is hyperinflation, money will be very available, it will just be worthless. There is practically zero scenarios where prices are rising very quickly and there is no money anywhere.

Things don't tend to go only one way when there is a financial crunch. We tend to think they always go the way of the last one, but it isn't the case. Different sectors and populations get hit differently, depending on the drivers of the crisis and the response. But the absolute rule is that if you have massive inflation, something that was worth a dollar yesterday is worth less than that today. And so it is for debt. When you think about historical hyperinflation, you think about Germans burning wads of money for heat, right? What you don't realize is that not only were those wads of money worthless, but they were, numerically, more than the Germans had before. Exponentially. And it is in this degraded, ubiquitous currency that you would be paying back your debt. So it really would be the best investment if you were right about inflation.

True insane hyper inflation is not likely to happen soon, at least to the extent that it would force incomes to be going up at a similar rate aka historical anomalies or countries where you add a 0 to the currency each week.

Here's an example right now. My income went down dramatically for some time thanks to the government's messing up the economy and not letting people do free commerce.

Meanwhile, my weekly grocery bill for the same stuff went up by 30% in less than a year and fuel almost doubled in cost and my property taxes went up by 10% , household repair items went up much higher and pretty much everything expense wise went up.

By not having a high debt load to spare income ration and being able to rapidly shed or delay non essential expenses or purchases, I was able to be fine even if my margin of money left over after paying the bills got rather small & I couldn't afford to buy / do some things I wanted.

If I had a large debt load that I had to service, it would have been exceptionally uncomfortable.

Or like right now here in our housing market, wages are not going up, but home prices are skyrocketing as Chinese and corporate money is flooding in to buy up everything to make expensive rentals, and people flooding in with out of state money. The local wages are not rising to meet that anytime soon and as such locals are finding it very hard to rent or buy any housing.

I suspect that is more like what we will be seeing for some years to come.

Everything gets more expensive, but not fast enough for a "crisis", while income / wages lag way behind and Taxes go up.

So, I will tell you where I agree with you, and where I don't agree with you, not just to this post but overall. I'll start with agreements.True insane hyper inflation is not likely to happen soon, at least to the extent that it would force incomes to be going up at a similar rate aka historical anomalies or countries where you add a 0 to the currency each week.

Here's an example right now. My income went down dramatically for some time thanks to the government's messing up the economy and not letting people do free commerce.

Meanwhile, my weekly grocery bill for the same stuff went up by 30% in less than a year and fuel almost doubled in cost and my property taxes went up by 10% , household repair items went up much higher and pretty much everything expense wise went up.

By not having a high debt load to spare income ration and being able to rapidly shed or delay non essential expenses or purchases, I was able to be fine even if my margin of money left over after paying the bills got rather small & I couldn't afford to buy / do some things I wanted.

If I had a large debt load that I had to service, it would have been exceptionally uncomfortable.

Or like right now here in our housing market, wages are not going up, but home prices are skyrocketing as Chinese and corporate money is flooding in to buy up everything to make expensive rentals, and people flooding in with out of state money. The local wages are not rising to meet that anytime soon and as such locals are finding it very hard to rent or buy any housing.

I suspect that is more like what we will be seeing for some years to come.

Everything gets more expensive, but not fast enough for a "crisis", while income / wages lag way behind and Taxes go up.

- People have noticed that education can be a big moneymaker, and that is part of the push towards everybody getting a college degree, and student loans have been part of that.

- Way too many people are getting marginally valuable degrees, and are paying a lot for them

- The increased demand for education plus the availability of student loans has caused the cost of education to skyrocket.

- The various actions taken by governments at all levels during Covid have skewed the pricing mechanism badly.

- While I am not particularly in favor of personal debt, I think each situation needs to be assessed individually, because the cost of taking on debt is often lower than other costs, including opportunity cost.

- I do not see a long term economic scenario that can support higher than normal inflation without wage gains. That is because of two things. First, wage pressure is one of the drivers of costs that tends to lead to inflation, and second, demand for most goods is even among income levels, and pricing goods out of the reach of the middle class is not sustainable long term, or even medium term. Yes, some of that happened during the Covid, but that was an extreme scenario. You would have to believe in such a strong form of monetary inflation to predict otherwise, so strong that inflation would have to be completely decoupled from consumer demand.

- The corporate/chinese housing purchase issue is very misunderstood. Fools like Frodo Ballsack present this as an issue of "cornering the market," when it is an issue of marginal demand. So yes, increased demand inputs in an already tight market are going to drive prices up, but only to a point. Likewise, people are going to have to deal with out of staters moving in. That is just going to be a reality. But I would not assume that these moves will not drive local wages up. They might lag a little, but it is unfathomable to suppose that increased demand for construction labor won't drive up construction wages, especially given that the likelihood of this migration you talk about is less blue collar workers and more white collar, so not only should demand rise for construction work, but the supply of workers should shrink marginally. As to when it will happen, I would answer the same way I did when somebody asked about when retail lumber prices would drop -- as slowly as is possible.

I think it is great that you built in a margin of safety in your own finances that allowed you to weather this. That is idea. Alternately, one could argue that had you borrowed more and used it to high returns, your margin would actually have been even greater, and your risk greater as well. I'm not suggesting that as a good idea, just trying to illuminate the point that debt is a personal choice, a contract into which we enter freely, and that it can very often be used to better ones situation if he makes good decisions regarding it. It isn't something the banks force on people for bad reasons and then kick them out of their houses. It only feels that way when it happens.

One additional thought is that people who are professionally detached from an industry tend to see issues in more moral/ethical/religious terms than those in an industry who see things as largely strategic and technical. A good example is military/war. I am, and have always been, a civilian. I really only think of military issues through those lenses because it is the totality of my experience. Most people who have served, even at a low level, have insight I could not dream to have, if only because they have seen the machinery from the inside, so I think it can get difficult to discuss things through that experiential wall. Don't take that to mean I think my beliefs then become more valuable because of my career, I think they become more varied, but like the military, finance is something that affects everybody in the world, so all of our opinions are valid and necessary. I wouldn't expect to be told to STFU because I didn't serve, and don't mean to say that here regarding financial stuff.

Last edited:

I think there are a couple things that we probably all agree upon regarding education, understanding that it is not a costless good.

- We don't like the idea that only the children of the wealthy should be able to go to good schools.

- We don't like the fact that many of the best schools, and therefore the most able students, are being taught race based garbage in school with very little to no accountability.

- We don't think that post secondary education should be publicly funded.

- We don't like that educational institutions are able to use tax laws to avoid paying taxes on some of the biggest piles of money in the country, especially given their ideological attacks on the country at large.

We don't think that post secondary education should be publicly funded.

Not all of us. I disagree with this list item. I do not have a problem with publicly funded education after high school.

Texas has had it that idea since 1839, when the Congress of the Republic of Texas set aside 221,400 acres of land to fund higher education. Despite some setbacks with the funding and a change to the original arrangement, those lands are still supporting higher education in the State.

it all depends on what the degree is in and what the actual cost of the school is.

i used grants, student loans (subsidixzed and unsubsidized) and whatever other financing i could to get through with my degree in engineering. Interest rates were low, i consolidated everything to like 2.1% after i got out of school, and by age 34 I had them completely paid off.

my total student loan burden was probably less than $30k. if you are getting into the 6 figures, then yeah, id say avoid that.

Charger,

if you’re a civil/water resources engineer and wouldn’t mind living in Indiana, PM me, we’ve got openings….

I would add one thing. Universities should not be able to use their Foundations or any 501c3 charitable organization status to fund NCAA athletics, athletic departments, or anything connected to athletics.

IU buys out their BB coaches contract for $10 mil. 2 donors contributed $5mil each to the Foundation, which then “donates” the money to the athletics department. The 2 alums get tax deductions for charitable contributions.

That shit should be illegal. University hires the wrong coach? Deal with it, fuckers…

IU buys out their BB coaches contract for $10 mil. 2 donors contributed $5mil each to the Foundation, which then “donates” the money to the athletics department. The 2 alums get tax deductions for charitable contributions.

That shit should be illegal. University hires the wrong coach? Deal with it, fuckers…

I don't know what y'all are fretting about. It's just temporary!!

It'll probably only be a few years and then the potato Joe economy will kick in.

Someone said but but but lumber prices are coming down. Ummmm let's see if they get back to where they were.

It'll probably only be a few years and then the potato Joe economy will kick in.

Someone said but but but lumber prices are coming down. Ummmm let's see if they get back to where they were.

The answer to student loans is to get the interest rates to a realistic level. I know grads that are paying 7% interest (and more) on six figure loans but paying half that on home loans and auto loans are less than 2%. The lenders have a loan that cannot be extinguished by bankruptcy, is insured by the government against default and has little service or origination responsibility. These should be low interest loans not a meal ticket for lenders.

I would like to see an investigation into how student loan lenders were able to get such a sweetheart deal.

I would like to see an investigation into how student loan lenders were able to get such a sweetheart deal.

I would like to see an investigation into how student loan lenders were able to get such a sweetheart deal.

Bribing politicians of course. The way it always works....

2008 and the great bailout.

DOD Frank and that bullshit of too big to fail?I would like to see an investigation into how student loan lenders were able to get such a sweetheart deal.

Well..... Look into your crystal ball, what does this mean?

U.S. wholesale inventories surge in May as businesses rush to keep up with strong sales

Home - Businesshala News

Businesshala is the part of journalism that tracks, records, analyzes, and interprets the business, economic and financial activities.businesshala.com

Accumulation of inventory is often a precursor to a classical recession. Considering that we don't do those type of recessions any longer, I have no idea what this means, but typically, it's the sort of thing that'd have me predicting a negative GDP print in the next quarter or three (which I think is something that's still totally possible, and of course would be anti-inflationary).

BTW, that headline makes no sense, and the editor responsible for it should be banned from the internet. But the logic fits this thread fairly well, so I understand the appeal.

I agree it’s this but I also firmly believe that if you commit to a loan you see it through. There are those who think they can take out a loan and just walk away from it and leave the banks holding the bag. In most cases this is wrong. There are events that cause issues in life, I get it. This is not what I am talking about.The answer to student loans is to get the interest rates to a realistic level. I know grads that are paying 7% interest (and more) on six figure loans but paying half that on home loans and auto loans are less than 2%. The lenders have a loan that cannot be extinguished by bankruptcy, is insured by the government against default and has little service or origination responsibility. These should be low interest loans not a meal ticket for lenders.

I would like to see an investigation into how student loan lenders were able to get such a sweetheart deal.

Container Freight Rates Spike to New Extremes, up 500% for Asia-US, Asia-EU since Early 2020. Worse Still Ahead

If you look at what has happened in the bond markets over the last almost two months, you get a pretty good picture of how expectations have changed. Mid may was the height of inflation madness, and since then the 5 and 10 year inflation breakevens have rolled over in a head and shoulders pattern, which is a pretty good indicator of a peak having been made in the inflation expectations market. Both peaked at around 2.5% and are 10% off of their highs. But as I said, more interesting is the market action as to how they got there. I am not much of a believer in technical analysis leading to fundamental insights, but since bond traders use it widely, it is a good map of their thoughts. Further, 10 year yields have come down a lot. 25% or so from their highs.

Second, the rollover in the commodities markets is really interesting. We now "know," or have a pretty good idea, that the decrease in commodities prices is directly related to China wanting to bring down prices and their regulators made some moves to do so. https://www.cnbc.com/2021/06/17/com...-tumble-on-china-crackdown-rising-dollar.html. Ask yourself why they would want to do this, if they were benefitting from the rise. The answer is that they don't believe there is sufficient demand for commodities at those prices, and that things are softening.

Third, the only commodity that is really continuing to do well is oil, though as I have pointed out, it is well below its multi year highs. And oil prices rising is not a sign of mass inflation as much as it is a precursor to a decline in economic activity. That isn't to say it has no inflationary influence, but its influence depends a lot on what the greater economic situation looks like.

Second, the rollover in the commodities markets is really interesting. We now "know," or have a pretty good idea, that the decrease in commodities prices is directly related to China wanting to bring down prices and their regulators made some moves to do so. https://www.cnbc.com/2021/06/17/com...-tumble-on-china-crackdown-rising-dollar.html. Ask yourself why they would want to do this, if they were benefitting from the rise. The answer is that they don't believe there is sufficient demand for commodities at those prices, and that things are softening.

Third, the only commodity that is really continuing to do well is oil, though as I have pointed out, it is well below its multi year highs. And oil prices rising is not a sign of mass inflation as much as it is a precursor to a decline in economic activity. That isn't to say it has no inflationary influence, but its influence depends a lot on what the greater economic situation looks like.

CHICAGO (Reuters) - Farmers in the northern U.S. Plains are on track to harvest the smallest spring wheat crop in 33 years, reflecting the impact of severe drought in the key farming region, the U.S. Department of Agriculture (USDA) said on Monday.

www.reuters.com

www.reuters.com

Northern U.S. Plains drought shrivels spring wheat crop to smallest in 33 years, USDA says

Farmers in the northern U.S. Plains are on track to harvest the smallest spring wheat crop in 33 years, reflecting the impact of severe drought in the key farming region, the U.S. Department of Agriculture (USDA) said on Monday.

Inflation climbs higher than expected in June as price index rises 5.4%

Inflation climbs higher than expected in June as price index rises 5.4%

The consumer price index was expected to increase 5% year over year in June, according to economists surveyed by Dow Jones.

Come on man!! You dog face pony soldier. It's only temporary.... Until it's not

Inflation climbs higher than expected in June as price index rises 5.4%

Inflation climbs higher than expected in June as price index rises 5.4%

The consumer price index was expected to increase 5% year over year in June, according to economists surveyed by Dow Jones.www.cnbc.com

I've been on a 3-month waiting list for a new, one-trip 20' shipping container. I was originally quoted $4500, and today I had to pay $5600 to get one. A few other places I contacted before this unit arrived were quoting me $7000, or said they stopped selling them so they could maintain units to rent.

Federal Reserve Chairman Jerome Powell said Wednesday that the economy needs to improve more before the central bank will change its ultra-easy monetary policy.

In remarks prepared for the House Financial Services Committee, the central bank chief noted improvements but said the labor market in particular is still well below where it was before the Covid-19 pandemic hit.

_____________________________________________

www.cnbc.com

www.cnbc.com

www.cnn.com

www.cnn.com

In remarks prepared for the House Financial Services Committee, the central bank chief noted improvements but said the labor market in particular is still well below where it was before the Covid-19 pandemic hit.

_____________________________________________

BlackRock’s CEO is concerned about inflation. But here’s why he still sees stocks going higher

Powell says the Fed is still a ways off from altering policy, expects inflation to moderate

Powell said Wednesday that the economy needs to improve more before the central bank will change its ultra-easy monetary policy.

Why inflation may not go away anytime soon

America's finance chiefs don't think inflation will go away overnight.

Last edited:

OatsCommodity

3.86+0.12+3.21%01:38:00 PM EDT 6/30/2021

MI Indication

Up 71% for 5 years

Highest price since 2014

__________________________________________

OatsCommodity

4.31+0.45+11.66%Up 96% for 5 years

_____________________________

OatsCommodity

4.39+0.53+13.73% (For the day)02:18:00 PM

MI Indication

Up, up, up

It's all about the food

Last edited:

Yesterday I heard that blackrock now has over ten trillion in accounts.

Federal Reserve Chairman Jerome Powell said Wednesday that the economy needs to improve more before the central bank will change its ultra-easy monetary policy.

In remarks prepared for the House Financial Services Committee, the central bank chief noted improvements but said the labor market in particular is still well below where it was before the Covid-19 pandemic hit.

_____________________________________________

BlackRock’s CEO is concerned about inflation. But here’s why he still sees stocks going higher

Powell says the Fed is still a ways off from altering policy, expects inflation to moderate

Powell said Wednesday that the economy needs to improve more before the central bank will change its ultra-easy monetary policy.www.cnbc.com

Why inflation may not go away anytime soon

America's finance chiefs don't think inflation will go away overnight.www.cnn.com

Yep......... And if the economy takes a dump.... Blackrock takes a hit...... Blackrock has very little money in those accounts.... That 10 trillion is other people's money (Pension funds, Retirement accounts, off shore funds, etc).... They bull shit those fund managers to invest in one of the riskiest deals around in order to get the highest return. Blackrock itself is "reinsured" and when the failure hits Blackrock will collect on the insurance and the little guys will take the hit... History repeating itself... One more Ponzi scheme.... Watch how the chips will fall...Yesterday I heard that blackrock now has over ten trillion in accounts.

I can validate your findings...I've been on a 3-month waiting list for a new, one-trip 20' shipping container. I was originally quoted $4500, and today I had to pay $5600 to get one. A few other places I contacted before this unit arrived were quoting me $7000, or said they stopped selling them so they could maintain units to rent.

Used 40' Containers Available Now - general for sale - by dealer

Mountain Container has aquired a Mountain of used 40' containers that are now starting to arrive. Local delivery is included in our special price of $7920 per container. These will go fast so call...

missoula.craigslist.org

Lis

Listen to the man.......... he is quoting fact... not Government fiction..... The bear trap is set.

Listen to the man.......... he is quoting fact... not Government fiction..... The bear trap is set.

That was basically the topic of conversation. It kinda reminded me of the dot com and the 08 bullshit combined.Yep......... And if the economy takes a dump.... Blackrock takes a hit...... Blackrock has very little money in those accounts.... That 10 trillion is other people's money (Pension funds, Retirement accounts, off shore funds, etc).... They bull shit those fund managers to invest in one of the riskiest deals around in order to get the highest return. Blackrock itself is "reinsured" and when the failure hits Blackrock will collect on the insurance and the little guys will take the hit... History repeating itself... One more Ponzi scheme.... Watch how the chips will fall...

Funny how the government fixed all that.

Gonna be awesome to watch home prices and stock valuations if the Fed gets painted into a corner and is forced to raise rates. But that's nothing like what happened in 2005-'07, right?

I thought that the banks all had to be financially sound enough to go through another fiasco?? The Fed was supposed to make sure of it.

Someone said that the average wait for a buyer right now is 17 days here. Prices are insane. 80% over the value is probably average. It's like 08 never happened

Gonna be awesome to watch home prices and stock valuations if the Fed gets painted into a corner and is forced to raise rates. But that's nothing like what happened in 2005-'07, right?

Someone said that the average wait for a buyer right now is 17 days here. Prices are insane. 80% over the value is probably average. It's like 08 never happened

Watching the lines be drawn... Politicians / Government "Remain Calm"...... Man on Main Street "This is not looking good".....

____________________

Forbes reports: Senate Democrats Unveil $3.5 Trillion Spending Deal. JWR’s Comment: If they ramrod this through, then there is little hope of saving the U.S. Dollar from destruction. My advice: Diversify into land and practical, barterable tangibles, in anticipation of higher inflation.

____________________

Forbes reports: Senate Democrats Unveil $3.5 Trillion Spending Deal. JWR’s Comment: If they ramrod this through, then there is little hope of saving the U.S. Dollar from destruction. My advice: Diversify into land and practical, barterable tangibles, in anticipation of higher inflation.

Honey Crisp apples - $4 / lb

_________________

New York (CNN Business)The biggest question facing the US economy is when skyrocketing consumer prices will come back to earth. The emergence of the Delta variant only deepens that inflation mystery.

The hope is that inflation will cool off as the economy fully reopens, allowing supply to catch up with increasing demand

www.cnn.com

www.cnn.com

_________________

New York (CNN Business)The biggest question facing the US economy is when skyrocketing consumer prices will come back to earth. The emergence of the Delta variant only deepens that inflation mystery.

The hope is that inflation will cool off as the economy fully reopens, allowing supply to catch up with increasing demand

Inflation is here. The Delta variant could make it worse

The biggest question facing the US economy is when skyrocketing consumer prices will come back to earth. The emergence of the Delta variant only deepens that inflation mystery.

The next one:

Coffee futures soared 10% on Thursday, with prices posting their largest single-session gain since early 2014 and their highest settlement in more than six years, as drought and frost threaten coffee crops in Brazil, the world’s largest coffee producer.

www.marketwatch.com

www.marketwatch.com

Coffee futures soared 10% on Thursday, with prices posting their largest single-session gain since early 2014 and their highest settlement in more than six years, as drought and frost threaten coffee crops in Brazil, the world’s largest coffee producer.

Why coffee futures scored their biggest 1-day gain in over 7 years

Coffee futures moved up by 10% on Thursday, with prices posting their largest single-session gain since early 2014 and their highest settlement in more than...

Hold up right there, motherfuckers...The next one:

Coffee futures soared 10% on Thursday, with prices posting their largest single-session gain since early 2014 and their highest settlement in more than six years, as drought and frost threaten coffee crops in Brazil, the world’s largest coffee producer.

Why coffee futures scored their biggest 1-day gain in over 7 years

Coffee futures moved up by 10% on Thursday, with prices posting their largest single-session gain since early 2014 and their highest settlement in more than...www.marketwatch.com

Hold up right there, motherfuckers...

CoffeeCommodity

2.05+0.13+6.77%09:42:00 AM

MI Indication

Up 52% for the year.....

I don’t know how much the price of coffee can go up and have it matter. Other than Starbucks and the like. There are alternatives like the swill that is available at any discount store.CoffeeCommodity

2.05+0.13+6.77%

09:42:00 AM

MI Indication

Up 52% for the year.....

hint: caffeine pills are way cheaper than most coffee brands. Not that I know……

A lot of people drink coffee and I think it spills over to all drinks. I don't think soda/flavored water/ tea will pass up a reason to raise the price and follow it.

A lot of people drink coffee and I think it spills over to all drinks. I don't think soda/flavored water/ tea will pass up a reason to raise the price and follow it.

Good - maybe this will result in fewer people drinking that garbage. But probably not, because even a 2x increase would mean that it's still damn affordable to guzzle one's way into Type 2 diabetes.

Something that came up on Twitter over the weekend bears mentioning here - it will become increasingly important over the coming months to distinguish between monetary inflation and cost increases driven by scarcity. It might feel like the same thing at the cash register, but the root causes are much different. This probably won't matter because it's not like there will be any effective attempts at driving policies to change the problems, but it'd be nice to at least see some nuanced discussion.

it will become increasingly important over the coming months to distinguish between monetary inflation and cost increases driven by scarcity.Good - maybe this will result in fewer people drinking that garbage. But probably not, because even a 2x increase would mean that it's still damn affordable to guzzle one's way into Type 2 diabetes.

Something that came up on Twitter over the weekend bears mentioning here - it will become increasingly important over the coming months to distinguish between monetary inflation and cost increases driven by scarcity. It might feel like the same thing at the cash register, but the root causes are much different. This probably won't matter because it's not like there will be any effective attempts at driving policies to change the problems, but it'd be nice to at least see some nuanced discussion.

I am in agreement with E. Bryant

The difference being how long it takes the price of an item to return to a pre-pandimic level. The housing market cooled last month due to higher prices and fewer houses on the market while interest rates remained low. Unfavorable weather conditions appear to be driving the price of commodities up.

Natural Gas (Henry Hub)Commodity

4.11+0.06+1.48%02:06:00 PM

MI Indication

Up 124% for the year

Another often over looked commodity.... Shut down the coal burner power plants and bring the natural gas power plants online... Those gas turbine plants started out being called "Peaker Plants" since they could be fired up on short notice when the major power plants were running at max capacity to give a boost to the grid. Now, natural gas power plants are providing 100% of the power in many regions. Refineries and chemical plants, food processing plants, boiler heat for large buildings all depend on natural gas.... Winter is not that far away.

Natural Gas (Henry Hub)Commodity

4.11+0.06+1.48%

02:06:00 PM

MI Indication

Up 124% for the year

Another often over looked commodity.... Shut down the coal burner power plants and bring the natural gas power plants online... Those gas turbine plants started out being called "Peaker Plants" since they could be fired up on short notice when the major power plants were running at max capacity to give a boost to the grid. Now, natural gas power plants are providing 100% of the power in many regions. Refineries and chemical plants, food processing plants, boiler heat for large buildings all depend on natural gas.... Winter is not that far away.

As T Boone Pickens once pointed out, natural gas is a usable transportation fuel - probably not the best one, but workable. If we end up burning it up in stationary plants providing base load for the grid, it might not be our finest moment in resource allocation.

And yet less than 1% of the people have their wood and or alternate means prepared while there is still time.Winter is not that far away.

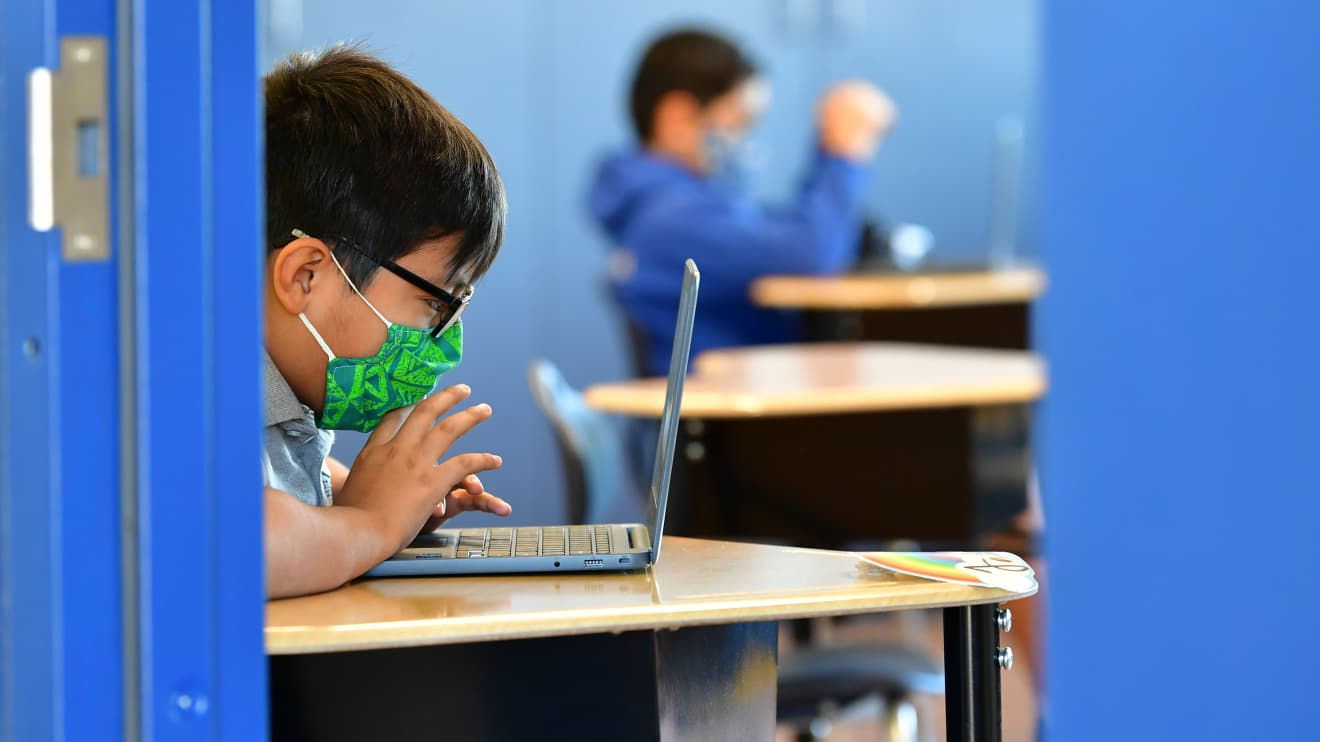

COVID-related global chip shortage will make back-to-school shopping more expensive

Families say they plan to spend an average of nearly $850 on back-to-school shopping this year, up $59 from 2020

COVID-related global chip shortage will make back-to-school shopping more expensive

Families say they plan to spend an average of nearly $850 on back-to-school shopping this year, up $59 from 2020.

I think Texas road House used a very, very conservative inflation number. Didn't take much to spook investors. When the real numbers come out at the end of the year that will be spooky.

_________________________________________________

www.marketwatch.com

www.marketwatch.com

_________________________________________________

Texas Roadhouse spooks investors by talking of 7% food inflation for the year

Texas Roadhouse spooks investors by talking of 7% food inflation for the year

Texas Roadhouse Inc. beat Wall Street expectations for its profit and sales, but spooked investors by saying it expects even higher food costs for the year.

Similar threads

- Replies

- 32

- Views

- 1K

- Replies

- 109

- Views

- 4K

- Replies

- 61

- Views

- 2K