This sounds ominous, but in reality the two major changes, that people substitute goods when relative prices change (say pasta for rice) and that there should be some sort of calculation for product quality (computers are the great example) make the inflation numbers more more economically realistic than does a more fixed basket of goods. It would be great to publish both, but the new one is preferable to the old on an economic basis.Only thing Transitory is the way they measure inflation. Blue If the inflation was measured by 80's standards

View attachment 7728194

Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Inflation.......... ?

- Thread starter Hobo Hilton

- Start date

Sho’ am glad we saved $0.16 per pack of hotdogs on Independence Day!

www.yahoo.com

www.yahoo.com

This Year's Thanksgiving Feast Will Wallop the Wallet

Thanksgiving 2021 is shaping up to be the most expensive meal in the history of the holiday. Caroline Hoffman is already stashing canned pumpkin in the kitchen of her Chicago apartment when she finds some for under a dollar. She recently spent almost $2 more for the vanilla she’ll need to bake...

12 mo. ago, Kamala Harris charged $25 for a BJ. Now she's up to $75.

If post #1084 is right, imagine how much Janet Yellen gets...Gross...12 mo. ago, Kamala Harris charged $25 for a BJ. Now she's up to $75.

Cathie Wood (Arc Investment) manages $50 billion in assets. She sees deflation coming into play next year. Interesting theories.

While many market participants are concerned about rising prices, the hot-handed investor expects deflation amid a breakdown in commodity prices, a failure of companies that fell behind innovation, company stockpiling and innovation trends taking off.

www.cnbc.com

www.cnbc.com

While many market participants are concerned about rising prices, the hot-handed investor expects deflation amid a breakdown in commodity prices, a failure of companies that fell behind innovation, company stockpiling and innovation trends taking off.

Cathie Wood disputes Jack Dorsey's hyperinflation warning, says prices will fall after holidays

Cathie Wood took to Twitter to expound on deflation after Dorsey tweeted "Hyperinflation is going to change everything. It's happening."

She is likely wrong, but the important message in her comments is that it is because she was wrong in her predictions before, specifically in 08-09, that she is unwilling to use the same analytical framework she did during that period with the same level of certainty she had before. That is the kind of intellect that adapts and wins. That said, calling for deflation is a pretty bold move, even if the breakdown in certain commodity prices is something I have pointed out here many times. I don't think you will see a breakdown in oil prices without a pretty significant recession, though the collapsing food commodity prices may well continue. I just don't think there is, at this point, enough softness to break oil prices, and not by a long shot.Cathie Wood (Arc Investment) manages $50 billion in assets. She sees deflation coming into play next year. Interesting theories.

While many market participants are concerned about rising prices, the hot-handed investor expects deflation amid a breakdown in commodity prices, a failure of companies that fell behind innovation, company stockpiling and innovation trends taking off.

Cathie Wood disputes Jack Dorsey's hyperinflation warning, says prices will fall after holidays

Cathie Wood took to Twitter to expound on deflation after Dorsey tweeted "Hyperinflation is going to change everything. It's happening."www.cnbc.com

Deflation occurs when prices go down. You have rampant money creation at the moment. In order for deflation to occur you will need a lack of general market demand and monetary destruction through defaulting loans. She is basically saying that she expects the Fed to fail.Cathie Wood (Arc Investment) manages $50 billion in assets. She sees deflation coming into play next year. Interesting theories.

While many market participants are concerned about rising prices, the hot-handed investor expects deflation amid a breakdown in commodity prices, a failure of companies that fell behind innovation, company stockpiling and innovation trends taking off.

Cathie Wood disputes Jack Dorsey's hyperinflation warning, says prices will fall after holidays

Cathie Wood took to Twitter to expound on deflation after Dorsey tweeted "Hyperinflation is going to change everything. It's happening."www.cnbc.com

Deflation last occurred big time in the 30's. You don't want this with the current money and debt structure we have.

Innovation trends taking off requires investment. Tough to do during a deflationary period as willing investors may be hard to find. Unless innovation is propped up through government spending.

I've re-read Cathie Wood (Arc Investment) article and some other comments by other's.

Is she banking on an increase in interest rates by the Fed in an effort to curb inflation ? If so, is she "cherry picking" companies / industries that will do well as interest rates increase? She could also be shorting (or options) on the sector that will fall the fastest and hardest when interest rates increase.

Is she banking on an increase in interest rates by the Fed in an effort to curb inflation ? If so, is she "cherry picking" companies / industries that will do well as interest rates increase? She could also be shorting (or options) on the sector that will fall the fastest and hardest when interest rates increase.

Food companies could see $3 billion in monthly sales vanish, as low-income households get squeezed

About 16% of households across the U.S. — 42 million people in total — participate in the SNAP program.

Food companies could see $3 billion in monthly sales vanish, as low-income households get squeezed

As pandemic stimulus checks end, consumer packaged goods companies will feel the pain, too, according to IRI.

I wouldn’t let that nasty cackling whore pay me to suck my dick!12 mo. ago, Kamala Harris charged $25 for a BJ. Now she's up to $75.

Hmm, maybe Google and AWS giving away training and services for AI are driving this into a commodity. I wouldn't predict our economy on that data point.The ARK Innovation portfolio manager noted that training costs for artificial intelligence are dropping 40% to 70% per year, which she believes is a "record-breaking deflationary force."

Del Monte produce raising prices in response to 'unprecedented market conditions' and 'inflationary pressures'

The Del Monte produce company has announced that it will be raising costs on certain products in response to “unprecedented market conditions” and “inflationary pressures.”

He called exporting "the other half of the crisis," and noted that agricultural exporters are "almost in a panic."

That is a good article.... The comments section bring the situation to light.... The majority of American's have noted the increasing cost of food.... There some optimistic articles by fund managers but most are saying nothing will change for at least 6 months. If the "seasonal adjustments" are removed from the reports on the economy stagflation seems to be setting in.

Del Monte produce raising prices in response to 'unprecedented market conditions' and 'inflationary pressures'

The Del Monte produce company has announced that it will be raising costs on certain products in response to “unprecedented market conditions” and “inflationary pressures.”www.foxbusiness.com

so I saved up 15k to do some work on my house. worked hard and sacrificed to save it up. the contractor, who is a lazy turd, kept putting me off all year and now he says that he'll have to do it next spring. how much do you want to bet that this bastard's price will go up, despite our agreement, "because of inflation"

Claim force majeure and end the agreement. Do it now while time is on your side.so I saved up 15k to do some work on my house. worked hard and sacrificed to save it up. the contractor, who is a lazy turd, kept putting me off all year and now he says that he'll have to do it next spring. how much do you want to bet that this bastard's price will go up, despite our agreement, "because of inflation"

Force majeure events are usually defined as certain acts, events or circumstances beyond the control of the parties, for example, natural disasters or the outbreak of hostilities. A force majeure clause typically excuses one or both parties from performance of the contract in some way following the occurrence of such events. Its underlying principle is that on the occurrence of certain events which are outside a party's control, that party is excused from, or entitled to suspend performance of all or part of its obligations. That party will not be liable for its failure to perform the obligations, in accordance with the clause.

Farmers in my District warn that consumers may soon face an additional increase in the price of food

Democrats' out of control spending will wreck our food supply: Rep. Bruce Westerman

While Democrats fight each other to spend nearly $5 trillion, farmers and producers understand what effect such reckless, out of control spending will have on our food supply.

Because he will either back out claiming he cant do it due to rising costs of materials and labor shortages or he will half-ass it and you will get a piece of shit that you paid for and tried to force him to build in a pissed off state of mind while losing money at the same time. Then you can repay to have it all done again or have constant maintenance to band-aid repairs.why the fuck would I want to excuse him from doing the work for the amount previously agreed, and allow him to charge more. cold weather has set in now, and nobody can do the job until next year. if I had known we were about to become 1920's Weimar Germany, I would have found someone else while it was warm enough to do the work, and before inflation set in

Interesting you would bring Elaine up at this point in time. I went back and read her thoughts in an article (Link Below) from May 15, 1991.... 30 years ago she was on top of her game by using some reliable market indicators that are mentioned in the article. The worldwide market is a different animal today... This is why the economy is beginning to stagnate. Similar to some phrases with Nautical origin's.... Tide Over, Hand The Sails, The Doldrums, Flat Calm, Becalmed, etc.Elaine Garzarelli..............

The largest fund managers are rolling the dice while playing with other folks money... They are also hedged in mega funds where the small investors can't play.

ELAINE GARZARELLI PREDICTS A NINE-MONTH RALLY

WHEN IT comes to predicting where the stock market is headed, not too many analysts lately have been better than Shearson Lehman Brothers strategist Elaine Garzarelli. Miss Garzarelli was one

lol. Literally lol.Interesting you would bring Elaine up at this point in time. I went back and read her thoughts in an article (Link Below) from May 15, 1991.... 30 years ago she was on top of her game by using some reliable market indicators that are mentioned in the article. The worldwide market is a different animal today... This is why the economy is beginning to stagnate. Similar to some phrases with Nautical origin's.... Tide Over, Hand The Sails, The Doldrums, Flat Calm, Becalmed, etc.

The largest fund managers are rolling the dice while playing with other folks money... They are also hedged in mega funds where the small investors can't play.

ELAINE GARZARELLI PREDICTS A NINE-MONTH RALLY

WHEN IT comes to predicting where the stock market is headed, not too many analysts lately have been better than Shearson Lehman Brothers strategist Elaine Garzarelli. Miss Garzarelli was onebuffalonews.com

I frequent the Thrift Stores, Second Hand stores, Goodwill and Habitat for Humanity store. Recently I started asking what second hand items were in demand. The number one reply was used appliances (Stoves, washing machines, etc)...

www.cnbc.com

www.cnbc.com

Economic growth rate slows to 2% on a sharp slowdown in consumer spending

The U.S. economy grew at a 2% rate in the third quarter, its slowest gain of the pandemic-era recovery.

WASHINGTON—The Biden administration is in talks to offer immigrant families that were separated during the Trump administration around $450,000 a person in compensation, according to people familiar with the matter, as several agencies work to resolve lawsuits filed on behalf of parents and children who say the government subjected them to lasting psychological trauma.

WSJ News Exclusive | U.S. in Talks to Pay Hundreds of Millions to Families Separated at Border

The government is considering payments of $450,000 a person affected by the Trump administration’s zero-tolerance policy in 2018 for asylum seekers illegally crossing the border.

WASHINGTON—The Biden administration is in talks to offer immigrant families that were separated during the Trump administration around $450,000 a person in compensation, according to people familiar with the matter, as several agencies work to resolve lawsuits filed on behalf of parents and children who say the government subjected them to lasting psychological trauma.

WSJ News Exclusive | U.S. in Talks to Pay Hundreds of Millions to Families Separated at Border

The government is considering payments of $450,000 a person affected by the Trump administration’s zero-tolerance policy in 2018 for asylum seekers illegally crossing the border.www.wsj.com

Just. Send. It.

Keep digging that hole idiot. He can't stop now. Just keep digging. With his favorable public opinion evaporating like dry ice on a warm day, it will be obvious what needs to happen and those not engaged will at least step aside and watch. Accelerationism in action. We are watching the car drive off the cliff in double speed.Just. Send. It.

U.S. Prices, Wages Rise at Fastest Pace in Decades

Consumer prices rose at the fastest pace in 30 years in September while workers saw their biggest compensation boosts in at least 20 years. Consumer spending also rose in September.

A few morning headlines:

www.bbc.com

www.bbc.com

U.S. consumers dipped into savings to keep spending in September

Inflation notches a fresh 30-year high as measured by the Fed’s favorite gauge

Exxon posts highest quarterly profit in years, but revenue disappointsU.S. stock futures fall as Apple, Amazon decline on disappointing earnings

Pope urges 'radical' climate response

Slow rise from ultra-low mortgage rates predicted - Appearing the British will lead off in raising the interest rates.

Slow rise from ultra-low mortgage rates predicted

Brokers say the current cost of a mortgage is the lowest it will be "for some time".

This sounds ominous, but in reality the two major changes, that people substitute goods when relative prices change (say pasta for rice) and that there should be some sort of calculation for product quality (computers are the great example) make the inflation numbers more more economically realistic than does a more fixed basket of goods. It would be great to publish both, but the new one is preferable to the old on an economic basis.

Amazon has maybe the best measure of inflation with a basket of goods numbering about 1.5MM. Their models show inflation far higher than what the Fed reports, in part becuase they examine purchasing power. The Fed has always worked to remove inflation from inflation measures. Inflation over the last 30 years inflation is at least double the ~2% the Fed/BLS/World Bank, etc. report.

Honestly, I would love to look at this if you have a link. It sounds interesting. The only thing I could find was this, which actually shows the opposite of what you are saying:Amazon has maybe the best measure of inflation with a basket of goods numbering about 1.5MM. Their models show inflation far higher than what the Fed reports, in part becuase they examine purchasing power. The Fed has always worked to remove inflation from inflation measures. Inflation over the last 30 years inflation is at least double the ~2% the Fed/BLS/World Bank, etc. report.

Been having some conversations with some of the 4th - 5th generation cattle people here. Their financial advice boils down to one sentence - "Save Your Money"... When I point out that inflation is eating away at that money in savings they nod in agreement. Very, very few have invested in new equipment (trucks, tractors, bailing equipment, etc) this year. Their theory is the economy is like a pendulum and will swing the other direction. While the money they have in the bank is losing value, they plan on being able to pick up equipment they need at a discount that will offset the inflation factor on their money.

“The secret of patience is to do something else in the meantime.” – Croft M. Pentz

“The secret of patience is to do something else in the meantime.” – Croft M. Pentz

Sure thing, but it will have to wait until Monday as I can't access those data sets from where I sit. So I'll have to explain less rigorously, for the moment. To understand inflation you need to take into account purchasing power.Honestly, I would love to look at this if you have a link. It sounds interesting. The only thing I could find was this, which actually shows the opposite of what you are saying:

View attachment 7731447

We'll accept that CPI average around 2% for recent history:

Indexed y/y since 1990 CPI looks like this:

Now that we know our capital (i.e. money) is losing 2% of value every year, here’s the obvious follow-up question: how do we prevent that?

To offset the effect of inflation, we need to either 1) earn income on our capital, or 2) grow our capital, at a rate greater than 2% per year to keep pace.

Now here's USD purchasing power indexed over the same period of time

I am sure that folks have already started thinking about their investments (house, stocks, bonds, etc) that have beat CPI by far more than 2%. But have you really beat inflation? Like I said previously, the Fed works hard to keep inflation out of inflation measurements. Does anyone really agree that the price of food is not a VERY important factor to a majority of Americans? But perhaps more importantly, why are financial assets not included in measures of inflation?

While I will later (like later during the week) argue that wages are wayyyy behind inflation, for now I will refer back to the tweet I posted above.

‘Fiat’ just means a currency created by a government. If we break down what a currency is it gets interesting. A $100 US printed note is an IOU from the government. Cash you can hold in your hand is an IOU. Once upon a time these slips of paper were redeemable for gold if you wanted it. Not anymore, obviously.

Stocks, bonds, and real estate. These assets act as a store of value. Many people think they are escaping the (huge) problems of governments creating currency out of thin air and inflation by owning them.

What if the financial assets you have always been taught to buy weren’t what they seemed?

When you say “my house went up by 11% last year” or “my Amazon stocks went up by 25% this year,” did either asset really go up? When you measure whether stocks or real estate went up in price, it depends on what you measure them in.

When we measure how much the overall US stock market went up over the last 30 years we might be impressed. It looks amazing! This is where the painful “buy the vanguard stock market index fund” cliche advice comes from.

What am I measuring the value I create in? What does my value look like when measured with a different metric? Did the price of the assets you own go up, or did the value of the currency you’re using to measure those assets (your purchasing power) go down?

The government and central banks that control money have two magic tricks: 1) Create more money out of thin air. 2) Raise or lower interest rates.

Both of these magic tricks go by several names: quantitative easing, stimulus ($2000 checks of free money), fiscal spending. It’s all bullshit.

Monetary expansion means creating more currency out of thin air. This is a hidden tax on the people who hold that currency.

Currency is created out of thin air for a few reasons: a pandemic (crisis), to fund wars, to help lift a country out of a recession, to give the currency to a bank so they will lend more money to people and businesses.

“Grow cash flows” faster than the printing of money is the last part of the tweet. Some stocks, bonds, and real estate generate cash when you own them. (You knew that already — it’s not rocket science.) If you have an asset generating cash and rising in value over time, then the increase in money created out of thin air matters to you. But none of this, the very thing we build our nest egg out of, is measure within CPI. I'm not sure how much more misleading it could be.

Michael says the cash you generate from your assets must be greater than the amount of money created out of thin air (also known as inflation, which simply means prices rising).

Very few people are able to do this.

I'll refer to a more honest index than CPI created by financial advisor Ed Butowsky, called the Chapwood Index. The Chapwood Index shows that the average inflation over the last 5 years is between 8.1% and 12.9% in the top 10 US cities.

The explanation of the lie that is inflation is articulately nicely on the Chapwood website. Salary and benefit increases are pegged to the Consumer Price Index (CPI), which for more than a century has purported to reflect the fluctuation in prices for a typical “basket of goods” in American cities — but which actually hasn’t done that for more than 30 years. As long as pay raises and benefit increases are tied to a false CPI, this trend will continue.

Attachments

Last edited:

That’s what I’m waiting on. $4.00-$4.50 per gallon gas in the south east should start it off.Been having some conversations with some of the 4th - 5th generation cattle people here. Their financial advice boils down to one sentence - "Save Your Money"... When I point out that inflation is eating away at that money in savings they nod in agreement. Very, very few have invested in new equipment (trucks, tractors, bailing equipment, etc) this year. Their theory is the economy is like a pendulum and will swing the other direction. While the money they have in the bank is losing value, they plan on being able to pick up equipment they need at a discount that will offset the inflation factor on their money.

“The secret of patience is to do something else in the meantime.” – Croft M. Pentz

Right, I get what he, and you, are saying is basically to look at your standard free cash flow discount model and rather than to simply use a risk free rate plus ERP as a discount rate, to try to estimate an inflation rate and then apply your ERP. That is all well and good, though the concept of using a risk free rate is to allow the market to estimate what the cost of money is rather than to estimate it yourself. It seems that both methods, along with using individual hurdle rates for investments, are basically trying to get at the same thing, though none particularly does it perfectly. Were there a 1:1 ratio between monetary expansion and the cost of living, even including inflation in financial assets, it would be easier, but there isn't. At least there isn't short term in that we all kind of agree, for the sake of simplicity, that MV=PQ, though we all also kind of agree that it doesn't quite do it either, but the basic concept that there is are two factors (M and V) rather than one factor with regard to inflation, at least short term. Perhaps long term V is basically a constant and M is all we have, but that is yet to be determined, IMO.Sure thing, but it will have to wait until Monday as I can't access those data sets from where I sit. So I'll have to explain less rigorously, for the moment. To understand inflation you need to take into account purchasing power.

We'll accept that CPI average around 2% for recent history:

View attachment 7731467

Indexed y/y since 1990 CPI looks like this:

View attachment 7731466

Now that we know our capital (i.e. money) is losing 2% of value every year, here’s the obvious follow-up question: how do we prevent that?

To offset the effect of inflation, we need to either 1) earn income on our capital, or 2) grow our capital, at a rate greater than 2% per year to keep pace.

Now here's USD purchasing power indexed over the same period of time

View attachment 7731469

I am sure that folks have already started thinking about their investments (house, stocks, bonds, etc) that have beat CPI by far more than 2%. But have you really beat inflation? Like I said previously, the Fed works hard to keep inflation out of inflation measurements. Does anyone really agree that the price of food is not a VERY important factor to a majority of Americans? But perhaps more importantly, why are financial assets not included in measures of inflation?

While I will later (like later during the week) argue that wages are wayyyy behind inflation, for now I will refer back to the tweet I posted above.

View attachment 7731470

‘Fiat’ just means a currency created by a government. If we break down what a currency is it gets interesting. A $100 US printed note is an IOU from the government. Cash you can hold in your hand is an IOU. Once upon a time these slips of paper were redeemable for gold if you wanted it. Not anymore, obviously.

Stocks, bonds, and real estate. These assets act as a store of value. Many people think they are escaping the (huge) problems of governments creating currency out of thin air and inflation by owning them.

What if the financial assets you have always been taught to buy weren’t what they seemed?

When you say “my house went up by 11% last year” or “my Amazon stocks went up by 25% this year,” did either asset really go up? When you measure whether stocks or real estate went up in price, it depends on what you measure them in.

When we measure how much the overall US stock market went up over the last 30 years we might be impressed. It looks amazing! This is where the painful “buy the vanguard stock market index fund” cliche advice comes from.

What am I measuring the value I create in? What does my value look like when measured with a different metric? Did the price of the assets you own go up, or did the value of the currency you’re using to measure those assets (your purchasing power) go down?

The government and central banks that control money have two magic tricks: 1) Create more money out of thin air. 2) Raise or lower interest rates.

Both of these magic tricks go by several names: quantitative easing, stimulus ($2000 checks of free money), fiscal spending. It’s all bullshit.

Monetary expansion means creating more currency out of thin air. This is a hidden tax on the people who hold that currency.

Currency is created out of thin air for a few reasons: a pandemic (crisis), to fund wars, to help lift a country out of a recession, to give the currency to a bank so they will lend more money to people and businesses.

“Grow cash flows” faster than the printing of money is the last part of the tweet. Some stocks, bonds, and real estate generate cash when you own them. (You knew that already — it’s not rocket science.) If you have an asset generating cash and rising in value over time, then the increase in money created out of thin air matters to you.

Michael says the cash you generate from your assets must be greater than the amount of money created out of thin air (also known as inflation, which simply means prices rising).

Very few people are able to do this.

I'll refer to a more honest index than CPI created by financial advisor Ed Butowsky, called the Chapwood Index. The Chapwood Index shows that the average inflation over the last 5 years is between 8.1% and 12.9% in the top 10 US cities.

The explanation of the lie that is inflation is articulately nicely on the Chapwood website. Salary and benefit increases are pegged to the Consumer Price Index (CPI), which for more than a century has purported to reflect the fluctuation in prices for a typical “basket of goods” in American cities — but which actually hasn’t done that for more than 30 years. As long as pay raises and benefit increases are tied to a false CPI, this trend will continue.

That complaint out of the way, I think you are basically right on that people don't complain when inflation is solely in financial instruments, and not in goods. It is actually a point I have tried to make in here many times. Back to discount rates, or hurdle rates, one of the hardest issues I dealt with in running a fund is that mine and my clients may not be the same. That is to say that it is easy to look at the market as a comparison rate, but that is ex post when selecting investments, so you are kind of stuck with choosing your own hurdle rate, hopefully based somewhat on historical returns, and, if you are doing it for yourself, you need to be honest with yourself. If you are running money professionally, it really helps to have good clients! But again, where I think you have this right, is that investors are more at the whim of the fed now than they were when I started, and that doesn't look like it is going to change. It would be nice to run everything off of something like a Taylor Rule, so that we could plug our individual estimates in and come out with a policy we could predict, rather than doing so and then hoping the fed saw things the same way. At least in the first case you are only subject to your own mistakes, not subject to the mistakes of others as well. But alas.

You touch on fiscal policy a bit in there as well, but I have pushed back on its efficacy in this thread, and continue to do so. I think it is far more impotent than we were taught when I was in school. I will give as example the 2009 stimulus. Everybody, at this point, pretty much accepts that it was a failure. Conservatives say it didn't work, Liberals say it wasn't big enough. Nobody says "hey that was great." But what does that mean? Since stimulus is just a nice word for planned inflation (reflation) it just means that we were able to throw a shit ton of money at a "problem" and end up getting very little out of it. In other words, we weren't able to inflate even when we tried. Now, that doesn't mean that it isn't insane to spend all of this money while in an inflationary period, but, and I think you and Saylor seem to agree with me here, fiscal mismanagement is rather small potatoes when compared to monetary mismanagement.

So, all that agreement aside, I am still unconvinced by a group of shadow cpi numbers like the ones you linked to. That is why I would like to see the Amazon ones, especially in light of what I posted above that the Amazon CPI seems to be much lower than the CPI proper. That is exactly what I would expect, because Amazon literally makes it simple to substitute as relative prices change. They show you the substitutes themselves. And I would argue that substitution effect is a feature of the new way of measuring CPI, rather than a bug, exactly because it is how people act in real life.

Sorry to drone on, I hope you are able to find the numbers. They might me quite enlightening.

So transitory it is? I mean this is literally the definition of transitory.Been having some conversations with some of the 4th - 5th generation cattle people here. Their financial advice boils down to one sentence - "Save Your Money"... When I point out that inflation is eating away at that money in savings they nod in agreement. Very, very few have invested in new equipment (trucks, tractors, bailing equipment, etc) this year. Their theory is the economy is like a pendulum and will swing the other direction. While the money they have in the bank is losing value, they plan on being able to pick up equipment they need at a discount that will offset the inflation factor on their money.

“The secret of patience is to do something else in the meantime.” – Croft M. Pentz

One of the mega fund managers said, two months, that the secret to getting all of the shelves fully stocked is to lower the value of the USD to the point where people will stop buying things.That’s what I’m waiting on. $4.00-$4.50 per gallon gas in the south east should start it off.

You mean, when demand goes up and supply goes down, that prices will rise? Less buying power with our Bernanke, oops I meant Powell, bucks?One of the mega fund managers said, two months, that the secret to getting all of the shelves fully stocked is to lower the value of the USD to the point where people will stop buying things.

No. Hobo’s quote deals with devaluing the dollar so that prices go up so high that purchases are deferred in favor of necessities. IOW, raise prices so much through monetary inflation that the current supply is adequate to meet demand.You mean, when demand goes up and supply goes down, that prices will rise? Less buying power with our Bernanke, oops I meant Powell, bucks?

IOW, fewer people will buy a $25/lb t-bone than a $12 one. And the TV you have will suffice since everything is more expensive and the necessities take more of your income. Especially since wages lag behind all types of inflation. Of course this means that the retailers that survive such a scenario will have the sales volume to keep going. Others will not, which will result in fewer overall shelves to fill. Then the surviving shelves left will be filled with what is both available and in demand. This basket of goods would be different than the 2019 basket you saw at that time.

What the hedge fund manager is suggesting is the use of monetary inflation to remove your purchasing power. This would happen through the manipulation of the exchange rate by flooding the market with dollars. This would cause a collapsing of the value of the dollar relative to the currency of the nations we trade with since so much of what we consume comes from other countries. It will take more dollars to buy things, faster than wage increases could keep up with.

Bingo. It’s the use of markets forces to create desired outcomes. Just like taxation. Psychology and economics are interrelated.You mean, like what is happening now? You don’t say!

ETA: on a side note, this is how internal conflict arises within any country. Dissatisfaction begins with lean times and the bogeyman seeds are sown in the masses. In times of true need is when those seeds sprout into blame. Then it gets kinetic. If everyone worked together within the country as countrymen to help each other in a mature fashion it would not come to such an outcome, but it never seems to go that way. Socialism tries to sell itself as just such a solution but is actually just a faster devolution into desperate times that last longer than would otherwise be necessary to wash out the bad investments from the economy.

Last edited:

I have seen this "Financial Bear Trap" laid several times in my lifetime.

Many excuses - "But it's Christmas and these people give us gifts"... "I'll pay my credit card off with my tax refund".... "But this is Black Friday and _______ (fill in the blank) will never be this cheap again".... "But the kids really want ________".....

Just a word to the wise. Hang onto your money.

__________________________________________

1 in 3 Americans expect to take on debt this holiday shopping season, according to an October Credit Karma survey. But no matter how people plan to purchase their holiday items, consumers should be mindful of their spending, and any interest or late fees that may be part of credit card or BNPL models.

www.cnbc.com

www.cnbc.com

Many excuses - "But it's Christmas and these people give us gifts"... "I'll pay my credit card off with my tax refund".... "But this is Black Friday and _______ (fill in the blank) will never be this cheap again".... "But the kids really want ________".....

Just a word to the wise. Hang onto your money.

__________________________________________

1 in 3 Americans expect to take on debt this holiday shopping season, according to an October Credit Karma survey. But no matter how people plan to purchase their holiday items, consumers should be mindful of their spending, and any interest or late fees that may be part of credit card or BNPL models.

The benefits and risks when using buy now, pay later for holiday shopping: Credit experts

The 'buy now, pay later' alternative to credit cards will be popular this holiday season, but it does not come without consumer risks.

Two years ago I wanted a tandem dump trailer to pull behind my truck. I'm getting old and tired of shoveling top soil, garden soil, etc off of my flat bed trailer. I'm retired and it would not have been for a contracting business, just around my homestead.. A new one was $4,000. When the pandemic hit and everyone became a contractor, there were no dump trailers to buy or rent. Few new dump trailers were fabricated during the pandemic due to businesses short on labor. Now, every truck equipment sales yard has many of those dump trailers. The price for the exact one is now $9,000.... They don't seem to be moving much inventory.You mean, like what is happening now? You don’t say!

They were $7,999 around here back in June.Two years ago I wanted a tandem dump trailer to pull behind my truck. I'm getting old and tired of shoveling top soil, garden soil, etc off of my flat bed trailer. I'm retired and it would not have been for a contracting business, just around my homestead.. A new one was $4,000. When the pandemic hit and everyone became a contractor, there were no dump trailers to buy or rent. Few new dump trailers were fabricated during the pandemic due to businesses short on labor. Now, every truck equipment sales yard has many of those dump trailers. The price for the exact one is now $9,000.... They don't seem to be moving much inventory.

Went grocery shopping today. I’ve had the same grocery budget of $300 a month since 2004. Was able to fill the cart pretty well. A lot of chicken and pork this time though. Beef is more than I want to pay. Have switched to a lot of off brands as well.

Veggies were decently priced.

Yep, yep, yep ...... I'm with you. Funny thing is my eating habits have changed as I age and I just don't eat as much as I used to. I'm on a one man homestead with a garden. I'm watching my children's grocery bills to feed my grandchildren / three teenagers.... I encourage anyone who will listen to start growing some sort of vegetables and get a few chickens...... Just in case.They were $7,999 around here back in June.

Went grocery shopping today. I’ve had the same grocery budget of $300 a month since 2004. Was able to fill the cart pretty well. A lot of chicken and pork this time though. Beef is more than I want to pay. Have switched to a lot of off brands as well.

Veggies were decently priced.

Wise words. A little late in the year to be growing now though!Yep, yep, yep ...... I'm with you. Funny thing is my eating habits have changed as I age and I just don't eat as much as I used to. I'm on a one man homestead with a garden. I'm watching my children's grocery bills to feed my grandchildren / three teenagers.... I encourage anyone who will listen to start growing some sort of vegetables and get a few chickens...... Just in case.

My cart is always different as I buy what’s on sale, and or what I have coupons for.

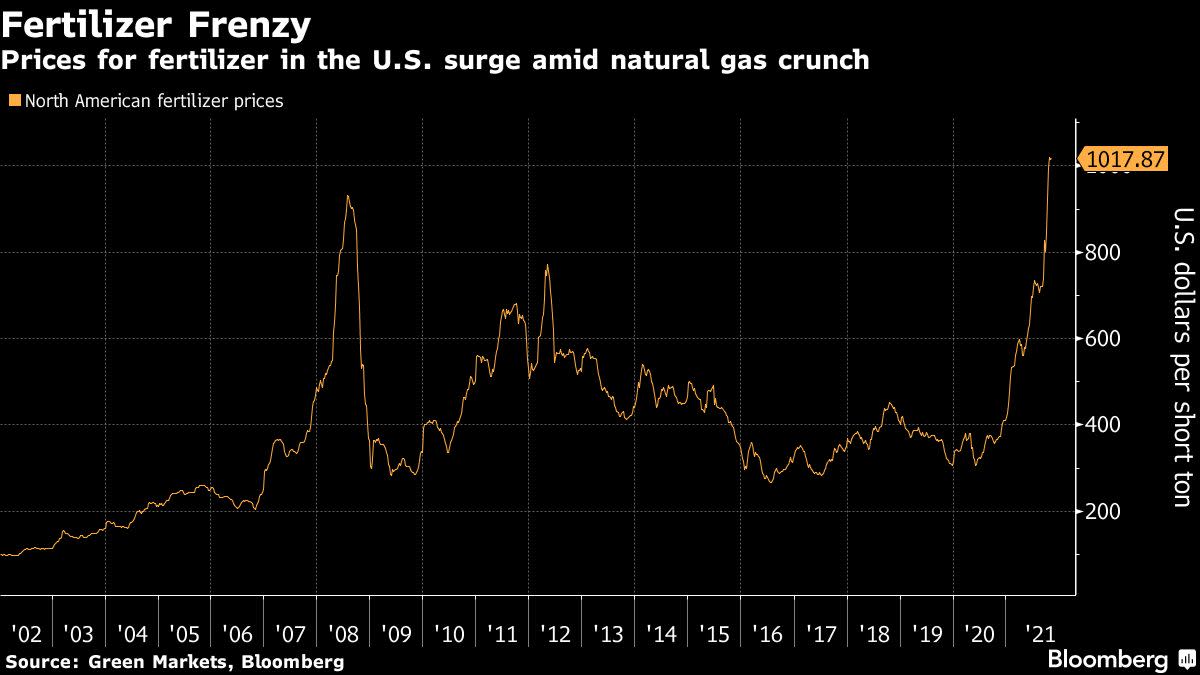

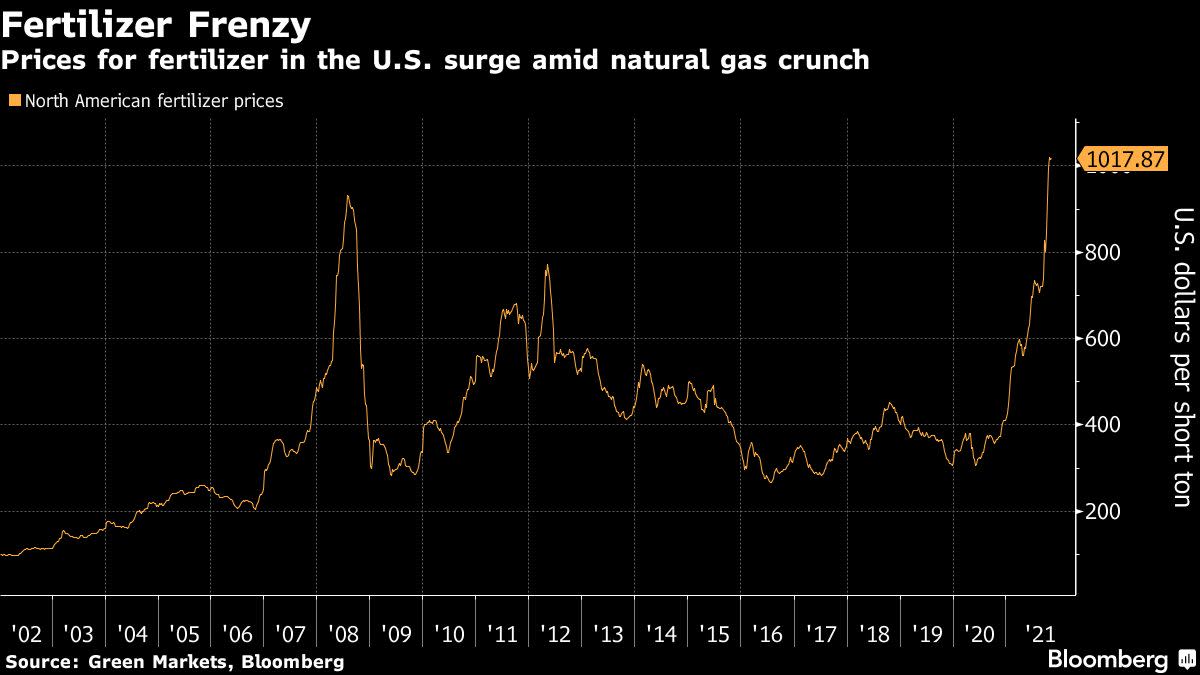

Looking ahead = ......... some customers requesting commitments as far forward as second quarter of 2022.

ca.finance.yahoo.com

ca.finance.yahoo.com

Top Fertilizer Producer Mosaic Sees Massive Price Surge Continuing

(Bloomberg) -- Two of the world’s top fertilizer producers expect the crop-nutrient price surge will continue.Most Read from BloombergInto the Metaverse: Where Crypto, Gaming and Capitalism CollideCan a New Mayor Fix Seattle’s Downtown?Atlanta’s Crowded Election Pits Former Mayor Versus ‘Anyone...

Starting to get some garden seed catalogs for the 2022 season. Some some substantial price increases and shortages are starting to show up. One catalog is advertising heirloom russet potato seed spuds for $2 / each.

Similar threads

- Replies

- 32

- Views

- 1K

- Replies

- 109

- Views

- 4K

- Replies

- 61

- Views

- 1K