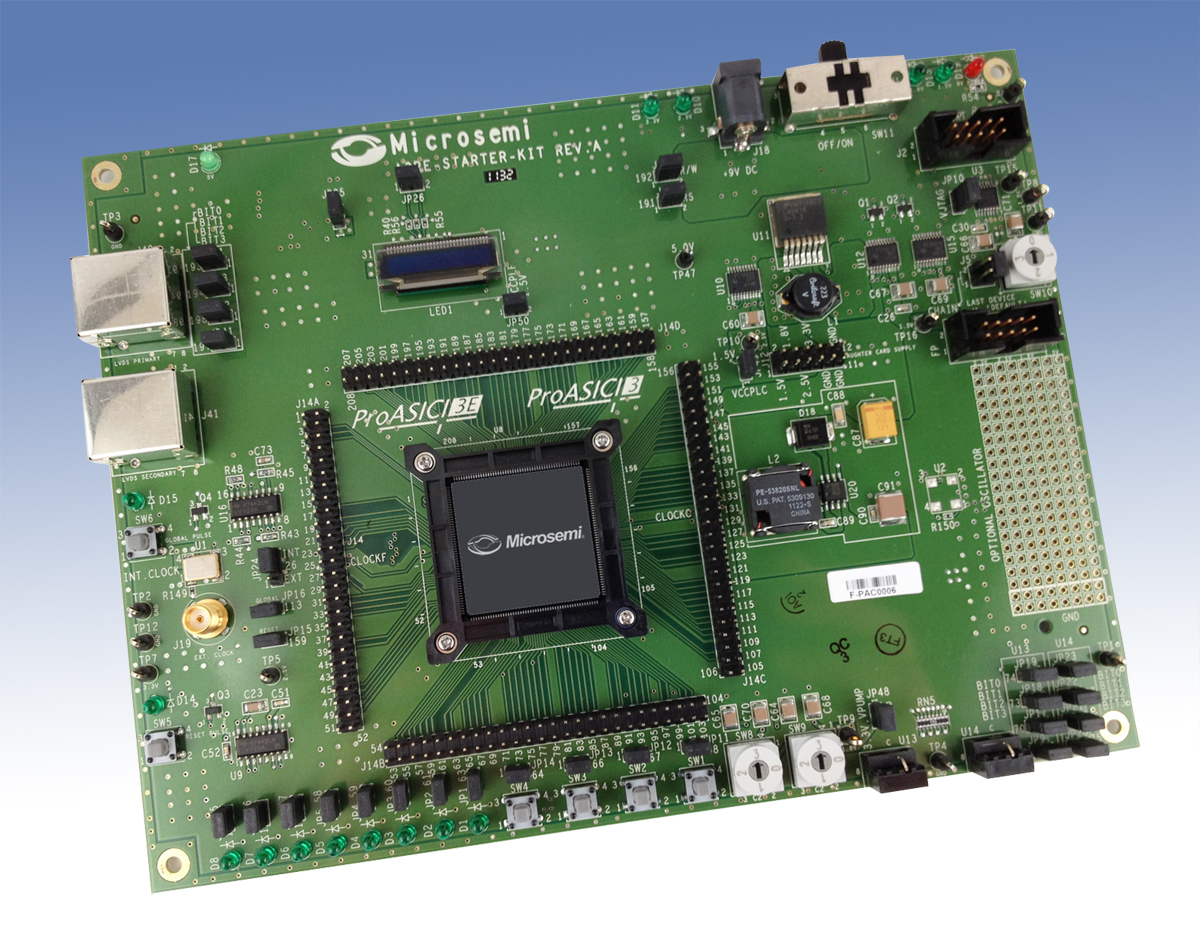

As a result, the ability of U.S. semiconductor fabrication plants (fabs) to meet the Pentagon’s integrated circuit needs is limited

and diminishing. This erosion is increasingly apparent:

* The industry lost nearly 1,200 plants of all sizes between 1998-2008, a 17 percent drop,

including a 37 percent loss in large establishments (over 500 employees) and a 41 percent

loss of mid-sized plants (100-500 employees).

* By 2008, employment levels, number of establishments, and GDP for the industry had fallen

below its 2001 levels. 20 In 2007, imports accounted for nearly one-half the U.S. market for

semiconductor and related devices.

* The U.S. share of global semiconductor capacity has been in descent, falling to 17 percent in

2007, and 14 percent in 2009. Once the world leader in semiconductor manufacturing, the

United States fell to fourth place in 2009.

* In 2009, of 16 semiconductor fabs under construction around the world, only one was being

built in the United States. Meanwhile, the United States leads in fab closures: 15 out of 27

fabs closed worldwide in 2009, and 4 out of 15, in 2008.

Although U.S. semiconductor firms typically have maintained control over their design work when contracting

overseas for wafer fabrication, in order to maintain close contact with their Asian customers—have also

been offshoring complex semiconductor fabrication and design services.

In 2006, China reportedly accounted for 70 percent of the semiconductor designing market in the Asia-Pacific region. 23 In 2009, China led the

world in new semiconductor factory construction.

ukraine-inc.info

ukraine-inc.info

ukraine-inc.info

ukraine-inc.info