They make a pretty badass hot air balloon.Would you trust a plane with a “made in China” sticker?

Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Maggie’s Motivational Pic Thread v2.0 - - New Rules - See Post #1

- Thread starter Snake-Eyes

- Start date

-

- Tags

- motivational pictures

I never would have guessed your name is Toby.

or simply stated where some of the taxes he/she/it was bitching about were spent. I don’t like paying taxes as much as the next person, but I also enjoy not going to jail for not paying.

Think about context next time.

Honda Civic?

Definitely notI never would have guessed your name is Toby.

If you get this you probably need to schedule a prostate exam

I have a son-in-law who works as a banker in New York City. More than 50% of his income goes to taxes. The top 10% income earners in this country pay 70% of all federal taxes collected. Approximately 40% of households in this country will not pay any income tax for 2022. And Democrats complain that the rich do not pay their fair share.I guess because if you like sending your kids to school, drive on maintained roads, have “free stuff” to do where you live, then you pay taxes I guess? Don’t you just wish all that stuff was a one-off expense? Sadly it’s not.

That's only "income tax". Everything else is taxed too. It's not just "sales tax" when you buy something, that "something" was taxed heavily before it ever made it to the store...the resources for it, TAXED, the manufacture of it, TAXED, transportation to the store, TAXED, and on and on...I'm sure I left out a few stages of TAXED...but have to try and keep it simple for the little brains.I have a son-in-law who works as a banker in New York City. More than 50% of his income goes to taxes. The top 10% income earners in this country pay 70% of all federal taxes collected. Approximately 40% of households in this country will not pay any income tax for 2022. And Democrats complain that the rich do not pay their fair share.

My wife and I pay around 40% income tax...we don't make enough money to afford a tax lawyer to save tax money.

Nothing is foolproof to a sufficiently talented fool……

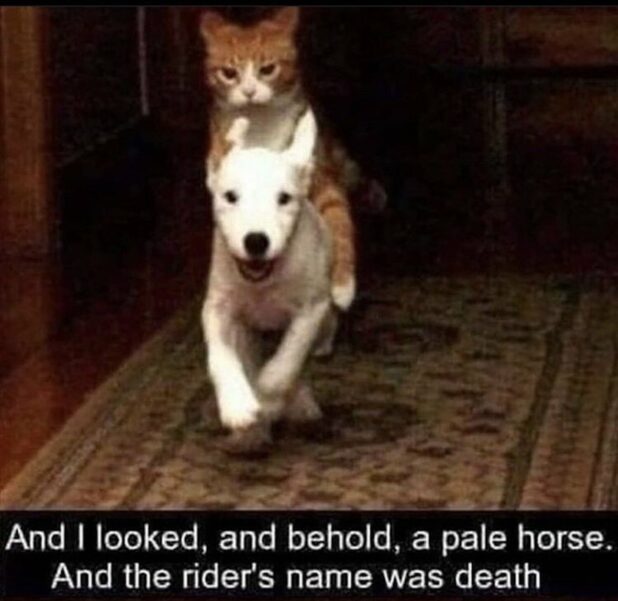

I am become death

@akmike47 showing off his new red boots, of course you guys that follow him on Grindr already knew that.

Shit, this was a practice run. You should have seen this on stage, it was glorious

Similar threads

- Replies

- 0

- Views

- 41K