So yes, you are right. But the fed number for the velocity of money is GDP/M2, so it just finishes the equation V=PT/M where PT=GDP. So it isn't something measured independently. I was certainly sloppy with my words there. What I was referring to was that it doesn't appear that other things that determine what we perceive as the velocity of money, like savings rate etc, aggregate demand, etc have changed much over time, which is the conundrum I consistently allude to.

You may be right about who, and how many can afford, but I'd argue otherwise, to wit there has been a great flattening of the sense of "luxury goods" over that period. Whereas in, say the '50s, there was a huge disconnect between what the elite had, air travel, television, opera, and what the common man had, radio, baseball, at this point we all have iphones, flat screens and garbage sports, while the differences come in the ability to amass capital, not how to enjoy it.

I think that both of these things, how the fundamental above equation holds up, and how the flattening or steepening of the "luxury curve" changes are going to be interesting, and going to determine what of what we knew was right, and what was wrong.

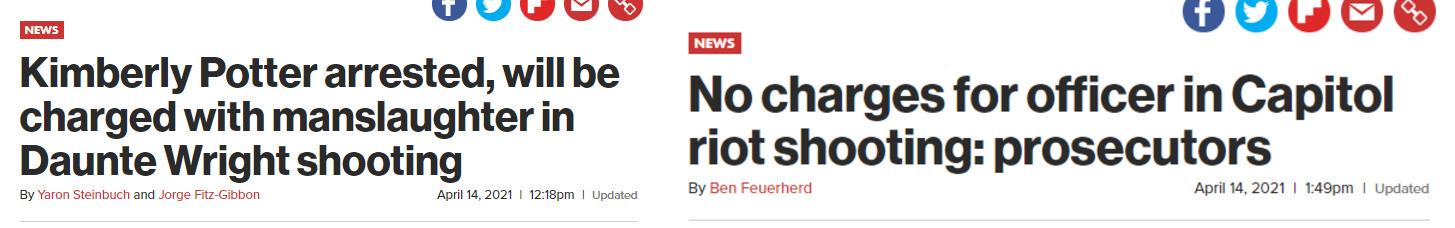

www.dailymail.co.uk

www.dailymail.co.uk