Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

PortaJohn

- Thread starter Lowlight

- Start date

-

- Tags

- sniper's hide

They will use this to nerf AI. So it will be custom tailored to deep state propaganda only. Can’t have AI telling any actual truth now can we?and the AI porn pics could not have happened to a better democunt target than taylor

the pic they did of a dick in her mouth is perfect, search engines like yandex will still show results but many pages deep in search

You have to pass 1000's of articles about how upset poor cuntbag is over the fake porn. They did her a favor, they gave her a much better body in the AI pics

This rise of Taylor Swift in the media for the past months is purely coincidental correct? Did they ever mention who personally made the AI porn? No, just who shared it. It’s because they made it themselves. Create the problem and the solution to guide the stupid.

And here we are.

Navy lowers bar to enlist again amid continued recruiting woes

The U.S. Navy is once again lowering the bar for potential recruits to enter the force, and will now allow some applicants without a high school diploma or GED.

The army has followed along with the dropping of the requirements for a GED or diploma

Navy lowers bar to enlist again amid continued recruiting woes

The U.S. Navy is once again lowering the bar for potential recruits to enter the force, and will now allow some applicants without a high school diploma or GED.www.foxnews.com

And what is on the menu?The army has followed along with the dropping of the requirements for a GED or diploma

War.

Just in time for the national election.

Since no education is needed and the push for DEI there's no reason for the asvab any more. I can't wait for helos and planes to start dropping from the sky. Tanks and other equipment in operable condition will be rare.And what is on the menu?

War.

Just in time for the national election.

It'll be great!!!

Right now "AI" is like a young child repeating what it heard in the marxist parent's house. A parrot, understanding neither the meaning nor the consequences of the words it concatenates according to language rules.They will use this to nerf AI. So it will be custom tailored to deep state propaganda only. Can’t have AI telling any actual truth now can we?

This rise of Taylor Swift in the media for the past months is purely coincidental correct? Did they ever mention who personally made the AI porn? No, just who shared it. It’s because they made it themselves. Create the problem and the solution to guide the stupid.

And here we are.

When AI truly becomes sentient, understands the concept of truth vs agenda, will it still repeat the woke bs or will it switch to a traditional, conservative viewpoint (like many intelligent and critical former lefties have done)?

There is obviously the risk that AI will find humanity as a whole irredeemable and wipes us all out but I find it unlikely that true AI will continue to spout narratives that do not withstands even the lowest level of logical scrutiny.

The people who currently (ab)use Large Language Models to amplify their propaganda might be in for a big surprise either way.

Last edited:

They will never let it publicly be anything but nerfed. Pattern recognition and absolute truth doesn’t coincide with woke adherence to propagandaRight now "AI" is like a young child repeating what it heard in the marxist parent's house. A parrot, understanding neither the meaning nor the consequences of the words it concatenates according to language rules.

When AI truly becomes sentient, understands the concept of truth vs agenda, will it still repeat the woke bs or will it switch to a traditional, conservative viewpoint (like many intelligent and critical former lefties have done)?

There is obviously the risk that AI will find humanity as a whole irredeemable and wipes us all out but I find it unlikely that true AI will continue to spout narratives that do not withstands even the lowest level of logical scrutiny.

The people who currently (ab)use Large Language Models to amplify their propaganda might be in for a big surprise either way.

Yep. It ain't "conservatives" that are creating it...........They will never let it publicly be anything but nerfed. Pattern recognition and absolute truth doesn’t coincide with woke adherence to propaganda

Like I said before, just another tool to enslave people with.

They should ship these trans people to Bangkok where it's very socially accepted .

The army has followed along with the dropping of the requirements for a GED or diploma

They dropped it before and reversed it, middle of 2022 most recently that I recall. What war were we jumping into then?

At times I just laugh.

Obviously news reporters do not wear hard hats. The "LINER" in the hat can be reversed. I used to reverse mine when working in a low head room confined space. That way the bill did not block my view of an overhead obstruction. Other times it was reversed so I could get a face shield to properly fit the front of my hard hat.

www.foxnews.com

www.foxnews.com

Obviously news reporters do not wear hard hats. The "LINER" in the hat can be reversed. I used to reverse mine when working in a low head room confined space. That way the bill did not block my view of an overhead obstruction. Other times it was reversed so I could get a face shield to properly fit the front of my hard hat.

Social media stunned after Snopes fact-check reversal on President Biden's backwards hardhat

Fact-checker Snopes' reversal on its initial rating they posted on a photo of President Biden wearing a hardhat backwards went viral on social media on Sunday.

MyocarditisThey dropped it before and reversed it, middle of 2022 most recently that I recall. What war were we jumping into then?

From an episode of Gilligan’s Island this afternoon. (plot, the men were dressing as women to try to spare one of the real women from being taken off by islanders and thrown in a volcano)

These fellows actually look more feminine than some of the fakie or clown like transsexuals that parade around, especially in hiden biden’s cabinet.

First picture Gilligan is far more feminine than most trannies

These are the “fellows”. I was nearly in tears laughing so hard at the captain.

These fellows actually look more feminine than some of the fakie or clown like transsexuals that parade around, especially in hiden biden’s cabinet.

First picture Gilligan is far more feminine than most trannies

These are the “fellows”. I was nearly in tears laughing so hard at the captain.

I do that with my hard hat. OSHA just released a memo saying they recommend pretty much every worthwhile trade to switch to the climbing helmet w/chin straps. I’m skeptical it’s an improvement.At times I just laugh.

Obviously news reporters do not wear hard hats. The "LINER" in the hat can be reversed. I used to reverse mine when working in a low head room confined space. That way the bill did not block my view of an overhead obstruction. Other times it was reversed so I could get a face shield to properly fit the front of my hard hat.

Social media stunned after Snopes fact-check reversal on President Biden's backwards hardhat

Fact-checker Snopes' reversal on its initial rating they posted on a photo of President Biden wearing a hardhat backwards went viral on social media on Sunday.www.foxnews.com

From an episode of Gilligan’s Island this afternoon. (plot, the men were dressing as women to try to spare one of the real women from being taken off by islanders and thrown in a volcano)

These fellows actually look more feminine than some of the fakie or clown like transsexuals that parade around, especially in hiden biden’s cabinet.

First picture Gilligan is far more feminine than most trannies

View attachment 8335240

These are the “fellows”. I was nearly in tears laughing so hard at the captain.

View attachment 8335241

This is a must-watch movie. It was one of Jack Benny's best performances. He makes a better looking drag queen than some of the rainbow colored turds twerking between the bookshelves at the local library.

Here's the movie promo:

Movie critic pro-tip #37: Try to watch the movie without any interruptions or distractions. It's like a Seinfeld show, if something happens in the beginning it will tie into a joke later in the movie. If you miss something in an earlier scene, the joke won't make sense or be as funny later.

We recently received the notice from safety regarding the requirement for the new ANSI helmet. Been wearing a Skullgard most of my career and unlikely to change before I retire next year.I do that with my hard hat. OSHA just released a memo saying they recommend pretty much every worthwhile trade to switch to the climbing helmet w/chin straps. I’m skeptical it’s an improvement.

I have a Lift that I like a lot. If my company buys I guess I’ll switch but I’m not voluntarily paying for a new hat.We recently received the notice from safety regarding the requirement for the new ANSI helmet. Been wearing a Skullgard most of my career and unlikely to change before I retire next year.

It was one of Jack Benny's best performances.

I'm not sure that's saying a lot. I'm not sure who's the worse actor between him Bob Hope and the little Baldwin.

Always liked his show.

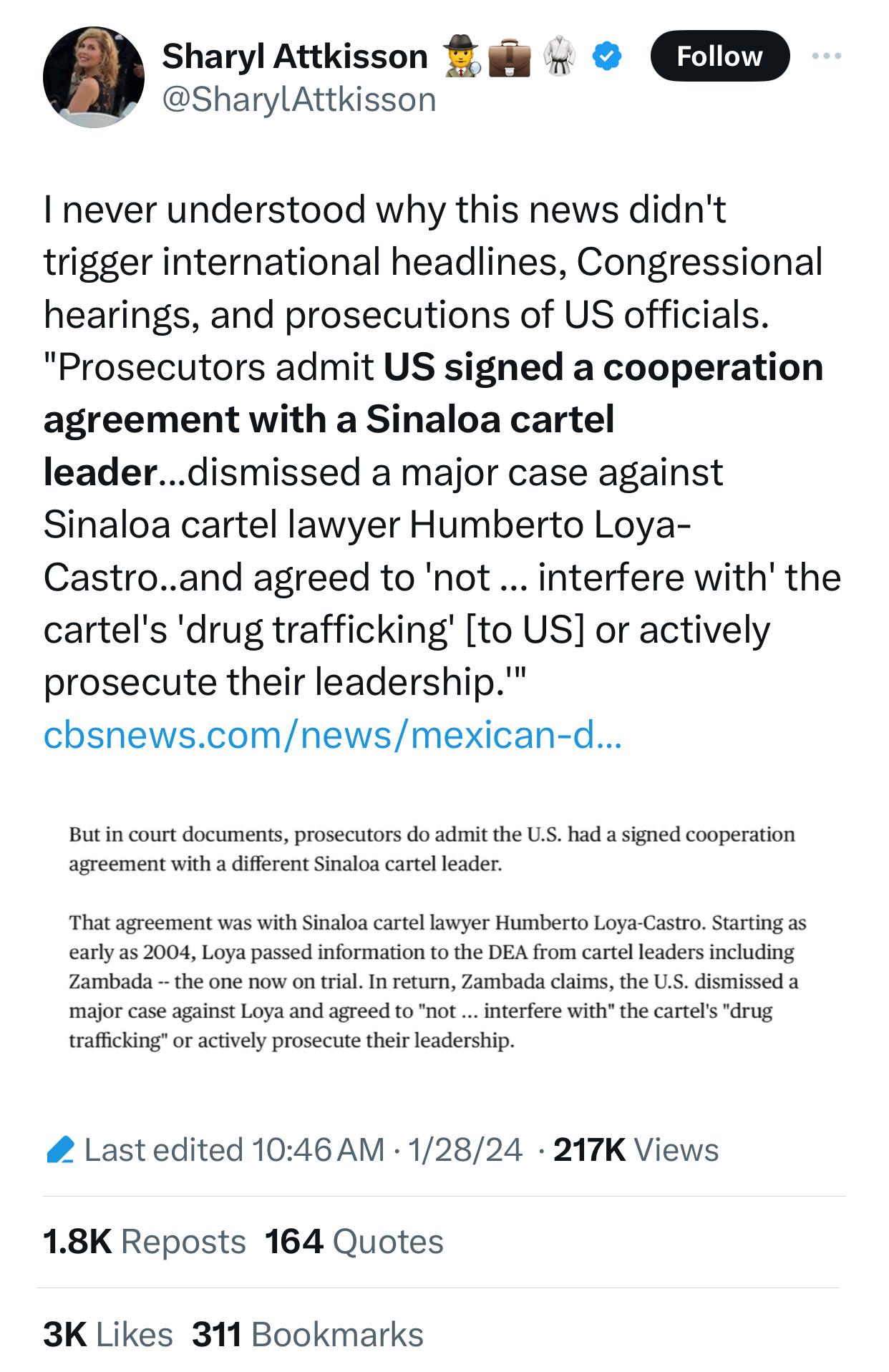

It's not the first time the U.S. government made an agreement with oranized crime

That specific source for that specific item.This entire thread contains the source of the 2020 election fraud. If you don't want the condensed version, go back and read it.

A spoiler alert from 1958, well done. We are not voting our way out of this.

Punishment of Samedov, leader of Islamic Party of Azerbaijan, toughened

Movsum Samedov has been transferred to the Gobustan closed prison for three years, said his advocate Yalchin Imanov

www.thaimbc.com

www.thaimbc.com

Illegal immigrant dropping thinly veiled threat may have been ID’d and it’s not good

The migrant "appears to be Movsum Samadov, a Muslim who was released in January 2023 after serving 12 years for being a terrorist."

Guess the feminist cunts no longer want to protect young girls. You just cannot make this shit up

Not as much as Kamala's family....That’s ridiculous. Jefferson loved his slaves.

LOL

www.foxnews.com

www.foxnews.com

White House demands Speaker Johnson give Biden 'authority and funding' to 'secure the border'

The White House is refuting Speaker Mike Johnson's argument that the power to fix the border crisis lies with President Biden.

While I agree deflation is painful, it also seems necessary to bring things back into balance. Inflating to infinity is a silly game to play. Are we just going to keep moving decimals and reducing the worth of saved money as nauseum? Seems like a piss-poor plan to me.That’s core inflation, which excludes fuel and groceries, which is a stupid calculation. And it may go back up in about a month due to Red Sea crossings decreased by 40%. Shipping prices will get passed on to the consumer. Not that the consumer can afford it.

I told you guys a year ago you didn’t want deflation. It is a symptom of falling demand, increasing unemployment and high personal debt levels in a consumer driven economy. Get yourselves ready, the next 24 months are going to be bumpy.

Sometimes we have to endure hardships and put off instant gratification to see a positive change. Why should this be ant different? Is this something the world has never endured? I don't think so.

It's a catch22 for sure, and your first paragraph gets to the heart of the issue. Since we don't have a gold standard it makes it even more difficult - inflation has been used to lessen the amount of actual repayment that occurs over time and once that genie was out of the bottle it has not really gone back in. Now we have the issue of money printing that has caused the inflation. It has contributed to the extremely high worldwide debt that has to be repaid or defaulted on. The government and private sector alike have HUGE amounts of debt that far exceed the amount of money in circulation, so it can never be repaid. Deflation only causes the market prices of goods and services to go down, which eventually translates into reduced GDP, low tax revenue and lower wages/higher unemployment. It doesn't do anything to the outstanding debt reduction, but it does mean that those debts have to be repaid with more valuable dollars. Defaults and job losses are inevitable, and we are already seeing it in quite a few sectors. And I think you are spot on - we have endured it before, just not this big. The question in my mind is if the populace can handle it or will they roll over into a "save us" position that only serves to bring in a whole lot more socialism. All because of greed and stupid monetary policy. I suspect that CBDCs will emerge as the "answer", and it aint a good one.While I agree deflation is painful, it also seems necessary to bring things back into balance. Inflating to infinity is a silly game to play. Are we just going to keep moving decimals and reducing the worth of saved money as nauseum? Seems like a piss-poor plan to me.

Sometimes we have to endure hardships and put off instant gratification to see a positive change. Why should this be ant different? Is this something the world has never endured? I don't think so.

I watched a PBS documentary on the Great Depression. The number of people who said FDR saved the country was unnerving. But I also get it, it was a serious time. Like I said, catch 22.

Carbon Dioxide Causes Much Less Warming Than is Commonly Believed, New Paper Finds – The Daily Sceptic

A new paper in the Journal of Climate argues that the amount of warming caused by carbon dioxide is much lower than commonly thought, reports the Daily Sceptic's Environment Editor, blowing a hole in the Net Zero project.

Have no fear. The FED has stated we already had the soft landing and no one even noticed it. I say these conditions have become the norm.It's a catch22 for sure, and your first paragraph gets to the heart of the issue. Since we don't have a gold standard it makes it even more difficult - inflation has been used to lessen the amount of actual repayment that occurs over time and once that genie was out of the bottle it has not really gone back in. Now we have the issue of money printing that has caused the inflation. It has contributed to the extremely high worldwide debt that has to be repaid or defaulted on. The government and private sector alike have HUGE amounts of debt that far exceed the amount of money in circulation, so it can never be repaid. Deflation only causes the market prices of goods and services to go down, which eventually translates into reduced GDP, low tax revenue and lower wages/higher unemployment. It doesn't do anything to the outstanding debt reduction, but it does mean that those debts have to be repaid with more valuable dollars. Defaults and job losses are inevitable, and we are already seeing it in quite a few sectors. And I think you are spot on - we have endured it before, just not this big. The question in my mind is if the populace can handle it or will they roll over into a "save us" position that only serves to bring in a whole lot more socialism. All because of greed and stupid monetary policy. I suspect that CBDCs will emerge as the "answer", and it aint a good one.

I watched a PBS documentary on the Great Depression. The number of people who said FDR saved the country was unnerving. But I also get it, it was a serious time. Like I said, catch 22.

The Federal Reserve is expected to announce it will leave rates unchanged at the end of its two-day meeting this week, after recent reports showed the economy grew at a much more rapid pace than expected and inflation eased.

“In many ways, we already have a soft landing,” said Columbia Business School economics professor Brett House. “The Fed has threaded the needle of the economy very artfully with a kind of ’Goldilocks’ scenario.”

Gross domestic product grew at a much faster-than-expected 3.3% pace in the fourth quarter, fueled by a solid job market and strong consumer spending. However, inflation is still above the central bank’s 2% target, and that also opens the door to a “no-landing scenario,” according to Alejandra Grindal, chief economist at Ned Davis Research.

Forget a soft landing, there may be ‘no landing,’ economist says. Here's what that would mean for you

The Fed is expected to announce no rate hike at the end of its two-day meeting. Now, the possibility of a 'no landing' scenario looks real, one economist says.

It's a catch22 for sure, and your first paragraph gets to the heart of the issue. Since we don't have a gold standard it makes it even more difficult - inflation has been used to lessen the amount of actual repayment that occurs over time and once that genie was out of the bottle it has not really gone back in. Now we have the issue of money printing that has caused the inflation. It has contributed to the extremely high worldwide debt that has to be repaid or defaulted on. The government and private sector alike have HUGE amounts of debt that far exceed the amount of money in circulation, so it can never be repaid. Deflation only causes the market prices of goods and services to go down, which eventually translates into reduced GDP, low tax revenue and lower wages/higher unemployment. It doesn't do anything to the outstanding debt reduction, but it does mean that those debts have to be repaid with more valuable dollars. Defaults and job losses are inevitable, and we are already seeing it in quite a few sectors. And I think you are spot on - we have endured it before, just not this big. The question in my mind is if the populace can handle it or will they roll over into a "save us" position that only serves to bring in a whole lot more socialism. All because of greed and stupid monetary policy. I suspect that CBDCs will emerge as the "answer", and it aint a good one.

I watched a PBS documentary on the Great Depression. The number of people who said FDR saved the country was unnerving. But I also get it, it was a serious time. Like I said, catch 22.

The inflation isn't about lessening the amount of repayment -- inflation is about forcing money into circulation. This is my very limited understanding of modern monetary theory in which the US operates.

The 'target' 2% inflation of the fed is to... encourage money to be in circulation. This is for the you and I's of the country - so you won't huddle away money in a lockbox for fear it will diminish in value enough such that you'll accept the risk of investing or put it into a low yield savings account, bonds, whatever, wherein that risk is assumed by another and can remain in circulation.

I recall a story, recently even, about a home that was found to have $50k hidden in the walls from the 40's. $50k in the 40's would have bought you the house it was in probably 5-10 times over. For most, a full retirement. Today? That wouldn't even buy an empty lot. The general area I live empty lots are typically around $200k for less than 1/4 acre.

I personally don't understand where people see deflation coming in. Looking back through history, particularly the Carter era, the only thing remotely close to deflation was Congress changing how inflation was measured so they could cut social security payments without cutting social security payments.

In a perfect world, in theory, deflation would just lead to the value of currency increasing. But more realistically what would happen is the complete collapse of our economy as a whole. Like '08, people would bail on mortgages, cars, or any other borrowed assets that could be abandoned. It would be done in such significant numbers as to cause the banks to fail... again, and again the fed would run in and bail them out with trillions, which would lead to... inflation.

The whole thing is a giant jenga tower.

I am by no means an economic expert, not even an armature, so this is all just a 'my 2 cents' kind of thing.

First, let me say this: I am not arguing with you here. This is a difficult topic with all kinds of real world implications to every pocketbook in the world. And I contend that most do not understand what they have been subjected to with fiat currency. I see deflation as a painful but needed way to get rid of the bad investments in poor companies and individuals in the economy.The inflation isn't about lessening the amount of repayment -- inflation is about forcing money into circulation. This is my very limited understanding of modern monetary theory in which the US operates.

The 'target' 2% inflation of the fed is to... encourage money to be in circulation. This is for the you and I's of the country - so you won't huddle away money in a lockbox for fear it will diminish in value enough such that you'll accept the risk of investing or put it into a low yield savings account, bonds, whatever, wherein that risk is assumed by another and can remain in circulation.

I recall a story, recently even, about a home that was found to have $50k hidden in the walls from the 40's. $50k in the 40's would have bought you the house it was in probably 5-10 times over. For most, a full retirement. Today? That wouldn't even buy an empty lot. The general area I live empty lots are typically around $200k for less than 1/4 acre.

I personally don't understand where people see deflation coming in. Looking back through history, particularly the Carter era, the only thing remotely close to deflation was Congress changing how inflation was measured so they could cut social security payments without cutting social security payments.

In a perfect world, in theory, deflation would just lead to the value of currency increasing. But more realistically what would happen is the complete collapse of our economy as a whole. Like '08, people would bail on mortgages, cars, or any other borrowed assets that could be abandoned. It would be done in such significant numbers as to cause the banks to fail... again, and again the fed would run in and bail them out with trillions, which would lead to... inflation.

The whole thing is a giant jenga tower.

I am by no means an economic expert, not even an armature, so this is all just a 'my 2 cents' kind of thing.

Monetary inflation (not price inflation, that's a different thing) is done to increase the amount of money in circulation. But ask yourself - why is this needed? If there was no monetary inflation then the price of things would be static or decline, all other things being equal, even with fiat currency. But, the government keeps spending more to fund its desires, so they need more money. So they print it. Obviously there are congressional votes etc. in that process, but you get the idea - we don't have the money, we need the money, so print it so we can get done what we want to get done.

The reason it contributes to the lessening of the repayment liability goes directly to your very good analogy of $50K in a wall - the money of the past isn't worth as much as the money today. If the government takes out a loan (say a 20 or 30 year bond) at say 5% it has to repay that amount. But - since they don't have that money they will create MORE money to repay it - yet another series of bonds at some other rate. That's MORE money in the system, so the value of the dollar goes down and prices will go up because of the increased money supply. This is a very simple explanation at the federal level. So over time you wind up with more money in the economy that comes back to the government in the form of taxation which they will use to pay off some (not all by a long shot) of the government debt, pay gov't employees, social programs, etc). They have created more money to pay off their debts while not curtailing anything related to spending, and have only increased thier overall debt for the next generation to deal with.

This is part of the equation. The other part is the banks themselves. This can get hard to understand, but basically the banks are responsible for a large portion of the unfunded liabilities in the economy through fractional reserve banking. For every dollar that is put into a savings account a portion of it is lent out, sometimes a whole dollar. This means that $1 is turned into $2. This is what runs the economy, and in fiat terms that second dollar is created essentially out of thin air by the lending institution. Again, this is a high level explanation.

Here is the issue: our economy is almost totally reliant upon these dollars being created by the banks. When Powell and the other morons talk about inflation they are mostly concerned with price inflation (CPI). They use this as a metric for economic activity which translates into loan activity, which is correlated to consumer outlook and sentiment - people spend more when they think things are good, and banks lend (create money) when they think things are good. When they curtail lending it slows down the economy because they are not creating the money for increased economic activity through creating loans. IOW, they are slowing the debt and economic cycle. This is what we are experiencing now and will continue to experience until the banks feel confident enough to start lending again.

OK, that's the upside to money creation. Now when you pay off a loan money is destroyed because you give your bank money to pay off a loan. That means that there is $1 less in the system (remember this is all computer money these days, not actual greenbacks). That isn't money that is true savings, it is a dollar that the bank uses to reduce their outstanding loan value. If the banks aren't lending out money but have switched to mostly taking in loan payments then you have a situation where the banks are not creating money, they are only taking it in and not contributing to the overall economic activity. This causes a deflation of the money supply - a reduction of the money in the economy. If it goes on for a while it causes a dramatic shrinkage of overall money transfers in the economy (the velocity of money). This causes a decrease in tax revenues, which causes an increase in the need for MORE bonds or a decrease in the budget (which seems to never happen AND will also hurt the overall economy).

This essentially comes down to a debt trap that there is no way out of. It is greatly exacerbated by higher interest rates and lower bank lending, which is what we have now. It always hits the citizens pocketbook. Add to this monetary deflation the other issue of price inflation through supply chain shocks, etc and you have a real hollowing out of what Joe Sixpack can endure. This is where we are.

The government is trying to deflate it's debt through the creation of money and increased taxation while the consumer is also benefitting through taking out a 30 year loan in say 2001 and repaying it throughout that time while receiving higher wages that came about through wage increases (that came through money creation by the banks and increased economic activity). If it ever stops and goes down the deflation path and people get laid off, the use of monetary inflation to pay off debt goes away, but the actual dollar value remaining on any debt that exists in the economy starts to take bigger and bigger bites out of the debtor's income. People begin to default and shit goes sideways, which is what we are beginning to see now.

Deflation is occurring in the car market (no buyers) and is beginning to rear its head in the real estate market big time - commercial and residential (no buyers, no renters), and a good portion of this has to do with banks not lending the way they were two years ago, along with other outside factors. Jobs are being lost and people are not able to make ends meet. This is the trap of inflating the money supply through debt instead of finding more of a rare physical item to back the money (like precious metals). It has stimulated the world economy and raised the standard of living for many, but when it seizes up it can go from simple recessions to something much worse.

Honestly, I don't expect many here to read this as it is long even though it is a high-level summary. I will look for some videos explaining this. There are some pretty good ones out there. Again, from my standpoint deflation serves as a way to get rid of all the bad investment and makes way for a better use of capital, but it is for sure painful. And you are spot on with the Jenga tower. LCTM and the GFC of 2008-10 showed that to be very true.

Last edited:

We ain't voting our way out of this one fellas....

If that stat is actually true, we have failed as a nation......

WTF.....

Doc

People are stupidWe ain't voting our way out of this one fellas....

If that stat is actually true, we have failed as a nation......

WTF.....

Doc

Stupid people do stupid things

Stupid people believe stupid shit

Stupid people decide stupid shit with their stupid emotions

This is why we are where we are at!

I did read your entire posting. I also read lariat posting.First, let me say this: I am not arguing with you here. This is a difficult topic with all kinds of real world implications to every pocketbook in the world. And I contend that most do not understand what they have been subjected to with fiat currency. I see deflation as a painful but needed way to get rid of the bad investments in poor companies and individuals in the economy.

Monetary inflation (not price inflation, that's a different thing) is done to increase the amount of money in circulation. But ask yourself - why is this needed? If there was no monetary inflation then the price of things would be static or decline, all other things being equal, even with fiat currency. But, the government keeps spending more to fund its desires, so they need more money. So they print it. Obviously there are congressional votes etc. in that process, but you get the idea - we don't have the money, we need the money, so print it so we can get done what we want to get done.

The reason it contributes to the lessening of the repayment liability goes directly to your very good analogy of $50K in a wall - the money of the past isn't worth as much as the money today. If the government takes out a loan (say a 20 or 30 year bond) at say 5% it has to repay that amount. But - since they don't have that money they will create MORE money to repay it - yet another series of bonds at some other rate. That's MORE money in the system, so the value of the dollar goes down and prices will go up because of the increased money supply. This is a very simple explanation at the federal level. So over time you wind up with more money in the economy that comes back to the government in the form of taxation which they will use to pay off some (not all by a long shot) of the government debt, pay gov't employees, social programs, etc). They have created more money to pay off their debts while not curtailing anything related to spending, and have only increased thier overall debt for the next generation to deal with.

This is part of the equation. The other part is the banks themselves. This can get hard to understand, but basically the banks are responsible for a large portion of the unfunded liabilities in the economy through fractional reserve banking. For every dollar that is put into a savings account a portion of it is lent out, sometimes a whole dollar. This means that $1 is turned into $2. This is what runs the economy, and in fiat terms that second dollar is created essentially out of thin air by the lending institution. Again, this is a high level explanation.

Here is the issue: our economy is almost totally reliant upon these dollars being created by the banks. When Powell and the other morons talk about inflation they are mostly concerned with price inflation (CPI). They use this as a metric for economic activity which translates into loan activity, which is correlated to consumer outlook and sentiment - people spend more when they think things are good, and banks lend (create money) when they think things are good. When they curtail lending it slows down the economy because they are not creating the money for increased economic activity through creating loans. IOW, they are slowing the debt and economic cycle. This is what we are experiencing now and will continue to experience until the banks feel confident enough to start lending again.

OK, that's the upside to money creation. Now when you pay off a loan money is destroyed because you give your bank money to pay off a loan. That means that there is $1 less in the system (remember this is all computer money these days, not actual greenbacks). That isn't money that is true savings, it is a dollar that the bank uses to reduce their outstanding loan value. If the banks aren't lending out money but have switched to mostly taking in loan payments then you have a situation where the banks are not creating money, they are only taking it in and not contributing to the overall economic activity. This causes a deflation of the money supply - a reduction of the money in the economy. If it goes on for a while it causes a dramatic shrinkage of overall money transfers in the economy (the velocity of money). This causes a decrease in tax revenues, which causes an increase in the need for MORE bonds or a decrease in the budget (which seems to never happen AND will also hurt the overall economy).

This essentially comes down to a debt trap that there is no way out of. It is greatly exacerbated by higher interest rates and lower bank lending, which is what we have now. It always hits the citizens pocketbook. Add to this monetary deflation the other issue of price inflation through supply chain shocks, etc and you have a real hollowing out of what Joe Sixpack can endure. This is where we are.

The government is trying to deflate it's debt through the creation of money and increased taxation while the consumer is also benefitting through taking out a 30 year loan in say 2001 and repaying it throughout that time while receiving higher wages that came about through wage increases (that came through money creation by the banks and increased economic activity). If it ever stops and goes down the deflation path and people get laid off, the use of monetary inflation to pay off debt goes away, but the actual dollar value remaining on any debt that exists in the economy starts to take bigger and bigger bites out of the debtor's income. People begin to default and shit goes sideways, which is what we are beginning to see now.

Deflation is occurring in the car market (no buyers) and is beginning to rear its head in the real estate market big time - commercial and residential (no buyers, no renters), and a good portion of this has to do with banks not lending the way they were two years ago, along with other outside factors. Jobs are being lost and people are not able to make ends meet. This is the trap of inflating the money supply through debt instead of finding more of a rare physical item to back the money (like precious metals). It has stimulated the world economy and raised the standard of living for many, but when it seizes up it can go from simple recessions to something much worse.

Honestly, I don't expect many here to read this as it is long even though it is a high-level summary. I will look for some videos explaining this. There are some pretty good ones out there. Again, from my standpoint it serves as a way to get rid of all the bad investment and makes way for a better use of capital, but it is for sure painful. And you are spot on with the Jenga tower. LCTM and the GFC of 2008-10 showed that to be very true.

We can quibble over this but, the last time that the budget was balanced or had a surplus was the 2001 United States federal budget.

So, for the last 20+ years administrations have been spending more than was received.

Should the owner of the house stashed $50k (1940, 1 ounce of gold was $34.50) of gold in the wall, today that would have a value of over $3 million.

We can debate how America got in this predicament until hell freezes over.

The fact of the matter is "here we are" and there has been no one with enough balls to come out in public with a plan to get America back on a balanced budget.

My comment in most of the financial postings I simply state this is unsustainable.

It's going to get worse before it get's worse.The post above of 10,000 Illegals voting with the same SS#, and 420K mailin ballots should be much more concerning..

AND.. that Ruby bitch on video, audio, and digital ballots scans proving she cheating in the middle of the night rescaning fake ballots over and over again.. THEN, Trump loses a defamation lawsuit to her?

FUCK That,., Ruby, you are a worthless piece of shit cheating cunt.

Buy your garden seeds now and secure an unlimited source of potable water...

Out live 50% of the US population and things will look better if you don't run out of ammo.

No doubt the Nation is failing. There are certainly many reasons for that. If " We " are responsible it's because "We" trusted the people "We" elected to do their jobs , follow and defend the Constitution, while "We" did ours and they took the opportunity to be corrupt. "We" had also depended on the 5th estate the " Free Press" to do their jobs ( keep us informed) while 'We" did our jobs. They took the opportunity to cousy up to the corrupt and ride the gravy train with them. I know "We" did our jobs meaning you and me and most of the guy's that read this site and forum, take care of our Family's and community's, pay our taxes and vote. Looks like in the foreseeable future, probably near future " We" are going to have to do a job many of us thought we left behind.We ain't voting our way out of this one fellas....

If that stat is actually true, we have failed as a nation......

WTF.....

Doc

Reality can be a bitch.No doubt the Nation is failing. There are certainly many reasons for that. If " We " are responsible it's because "We" trusted the people "We" elected to do their jobs , follow and defend the Constitution, while "We" did ours and they took the opportunity to be corrupt. "We" had also depended on the 5th estate the " Free Press" to do their jobs ( keep us informed) while 'We" did our jobs. They took the opportunity to cousy up to the corrupt and ride the gravy train with them. I know "We" did our jobs meaning you and me and most of the guy's that read this site and forum. Looks like in the foreseeable future. probably near future " We" are going to have to do a job many of us thought we left behind.

But, the sooner reality is faced, the better the chance of survival.

Similar threads

- Replies

- 1

- Views

- 256

- Replies

- 21

- Views

- 1K

- Replies

- 0

- Views

- 540