Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Average Monthly Mortgage Payment Explodes to $3,322 In Biden’s America

- Thread starter PatMiles

- Start date

That doesn't make financial sense... but hey, at least you have the peace of mind of not being in the banks pocket.Me…4 times. Well, they weren’t all 3% but 2 of them were close.

Not sure how you put a price on that.

It makes sense for me and isn’t really about being in the bank’s pocket. I have the money so I did. I don’t like to borrow money if I can avoid it.That doesn't make financial sense... but hey, at least you have the peace of mind of not being in the banks pocket.

Not sure how you put a price on that.

I never stopped my investments into other areas. Been buying the S&P 500 since 1991 (year, not price).

3 of those 4 houses have been providing income for over a decade as rentals.

My primary residence is a 2,800 sf 4 bed/3 bath home purchased for $134,000.

I live cheap. Shriners and St Jude are going to be ecstatic when I die.

Sounds like you're pretty well set, which is awesome. If it's working for you, keep at it.It makes sense for me and isn’t really about being in the bank’s pocket. I have the money so I did. I don’t like to borrow money if I can avoid it.

I never stopped my investments into other areas. Been buying the S&P 500 since 1991 (year, not price).

3 of those 4 houses have been providing income for over a decade as rentals.

My primary residence is a 2,800 sf 4 bed/3 bath home purchased for $134,000.

I live cheap. Shriners and St Jude are going to be ecstatic when I die.

Nevertheless, the math just doesn't make sense. Financial wins and losses are measured in terms of opportunity cost and the cost of paying off fixed rate 3% loans in an inflationary economy is awfully high.

In any case, there are always worse ways to spend your money than paying down debt.

Just days after the 2020 election we were closing on a refi that was going to get our 3.5 down to 3.

I had less than ten years easy to pay and the savings would have went back into principle.

Mrs P McLaine said let’s take money out to build a bigger kitchen.

They were still counting votes but I already had a sick feeling.

I said worst financial decision ever!

My argument was that people like us would be hunted animals and I doubted I’d be working in a year. Also doubted she would be working because the Smithsonian has to be a target - you can’t show case America in a commie country.

I was right on time with predictions of my career and tomorrow will be her last day because her douche director decided to rif her rather than be told the rules about donor money spending.

I’d be way better off with about 5-6 years left on the mortgage and my old kitchen.

She knows to tell her friends to STFU when they ask “Phil how do you like the kitchen”

I had less than ten years easy to pay and the savings would have went back into principle.

Mrs P McLaine said let’s take money out to build a bigger kitchen.

They were still counting votes but I already had a sick feeling.

I said worst financial decision ever!

My argument was that people like us would be hunted animals and I doubted I’d be working in a year. Also doubted she would be working because the Smithsonian has to be a target - you can’t show case America in a commie country.

I was right on time with predictions of my career and tomorrow will be her last day because her douche director decided to rif her rather than be told the rules about donor money spending.

I’d be way better off with about 5-6 years left on the mortgage and my old kitchen.

She knows to tell her friends to STFU when they ask “Phil how do you like the kitchen”

Those are good places to give it. My dad was a Shriner, they do a lot for kids. As does St. Judes. I'm probably going to send them a check shortly.It makes sense for me and isn’t really about being in the bank’s pocket. I have the money so I did. I don’t like to borrow money if I can avoid it.

I never stopped my investments into other areas. Been buying the S&P 500 since 1991 (year, not price).

3 of those 4 houses have been providing income for over a decade as rentals.

My primary residence is a 2,800 sf 4 bed/3 bath home purchased for $134,000.

I live cheap. Shriners and St Jude are going to be ecstatic when I die.

Last edited:

Nice kitchen, and it will add value to your home, but you should have followed your gut.Just days after the 2020 election we were closing on a refi that was going to get our 3.5 down to 3.

I had less than ten years easy to pay and the savings would have went back into principle.

Mrs P McLaine said let’s take money out to build a bigger kitchen.

They were still counting votes but I already had a sick feeling.

I said worst financial decision ever!

My argument was that people like us would be hunted animals and I doubted I’d be working in a year. Also doubted she would be working because the Smithsonian has to be a target - you can’t show case America in a commie country.

I was right on time with predictions of my career and tomorrow will be her last day because her douche director decided to rif her rather than be told the rules about donor money spending.

I’d be way better off with about 5-6 years left on the mortgage and my old kitchen.

She knows to tell her friends to STFU when they ask “Phil how do you like the kitchen”

View attachment 8295028

My house is paid off because everything else has some risk. I wasn't going to play the stock market game and hope I may come out ahead.

It's nice knowing I can say fuck it and retire any minute I choose.

It's nice knowing I can say fuck it and retire any minute I choose.

Last edited:

Except for those ever increasing taxes on evrything.My house is paid off because everything else has some risk. I wasn't going to play the stick market game and hope to may come out ahead.

It's nice knowing I can say fuck it and retire any minute I choose.

So a question to those who say better to invest than to pay off debt:

It's no secret I'm hugely against unnecessary debt, but I want to hear from the millionaires in here about how you took out a loan on your house to make your seventh or eighth figure in net worth.

On a forum populated by so many of us who scream "Buy more ammo" to be prepared for the shooting match that stands a 0.01% chance of happening, I find it interesting so many would allow themselves to be at risk of losing their entire house in the event of a traumatic event like a market collapse, a career ending injury or crippling disease of self or loved one, years long layoffs in an "Even More Greater Recession", or any of another multitude of events that can and do happen all the time that throw a family into financial strife.

It makes zero fucking sense to me. Look at my math from earlier, under $900 a year earned per $100,000 withheld in the bank versus paid towards a debt, and a bank holding the ownership title to your house instead of you. That's the math you're preaching is right and undeniable? Fuck, I make that and then some in a single weekend of overtime. I'll go get some exercise at work and sleep even better at night while getting the bank out of my life.

Did you take out a new mortgage/HELOC against your house to invest when the rates were at rock bottom lows?

If so, how much did you make on your investments compared to increased interest payments?

If not, why? If the math makes sense, why didn't you cash in that increased equity and put it back to work for you?

It's no secret I'm hugely against unnecessary debt, but I want to hear from the millionaires in here about how you took out a loan on your house to make your seventh or eighth figure in net worth.

On a forum populated by so many of us who scream "Buy more ammo" to be prepared for the shooting match that stands a 0.01% chance of happening, I find it interesting so many would allow themselves to be at risk of losing their entire house in the event of a traumatic event like a market collapse, a career ending injury or crippling disease of self or loved one, years long layoffs in an "Even More Greater Recession", or any of another multitude of events that can and do happen all the time that throw a family into financial strife.

It makes zero fucking sense to me. Look at my math from earlier, under $900 a year earned per $100,000 withheld in the bank versus paid towards a debt, and a bank holding the ownership title to your house instead of you. That's the math you're preaching is right and undeniable? Fuck, I make that and then some in a single weekend of overtime. I'll go get some exercise at work and sleep even better at night while getting the bank out of my life.

I don’t know whether to tap like or a sad face!Just days after the 2020 election we were closing on a refi that was going to get our 3.5 down to 3.

I had less than ten years easy to pay and the savings would have went back into principle.

Mrs P McLaine said let’s take money out to build a bigger kitchen.

They were still counting votes but I already had a sick feeling.

I said worst financial decision ever!

My argument was that people like us would be hunted animals and I doubted I’d be working in a year. Also doubted she would be working because the Smithsonian has to be a target - you can’t show case America in a commie country.

I was right on time with predictions of my career and tomorrow will be her last day because her douche director decided to rif her rather than be told the rules about donor money spending.

I’d be way better off with about 5-6 years left on the mortgage and my old kitchen.

She knows to tell her friends to STFU when they ask “Phil how do you like the kitchen”

View attachment 8295028

So howd you do it?My house is paid off because everything else has some risk. I wasn't going to play the stock market game and hope I may come out ahead.

It's nice knowing I can say fuck it and retire any minute I choose.

North Texas 10 years ago, cheap(ish) housing.So howd you do it?

Buying under your income. I Couldn't do it at today's prices as a younger worker.

I'm sure California transplants are getting free housing in the switch and plenty leftover to donate to Beto.

With your home, I agree 100%. Pay it off, keep it clear.So a question to those who say better to invest than to pay off debt:

Did you take out a new mortgage/HELOC against your house to invest when the rates were at rock bottom lows?

If so, how much did you make on your investments compared to increased interest payments?

If not, why? If the math makes sense, why didn't you cash in that increased equity and put it back to work for you?

It's no secret I'm hugely against unnecessary debt, but I want to hear from the millionaires in here about how you took out a loan on your house to make your seventh or eighth figure in net worth.

On a forum populated by so many of us who scream "Buy more ammo" to be prepared for the shooting match that stands a 0.01% chance of happening, I find it interesting so many would allow themselves to be at risk of losing their entire house in the event of a traumatic event like a market collapse, a career ending injury or crippling disease of self or loved one, years long layoffs in an "Even More Greater Recession", or any of another multitude of events that can and do happen all the time that throw a family into financial strife.

It makes zero fucking sense to me. Look at my math from earlier, under $900 a year earned per $100,000 withheld in the bank versus paid towards a debt, and a bank holding the ownership title to your house instead of you. That's the math you're preaching is right and undeniable? Fuck, I make that and then some in a single weekend of overtime. I'll go get some exercise at work and sleep even better at night while getting the bank out of my life.

But on other items, like a new $1500 refrigerator, why pay cash when Best Buy will finance it for 0%? Put that cash in an account at any interest and you come out ahead. Or a 2.5% car loan.

We did the second we had the money as well.Me…4 times. Well, they weren’t all 3% but 2 of them were close.

People just don't know what it is like having $2k extra every month. You need to save for insurance and property tax now, but that is generally around a month or two, then you are in the clear with all that money not going anywhere.

The next thing to go are the cars, both paid for, there is another $1000 + every month.

Now ask yourself if you had $2000 extra EACH AND EVERY MONTH what would you do with it. The last thing for me was I was sick and tired of fighting with a welder told the wife hay I want a new welder, how much $1600 after the rebate, put it on the X card. It was in my driveway 2 days later.

I am now "saving" up for a mini truck. I refuse to spend the money on a new SxS, that is just fucking stupid what those things cost.....just flat no.

I totally agree with our well endowed member here. If you can afford to pay it off, pay it off. The only loan I ever had that I let get close to term was a 0% from Kubota. And I paid that off early as I did not like that hanging over my head.

I kind of fit into that.Really only matters if you’re an investor like BlackRock. The average Joe is not making anything with the property value if they purchase in the last few years. Baby boomers who want to downsize will make out.

My house is small, 1400ish sq feet. Wife and I had it built. Why build a bigger one it will just cost more to heat and cool. (At the time) we MIGHT have one kid, why do we need all that room in a house for the two of us. Three bedrooms now, the master, and now her room and "my" room. You likely know why the "my" is stated like that.

I do have just enough land to shoot on out to 100 yards, enough land to ride motorcycles on enough and have fun (not anymore I am not so bendy anymore) I have my shop and love it.

Many do just to massage their egos. Bigger/Better rather than 'logical and reasonable'.I kind of fit into that.

My house is small, 1400ish sq feet. Wife and I had it built. Why build a bigger one it will just cost more to heat and cool. (At the time) we MIGHT have one kid, why do we need all that room in a house for the two of us. Three bedrooms now, the master, and now her room and "my" room. You likely know why the "my" is stated like that.

I do have just enough land to shoot on out to 100 yards, enough land to ride motorcycles on enough and have fun (not anymore I am not so bendy anymore) I have my shop and love it.

Hmmm, I wonder who came up with the system?The math of holding debt simply because it’s at a lower rate than what you may earn in a savings account is minimal and to me, splitting hairs and exposing unnecessary risk.

Take a simple $100k as an example. A 3% rate on the loan means you’re giving the bank $3k a year. A damn good high yield savings account gives you 5%, earning you $5116 compounded, that is taxed at your highest tax bracket, middle range income that’s 22% at another $1125 to the feds and whatever more if you have state income taxes, leaving you at $3891. That means you held back all that money versus paying down the debt for $891, less than $75 a month.

Yeah, $75 bucks a month is $75 bucks, but you’re feeding the mega banking system in the process. It can be argued investing in the stock market potentially earns more as well as keeps gains unrealized until sold, but that money is eventually going to get taxed and the market’s volatility exposes more risk into the fold.

The banks fucking hate us and just want us to keep sending them more money, while simultaneously promoting an agenda against our ideals. We are sheep to them, and they want nothing more than for us to stay stuck in an endless debt cycle. The big banks are attacking gun owners and manufacturers, wanting to track us and blockading manufacturers and dealers from loans and payment systems. I see zero reason to give them one fucking penny more than we have to.

And if you’re a banker and don’t like what I have to say? Fuck you.

Say you’re out winter hunting in the woods, following a path and you come up to a creek. It’s icy flowing water, only waist deep. You have right in front of you a tree across the creek, and a few hundred yards up stream a foot bridge. You’ve balanced across trees a lot in the past and you think you can manage this one okay too, and it will save you the time of going around to take the bridge. If you fall in, it will be a suck fest and you may even damage some of the equipment on you costing money, but it’s not like you’re going to die or anything. Taking the bridge will cost you time, and you really want to get on with your hunt as it’s your only day off for the month.With your home, I agree 100%. Pay it off, keep it clear.

But on other items, like a new $1500 refrigerator, why pay cash when Best Buy will finance it for 0%? Put that cash in an account at any interest and you come out ahead. Or a 2.5% car loan.

Do you take the tree or the bridge?

That’s how I think of those loans and acceptable risk for little reward. Zero interest, so long as you don’t fuck it up and miss a payment because then it’s a windfall for the lender. It also a big enticement for people to spend beyond their budget as it’s just little bites in payments instead of all at once, so they spend more on something they can’t afford or don’t really even need, but it’s shiny and cool so they splurge.

The lenders know most will make their payments on time, but they make money hand over fist on those who get busy or forgetful and miss one payment to the tune of millions of dollars a quarter, just like most will make it over the tree just fine but some are going for an icy swim and will pay for it.

Scale back the math I showed earlier on $100k in savings to only $1500 for that new fridge at 18 months loan at zero interest put away in a 5% high yield savings account. It’s just shy of $92 post tax over a year and a half, or about $5 a month. Is that worth the risk? Not to me, I can afford to skip a monthly burger with no sides and water to drink if I need another $5 a month that bad.

It’s no surprise to me that Americans hold over a trillion fucking dollars in credit card debt. The entire commerce system is geared around it, constantly throwing it in our face. “Apply here to save $50 now!” “An extra 10% off when you use our card!” “Earn 3% cash back!” “Four easy installments of $8.96 when you use Klarma for this case of dog food.”

How can we bitch at Congress for deficit spending when we do the exact same fucking thing? You think war is a racket? Credit is an exponentially bigger racket.

No arguments with part of what you said, however, ...I do assume a bit of financial intelligence from the person taking the loan...and yeah,, a lot of thats aimed at those who arent responsible.Say you’re out winter hunting in the woods, following a path and you come up to a creek. It’s icy flowing water, only waist deep. You have right in front of you a tree across the creek, and a few hundred yards up stream a foot bridge. You’ve balanced across trees a lot in the past and you think you can manage this one okay too, and it will save you the time of going around to take the bridge. If you fall in, it will be a suck fest and you may even damage some of the equipment on you costing money, but it’s not like you’re going to die or anything. Taking the bridge will cost you time, and you really want to get on with your hunt as it’s your only day off for the month.

Do you take the tree or the bridge?

That’s how I think of those loans and acceptable risk for little reward. Zero interest, so long as you don’t fuck it up and miss a payment because then it’s a windfall for the lender. It also a big enticement for people to spend beyond their budget as it’s just little bites in payments instead of all at once, so they spend more on something they can’t afford or don’t really even need, but it’s shiny and cool so they splurge.

The lenders know most will make their payments on time, but they make money hand over fist on those who get busy or forgetful and miss one payment to the tune of millions of dollars a quarter, just like most will make it over the tree just fine but some are going for an icy swim and will pay for it.

Scale back the math I showed earlier on $100k in savings to only $1500 for that new fridge at 18 months loan at zero interest put away in a 5% high yield savings account. It’s just shy of $92 post tax over a year and a half, or about $5 a month. Is that worth the risk? Not to me, I can afford to skip a monthly burger with no sides and water to drink if I need another $5 a month that bad.

It’s no surprise to me that Americans hold over a trillion fucking dollars in credit card debt. The entire commerce system is geared around it, constantly throwing it in our face. “Apply here to save $50 now!” “An extra 10% off when you use our card!” “Earn 3% cash back!” “Four easy installments of $8.96 when you use Klarma for this case of dog food.”

How can we bitch at Congress for deficit spending when we do the exact same fucking thing? You think war is a racket? Credit is an exponentially bigger racket.

--At least to me its less about saving that $92 dollars than about keeping my $1500 in my pocket 'just in case'. Its nice to have that cash in hand in an emergency.

-Anything like that I put on auto debit from my checking account so there is 0 chance of missing a payment. ...its that simple

So there isnt a 'right' answer, just the one that works for each individual.

All of my auto bill pay stuff goes onto a credit card then from my bank account. I earn points and pay the credit card every week.No arguments with part of what you said, however, ...I do assume a bit of financial intelligence from the person taking the loan...and yeah,, a lot of thats aimed at those who arent responsible.

--At least to me its less about saving that $92 dollars than about keeping my $1500 in my pocket 'just in case'. Its nice to have that cash in hand in an emergency.

-Anything like that I put on auto debit from my checking account so there is 0 chance of missing a payment. ...its that simple

So there isnt a 'right' answer, just the one that works for each individual.

I paid my house/land off in in one payment of cash 28 years ago . I find it strange that people ask for things not knowing what the future brings . I rather earn my money first . My idea worked, that 28 years of freedom has allowed me to retire with no debt .Ok, I’m gonna ask, “how the hell did you pay your house off in 6 years?”

You should have your emergency fund funded before buying new appliances UNLESS your refrigerator shit the bed.No arguments with part of what you said, however, ...I do assume a bit of financial intelligence from the person taking the loan...and yeah,, a lot of thats aimed at those who arent responsible.

--At least to me its less about saving that $92 dollars than about keeping my $1500 in my pocket 'just in case'. Its nice to have that cash in hand in an emergency.

-Anything like that I put on auto debit from my checking account so there is 0 chance of missing a payment. ...its that simple

So there isnt a 'right' answer, just the one that works for each individual.

That has 0 to do with the point Im making, but yes, you should.You should have your emergency fund funded before buying new appliances UNLESS your refrigerator shit the bed.

I do that as well, where I can, but many won't allow the CC. Points are good, I have half a million with Amex, as well as getting a free night every 15K I spend.All of my auto bill pay stuff goes onto a credit card then from my bank account. I earn points and pay the credit card every week.

Saving up for blow out trip.

Like I said in my tl'dr post, you can fund different pots of money at once

step 1 - earn money

step 2 - live below your means

step 3 - prioritize financial goals (everything from food/rent/car/gas to buying a pack of gum)

step 4 - don't waste money on stupid shit you don't need (this is a HUGE struggle and confusion for most people)

Tips that help, price shop everything, you can always find something cheaper if you look around.

Many waste thousands on convenience items that could go to pay your house off early (every dollar matters, 50 cents off coupons at the grocery store matter)

but

don't forget in all the priorities, you have to live too, you have to enjoy life at times and just buy some shit just because you want it. BUDGET THAT, don't be random and emotional

step 1 - earn money

step 2 - live below your means

step 3 - prioritize financial goals (everything from food/rent/car/gas to buying a pack of gum)

step 4 - don't waste money on stupid shit you don't need (this is a HUGE struggle and confusion for most people)

Tips that help, price shop everything, you can always find something cheaper if you look around.

Many waste thousands on convenience items that could go to pay your house off early (every dollar matters, 50 cents off coupons at the grocery store matter)

but

don't forget in all the priorities, you have to live too, you have to enjoy life at times and just buy some shit just because you want it. BUDGET THAT, don't be random and emotional

Man, I wish the Federal .gov would do this instead of what they are doing now.Like I said in my tl'dr post, you can fund different pots of money at once

step 1 - earn money

step 2 - live below your means

step 3 - prioritize financial goals (everything from food/rent/car/gas to buying a pack of gum)

step 4 - don't waste money on stupid shit you don't need (this is a HUGE struggle and confusion for most people)

Tips that help, price shop everything, you can always find something cheaper if you look around.

Many waste thousands on convenience items that could go to pay your house off early (every dollar matters, 50 cents off coupons at the grocery store matter)

but

don't forget in all the priorities, you have to live too, you have to enjoy life at times and just buy some shit just because you want it. BUDGET THAT, don't be random and emotional

Not necessarily. Most accounts aren’t paying crap. Some CDs might be paying 3-5% these days but that ties all your money up for a year or whatever the term is. Pretty much all savings accounts aren’t paying Jack crap.With your home, I agree 100%. Pay it off, keep it clear.

But on other items, like a new $1500 refrigerator, why pay cash when Best Buy will finance it for 0%? Put that cash in an account at any interest and you come out ahead. Or a 2.5% car loan.

Um, that’s great. Where’d you get the money? Most people aren’t sitting in $700k or whatever it is that your house cost.I paid my house/land off in in one payment of cash 28 years ago . I find it strange that people ask for things not knowing what the future brings . I rather earn my money first . My idea worked, that 28 years of freedom has allowed me to retire with no debt .

Last edited:

Not necessarily. Most accounts aren’t paying crap. Some CDs might be paying 3-5% these days but that ties all your money up for a year or whatever the term is. Pretty much all savings accounts aren’t paying Jack crap.

Home — TreasuryDirect

Look at Treasury Bills - 4 week to 52 week terms

You can ladder these like some people do with CDs so that every month or every other month you have money cash out

You do not pay state income tax on T-Bill profits, only federal

I do this with my 'emergency money' have a sum of money hitting me every month, don't need it, put it back in a new T-Bill, easy to track in a spreadsheet

have credit cards to cover that month I am waiting on a cash out from a T-Bill **IF** I need to...

My money market accout is paying 6% or better and I can access the money iwth a phone call.Not necessarily. Most accounts aren’t paying crap. Some CDs might be paying 3-5% these days but that ties all your money up for a year or whatever the term is. Pretty much all savings accounts aren’t paying Jack crap.

Um, that’s great. Where’d you get the money? Most people aren’t sitting in $700k

Ny guess is that Haney bought a less expensive home, like a reasonable person would, and paid it off. First home I bought was a run down dump I bought for 8K, but sweat equity and a bit of $$$ into it ans sold it 8 years later for 35K (that was in the early 80's). Bought another for $30K cash, improved it, sold it for a nice profit, and never looked back. I've flipped a bunch of them and made $$$ on everyone, and lived in them rent free.

Um, that’s great. Where’d you get the money? Most people aren’t sitting in $700k or whatever it is that your house cost.

This is the big question and the answer is most people don't fall into $700k unless they hit the lottery or get an inheritance

For most, paying off a house is a 10-30 year commitment and comes in chunks of $100

people can't see it happening fast enough to put $100 here and there towards a mortgage

progress is like watching grass grow

more exciting to put that $100 into something else I can see and have fun now

You get $700k by putting it together $1 at a time and being able to recognize that it will happen if you keep at it.

Also, don't buy a $700k house, you don't need it.

I had a Tbill (I series ) last year when the rate was 9.5% but this year they dropped it to abut 3% so I closed it outHome — TreasuryDirect

www.treasurydirect.gov

Look at Treasury Bills - 4 week to 52 week terms

You can ladder these like some people do with CDs so that every month or every other month you have money cash out

You do not pay state income tax on T-Bill profits, only federal

I do this with my 'emergency money' have a sum of money hitting me every month, don't need it, put it back in a new T-Bill, easy to track in a spreadsheet

have credit cards to cover that month I am waiting on a cash out from a T-Bill **IF** I need to...

That’s a lot smarter than having $40k sitting in a savings account.Home — TreasuryDirect

www.treasurydirect.gov

Look at Treasury Bills - 4 week to 52 week terms

You can ladder these like some people do with CDs so that every month or every other month you have money cash out

You do not pay state income tax on T-Bill profits, only federal

I do this with my 'emergency money' have a sum of money hitting me every month, don't need it, put it back in a new T-Bill, easy to track in a spreadsheet

have credit cards to cover that month I am waiting on a cash out from a T-Bill **IF** I need to...

I had a Tbill (I series ) last year when the rate was 9.5% but this year they dropped it to abut 3% so I closed it out

That is not a T-Bill, that was an I bond

Different animal

most recent rates

Price is irrelevant. I agree with you. Most people are paying the same way, over time, which is why I asked how he did it. Haney claims that he paid for all of his at one time with one lump sum, 28 years ago and never looked back. $100k, $400k, $700k doesn’t matter. Most people aren’t sitting on that type of money. I’m sitting on $100k in cash right now. It’s not enough to pay off the house. So I’m contemplating what to do with it. Throwing into retirement or the market seems kind of stupid cause that’s a gamble. So what do you do?This is the big question and the answer is most people don't fall into $700k unless they hit the lottery or get an inheritance

For most, paying off a house is a 10-30 year commitment and comes in chunks of $100

people can't see it happening fast enough to put $100 here and there towards a mortgage

progress is like watching grass grow

more exciting to put that $100 into something else I can see and have fun now

You get $700k by putting it together $1 at a time and being able to recognize that it will happen if you keep at it.

Also, don't buy a $700k house, you don't need it.I know I know too late.

Send it to me.Price is irrelevant. I agree with you. Most people are paying the same way, over time, which is why I asked how he did it. Haney claims that he paid for all of his at one time with one lump sum, 28 years ago and never looked back. $100k, $400k, $700k doesn’t matter. Most people aren’t sitting on that type of money. I’m sitting on $100k in cash right now. It’s not enough to pay off the house. So I’m contemplating what to do with it. Throwing into retirement or the market seems kind of stupid cause that’s a gamble. So what do you do?

Or put it into a liquid fund. As I said above, I'm making 6% with no penalty for withdrawl.

Now does OnlyFans for a nice profit!Haney probably saved his money from being a male prostitute

The market is not a gamble if you buy quality and have a long term outlook. Depending on your age and when you retire, it might still be a good choice.Price is irrelevant. I agree with you. Most people are paying the same way, over time, which is why I asked how he did it. Haney claims that he paid for all of his at one time with one lump sum, 28 years ago and never looked back. $100k, $400k, $700k doesn’t matter. Most people aren’t sitting on that type of money. I’m sitting on $100k in cash right now. It’s not enough to pay off the house. So I’m contemplating what to do with it. Throwing into retirement or the market seems kind of stupid cause that’s a gamble. So what do you do?

I’ve bought every high and low of the S&P 500 for 30 years and damn sure am glad I did. Never stopped my purchases. There are others that have performed very well for me, especially the ones I purchased throughout the dot-com bust.

That’s why I always tell people to start a brokerage account that allows fractional share buyjng for their kids as soon as they get their first job.

$20 is $20.Haney probably saved his money from being a male prostitute

Buy early and often for a long period and you’ll be alright. Exactly what I have been doing. I don’t quote dollar cost avg but I put x amount a year that adds up to what I can do each year..The market is not a gamble if you buy quality and have a long term outlook. Depending on your age and when you retire, it might still be a good choice.

I’ve bought every high and low of the S&P 500 for 30 years and damn sure am glad I did. Never stopped my purchases. There are others that have performed very well for me, especially the ones I purchased throughout the dot-com bust.

That’s why I always tell people to start a brokerage account that allows fractional share buyjng for their kids as soon as they get their first job.

I must be more of a poor than I previously thought. My mortgage is $640 month including taxes and insurance.

Simple, banks are not your friend. And you make perfect sense with the points you bring up on why it is important to pay debts off before deciding investing is a better option.So a question to those who say better to invest than to pay off debt:

Did you take out a new mortgage/HELOC against your house to invest when the rates were at rock bottom lows?

If so, how much did you make on your investments compared to increased interest payments?

If not, why? If the math makes sense, why didn't you cash in that increased equity and put it back to work for you?

It's no secret I'm hugely against unnecessary debt, but I want to hear from the millionaires in here about how you took out a loan on your house to make your seventh or eighth figure in net worth.

On a forum populated by so many of us who scream "Buy more ammo" to be prepared for the shooting match that stands a 0.01% chance of happening, I find it interesting so many would allow themselves to be at risk of losing their entire house in the event of a traumatic event like a market collapse, a career ending injury or crippling disease of self or loved one, years long layoffs in an "Even More Greater Recession", or any of another multitude of events that can and do happen all the time that throw a family into financial strife.

It makes zero fucking sense to me. Look at my math from earlier, under $900 a year earned per $100,000 withheld in the bank versus paid towards a debt, and a bank holding the ownership title to your house instead of you. That's the math you're preaching is right and undeniable? Fuck, I make that and then some in a single weekend of overtime. I'll go get some exercise at work and sleep even better at night while getting the bank out of my life.

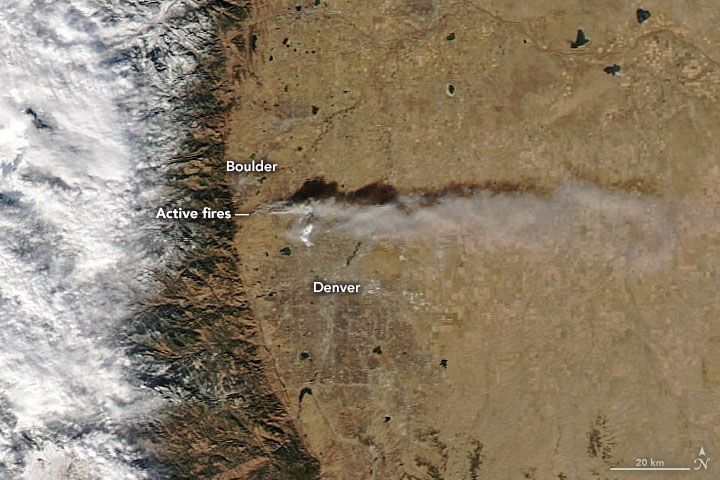

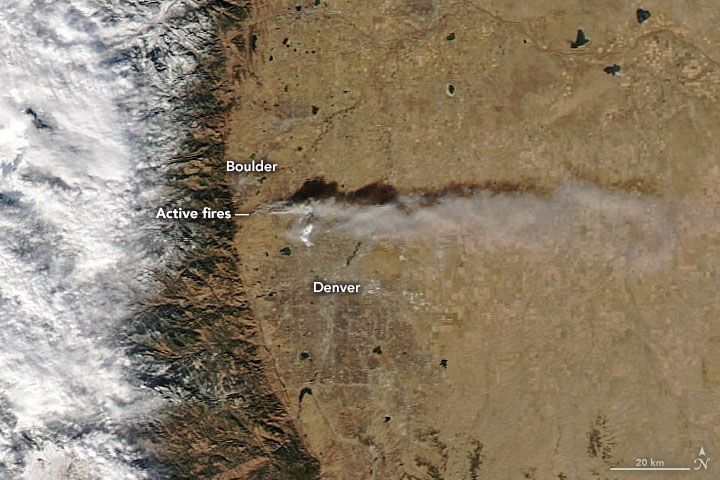

That's less than my taxes and insurance. And why I stated what I stated earlier. I could own my house but taxes and insurance would be too much if I was retired on a fixed income and they keep raising taxes and insurance. We get to pay for the fires in Superior now even though it was likely caused by the local power company and green fucks resistance to allowing cattle to graze the open spaces*.I must be more of a poor than I previously thought. My mortgage is $640 month including taxes and insurance.

Marshall Fire - Wikipedia

*speculation based on some "inside" info I've been privy to.

Thanks, Unhoused Zoomers!

You guys laugh but the way things are going in this country 1) within ~20 years investment groups will own the majority of homes and 2) most of your grandkids/great grandkids will wind up living in abject poverty, owning nothing.

Go back to what the banks did to the family farmers in the late 1970’s and early 80’s, raised the values on the farms and encouraged they borrowed $$$$$ to expand and improve their operations. Then by the early md 80’s they radically adjusted what the farm’s worth or devalue, along with raising interest rates they then put them into foreclosure.You guys laugh but the way things are going in this country 1) within ~20 years investment groups will own the majority of homes and 2) most of your grandkids/great grandkids will wind up living in abject poverty, owning nothing.

The financial raping of Americas working class.

Lenders love financially illiterate people.

Lenders love financially illiterate people.

Yep. Just saw that about 15% of GM Financial's loans are subprime. Imagine what that number looks like for Hyundai/Kia.

I understand the grade-school math that's used to justify borrowing at 3% and earning 8% annually from investments, but am generally unimpressed by the fact that nearly everyone touting this logic is perpetually in debt. My home and shop are modest but paid off, and the security those provides (including that of being able to tell employers and customers that I'm not beholden to them) has substantial value that can't be measured by a bank account. I'm constantly getting comments about "it must be nice to have the money to afford that!!!” when discussing a new firearm, tool, or car part. Imagine having a six-figure gross income and struggling to spend a few percent of that on an occasional discretionary expense.

I remember you now , the guy that was broke all the time . Always had shitty jobs or something like that to cry about . You will die in debt and your family left with your shit show of a debt filled life . Fitting.Haney probably saved his money from being a male prostitute

That's less than my taxes and insurance. And why I stated what I stated earlier. I could own my house but taxes and insurance would be too much if I was retired on a fixed income and they keep raising taxes and insurance. We get to pay for the fires in Superior now even though it was likely caused by the local power company and green fucks resistance to allowing cattle to graze the open spaces*.

Marshall Fire - Wikipedia

en.wikipedia.org

*speculation based on some "inside" info I've been privy to.

So what you are telling us is that when the city comes around and decides to raise property taxes your house payment does not change, or you don't get notice that something came out of escrow. Same with insurance?

Similar threads

- Replies

- 46

- Views

- 1K

- Replies

- 7

- Views

- 378

- Replies

- 0

- Views

- 176