It's not really hiding. Government can barely service it's current debt and they aren't slowing down in thier spending. Inflation is skyrocketing and they wouldn't slow it down even if they could. This is like that keanu Reeves movie speed with the bus. Keep your foot down and pray you don't crash and burn.

Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Inflation.......... ?

- Thread starter Hobo Hilton

- Start date

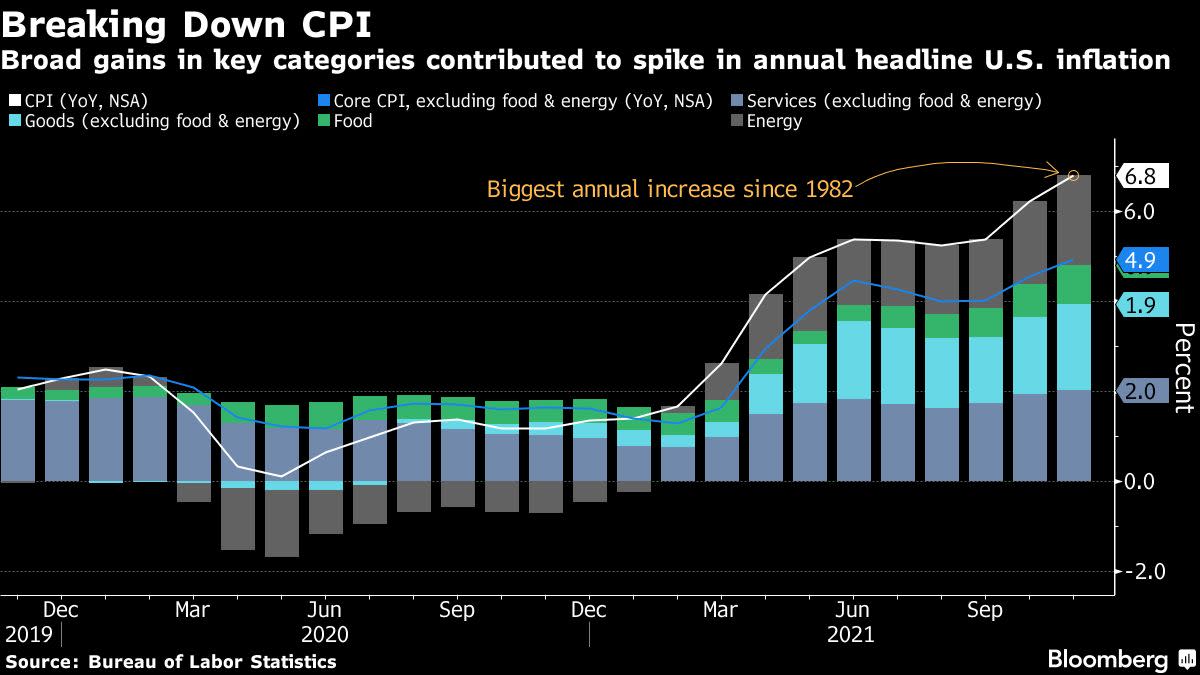

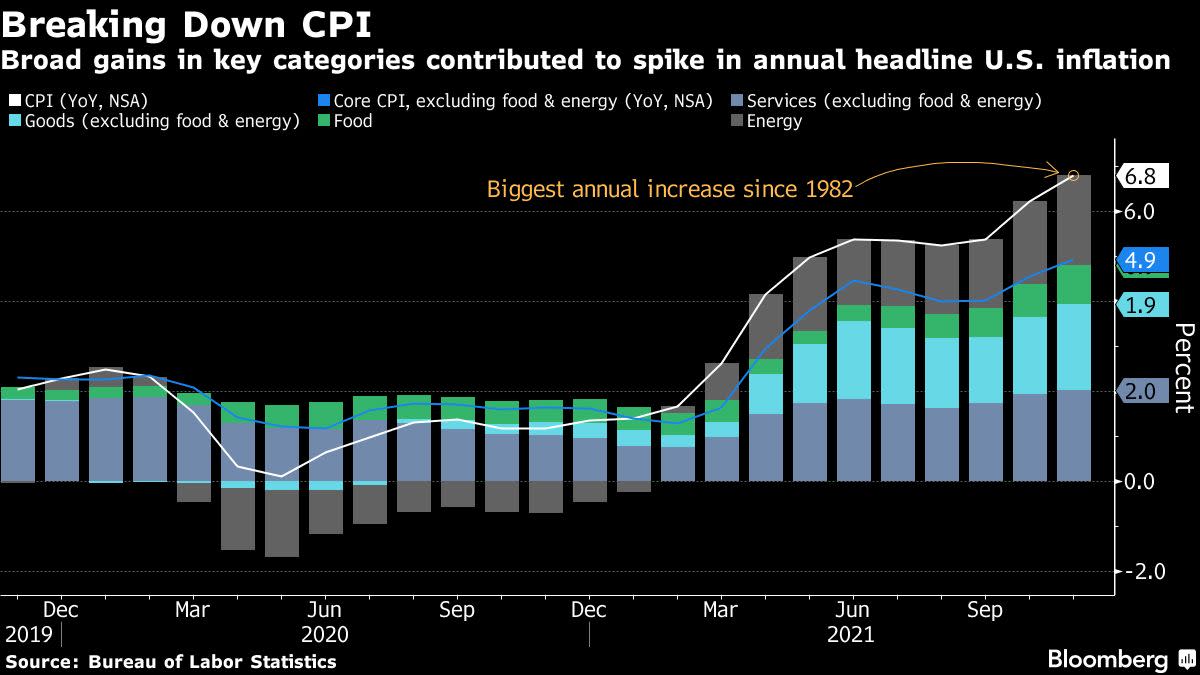

Just my opinion.... "Bad debt" will continue to be inflationary until the default. How long before the defaults start ? To me, it appears the defaults will begin to get noticed around the middle of 2022... Similar to the Savings and Loans collapsing many years ago. Many things (propaganda) will obscure the defaults.. ie words like transitory. Federal Reserve will invent new ways to kick the can down the road. Unfortunately the rules for the Fed won't apply to the middle class Americans. The lowest class people in America have little to lose and will live off of the government hand outs. The upper class has already prepared for a long downturn, similar to companies buying back their own stock. The biggest challenge to the remaining middle class will be debt.OK, so let's play this out. The hypothesis is that there is a lot of bad debt hiding in the system. Bad debt will eventually suffer from default, and the majority of those loans are non-recourse. Is that process of debt destruction inflationary, or deflationary?

Just something to keep in mind as one attempts to predict the future. I don't think this will be the sole driver of inflationary trends, but it can't be ignored, either.

Deflation may never come. It will be the rest of the countries in the world against the USD. The currency traders will be pitting other curriencies against the USD that are not now in the "basket" of currencies used to establish the value of the USD. When a foreign country backs it's dollar with gold, America will be at the Y in the road for the Gold Standard.

LOL... $$$ is getting to be the common ground.

____________

(Bloomberg) -- The Federal Reserve has managed to do something that’s rarely seen in the U.S. these days: Get members of the Democratic and Republican parties to agree.

ca.finance.yahoo.com

ca.finance.yahoo.com

____________

(Bloomberg) -- The Federal Reserve has managed to do something that’s rarely seen in the U.S. these days: Get members of the Democratic and Republican parties to agree.

Fed Unites Left and Right in Warning It’s Behind Inflation Curve

(Bloomberg) -- The Federal Reserve has managed to do something that’s rarely seen in the U.S. these days: Get members of the Democratic and Republican parties to agree.Most Read from BloombergCyprus Finds Covid-19 Infections That Combine Delta and OmicronOmicron Study in South Africa Points to...

Personal experience:

Went to Costco yesterday for the first time and packaged rotisserie chicken was up from $11 to $16 per package. Dog food was up from $27 to $36 per bag. Kcup coffee was also up from $33 a box to $41 a box.

Seemed like alot of other items increased too, but those were ones that we buy often so I know exactly what we paid for them previously.

Went to Costco yesterday for the first time and packaged rotisserie chicken was up from $11 to $16 per package. Dog food was up from $27 to $36 per bag. Kcup coffee was also up from $33 a box to $41 a box.

Seemed like alot of other items increased too, but those were ones that we buy often so I know exactly what we paid for them previously.

Understood. I bring a black Sharpie with me when in Costco. When an item goes in my basket there is a large price notation on the package. When things go into my "stores" at home, the price is looking outward. Just my simple way to note inflation, at a glance. It helps when making my next trip to the big box food stores.Personal experience:

Went to Costco yesterday for the first time and packaged rotisserie chicken was up from $11 to $16 per package. Dog food was up from $27 to $36 per bag. Kcup coffee was also up from $33 a box to $41 a box.

Seemed like alot of other items increased too, but those were ones that we buy often so I know exactly what we paid for them previously.

Many are seeing empty shelves of canned biscuits and related products in the cooler cases. No explanation.

The mega companies are spinning off many of the specialty products they produce to smaller companies. Many are moving back to their proven core items. Consumers can still get a product, just not as much variety.

Times are changing.

Go figure......

U.S. Mint sees strongest gold coin sales in 12 years, sells 1.25 million ounces in 2021

Outlook 2022

www.kitco.com

The only two options we have aside from full currency colapse is they pull currency out of the money supply, or they make this modern monetary theory bullshit work. Either way as long as we continue to use dollars we continue to get fucked by the banks who can create new dollars out of thin air.

One of the top "Snake Oil" Salesmen is speaking.

www.cnbc.com

www.cnbc.com

Jamie Dimon sees the best economic growth in decades, more than 4 Fed rate hikes this year

JPMorgan is the biggest U.S. bank by assets and has relationships with half of U.S. households.

Another Snake Oil salesman:

www.marketwatch.com

www.marketwatch.com

Powell paints the picture of a soft landing, says Fed can cool inflation without damaging labor market

Fed Chairman Jerome Powell said Tuesday the central bank can cool inflation without damaging the labor market.

Historically, I would agree with you. However, America has never had an administration dolling out cash like this one is doing. At the point where a wheel barrow full of USD's will buy one loaf of bread it will kill the economy.... History repeating itself.I want higher inflation.

Attachments

"Expectations".... To date, none of Powell's expectations have come true. Why would the Senate confirm a guy who is wrong most of the time ?

_______________________

Fed Chair Jerome Powell also said Tuesday that he thinks a main contributor to inflation — pressure in global supply chains — will ease up this year, though some business leaders and industry analysts disagree. During his confirmation hearing before the Senate, he told lawmakers that his expectation is that supply chains "will loosen up."

Proverbs 29:2

www.cnn.com

www.cnn.com

_______________________

Fed Chair Jerome Powell also said Tuesday that he thinks a main contributor to inflation — pressure in global supply chains — will ease up this year, though some business leaders and industry analysts disagree. During his confirmation hearing before the Senate, he told lawmakers that his expectation is that supply chains "will loosen up."

Proverbs 29:2

When the righteous are in authority, the people rejoice: but when the wicked beareth rule, the people mourn.

The big test for inflation is 12 months away

Annual consumer inflation in the United States has climbed to 7% as prices rise at the fastest clip in nearly four decades.

Last edited:

Hopefully this is "transitory" and will go away when warm weather arrives... In the mean time bend over if you want to stay warm.

01:33:00 PM

MI Indication

Natural Gas (Henry Hub)Commodity

4.74+0.52+12.32%01:33:00 PM

MI Indication

Lipstick on a pig.... These clowns are excited over "Solid Growth in prices charged to customers".... Now, Inflation = Solid Growth

www.marketwatch.com

www.marketwatch.com

Fed's Beige book sees 'solid growth' in prices charged to customers

Businesses have been able to pass along price gains to their customers, according to the latest Fed Beige Book report released Wednesday.

and I actually thought I may be able to retire before I die. Let's just hope as a white male, I don't get completely cancelled out of the job market.

I heard on the radio today that the average household debt to credit cards and other loans was $150k.

It reminds me of pre '08 and I don't believe we'll be able to face that again. Fed debt then was around nine trillion. We will hit the 30 trillion mark really soon.Just my opinion.... "Bad debt" will continue to be inflationary until the default. How long before the defaults start ? To me, it appears the defaults will begin to get noticed around the middle of 2022... Similar to the Savings and Loans collapsing many years ago. Many things (propaganda) will obscure the defaults.. ie words like transitory. Federal Reserve will invent new ways to kick the can down the road. Unfortunately the rules for the Fed won't apply to the middle class Americans. The lowest class people in America have little to lose and will live off of the government hand outs. The upper class has already prepared for a long downturn, similar to companies buying back their own stock. The biggest challenge to the remaining middle class will be debt.

Deflation may never come. It will be the rest of the countries in the world against the USD. The currency traders will be pitting other curriencies against the USD that are not now in the "basket" of currencies used to establish the value of the USD. When a foreign country backs it's dollar with gold, America will be at the Y in the road for the Gold Standard.

Read an article today that said the Federal Reserve had no part in the increasing inflation... As I read on it said "There is very little the Federal Reserve can do to lower the inflation rate"......I heard on the radio today that the average household debt to credit cards and other loans was $150k.

It reminds me of pre '08 and I don't believe we'll be able to face that again. Fed debt then was around nine trillion. We will hit the 30 trillion mark really soon.

Carter and Volcker thought differently.

______________________

Following a sharp rise in inflation between 1978 and 1979, President Jimmy Carter shuffled his economic policy team and nominated Volcker to become chairman of the Board of Governors.

The one sobering line was this = Even if lumber prices pull back somewhat, it doesn't mean we're headed back to pre-pandemic levels. There were announcements about new steel mills being built in Arkansas and other US locations... Basic commodities timber, iron ore, natural gas, fertilizer and refining capabilities are all in short supplies now. The declining value of the USD compounds the challenges. Any new manufacturing plants take years to get into production.. America does not have the skilled tradesmen to build multi-billion dollar projects.

When a man finds he has dug himself into a hole... The first thing to do is stop digging.

The Deep State is continuing to dig.... Going to take 10 years to climb out of this hole if the digging stops tomorrow.

Biden is pulling people from the old OBama administration.

_________________

Why it matters: It's Biden's biggest mark yet on the influential economic body that's center stage as the country grapples with inflation rising at the fastest pace in decades and a recovering labor market.

www.axios.com

www.axios.com

_________________

Why it matters: It's Biden's biggest mark yet on the influential economic body that's center stage as the country grapples with inflation rising at the fastest pace in decades and a recovering labor market.

Biden names Sarah Bloom Raskin as Fed's top banking regulator

It's Biden's biggest mark yet on the economic body grappling with soaring inflation.

It means the only plan the Fed has is "Hope"....Recovering labor market?

WTF does that mean?

Like domino's falling

First Lumber. Then Tin. Now the Newest Squeeze Is in Nickel

(Bloomberg) -- Nickel rallied to the highest in more than a decade as dwindling exchange inventories leave traders bracing for a historic supply squeeze.Most Read from BloombergCannabis Compounds Prevented Covid Infection in Laboratory StudyFrequent Boosters Spur Warning on Immune...

It's been a while since college econ, but I thought that an increase in prices was supposed to result in an increased supply:

www.zerohedge.com

www.zerohedge.com

Can't wait to watch the Fed botch the landing in such a fashion that it crashes the economy and stock market but fails to control inflation.

ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Can't wait to watch the Fed botch the landing in such a fashion that it crashes the economy and stock market but fails to control inflation.

Its retracting because we can't get the raw materials.It's been a while since college econ, but I thought that an increase in prices was supposed to result in an increased supply:

ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zerowww.zerohedge.com

Can't wait to watch the Fed botch the landing in such a fashion that it crashes the economy and stock market but fails to control inflation.

Its retracting because we can't get the raw materials.

Yep, I've heard that story once or twice (I work in automotive electronics). My opening comment was intended to be a bit tongue-in-cheek. My closing comment is tinged with the usual GenX ironic detachment but is a serious assessment of the most likely outcome.

Jan 14 (Reuters) - U.S. consumer sentiment soured in early January, falling to the second lowest level in a decade as Americans fretted about soaring inflation and doubted the ability of government economic policies to fix it, a survey showed on Friday.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/T3PTKPDYUFNMBNPFF2EK667F7M.jpg)

www.reuters.com

www.reuters.com

/cloudfront-us-east-2.images.arcpublishing.com/reuters/T3PTKPDYUFNMBNPFF2EK667F7M.jpg)

U.S. consumer sentiment sours in early January to second lowest level in decade

U.S. consumer sentiment soured in early January, falling to the second lowest level in a decade as Americans fretted about soaring inflation and doubted the ability of government economic policies tofix it, a survey showed on Friday.

I agree.... Interesting that the shortage of raw materials is world wide. Historically it has been regional shortages and that's the occasion's commodity traders make out like bandits.Its retracting because we can't get the raw materials.

Today's "Snake Oil" salesman: John C. Williams is the president and chief executive officer of the Federal Reserve Bank of New York.

Today he said.... he expects inflation to drop to around 2.5% this year and close to 2% in 2023.

Jun 30, 2021 — Yet he also predicts inflation will subside to 2% by 2022

___________________________________

Today he said.... he expects inflation to drop to around 2.5% this year and close to 2% in 2023.

Jun 30, 2021 — Yet he also predicts inflation will subside to 2% by 2022

___________________________________

Fed officials say rate hikes near as inflation soars By Reuters

Fed officials say rate hikes near as inflation soars

www.investing.com

Today's "Snake Oil" salesman: John C. Williams is the president and chief executive officer of the Federal Reserve Bank of New York.

Today he said.... he expects inflation to drop to around 2.5% this year and close to 2% in 2023.

Jun 30, 2021 — Yet he also predicts inflation will subside to 2% by 2022

___________________________________

Fed officials say rate hikes near as inflation soars By Reuters

Fed officials say rate hikes near as inflation soarswww.investing.com

I also believe that we could see 2% inflation in 2023. It would simply take a big recession and a banking crisis to do the trick. I'm mean, it's not like we've ever seen that in modern times, so this is purely hypothetical.

I agree...... about 12 months of being beat over the head with the financial 2" X 4" will knock some sense into the crowd that thinks they can live forever on the doll..........I also believe that we could see 2% inflation in 2023. It would simply take a big recession and a banking crisis to do the trick. I'm mean, it's not like we've ever seen that in modern times, so this is purely hypothetical.

A good start would be to shrink the US Government by 50%

Sobering forecast:

Jamie Dimon sees more rate hikes than we think for the U.S. economy this year.

The JPMorgan (JPM) chief executive officer predicted on Friday that rising inflation could prompt the Federal Reserve to raise short-term borrowing costs as many as six or seven times, doubling down on his earlier bet that the currently-anticipated three to four increases are likely a low estimate of what investors can expect.

“My view is, there’s a pretty good chance there will be more than four — there could be six or seven,” Dimon said during a post-earnings conference call Friday morning. “I grew up in a world where Paul Volcker raised his rates 200 basis points on a Saturday night.”

ca.finance.yahoo.com

ca.finance.yahoo.com

Jamie Dimon sees more rate hikes than we think for the U.S. economy this year.

The JPMorgan (JPM) chief executive officer predicted on Friday that rising inflation could prompt the Federal Reserve to raise short-term borrowing costs as many as six or seven times, doubling down on his earlier bet that the currently-anticipated three to four increases are likely a low estimate of what investors can expect.

“My view is, there’s a pretty good chance there will be more than four — there could be six or seven,” Dimon said during a post-earnings conference call Friday morning. “I grew up in a world where Paul Volcker raised his rates 200 basis points on a Saturday night.”

JPMorgan CEO Jamie Dimon says 'there could be 6 or 7' interest rate hikes

JPMorgan chief executive officer Jamie Dimon predicted on Friday that rising inflation could prompt the Federal Reserve to raise short-term borrowing costs as many as six or seven times, doubling down on his earlier bet that the currently-anticipated three to four increases are likely a low...

To qualify a few things. Simply raising interest rates alone is not going to curb inflation. The US Government must stop spending money to create inflation. Dolling out USD's while increasing interest is a futile effort.

This article is a good example.

www.foxnews.com

www.foxnews.com

This article is a good example.

Left-wing group secured $158 million taxpayer-funded contract to help illegal immigrants avoid deportation

The Vera Institute of Justice, a progressive nonprofit, receives hefty taxpayer-backed federal contracts to help illegal immigrants sidestep deportation.

**Must stop printing money**To qualify a few things. Simply raising interest rates alone is not going to curb inflation. The US Government must stop spending money to create inflation. Dolling out USD's while increasing interest is a futile effort.

This article is a good example.

Left-wing group secured $158 million taxpayer-funded contract to help illegal immigrants avoid deportation

The Vera Institute of Justice, a progressive nonprofit, receives hefty taxpayer-backed federal contracts to help illegal immigrants sidestep deportation.www.foxnews.com

I use coupons (no homo), and buy what’s on sale.Used to buy my bi-weekly groceries for $2-250, sometimes $300 when adding in detergents, motor oil, paper products. Just got home $480 + $50 fill up! Syntec oil has gone up to the same price as name brands. Fuck me a running...

Coming very soon to America. Energy (or lack of it) is a world wide problem. Not to be solved soon.

ca.finance.yahoo.com

ca.finance.yahoo.com

Europe’s Governments Face a Reckoning as Energy Prices Surge

(Bloomberg) -- Europe is gripped by one of the worst energy crunches in history, forcing politicians to step in as soaring prices threaten to leave millions of households unable to pay their bills. Most Read from BloombergDjokovic Loses Shot at Tennis History as Australia Deports StarOne of the...

Contributing to both inflation and debt..The Government can't run a two car parade:

The benefits of the historic small business support program designed at the height of the epidemic went largely to business owners instead of their employees, according to research from leading economists. Research from authors including renowned Massachusetts Institute of Technology professor David Autor, as well. like a few Federal Reserve economists, they have explored the $ 800 billion Paycheck Protection Program. It was distributed by the National Bureau of Economic Research and included in data from the payroll processor ADP.

| Up to three-quarters of the $800 billion PPP flowed to business owners instead of workers, study finds |

The benefits of the historic small business support program designed at the height of the epidemic went largely to business owners instead of their employees, according to research from leading economists. Research from authors including renowned Massachusetts Institute of Technology professor David Autor, as well. like a few Federal Reserve economists, they have explored the $ 800 billion Paycheck Protection Program. It was distributed by the National Bureau of Economic Research and included in data from the payroll processor ADP.

To qualify a few things. Simply raising interest rates alone is not going to curb inflation. The US Government must stop spending money to create inflation. Dolling out USD's while increasing interest is a futile effort.

This article is a good example.

Left-wing group secured $158 million taxpayer-funded contract to help illegal immigrants avoid deportation

The Vera Institute of Justice, a progressive nonprofit, receives hefty taxpayer-backed federal contracts to help illegal immigrants sidestep deportation.www.foxnews.com

Spending isn't the problem - if every dollar spent is accompanied by a dollar of taxation, no big deal. Even if deficits are run, if they are paid for with the private purchase of bonds, at least a portion of the inflationary pressure is offset. So this problem is not one of fiscal policy, but rather monetary policy.

The good news is that Jerome Powell has only three years and nine months left in his four-year term, and I totally expect that whomever takes office in 2024 will nominate someone even worse to replace Powell because raising rates will be political suicide.

I have been watching how the many foreign markets moved since the beginning of the pandemic. Many did not "throw money" at the pandemic. The headline today, somewhat, shows that with the US Markets closed, the rest of the world moves positive. Could the US Markets be pulling down the rest of the world markets ?

__________________________

Global stocks rose and U.S. futures had been regular Monday, as traders targeted on upcoming company earnings and rising rates of interest with U.S. exchanges shut in observance of the Martin Luther King Jr. vacation.

www.pehalnews.in

www.pehalnews.in

__________________________

Global stocks rose and U.S. futures had been regular Monday, as traders targeted on upcoming company earnings and rising rates of interest with U.S. exchanges shut in observance of the Martin Luther King Jr. vacation.

Global stocks advance with U.S. exchanges shut as traders wait for earnings reports

Global stocks rose and U.S. futures had been regular Monday, as traders targeted on upcoming company earnings and rising rates

Ever watch people in a crowd move away from a person with body odor ? Law of Nature ? The other countries of the World are subtly moving away from America. Becoming obvious the US is in a "sink or swim" situation. No one is coming to save America.

Attachments

New home construction down 14% in November 2021 compared to November 2020.

Hmmm. No shit. Materials are high as fuck.

Homebuilder confidence drops for the first time in four months, as inflation hits materials

Homebuilders are facing rising costs for materials and labor, causing the first drop in builder confidence in four months.

I honestly have no idea where this is going.

Homebuilder confidence drops for the first time in four months, as inflation hits materials

Homebuilders are facing rising costs for materials and labor, causing the first drop in builder confidence in four months.www.cnbc.com

Eventually something will give. Gas prices creeping back up since Krimuss is over.

I’m sticking with my hypothesis that $4 gallon gas for longer than a 3 month period on the east coast is going to cause the fall everyone is expecting.

I honestly have no idea where this is going.

Eventually something will give. Gas prices creeping back up since Krimuss is over.

I’m sticking with my hypothesis that $4 gallon gas for longer than a 3 month period on the east coast is going to cause the fall everyone is expecting.

Don't know if it will cause the fall, or just be correlated with it. The impact of $4/gal gas on household finances should be less that it was back in 2008. On a dollar-per-month basis, it would seem that skyrocketing housing costs, automobile purchase prices, and insurance premiums would be larger, but maybe I'm missing something, or maybe it's just a psychological matter.

All contribute. Rents up, grocery bills up. To me, I’m betting the gas prices will be the final nail. Utility prices are up too.Don't know if it will cause the fall, or just be correlated with it. The impact of $4/gal gas on household finances should be less that it was back in 2008. On a dollar-per-month basis, it would seem that skyrocketing housing costs, automobile purchase prices, and insurance premiums would be larger, but maybe I'm missing something, or maybe it's just a psychological matter.

You can surf a lot of debt until your cost to go to work jumps $300+ in a month. Can’t avoid that one, lol.

Let’s be honest, most Americans would be absolutely wrecked from a $300 a month increase in required spending.

Appearing the omicron virus is going to be the Fed's scapegoat for the next crash landing.

____________________________

The numbers: The Empire State survey of business conditions nosedived to -0.7 points in January from 31.9 in the prior month, the New York Federal Reserve said, reflecting fresh strains from the omicron virus and ongoing supply-chain bottlenecks.

It was the first decline in the index since June 2020. Economists had expected a reading of 25.5, according to a survey by The Wall Street Journal.

Any reading below zero indicates worsening conditions. The index has been quite strong through most of 2021, even during the delta wave of the coronavirus, before the recent tumble.

reporterwings.com

reporterwings.com

____________________________

The numbers: The Empire State survey of business conditions nosedived to -0.7 points in January from 31.9 in the prior month, the New York Federal Reserve said, reflecting fresh strains from the omicron virus and ongoing supply-chain bottlenecks.

It was the first decline in the index since June 2020. Economists had expected a reading of 25.5, according to a survey by The Wall Street Journal.

Any reading below zero indicates worsening conditions. The index has been quite strong through most of 2021, even during the delta wave of the coronavirus, before the recent tumble.

Nomor Keluaran HK - Togel Hongkong - Pengeluaran HK Pools - Data HK Prize - Live HK 4D

Togel hongkong adalah sebuah situs resmi penyedia paito hk yang berisikan semua angka keluaran hk pools dan pengeluaran hk prize dalam tabel data hk.

All contribute. Rents up, grocery bills up. To me, I’m betting the gas prices will be the final nail. Utility prices are up too.

You can surf a lot of debt until your cost to go to work jumps $300+ in a month. Can’t avoid that one, lol.

Let’s be honest, most Americans would be absolutely wrecked from a $300 a month increase in required spending.

I think that is happening at the grocery store faster than anywhere else. Change people's eating habits and they are going to get pissed.

NEW YORK, Jan 18 (Reuters) - Oil prices on Tuesday climbed to their highest since 2014 as possible supply disruption after attacks in the Mideast Gulf added to an already tight supply outlook.All contribute. Rents up, grocery bills up. To me, I’m betting the gas prices will be the final nail. Utility prices are up too.

You can surf a lot of debt until your cost to go to work jumps $300+ in a month. Can’t avoid that one, lol.

Let’s be honest, most Americans would be absolutely wrecked from a $300 a month increase in required spending.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/5L7A5E5CCBIGJBV4BXGODRBF3Q.jpg)

Oil hit 7-year highs as tight supply bites

Oil prices on Tuesday climbed to their highest since 2014 as investors worried about global political tensions involving major producers such as the United Arab Emirates and Russia that could exacerbate the already tight supply outlook.

odd considering omicron isn't as bad. I call bs!Appearing the omicron virus is going to be the Fed's scapegoat for the next crash landing.

____________________________

The numbers: The Empire State survey of business conditions nosedived to -0.7 points in January from 31.9 in the prior month, the New York Federal Reserve said, reflecting fresh strains from the omicron virus and ongoing supply-chain bottlenecks.

It was the first decline in the index since June 2020. Economists had expected a reading of 25.5, according to a survey by The Wall Street Journal.

Any reading below zero indicates worsening conditions. The index has been quite strong through most of 2021, even during the delta wave of the coronavirus, before the recent tumble.

Nomor Keluaran HK - Togel Hongkong - Pengeluaran HK Pools - Data HK Prize - Live HK 4D

Togel hongkong adalah sebuah situs resmi penyedia paito hk yang berisikan semua angka keluaran hk pools dan pengeluaran hk prize dalam tabel data hk.reporterwings.com

Similar threads

- Replies

- 2

- Views

- 267

- Replies

- 10

- Views

- 552

- Replies

- 152

- Views

- 6K