That’s all well and good, but this textbook explanation is the same as I had in college. It doesn’t address what happens when inflation goes from gradual to a $5T helicopter dump in the span of a year. All those words go out the window and traditional models are broken because of the furious injection of capital that can’t be easily digested by the world economy.I found the following description very helpful, I was searching for an answer to the question "How does inflation reduce debt?":

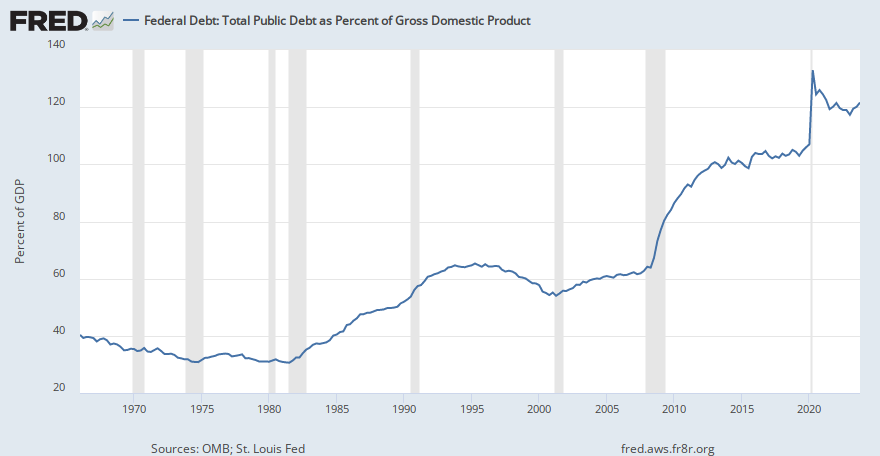

Inflation is the political savior of an overspending country that finds itself deep in debt, as the U.S. is today.

A country has four tools to retire its debt: raise taxes, cut spending, declare bankruptcy, or debase the currency through inflation.

Of these options, bankruptcy is the most unpalatable.

It would most likely mean the country goes through a gut-wrenching depression and is unable to borrow for the foreseeable future.

Almost as unpalatable to politicians are spending cuts of any kind.

Taking away something the electorate views as a “right” or an “entitlement” is akin to ending your political career.

Raising taxes is somewhat more appealing, especially in countries where the majority of the voters don’t pay taxes or the increases apply primarily to those the electorate perceives as “the rich.”

The risk here is that if taxes increase too much it reduces the incentive to work and the whole economy crashes.

This means gross tax revenues fall, which in the end actually increases the country’s debt problem as the government must increase borrowing to keep from making any spending cuts.

That leaves inflation.

A slow, chronic inflation is the most politically palatable way of reducing the debt in a manner that is somewhat unnoticeable to the electorate.

How Does Inflation Reduce Debt?

With inflation, the losers are the people and institutions that own the debt, because the currency shrinks in value.

For example, say you loan the government money by buying a $1000 U.S. government bond that matures in ten years.

At the time you buy it, you could buy a fully loaded laptop or a round trip ticket to London for $1000.

Now, let’s say the U.S. inflates its currency at a 7% rate for the next ten years, which would be about twice the “normal” inflation rate of 3.3% for the past 80 years.

At the end of that time the bond matures and you get your $1000 back.

You go to buy a laptop; they now sell for $2000.

That trip to London costs $2000, too.

Many people in this situation will think that the prices of laptops and airline tickets have gone up.

Actually, in real dollars (which are dollars adjusted for inflation), the cost of these items hasn’t gone up a dime.

It’s the value of the dollar that’s gone down, in this case, by 50% over ten years.

The big winner here is the U.S. government, because its multi trillion-dollar debt has been chopped in half (again in real dollar terms) in ten short years.

They accomplished this without raising taxes or cutting spending, which is intoxicatingly appealing to politicians.

If the country slides into chronic deflation, similar to Japan which has seen consumer prices fall up to 2% a year for 15 years, government revenues will fall while the real value of its massive debt will grow, further stagnating future growth.

It becomes a vicious cycle which politicians have few, if any tools, to combat.

That is why gradual inflation is the preferred medicine.

When it’s done well, citizens become like the proverbial frog that is cooked slowly in a pan of water where the temperature is gradually increased, rather than being frozen to death by deflation.

In the end, of course, neither outcome is good for the frog.

We are not in a gradual inflation scenario. We are in a full retard scenario that is combined with politicians viewing themselves as the masters of the universe.