LOL... We are in the same camp. On Monday I bought a used 3 pt hitch tiller (54" wide) and a 3 pt hitch 5' box grader for $500 from a guy retiring from the landscaping business. Spent 2 - 3 days in the shop refurbishing the tiller. Listed the box grader for $400 on Craigslist and a guy showed up an hour later with cash and a trailer to haul it away. He was tickled pink to even find a 5' box grader in my area. So, for $100 and some sweat equity I have my tiller. Welcome to the "World of the Poor's"... LOLI’ve still got my eye on purchasing more properties, but I’m only going to start being really interested about 25% below where we are now.

I’ve instead been deploying my cash on items I need and or want to have on hand.

I’m almost where I’ll be comfortable. I’m good on maintenance items, lumber, fasteners, tools, knowledge, etc. Now I have the comfort to sit back and watch for deals to add things at lower cost.

Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Inflation.......... ?

- Thread starter Hobo Hilton

- Start date

Same here. Been getting the farm in shape. Replacing fencing, a new corral, head gate and some tractor attachments. Getting all the vehicles new tires and serviced. Replaced battery cables on the 250 and replaced batteries. Keeping the diesel fuel storage and gas storage topped off.

I’ve still got my eye on purchasing more properties, but I’m only going to start being really interested about 25% below where we are now.

I’ve instead been deploying my cash on items I need and or want to have on hand.

I’m almost where I’ll be comfortable. I’m good on maintenance items, lumber, fasteners, tools, knowledge, etc. Now I have the comfort to sit back and watch for deals to add things at lower cost.

CA "solved" this a while ago...

50 Year Mortgage Loans Introduced In California

Gee it seems like only yesterday that we were talking about the newest innovation in mortgages - the <a href="http://www.mortgagenewsdaily.com/692005_Fannie_Mae_40_Year_Mortgage.asp">40 year loan . Actually it wasn't exactly yesterday, it was January, 2005 and the 40 year loan term wasn't...

www.mortgagenewsdaily.com

Attachments

a head of lettuce went from 1.00 to 1.50. A 50% increase.

don't want to get too far off topic; but...

don't want to get too far off topic; but...

You are on topic... Worldwide we are starting to hear people say ... " I can't get it at any price"....a head of lettuce went from 1.00 to 1.50. A 50% increase.

don't want to get too far off topic; but...

That’s why I started my buying spree, laying in supplies at any cost. Normally I bargain hunt to the extreme.You are on topic... Worldwide we are starting to hear people say ... " I can't get it at any price"....

Worldwide.....

www.zerohedge.com

www.zerohedge.com

ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Worldwide.....

ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zerowww.zerohedge.com

german time

11:34:35 PM

Sunday, April 3, 2022

They better find some rubles, lol.Worldwide.....

ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zerowww.zerohedge.com

I was thinkin' I might should get some.... Just in case.They better find some rubles, lol.

The End Of The World As We Know It ... TEOTWAWKIIt's the end of The World.

VooDoo

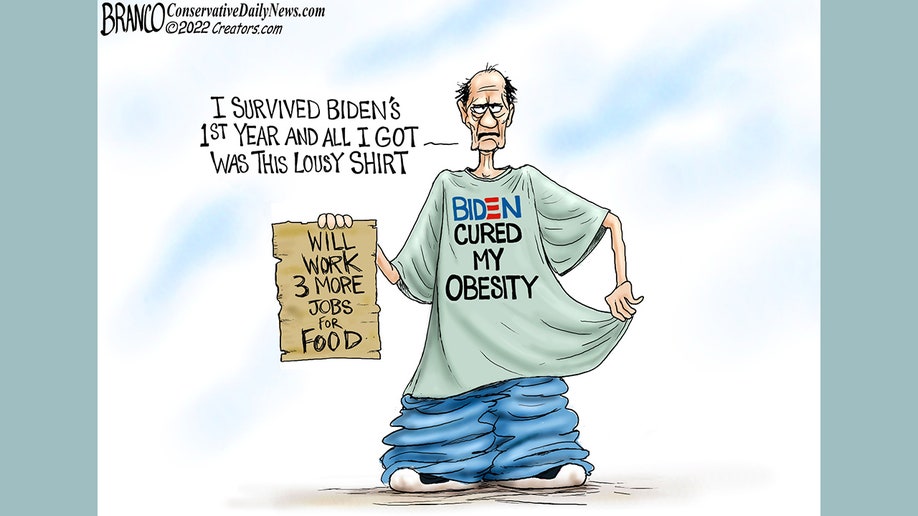

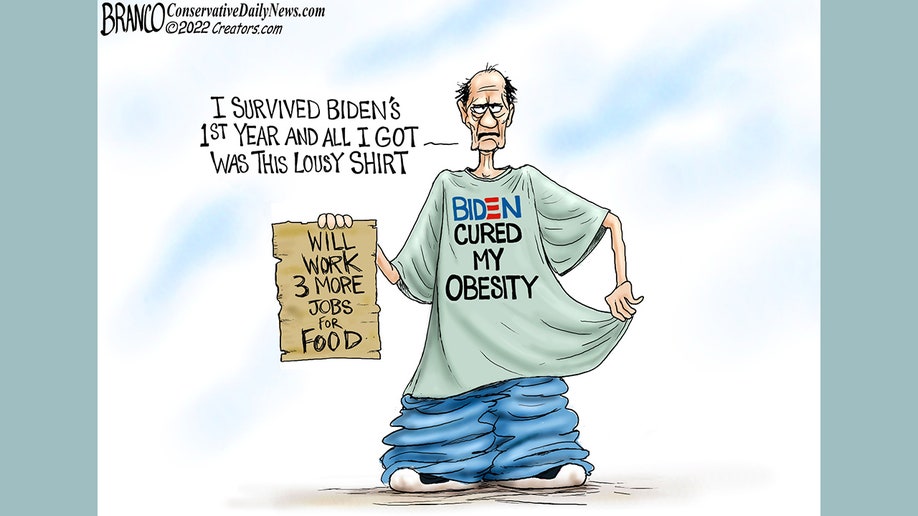

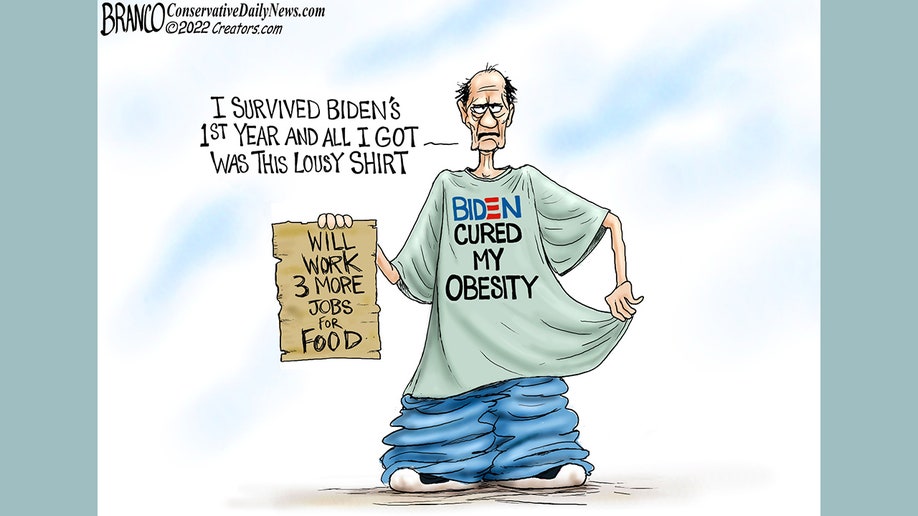

Remember, we are "Ridin' with Biden" for 3 more years.......... How was the first year ?

Attachments

Energy prices are going to trickle down.

Netherlands energy up over 102%

buy long? a crap load?? we missed the sell short..I was thinkin' I might should get some.... Just in case.

rubel is .011 vs .013 a few months a go..

buy long? a crap load?? we missed the sell short..

rubel is .011 vs .013 a few months a go..

Take this as sarcasm.......... The way Biden is draining the Strategic Oil Storage reserves......... We might have to buy some Russian oil..........

Which is why we need to open out borders to MORE than 2M a year...cause we will be facing a real food shortage and, and....You are on topic... Worldwide we are starting to hear people say ... " I can't get it at any price"....

They better find some rubles, lol.

Kinda interesting how quickly this whole situation swung from "we'll economically destroy Russia" to "ruble becomes preferred currency for commodities trading". Life comes at you fast.

Well, biden is dumb as fuck.Kinda interesting how quickly this whole situation swung from "we'll economically destroy Russia" to "ruble becomes preferred currency for commodities trading". Life comes at you fast.

A comment from JW Rawels.

JWR’s Comment: Take note that Biden’s proposed tax is based on “net worth” rather than annual income. So, if a “land rich” rancher only took a small profit as income, he’d still be taxed at this new confiscatory rate. This sort of tax is what will inevitably cause Atlas to Shrug.

www.foxbusiness.com

www.foxbusiness.com

JWR’s Comment: Take note that Biden’s proposed tax is based on “net worth” rather than annual income. So, if a “land rich” rancher only took a small profit as income, he’d still be taxed at this new confiscatory rate. This sort of tax is what will inevitably cause Atlas to Shrug.

Biden pitches largest tax hike in history as part of $5.8T budget request

President Biden made a renewed push on Monday to galvanize congressional Democrats to overhaul the nation's tax code and dramatically raise rates on corporations and ultra-wealthy Americans.

Could this be avoided with a trust? Wonder how the super wealthy are going to address this?A comment from JW Rawels.

JWR’s Comment: Take note that Biden’s proposed tax is based on “net worth” rather than annual income. So, if a “land rich” rancher only took a small profit as income, he’d still be taxed at this new confiscatory rate. This sort of tax is what will inevitably cause Atlas to Shrug.

Biden pitches largest tax hike in history as part of $5.8T budget request

President Biden made a renewed push on Monday to galvanize congressional Democrats to overhaul the nation's tax code and dramatically raise rates on corporations and ultra-wealthy Americans.www.foxbusiness.com

But also remember they told us this was coming. It’s how they reach a net zero impact of the multi-trillion spending bill. This should come as no surprise.

Good question about a trust.Could this be avoided with a trust? Wonder how the super wealthy are going to address this?

But also remember they told us this was coming. It’s how they reach a net zero impact of the multi-trillion spending bill. This should come as no surprise.

Money taken from a trust is subject to different taxation than funds from ordinary investment accounts. Trust beneficiaries must pay taxes on income and other distributions that they receive from the trust. Trust beneficiaries don't have to pay taxes on returned principal from the trust's assets.

/taxescoins-5bfc325cc9e77c002631a562.jpg)

Trust Beneficiaries: Do They Pay Taxes?

Beneficiaries of a trust typically pay taxes on distributions from the trust's income, but not on distributions from the trust's principal.

Think of "inflation" as your investment in their vision of your future prison.

Synopsis for those who don't have an hour to watch the video below.

They are 100 steps ahead of you.

www.thegatewaypundit.com

www.thegatewaypundit.com

Synopsis for those who don't have an hour to watch the video below.

They are 100 steps ahead of you.

Leo Hohmann Provides an Excellent Overview on the New World Order's Destruction of the Human Being | The Gateway Pundit | by Joe Hoft

Leo Hohmann addressed the faculty and staff at Regent University at the Globalism Rising event last week. Dean Michele Bachmann from the Roberston School of Government sponsored the event.

follow bill gates modelCould this be avoided with a trust? Wonder how the super wealthy are going to address this?

But also remember they told us this was coming. It’s how they reach a net zero impact of the multi-trillion spending bill. This should come as no surprise.

1) create non profit

2) donate land to non profit

3) have non profit, lease land back to farmer (or other farmers, so they take the risk)

4) farmer sits on board of non profit, his 'income' for running the non profit is determined by the board; namely himself and his family if he wishes.

facebook zucker did the same thing, cashed out, donated most to 'charity' and he runs that charity, so his income is tax free and he can pass it down to heirs TAX Free (avoiding inheritance tax); since it's a trust that pays out by who 'runs' the trust.

I'm surprised Elon Musk hasn't done this yet.

Saw that... Flash in the pan.... insiders made a killing.... Outsider's made nothing... another day at the Casino.twitter is going CRAZY.. shareprice is CLIMBING like mad, since Elon said he's going to buy it.

Get ahead of the curve and invest in the coming recession. Look at history of 3 previous recessions.

The discount, big box stores made out nicely. Economy foods like hot dogs, Mac n cheese etc did well... Luxury items, not so well. Tyson is the largest maker of hot dogs (below)

History is repeating.

Dollar Tree Inc., DLTR Quick Chart - (NAS) DLTR, Dollar Tree Inc. Stock Price - BigCharts.com

DLTR - Dollar Tree Inc. Basic Chart, Quote and financial news from the leading provider and award-winning BigCharts.com.

Walmart Inc., WMT Quick Chart - (NYS) WMT, Walmart Inc. Stock Price - BigCharts.com

WMT - Walmart Inc. Basic Chart, Quote and financial news from the leading provider and award-winning BigCharts.com.

Tyson Foods Inc. Cl A, TSN Quick Chart - (NYS) TSN, Tyson Foods Inc. Cl A Stock Price - BigCharts.com

TSN - Tyson Foods Inc. Cl A Basic Chart, Quote and financial news from the leading provider and award-winning BigCharts.com.

Dow Jones U.S. Retail Index, XX:DJUSRT Quick Chart - (Dow Jones Global) XX:DJUSRT, Dow Jones U.S. Retail Index Stock Price - BigCharts.com

XX:DJUSRT - Dow Jones U.S. Retail Index Basic Chart, Quote and financial news from the leading provider and award-winning BigCharts.com.

Last edited:

"I use all liquid fertilizer," Paul said. "The cost right now for that product is $4.50. About 14-15 months ago, the cost per gallon was about $1.62, for the same product."

www.kpax.com

www.kpax.com

Record prices, low inventory, drought the perfect storm of problems for Montana farmers

Millions of acres of Big Sky country provide the building blocks of life for so many. But many of them are dry. Montana is in a severe drought. Couple that with continued supply chain issues and the highest fertilizer prices in history and this industry is facing perhaps its biggest threat ever.

He gets his "high" the same as the rest of the oligarchs. Likely he wants to own more farmland than Bill Gates. Food = ControlElon might go full 'Ross Perot' when he gets on the board (Ross on GM board). Large payoff? or will Elon move forward for free speach?

8 - 9 months of downward momentum on the stock chart and a pop up of 25.62% over night... Elon's friends are sending him Thank You notes this morning... There is a subliminal message to those who were short.twitter is going CRAZY.. shareprice is CLIMBING like mad, since Elon said he's going to buy it.

TWTR - Multiple Matches - BigCharts.com

Excellent article on used farm equipment from 5 months ago.....

The challenge with late-model, low-hour machinery is that often this equipment, which is coming in on trade, is already sold before it reaches the dealership. “The really nice equipment doesn’t sit on our lots very long,” observes Jeremy Knuth of Heritage Tractor, a John Deere dealership network in Kansas and Missouri.

So, what changed in 5 months ? Shortages that were supposed to subside, in some cases, got worse. Inflation of parts, a war, shipping and labor increased dramatically and finally the FED Reserve is raising interest rates and farmers will pay more for financing.

:max_bytes(150000):strip_icc()/Searching20for20bids20at20an20auction20sale-2000-192c2fb399704f6f97bb9d57ff6d2ff4.jpg)

www.agriculture.com

www.agriculture.com

The challenge with late-model, low-hour machinery is that often this equipment, which is coming in on trade, is already sold before it reaches the dealership. “The really nice equipment doesn’t sit on our lots very long,” observes Jeremy Knuth of Heritage Tractor, a John Deere dealership network in Kansas and Missouri.

So, what changed in 5 months ? Shortages that were supposed to subside, in some cases, got worse. Inflation of parts, a war, shipping and labor increased dramatically and finally the FED Reserve is raising interest rates and farmers will pay more for financing.

:max_bytes(150000):strip_icc()/Searching20for20bids20at20an20auction20sale-2000-192c2fb399704f6f97bb9d57ff6d2ff4.jpg)

What Led to the Machinery Shortage of 2021 and What to Expect for 2022

The last time agriculture experienced such an equipment shortage was during World War II.

Last edited:

U.S. economy will fall into a recession this summer, as inflation eats into consumer spending, former Fed official warns

U.S. economy will fall into a recession this summer, as inflation eats into consumer spending, former Fed official warns

Former Fed Governor Lawrence Lindsey said Monday that the U.S. economy will slump into a recession in the third quarter.

“How did you go bankrupt?” Two ways. Gradually, then suddenly.”

― Ernest Hemingway, The Sun Also Rises

The bad news is that only about 5 percent of people in the United State are prepared. But “the more people prepare, the less they panic when shortages appear,” Adams said.

― Ernest Hemingway, The Sun Also Rises

The bad news is that only about 5 percent of people in the United State are prepared. But “the more people prepare, the less they panic when shortages appear,” Adams said.

When the goin' gets tough, look where the energy comes from... Solar, EV and similar can't do the heavy lifting like coal and crude. Maybe one day they will but when a war breaks out old habits die hard.

______________________

Prices for coal from Central Appalachia surged 9% to $106.15 a ton last week, the highest since late 2008, according to government data released Monday. Prices in the Illinois Basin rose to $109.55, topping $100 for the first time in records dating to 2005.

ca.finance.yahoo.com

ca.finance.yahoo.com

______________________

Prices for coal from Central Appalachia surged 9% to $106.15 a ton last week, the highest since late 2008, according to government data released Monday. Prices in the Illinois Basin rose to $109.55, topping $100 for the first time in records dating to 2005.

U.S. Coal Prices Top $100 a Ton for First Time Since 2008

(Bloomberg) -- U.S. coal prices topped $100 a ton for the first time in 13 years as Russia’s war in Ukraine upends international energy markets and an economic rebound from the pandemic drives up demand for fossil fuels.Most Read from BloombergA 30-Year-Old Crypto Billionaire Wants to Give His...

Picking up speed....

American customers are beginning to cut prices on mainstays from toothpaste to child system as inflation hits a swath of the economic system that had up to now confirmed proof against substantial value will increase.

Procter & Gamble Co., Clorox Co., Kraft Heinz Co. and different consumer-products giants have made a wager that customers pays up for family merchandise whilst inflation takes maintain. Over the previous year, the businesses have seen income and market share develop as they’ve raised costs on merchandise from detergent and diapers to snacks and soda.

American customers are beginning to cut prices on mainstays from toothpaste to child system as inflation hits a swath of the economic system that had up to now confirmed proof against substantial value will increase.

Procter & Gamble Co., Clorox Co., Kraft Heinz Co. and different consumer-products giants have made a wager that customers pays up for family merchandise whilst inflation takes maintain. Over the previous year, the businesses have seen income and market share develop as they’ve raised costs on merchandise from detergent and diapers to snacks and soda.

The longer the "shuck and jive" goes on the more painful it will be and the longer it will last.... The hard landing is looking more like a crash.

businesshala.com

businesshala.com

Home - Businesshala News

Businesshala is the part of journalism that tracks, records, analyzes, and interprets the business, economic and financial activities.

businesshala.com

businesshala.com

Sometimes the Doctor that prescribes some nasty medicine is not one of your favorites. But looking back, it got you back on your feet quick... I'm not a big fan of Lael Brainard but her prescription will get the economy back on it's feet quicker than what Jerome Powell has been doing (that is nothing).......

www.barrons.com

www.barrons.com

A Fed Official’s Speech Just Sank Markets. Here’s Why.

Tech stocks and bond markets both sold off on Tuesday. Blame comments from Federal Reserve Gov. Lael Brainard. Fed governor Lael Brainard took a hawkish tone in a speech Tuesday. Her remarks sent long-dated Treasury yields sharply higher and tech stocks lower.

Trying to figure out, if I would get a better return buying dollar store, or just buying a few BIG bags of flour to offset the rise that's coming.Sometimes the Doctor that prescribes some nasty medicine is not one of your favorites. But looking back, it got you back on your feet quick... I'm not a big fan of Lael Brainard but her prescription will get the economy back on it's feet quicker than what Jerome Powell has been doing (that is nothing).......

A Fed Official’s Speech Just Sank Markets. Here’s Why.

Tech stocks and bond markets both sold off on Tuesday. Blame comments from Federal Reserve Gov. Lael Brainard. Fed governor Lael Brainard took a hawkish tone in a speech Tuesday. Her remarks sent long-dated Treasury yields sharply higher and tech stocks lower.www.barrons.com

Never put all your eggs in one basket.....Trying to figure out, if I would get a better return buying dollar store, or just buying a few BIG bags of flour to offset the rise that's coming.

DLTR, WMT, AZO... Get my drift?

Junk silver (old silver dimes)

Water... Use your imagination

Garden - Potatoes, corn, veggies that can be canned

Dog - security

Like minded neighbors

Leave the Mega city

Your best return will be invest in what it takes to live through the first two die off's. Then you will need those weapons you hoarded.

It's about time to start selling all the PRC brass and ammo while the market is hot.....

Depends.... What are you going to convert it to ? Cash is losing value by the day.It's about time to start selling all the PRC brass and ammo while the market is hot.....

Worst part about inflation/CPI is how badly they game the system to keep the numbers lower than they really are, they've been doing this for decades. A couple simple examples, if something gets too expensive, they use another cheaper product for the inflation index, this happened a few years ago when beef was getting too expensive so they changed to using chicken to calculate it. If the quantity changes, they get the opportunity to substitute a cheaper product, say if a carton of eggs goes from qty. 12 to 10.

Another example is anything with technology, they get to deduct any new features/tech off the price increases when evaluated for inflation. For example if a 2010 base honda civic was $20k, and a 2020 base honda civic is $40k, let's say extra safety, convenience, etc. features they can "write off" $15k of that price increase, then for inflation purposes they only use a $5k increase, but the fact remains the cheapest honda civic you can buy is still $20k more than it was 10 years ago. Add wifi and resolution to the base TV model, even if the price goes up, it won't count toward inflation if they can explain the cost increase due to new features.

The financial outlook for the future is ugly for the average american.

Average price of a new car 2022: $47k 2000: $21k

Average price of a used car 2022: : $30k 2000: $10k

Average college student loans: $40k at 4-7% interest

Average price of a starter home: $250k (also keep in mind that last year 1 in 4 starter homes were bought by investment groups).

The National average rent for a 2 bedroom apt. $1990 a month.

Median household income in 2000: $60k

Median household income in 2020: $67k

What the median household income should be in 2020, using the 2000 $60k value and only adjusting for inflation: $91k So while the prices of many good and rent are climbing at higher than CPI average rates, median incomes have been flat for 20 years.

Only 4% of workers current have access to a traditional pension

Median 401k balance for 45-55 year olds: $85k (that's only for those with a 401k balance, 35% of Americans have no retirement savings at all)

Another example is anything with technology, they get to deduct any new features/tech off the price increases when evaluated for inflation. For example if a 2010 base honda civic was $20k, and a 2020 base honda civic is $40k, let's say extra safety, convenience, etc. features they can "write off" $15k of that price increase, then for inflation purposes they only use a $5k increase, but the fact remains the cheapest honda civic you can buy is still $20k more than it was 10 years ago. Add wifi and resolution to the base TV model, even if the price goes up, it won't count toward inflation if they can explain the cost increase due to new features.

The financial outlook for the future is ugly for the average american.

Average price of a new car 2022: $47k 2000: $21k

Average price of a used car 2022: : $30k 2000: $10k

Average college student loans: $40k at 4-7% interest

Average price of a starter home: $250k (also keep in mind that last year 1 in 4 starter homes were bought by investment groups).

The National average rent for a 2 bedroom apt. $1990 a month.

Median household income in 2000: $60k

Median household income in 2020: $67k

What the median household income should be in 2020, using the 2000 $60k value and only adjusting for inflation: $91k So while the prices of many good and rent are climbing at higher than CPI average rates, median incomes have been flat for 20 years.

Only 4% of workers current have access to a traditional pension

Median 401k balance for 45-55 year olds: $85k (that's only for those with a 401k balance, 35% of Americans have no retirement savings at all)

So what you are saying is... it's not transient any more?

I think it was many months ago that I posted something like. It's transient until it's not.The longer the "shuck and jive" goes on the more painful it will be and the longer it will last.... The hard landing is looking more like a crash.

Home - Businesshala News

Businesshala is the part of journalism that tracks, records, analyzes, and interprets the business, economic and financial activities.businesshala.com

We had that "Snake Oil" identified a year ago while Jerome Powell sat on his handsSo what you are saying is... it's not transient any more?

I think it was many months ago that I posted something like. It's transient until it's not.

There were a lot of deniers then. And not the vax type of deniers.

Yesterday's conspiracy... LoLWe had that "Snake Oil" identified a year ago while Jerome Powell sat on his hands

"Average price of a starter home: $250k (also keep in mind that last year 1 in 4 starter homes were bought by investment groups)."

Don't forget, one of the reasons the price of 'starter' homes when up, is because the FHA raised the basic home loan from

2020 was around 330,000 ish

2021 went to 360,000 (ish) working on memory

2022 linky

the FHA sets loan limits at 115% of the median home price in an area. FHA’s base nationwide limit, known as the “floor,” loan limit, is $420,680 for 2022.

loan limits for 2020 - 2022

Don't forget, one of the reasons the price of 'starter' homes when up, is because the FHA raised the basic home loan from

2020 was around 330,000 ish

2021 went to 360,000 (ish) working on memory

2022 linky

the FHA sets loan limits at 115% of the median home price in an area. FHA’s base nationwide limit, known as the “floor,” loan limit, is $420,680 for 2022.

loan limits for 2020 - 2022

They are playing with words and counting on us to be ignorant.So what you are saying is... it's not transient any more?

I think it was many months ago that I posted something like. It's transient until it's not.

Inflation is an action, so by its nature its existence at any point in time is transient. If inflation isn't transient, it doesn't exist. Example: inflation of a balloon is a transient process, with varying degrees of inflation until capacity is reached. Once air stops coming in, inflation stops, literally ceasing to exist as an action. HOWEVER, the fact that the inflation stopped doesn't mean that the balloon is empty - it is actually still full, just not increasing in volume. Now, it is not inflating, but inflated.

Prices are like the balloon: the forces that make them bigger are transitory at any given moment until the forces stop, at which time prices cease to increase. This does NOT meant that the prices go down (cease to be inflated), only that they are no longer increasing.

Don't let them lie to you. Inflation stopping will not help your wallet, although they will tell you it will. You will live with the results of inflated prices long after inflation stops. Until the balloon deflates or pops.

Similar threads

- Replies

- 32

- Views

- 1K

- Replies

- 109

- Views

- 4K

- Replies

- 61

- Views

- 1K