They are going to try to starve us on top of inflating the shit out of everything.Hard times are coming. Remember, $4+ gas is projected through the end of the year.

If people have children, I’d be getting my Christmas shopping done now.

Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Inflation.......... ?

- Thread starter Hobo Hilton

- Start date

Hard times are coming. Remember, $4+ gas is projected through the end of the year.

If people have children, I’d be getting my Christmas shopping done now.

If people have children, they best start weaning them off the idea of getting several hundred dollars of disposable Chinese goods dumped in their laps on religious holidays. Instead, they should be getting a small number of quality items that may be useful in the coming years. My boys have been getting tools and camping items.

Or just buy them apps - preferably time-wasting, brain-numbing games. Klaus Schwab would love that.

I think the phrase "no refunds" could be used in conjunction with most of their governmental policies in all sectors. Have to run it off the cliff to show people they are not serving the common man.

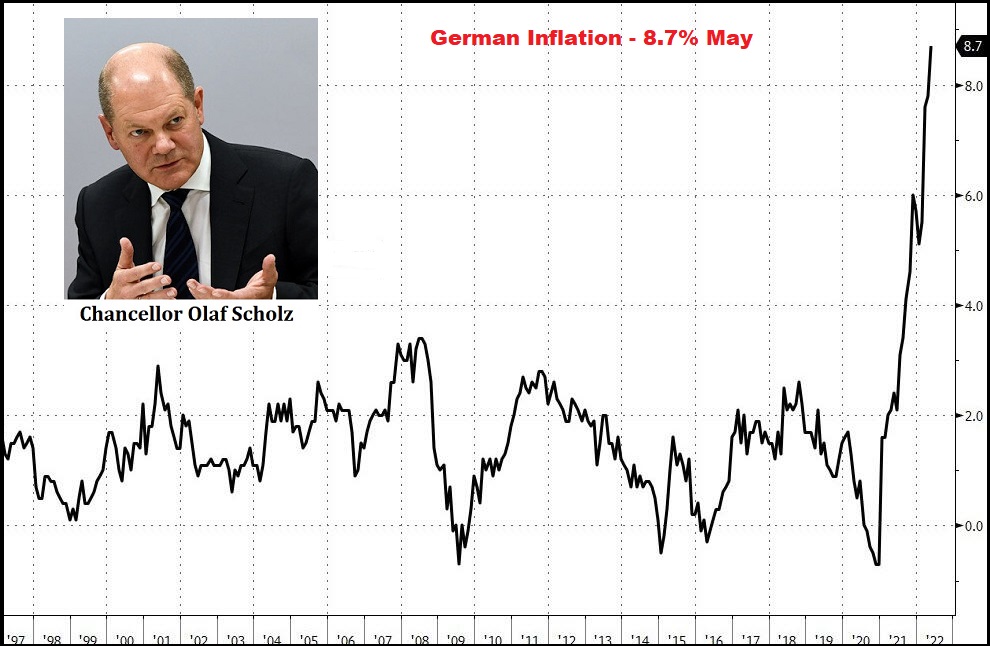

Central EU Economy, Inflation Rate in Germany Jumps Far Beyond Expectations in May to 8.7 Percent - The Last Refuge

Germany is the central and largest economy within the European Union; it is also the most influential for anything related to the response from the European Central Bank and EU Central Bank President Christine Lagarde. Today, Germany is reporting a massive (unexpected) jump in overall...theconservativetreehouse.com

Home prices surged over 20% in March as interest rates also rose, according to S&P Case-Shiller

Home prices continued to increase their gains, despite slower sales and higher mortgage rates.

While inflation is eating up the Middle Classes disposable income, Yellen says she was wrong....

/cloudfront-us-east-2.images.arcpublishing.com/reuters/HBEUOQPWJFMTHAUNFRPWN7JVRU.jpg)

www.reuters.com

www.reuters.com

/cloudfront-us-east-2.images.arcpublishing.com/reuters/HBEUOQPWJFMTHAUNFRPWN7JVRU.jpg)

Yellen says she was 'wrong' about inflation path; Biden backs Fed

U.S. Treasury Secretary Janet Yellen said she was wrong in the past about the path inflation would take.

While inflation is eating up the Middle Classes disposable income, Yellen says she was wrong....

/cloudfront-us-east-2.images.arcpublishing.com/reuters/HBEUOQPWJFMTHAUNFRPWN7JVRU.jpg)

Yellen says she was 'wrong' about inflation path; Biden backs Fed

U.S. Treasury Secretary Janet Yellen said she was wrong in the past about the path inflation would take.www.reuters.com

If she couldn’t figure that out then she needs to resign.

Producer Price Index is higher than the Consumer Price Index, signals continued inflation. Numbers I see put it in the teens for FY23. Also watch the food stamp/SNAP and how much they adjust those up that will tell you how much the GOV is seeing good inflation which is not included in the CPI.

No. For analysis purposes food stamps and SNAP are a very poor trailing indicator, just like SS payments. By the time they adjust those up its already behind the curve. Like a few quarters potentially. The government doesn't adjust welfare and social program payments in a forward looking manner. If that were the case then no one would be bitching about how their welfare, SS, and other benefits don’t go as far as they used to, and that has been a primary bitching point for decades. Reagan even made a commercial about it. Price inflation is moving way too fast for the social program payouts to keep up with it - the bureaucracy is too slow, there are financial and political reasons in the mix, etc.Producer Price Index is higher than the Consumer Price Index, signals continued inflation. Numbers I see put it in the teens for FY23. Also watch the food stamp/SNAP and how much they adjust those up that will tell you how much the GOV is seeing good inflation which is not included in the CPI.

Last edited:

Gas prices: A 'troubling sign' emerges on the health of consumers

Sticker price shock at the gas pump may finally be breaking the back of the U.S. consumer, new data shows.

Duh.

Lots of news of layoffs starting to hit too.

The train wreck is picking up momentum... Today's suggested purchase:

Gas prices: A 'troubling sign' emerges on the health of consumers

Sticker price shock at the gas pump may finally be breaking the back of the U.S. consumer, new data shows.www.yahoo.com

Duh.

Lots of news of layoffs starting to hit too.

It’s definitely starting to snowball. Told you over $4 gas for a sustained period would break people’s backs. I watched as many bought low MPG trucks/suvs, jacked them up resulting in lower MPG, all on 84 month loans.

It’s coming to roost, but not quite there yet. The used luxury goods market still isn’t pointing to everyone being broke AF yet.

However, with lowered demand, supply chains should catch up, leading to a glut.

Maybe 2-3 more months.

It’s coming to roost, but not quite there yet. The used luxury goods market still isn’t pointing to everyone being broke AF yet.

However, with lowered demand, supply chains should catch up, leading to a glut.

Maybe 2-3 more months.

Only a matter of time for the stories of farmers fuel tanks getting emptied at night.The train wreck is picking up momentum... Today's suggested purchase:

The FED's plan for a soft landing pushes the crash into 2023.... They are searching for a "Magic Wand" to get their ass off the hot seat.... Long and painful appears to be their only option.It’s definitely starting to snowball. Told you over $4 gas for a sustained period would break people’s backs. I watched as many bought low MPG trucks/suvs, jacked them up resulting in lower MPG, all on 84 month loans.

It’s coming to roost, but not quite there yet. The used luxury goods market still isn’t pointing to everyone being broke AF yet.

However, with lowered demand, supply chains should catch up, leading to a glut.

Maybe 2-3 more months.

There will be no soft landing.The FED's plan for a soft landing pushes the crash into 2023.... They are searching for a "Magic Wand" to get their ass off the hot seat.... Long and painful appears to be their only option.

I remember the old hippie vans with the floor cut out and a hand pump with a 55 gallon barrel inside. Roll over the bulk fuel tank fill cap at the gas station, drop the pump suction down into the storage tank and pump away.... Let's see - 55 gallons X $5.00 = $275.Only a matter of time for the stories of farmers fuel tanks getting emptied at night.

The Good Old Days..

It’s definitely starting to snowball. Told you over $4 gas for a sustained period would break people’s backs. I watched as many bought low MPG trucks/suvs, jacked them up resulting in lower MPG, all on 84 month loans.

It’s coming to roost, but not quite there yet. The used luxury goods market still isn’t pointing to everyone being broke AF yet.

However, with lowered demand, supply chains should catch up, leading to a glut.

Maybe 2-3 more months.

I think it will take a lot longer than 3 months. There is no sign of slowing down for anyone around my area.

No sign of slowing down? What about home sales? Gas prices, food prices, car prices, retail glut? You're saying none of those indicators of problems are present in your area? All of them are present in Oklahoma City though many are playing ostrich and ignoring them until they can't. I think a lot of people are going to be totally baffled when layoffs start and the whole house of cards comes down. Soft landing...i rather doubt it.I think it will take a lot longer than 3 months. There is no sign of slowing down for anyone around my area.

Not three months…..thats not even enough for unpaid credit card/Bills to go to collections.

Lets see what this conversation looks like June 3, 2023. Then we will see how we are really doing. I don’t think we have seen the economy really turn, and suspect there are still significant market corrections coming.

This is bizaro world these days. While models and indicators are interesting—many are still relevant—we are definitely in unchartered waters. Especially with trying to predict drops/recoveries. It just aint like it used to be.

Heck, this Could even go onuntil 6-12 months after the 2024 election—depending who wins. Thats a sobering thought. Solid cash reserves are your friend. Besides, next summer you can pick up that 2-yr old jet ski for .50 on the dollar….

ZY

Lets see what this conversation looks like June 3, 2023. Then we will see how we are really doing. I don’t think we have seen the economy really turn, and suspect there are still significant market corrections coming.

This is bizaro world these days. While models and indicators are interesting—many are still relevant—we are definitely in unchartered waters. Especially with trying to predict drops/recoveries. It just aint like it used to be.

Heck, this Could even go onuntil 6-12 months after the 2024 election—depending who wins. Thats a sobering thought. Solid cash reserves are your friend. Besides, next summer you can pick up that 2-yr old jet ski for .50 on the dollar….

ZY

We’ll see in 3 months I guess. People have taken a pay cut through food prices since last year, and a major pay cut through gas prices since January.

Don’t forget the pay cuts from electricity and heating fuel costs.

Tech is already starting lay-offs.

Builders and materials suppliers are next.

Restaurants soon too.

Increase in credit card debt and drop in savings correlates with increased fuel costs. Credit card companies upped limits and it wasn’t out of the kindness of their hearts.

Don’t forget the pay cuts from electricity and heating fuel costs.

Tech is already starting lay-offs.

Builders and materials suppliers are next.

Restaurants soon too.

Increase in credit card debt and drop in savings correlates with increased fuel costs. Credit card companies upped limits and it wasn’t out of the kindness of their hearts.

Deja Vu.... The same cycle, over and over.... Expecting a different outcome.I think there is truth in this. Credit card balances increasing with savings decreasing indicates that this is true.

A good opportunity for a young guy to set up a 1 ton repossession truck....

“In the midst of chaos, there is also opportunity” ― Sun Tzu.

How Repo Trucks Work

Did you know that an experienced repo man (or woman) can hook up a vehicle and drive off in about 10 seconds -- all without ever leaving the truck's cab? How do they do it?

No sign of slowing down? What about home sales? Gas prices, food prices, car prices, retail glut? You're saying none of those indicators of problems are present in your area? All of them are present in Oklahoma City though many are playing ostrich and ignoring them until they can't. I think a lot of people are going to be totally baffled when layoffs start and the whole house of cards comes down. Soft landing...i rather doubt it.

Most homes are still selling for 30k over asking. The amount of boats and campers headed to the lake is the same as any other year. Every restaurant is packed with a 45 minute to an hour wait every Friday and Saturday night. Snap on guy just said he is adding another guy/truck because he has had record sales in the past 3 months, he's been in that business for over 30 years so I'd say he knows the business is there to support it.

The Perfect StormMost homes are still selling for 30k over asking. The amount of boats and campers headed to the lake is the same as any other year. Every restaurant is packed with a 45 minute to an hour wait every Friday and Saturday night. Snap on guy just said he is adding another guy/truck because he has had record sales in the past 3 months, he's been in that business for over 30 years so I'd say he knows the business is there to support it.

Sounds like some upper tier stupidity going on and ignoring market signals. Food and energy prices are not something most people can ignore.Most homes are still selling for 30k over asking. The amount of boats and campers headed to the lake is the same as any other year. Every restaurant is packed with a 45 minute to an hour wait every Friday and Saturday night. Snap on guy just said he is adding another guy/truck because he has had record sales in the past 3 months, he's been in that business for over 30 years so I'd say he knows the business is there to support it.

Wasn’t saying you can use it as a indicator for forecasting rather they will show one number with the CPI and the increases for the welfare programs will show another that will be different and as you said won’t be correct. It just makes for an easy comp that you can reference as required. I would never make a plan around GOV numbers, merely one data point.No. For analysis purposes food stamps and SNAP are a very poor trailing indicator, just like SS payments. By the time they adjust those up its already behind the curve. Like a few quarters potentially. The government doesn't adjust welfare and social program payments in a forward looking manner. If that were the case then no one would be bitching about how their welfare, SS, and other benefits don’t go as far as they used to, and that has been a primary bitching point for decades. Reagan even made a commercial about it. Price inflation is moving way too fast for the social program payouts to keep up with it - the bureaucracy is too slow, there are financial and political reasons in the mix, etc.

Recent articles show the housing market not showing signs

time.com

time.com

www.noradarealestate.com

www.noradarealestate.com

Waiting For Home Prices to Drop? ‘You’ll Likely Be Waiting for a Long Time,’ Experts Say

Homebuyers hoping for prices to come down might see some relief as high mortgage rates take some buyers out of the market, but experts say it’s more likely that prices will rise more slowly than it is that they’ll fall.

Is Real Estate Market Slowing Down: Is it Cooling?

Discover the latest insights into the real estate market. Are we witnessing a slowdown, or is a crash on the horizon? Get the facts and expert analysis to stay informed.

don't buy itRecent articles show the housing market not showing signs

Waiting For Home Prices to Drop? ‘You’ll Likely Be Waiting for a Long Time,’ Experts Say

Homebuyers hoping for prices to come down might see some relief as high mortgage rates take some buyers out of the market, but experts say it’s more likely that prices will rise more slowly than it is that they’ll fall.time.com

Is Real Estate Market Slowing Down: Is it Cooling?

Discover the latest insights into the real estate market. Are we witnessing a slowdown, or is a crash on the horizon? Get the facts and expert analysis to stay informed.www.noradarealestate.com

I'll see that and raise you one..... The Institutional Fund managers are using other people's money to "Prop Up" the Dow 30.... Someone (???) is buying up the worst performing stocks of the Dow 30, on a daily basis. Basically buying at a bargain and increasing the Dow 30's daily average.... So, for their clients that are holding Index Funds things don't seem as bad as they really are... This scheme can only go on for just so long. Beware.I mentioned earlier that I am not using the housing market as an indicator due to institutional investors.

Cleveland Federal Reserve President Loretta Mester said Friday that she doesn’t see ample evidence that inflation has peaked and thus is on board with a series of aggressive interest rate increases ahead.

www.cnbc.com

www.cnbc.com

Fed's Mester says inflation hasn't peaked and multiple half-point rate hikes are needed

Cleveland Fed President Loretta Mester said she doesn't see evidence that inflation has peaked and is on board with supporting multiple rate increases.

Just got back from the liquor store.

5th of a Rare Eagle Bourbon is still $33.

It's not all bad news.

5th of a Rare Eagle Bourbon is still $33.

It's not all bad news.

I'd rather them siphon it than drill the tank. That's the new thing around here.The train wreck is picking up momentum... Today's suggested purchase:

It’s not new. They put those things on during the oil embargo last century. A good old screwdriver fixed that lock problem with a quickness.I'd rather them siphon it than drill the tank. That's the new thing around here.

I meant that drilling the tank was the new thing around here.It’s not new. They put those things on during the oil embargo last century. A good old screwdriver fixed that lock problem with a quickness.

Plan your business accordingly. No relief in sight. Bigfatcock

Citi’s second-quarter 2022 Brent forecast is now seen at $113 per barrel—up from $99 per barrel in its previous forecast. Citi also raised its Q3 and Q4 forecast to $99 and $85 per barrel, respectively. For 2023, Citi lifted its Brent price forecast to $75—up $16 per barrel.

Barclay’s also lifted its price forecast citing crude oil sanctions on Russia by the EU. Barclays now sees Brent prices averaging $111 this year and next—an increase of $11 for this year and $23 for next year. Barclay sees WTI at $108 for both years.

oilprice.com

oilprice.com

Citi’s second-quarter 2022 Brent forecast is now seen at $113 per barrel—up from $99 per barrel in its previous forecast. Citi also raised its Q3 and Q4 forecast to $99 and $85 per barrel, respectively. For 2023, Citi lifted its Brent price forecast to $75—up $16 per barrel.

Barclay’s also lifted its price forecast citing crude oil sanctions on Russia by the EU. Barclays now sees Brent prices averaging $111 this year and next—an increase of $11 for this year and $23 for next year. Barclay sees WTI at $108 for both years.

Citi And Barclays Raise Oil Price Forecasts | OilPrice.com

Two banks—Citi and Barclay’s—raised their oil price forecasts on Monday, citing the effects of Russian crude oil sanctions and delays in the renewal of the Iran nuclear deal

Beware the Oklahoma credit card trick.

An ice pick, a drain pan.

An empty tank when you come back to your car.

Drilling is for amateurs, an ice pick takes less than a second per hole......10-15 holes will drain a tank into a drain pan pretty f'n quick.

An ice pick, a drain pan.

An empty tank when you come back to your car.

Drilling is for amateurs, an ice pick takes less than a second per hole......10-15 holes will drain a tank into a drain pan pretty f'n quick.

We are in agreement.

The Government will hand out "Free Money" in the form of food, rent, education, medical care...

Those with $1m or more will only feel it when their investments don't produce record returns.

This is truly a "Middle Class Squeeze" by design.

The generation finishing college is priced out of the housing market and saddled with student loans. Living in an apartment is their future.

Very few articles about people "Living the Retirement Dream Life", mostly about people working at 70 years old.

Lot's of propaganda from the Financial Planners, Stock Market traders and Financial Experts.. They mixed a new bowl of Koolaid for this circus.

My plan is to maintain, stay healthy, do without, shop the Thrift stores and Estate sales, raise a garden, enjoy my chickens and count my blessings.

Will our Social Sec payments allow us to live in a beautiful 3rd world country?

stock up on cialis.. you want to get your $$ worthI’m going to barter foodstuffs for ass.

Once word gets out that I’m well stocked, roving warlords will attack.

I can’t beat them by myself, so plan on going out in a blaze of glory and cigarette smoke.

I would say "Yes".... Plan ahead, spend time there every year, get to know the culture.. Some of those third world countries have not dug themselves into a hole like the USA has...Will our Social Sec payments allow us to live in a beautiful 3rd world country?

The Russian invasion of Ukraine accounts for more than a third of U.S. inflation, forecaster says

The Russian invasion of Ukraine and the sanctions that it triggered is behind more than a third of the 40-year high inflation of 8.6%, according to analysis from a leading forecaster.

At first I thought this was from the Babylon Bee.

Somebody should copy right that saying.......... Print the T shirts.

The Russian invasion of Ukraine accounts for more than a third of U.S. inflation, forecaster says

The Russian invasion of Ukraine and the sanctions that it triggered is behind more than a third of the 40-year high inflation of 8.6%, according to analysis from a leading forecaster.www.yahoo.com

At first I thought this was from the Babylon Bee.

Somebody should copy right that saying.......... Print the T shirts.

For a second. I thought that was Michael Dukakis sticking his head out.

Hmm, russia, Russia, Russia, seems like the Dems theme for the last 6 years.

Well gas is at a point, from 6 months from now, I'll be wishing we were at today's prices.

More record breaking in the future from the Dems' policies.

More record breaking in the future from the Dems' policies.

Just the guy's who want to "flaunt it".......... Repo man has their address dialed into his GPS..... Been there, seen that.Not seeing as many boats at the boat launch this summer.

Just the guy's who want to "flaunt it".......... Repo man has their address dialed into his GPS..... Been there, seen that.

This is how the rich squeeze the little guy. Make everything cost so much (fees, gas, etc.) that only a few will be able to enjoy. Soon, we won't have as much traffic on the roads, it'll look like North Korea, and the elites will rejoice.

Then the Gov will start taxing by the mile. ahh, good times coming.

Let me tell you how it will be

There's one for you, nineteen for me

'Cause I'm the taxman

Yeah, I'm the taxman

Should five per cent appear too small?

Be thankful I don't take it all

'Cause I'm the taxman

Yeah, I'm the taxman

(If you drive a car, car)

I'll tax the street

(If you try to sit, sit)

I'll tax your seat

(If you get too cold, cold)

I'll tax the heat

(If you take a walk, walk)

I'll tax your feet

Well one of my lagging local indicators has closed its doors - the all you can eat Chinese buffet. They raised prices and now they are gone. They were cheaper and better than other restaurants around. Even cheaper than the fast food joints. They hung on through Covid but have shuttered the windows and even put the building up for sale.

A sign of the times.Well one of my lagging local indicators has closed its doors - the all you can eat Chinese buffet. They raised prices and now they are gone. They were cheaper and better than other restaurants around. Even cheaper than the fast food joints. They hung on through Covid but have shuttered the windows and even put the building up for sale.

When I'm running errands I will grab something at the deli counter at my local grocery store... Today they had the longest waiting line I have ever seen.... Their lunch special was cheaper then the local McD's so people are migrating to the cheapest lunch in town.

Similar threads

- Replies

- 2

- Views

- 263

- Replies

- 10

- Views

- 538

- Replies

- 152

- Views

- 6K