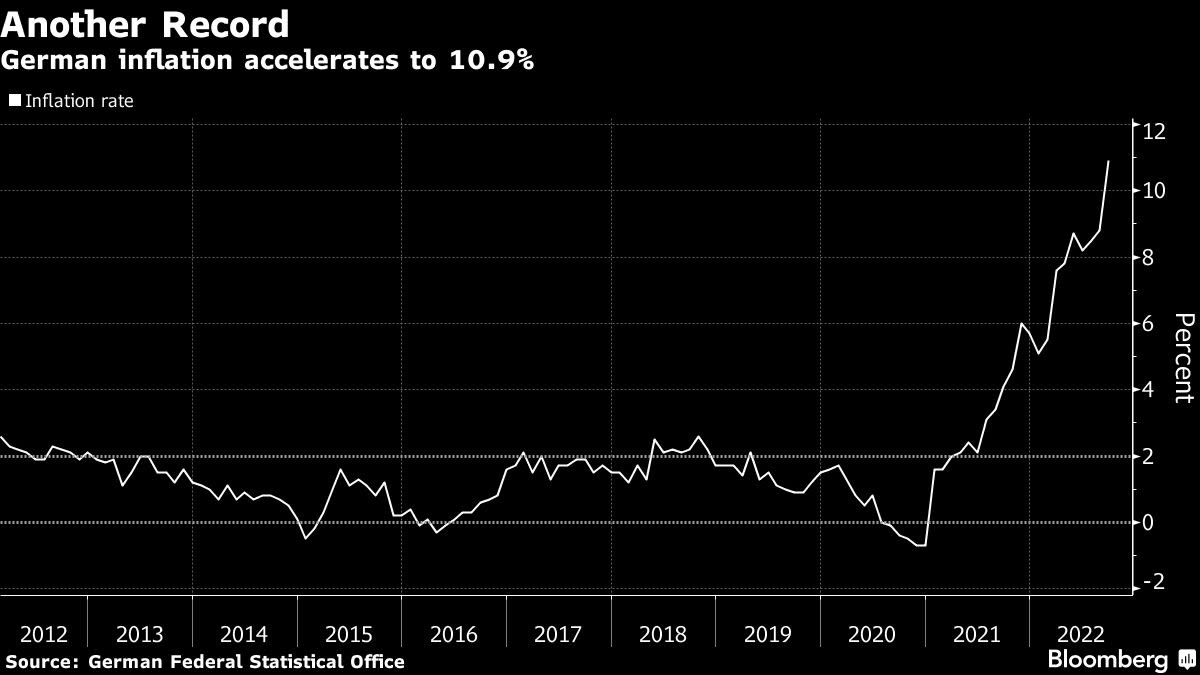

“This inflation is here to stay,” said JPMorgan Asset & Wealth Management CEO Mary Callahan Erdoes.

Unilever CEO Alan Jope said on CNBC’s “Closing Bell” on September 6, “We’re not seeing an easing off in our landed costs. So, any early optimism that inflation has peaked is misplaced.”

Nineteen percent of CFOs now say they expect a recession in the fourth quarter of this year, up from 13% in Q2.

www.cnbc.com

www.cnbc.com

Unilever CEO Alan Jope said on CNBC’s “Closing Bell” on September 6, “We’re not seeing an easing off in our landed costs. So, any early optimism that inflation has peaked is misplaced.”

Nineteen percent of CFOs now say they expect a recession in the fourth quarter of this year, up from 13% in Q2.

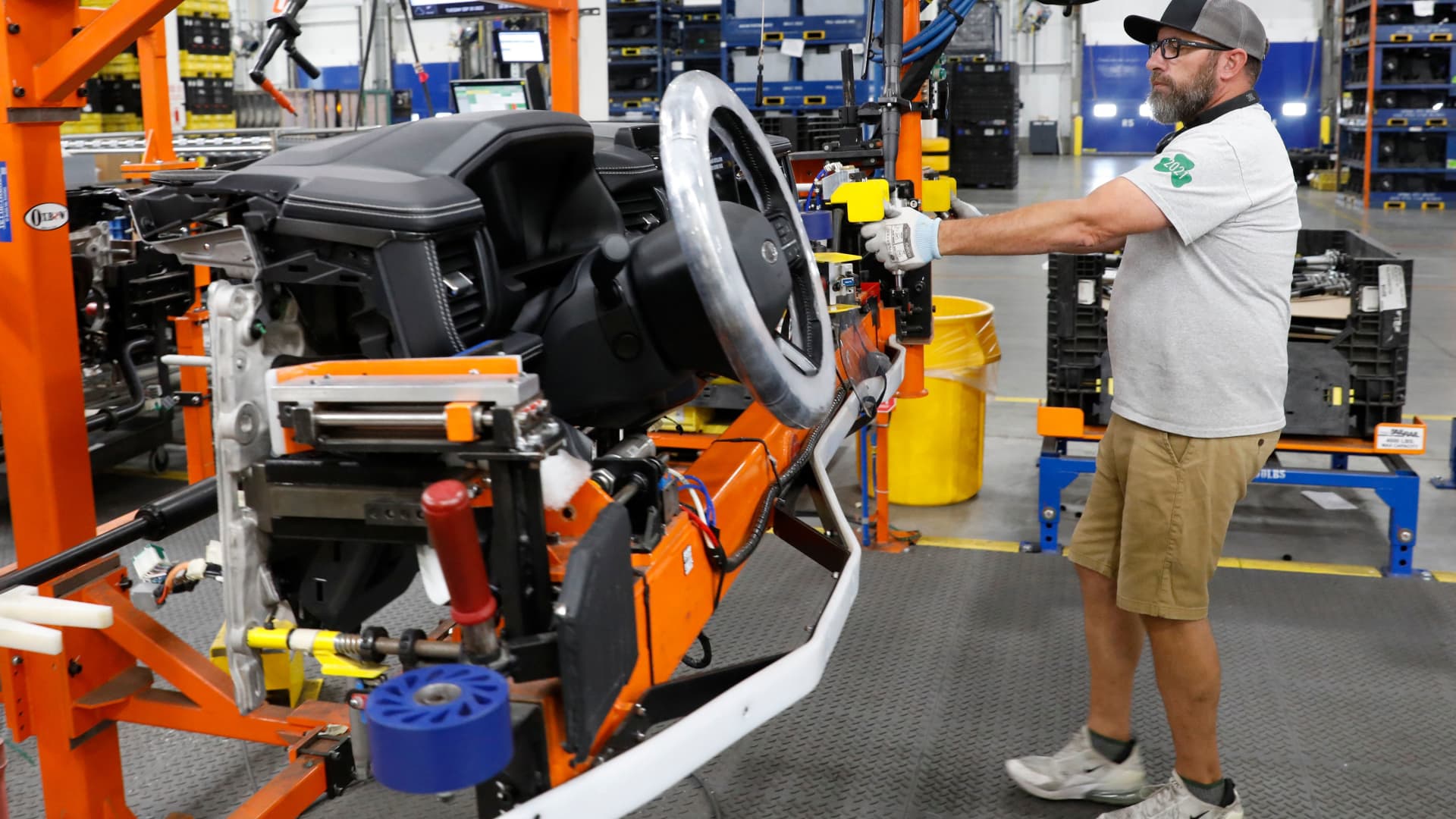

Inflation has yet to peak, CFOs say, and recession is already here or soon to hit

A majority of CFOs surveyed by CNBC said they do not think inflation has peaked, and some expect a recession for the economy sooner than previously forecast.