Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Negative oil prices?

- Thread starter Maggot

- Start date

1.54 in west central wisconsin. i had a co worker say he saw it for .99 a gallon in maiden rock, wi; which is right on the border of wisconsin and minnesota.

Um, you realize the entire and I do mean the entire stimulus package was robbery, right? Sadly, that probably cost Trump from getting back into office.

I cannot disagree with that statement.

me thinks that the Russians are getting screwed right now… woot

Not as bad as the Saudis

Not here, they're still capitalizing on us small mountain towns, with the excuse it costs more to get it to us.

If your state has a Price Gouge law, report this to the Attorney General. There is about $2 per gallon profit in that price...after transportation costs.Not here, they're still capitalizing on us small mountain towns, with the excuse it costs more to get it to us.

View attachment 7285444

$1.89/gallon yesterday.

I hope the country is loading the strategic reserve with every gallon it can get.

We should have more stored in underground limestone caverns than SA has the potential to pull out of the ground.

I hope the country is loading the strategic reserve with every gallon it can get.

We should have more stored in underground limestone caverns than SA has the potential to pull out of the ground.

Not just Sauds and Russians pretty much every one can stop pumping oil and it would still be too much of it on the market every tanker ship is now a seaborne storage.Every piece of pipeline a storage tank.

US storage is able to take another 135MM bbl more, assuming a build rate of 2MM b/d, the US can add 14MM bbl/week for 10 weeks until full.

US storage is able to take another 135MM bbl more, assuming a build rate of 2MM b/d, the US can add 14MM bbl/week for 10 weeks until full.

$1.84 for regular was what I paid on Saturday. Using a comparative money value tool, that's .75 cents in 1985 money. Good grief.

Hell, I remember being at the BX and paying $0.98 a gallon in 1986!

Sorry, slow on the uptick......how could gas prices go negative? We just roll up to the gas stations and they pay us to fill up?

You will never see negative gasoline prices, but the OP was talking crude oil. In certain spot markets, crude oil could go negative because the refineries have no capacity left to store it.Sorry, slow on the uptick......how could gas prices go negative? We just roll up to the gas stations and they pay us to fill up?

Sorry, slow on the uptick......how could gas prices go negative? We just roll up to the gas stations and they pay us to fill up?

*Gas* prices will not go negative, because of refinery margins and what-not. But *crude* prices may indeed go that low, at least for a moment. At some point in this crisis, it is possible - not likely, but possible - that a producer will pay a counterparty to take oil.

"Price elasticity of demand" is the term of the day. If a commodity has extremely inelastic pricing when demand moves one direction, it will be roughly as inelastic in the other direction as well. Put another way, this sword cuts both ways.

Your discount percentage is off just a little, I do believe.Just paid $137.9 at Sams Club this AM. With the 5% cash back thats about $1.30.

Your discount percentage is off just a little, I do believe.

Not really. For easy figures make it $138. 5% of 138 is 6.9 (make it 7). 138- 7= $131.00. Close enough.

God I feel bad for The Saudi Royal family and what this is probably doing to their Kingdom.

Ditto Russia.......

Nah, not really.

Serious side though, this could be a strategic blunder if we have to dump our fracking operations.

It's kind of the Walmart situation for oil.

Becoming dependent on crack than finding out the dealer starts to turn the screws and you have no alternative source.

Let's fill the limestone caverns while we can but than we have to have alternatives.....

A. This is the new norm and oil stays at 1985 prices (not likely).

B. We enjoy it until the strategic reserve is full than we invest in discovery of new domestic sources and build all necessary infrastructure on top of it so that we are within hours a ready to go drilling operation. Perhaps keep the exploration and drilling going now with the money we are "saving" over prices two months ago and have a capped pump ready to start flowing when needed.

C. Get some sort of hydrogen based transportation/economy going, transitioning in a period of cheap oil.

PS - Edit/Add - If this brings the collapse of ME oil we will have to decide what danger all those unemployed, jihad bent males pose.

Ditto Russia.......

Nah, not really.

Serious side though, this could be a strategic blunder if we have to dump our fracking operations.

It's kind of the Walmart situation for oil.

Becoming dependent on crack than finding out the dealer starts to turn the screws and you have no alternative source.

Let's fill the limestone caverns while we can but than we have to have alternatives.....

A. This is the new norm and oil stays at 1985 prices (not likely).

B. We enjoy it until the strategic reserve is full than we invest in discovery of new domestic sources and build all necessary infrastructure on top of it so that we are within hours a ready to go drilling operation. Perhaps keep the exploration and drilling going now with the money we are "saving" over prices two months ago and have a capped pump ready to start flowing when needed.

C. Get some sort of hydrogen based transportation/economy going, transitioning in a period of cheap oil.

PS - Edit/Add - If this brings the collapse of ME oil we will have to decide what danger all those unemployed, jihad bent males pose.

This is your statement. You said you paid $137.9 which where I come from is One Hundred thirty seven dollars an 90 cents. But with your 5% discount you only paid $1.30 one dollar an 30 cents?Just paid $137.9 at Sams Club this AM. With the 5% cash back thats about $1.30.

God I feel bad for The Saudi Royal family and what this is probably doing to their Kingdom.

Ditto Russia.......

Nah, not really.

Serious side though, this could be a strategic blunder if we have to dump our fracking operations.

It's kind of the Walmart situation for oil.

Becoming dependent on crack than finding out the dealer starts to turn the screws and you have no alternative source.

Let's fill the limestone caverns while we can but than we have to alternatives.....

A. This is the new norm and oil stays at 1985 prices (not likely).

B. We enjoy it until the strategic reserve is full than we invest in discovery of new domestic sources and build all necessary infrastructure on top of it so that we are within hours a ready to go drilling operation. Perhaps keep the exploration and drilling going now with the money we are "saving" over prices two months ago and have a capped pump ready to start flowing when needed.

*************C. Get some sort of hydrogen based transportation/economy going, transitioning in a period of cheap oil.

C, and fuck Russia and the Saudi's.

This is your statement. You said you paid $137.9 which where I come from is One Hundred thirty seven dollars an 90 cents. But with your 5% discount you only paid $1.30 one dollar an 30 cents?

Give me a break, I misplace the decimal. In context you should read past a small mistake.

I'll take Whats good for one, for 500 Alex,...LOLGive me a break, I misplace the decimal. In context you should read past a small mistake.

Sauds are at present doing oil version of FED moneyshot , will end up boosting the gowth of world economy and US economy by 0.5% , shale going bust is just business, it was always a fraud running on cheap loans and moronic investors that couldn't throw money down a hole fast enough, could barely turn a profit at best of times even with Uncle Sam taking off the market capacities of Libya, Venezuela ,Iran ,Syria etc. Most of the time shale was loosing tens of billions of $ a year.

By the way these free market champions are already looking for a massive handout , buy from them at fixed 62$/barrel taxing and regulating the cheap imported oil. https://oilprice.com/Energy/Energy-General/An-Oilmans-Plea-To-President-Trump.html

Its actualy funny that people consider oil market prices should be regulated and kept artificialy high by an OPEC cartel deals or in absence of OPEC cartel deal one of own making.

This oil flood will lead to masive restructuring of oil and gas industries big players gobling up small fish.

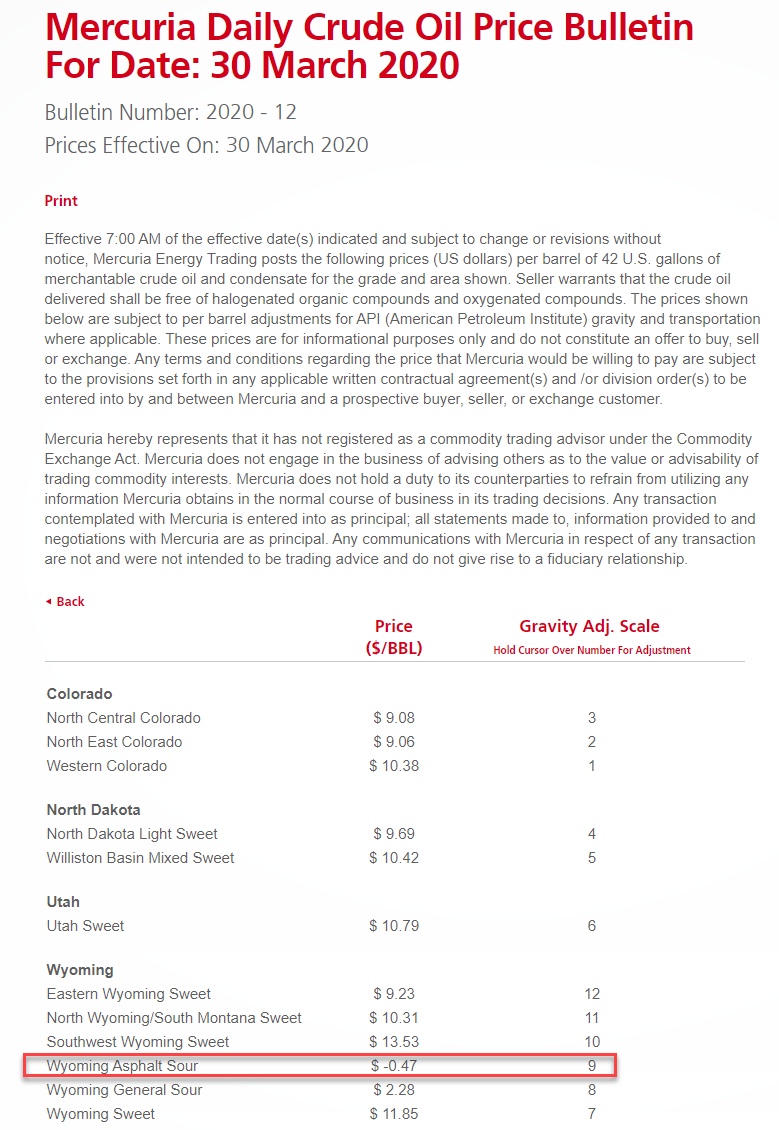

Reason why they mention negative price option is that some of the wells can not be shut down and restarted 6 months later without considerable cost that might make it a no go proposition. The main cadidates are older mainland wells andmost shale wells that have long logistic chains and no storage availible close and/or produce lesser grade oil . Negative prices have already hapened in the past with shale gas.

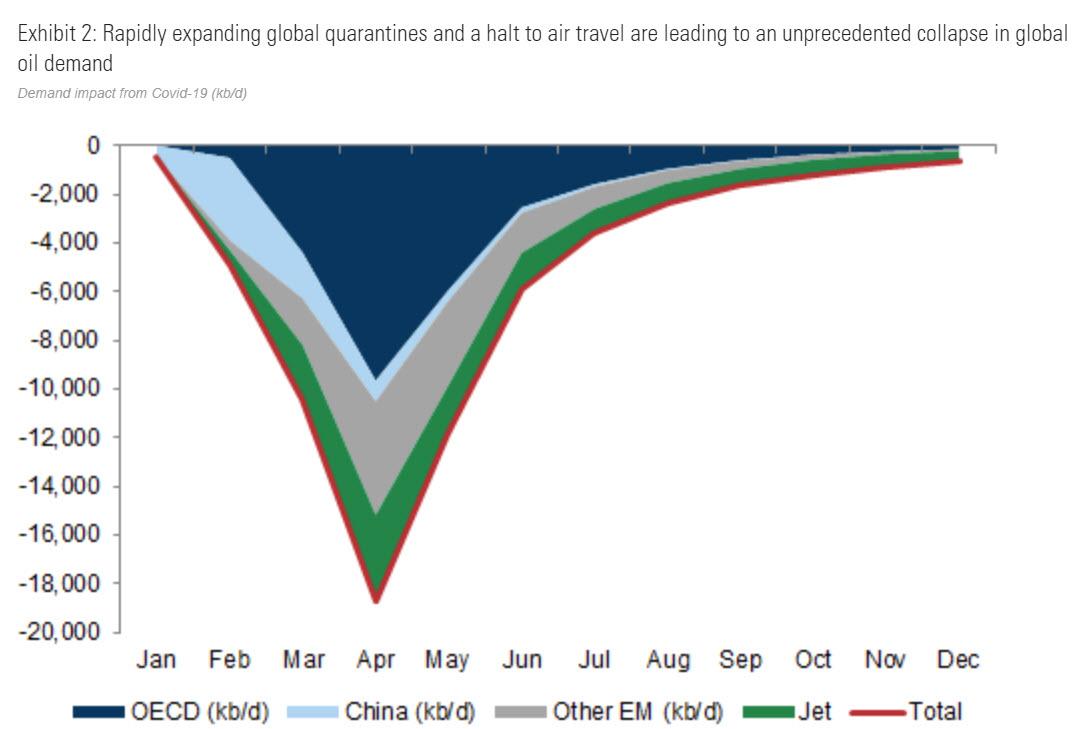

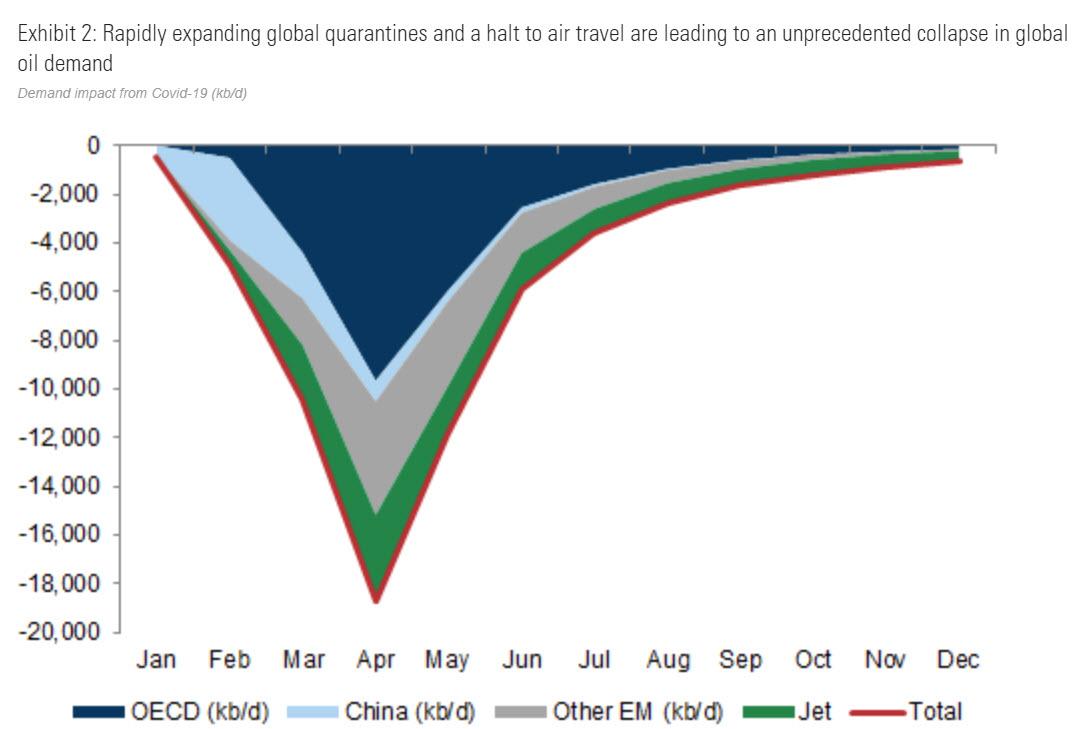

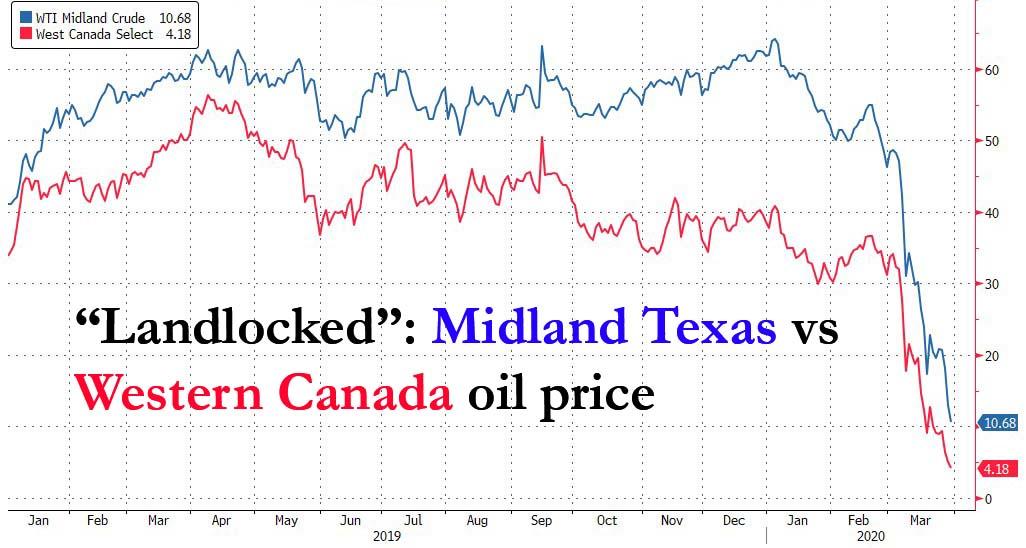

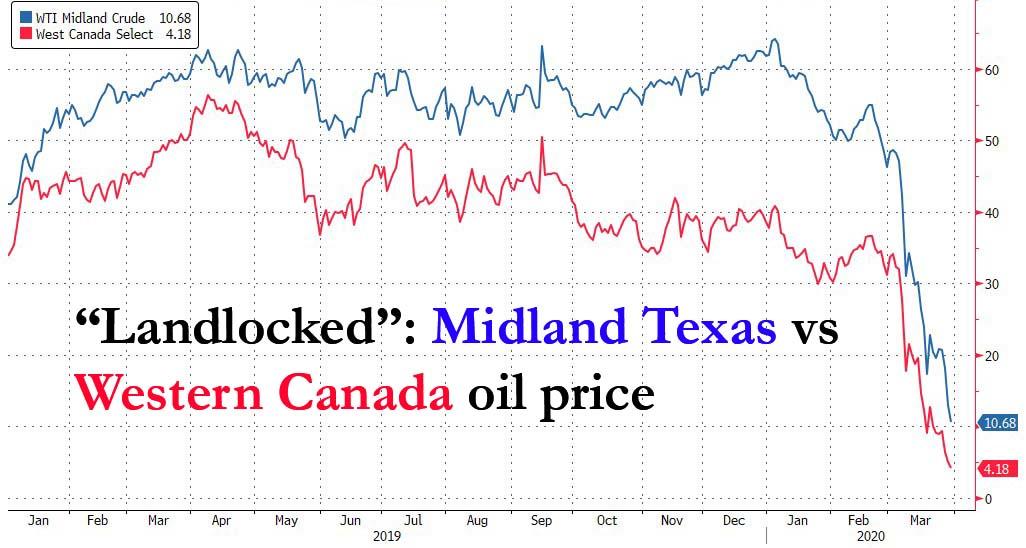

''A quick look at two of the most popular landlocked oil producing areas demonstrate that Goldman is spot on, and as the following chart shows as of this moment Texas Midland WTI was trading at just baove $10/barrel, while the price of oil produced in the notoriously landlocked Western Canada, as represented by Canada Western Selected index, was just above $4 per barrel ''

''Waterborne crudes like Brent will be far more insulated, staying near cash costs of $20/bbl with temporary spikes below. Brent is priced on an island in the North Sea, 500 meters from the water, where tanker storage is accessible.

So while markets like WTI, particularly WTI Midland, or Canada’s WCS can go negative, Brent is likely to stay near cash costs of $20/bbl. ''

By the way these free market champions are already looking for a massive handout , buy from them at fixed 62$/barrel taxing and regulating the cheap imported oil. https://oilprice.com/Energy/Energy-General/An-Oilmans-Plea-To-President-Trump.html

Its actualy funny that people consider oil market prices should be regulated and kept artificialy high by an OPEC cartel deals or in absence of OPEC cartel deal one of own making.

This oil flood will lead to masive restructuring of oil and gas industries big players gobling up small fish.

Reason why they mention negative price option is that some of the wells can not be shut down and restarted 6 months later without considerable cost that might make it a no go proposition. The main cadidates are older mainland wells andmost shale wells that have long logistic chains and no storage availible close and/or produce lesser grade oil . Negative prices have already hapened in the past with shale gas.

''A quick look at two of the most popular landlocked oil producing areas demonstrate that Goldman is spot on, and as the following chart shows as of this moment Texas Midland WTI was trading at just baove $10/barrel, while the price of oil produced in the notoriously landlocked Western Canada, as represented by Canada Western Selected index, was just above $4 per barrel ''

''Waterborne crudes like Brent will be far more insulated, staying near cash costs of $20/bbl with temporary spikes below. Brent is priced on an island in the North Sea, 500 meters from the water, where tanker storage is accessible.

So while markets like WTI, particularly WTI Midland, or Canada’s WCS can go negative, Brent is likely to stay near cash costs of $20/bbl. ''

Last edited:

Gas prices are getting ridiculous.

Went to Costco today, pumped $20 of gas and my receipt said $25 credit applied

Went to Costco today, pumped $20 of gas and my receipt said $25 credit applied

MBS doesnt seem to be budging , Sauds are still ramping up production , they are waiting til US makes big cuts in production ,US will have to cut production a whole lot as its pumping more than ither Sauds or Russians even as prices crashed.

''There is some hope, but for now with Trump failing to defuse the oil price war, Saudi Arabia has flooded the market as it warned it would less than a month ago, with Saudi Aramco’s oil supply surpassed 12 million bpd on the first day of April, up from 9.7mmb/d in March, and is boosting its production to its maximum, Bloomberg and the WSJ reported. As a reminder, in early March, Saudi Arabia instructed its state-owned oil company to boost supply to 12.3m b/d in April, and told Aramco to boost maximum production capacity to 13m b/d as soon as possible, something it has taken quite seriously as a tweet it just sent would indicate ''

''There is some hope, but for now with Trump failing to defuse the oil price war, Saudi Arabia has flooded the market as it warned it would less than a month ago, with Saudi Aramco’s oil supply surpassed 12 million bpd on the first day of April, up from 9.7mmb/d in March, and is boosting its production to its maximum, Bloomberg and the WSJ reported. As a reminder, in early March, Saudi Arabia instructed its state-owned oil company to boost supply to 12.3m b/d in April, and told Aramco to boost maximum production capacity to 13m b/d as soon as possible, something it has taken quite seriously as a tweet it just sent would indicate ''

Last edited:

Why should Trump defuse the oil price war?

It would depend on who is being hurt most.

This is crushing Iran, Venezuela (if they are even producing), SA, the other oil producing states, Russia.......

The only one it purely benefits is China, Europe, Japan, SK.

It will hurt US oil.

If their intent was max pressure they didnt expect the corona virus lack of demand.

Benefitting Trumps election chances.....if the oil industry dumps the layoffs will be attributed to CV19.

When CV19 ends Trump will be able to crow about diminishing unemployment and any change in pre/post CV19 unemployment numbers will be seen as CV19 related.

It would depend on who is being hurt most.

This is crushing Iran, Venezuela (if they are even producing), SA, the other oil producing states, Russia.......

The only one it purely benefits is China, Europe, Japan, SK.

It will hurt US oil.

If their intent was max pressure they didnt expect the corona virus lack of demand.

Benefitting Trumps election chances.....if the oil industry dumps the layoffs will be attributed to CV19.

When CV19 ends Trump will be able to crow about diminishing unemployment and any change in pre/post CV19 unemployment numbers will be seen as CV19 related.

i made good money on a pop in WLL the last two weeks. bought back in on a dip and then after market yesterday filed chapter 11.

another im in, suncor had a good pop after canada started talking about stimulus. took profits.

took profits yesterday in cvx, vlo cop. want to get out of mro but gonna ride a couple more days.

still have a fair amount in OG + services, but hoping to buy back in after they drop. if saudis / russia reach an agreement oil stocks will see a pop. but could be a long rebuild for prices if covid drives a decent size recession.

another im in, suncor had a good pop after canada started talking about stimulus. took profits.

took profits yesterday in cvx, vlo cop. want to get out of mro but gonna ride a couple more days.

still have a fair amount in OG + services, but hoping to buy back in after they drop. if saudis / russia reach an agreement oil stocks will see a pop. but could be a long rebuild for prices if covid drives a decent size recession.

Iran &Venezuela are not relevant US is crushing them with sanctions. They can't realy sell on much on openmarkets

Cheap oil is good for everyone but ones pumping oil.

But like US gov bailed out Boeing ,Airlines,Cruise lines (even tough they are registered offshore) bunch of folks(political donors and potential donors) are pushing for Oil industry bailout , the big investors that would lose out in Chapter 11.

Chapter 11 is actualy one of better solutions , here in Europe we don't have anything similar , our eqivalents take years and cost a lot of $$ that is spent on lawyers,auditors not realy aimed at getting anything up any running etc.

I guess good times right up to Chapter 11

Whiting Petroleum Corp.’s board approved $14.6 million in cash bonuses for top executives days before the shale oil producer filed for bankruptcy.

''Just days Whiting Petroleum it became the first shale casualty of the current oil price crash, when it filed for prepackaged Chapter 11 bankruptcy on Wednesday morning after the plunge in oil prices left it unable to pay its debts, the company's board - supposedly with the approval of the company's creditors - approved $14.6 million in cash bonuses for top executives.

https://www.bloomberg.com/news/arti...es-got-14-6-million-bonuses-before-bankruptcy

Cheap oil is good for everyone but ones pumping oil.

But like US gov bailed out Boeing ,Airlines,Cruise lines (even tough they are registered offshore) bunch of folks(political donors and potential donors) are pushing for Oil industry bailout , the big investors that would lose out in Chapter 11.

Chapter 11 is actualy one of better solutions , here in Europe we don't have anything similar , our eqivalents take years and cost a lot of $$ that is spent on lawyers,auditors not realy aimed at getting anything up any running etc.

I guess good times right up to Chapter 11

Whiting Petroleum Corp.’s board approved $14.6 million in cash bonuses for top executives days before the shale oil producer filed for bankruptcy.

''Just days Whiting Petroleum it became the first shale casualty of the current oil price crash, when it filed for prepackaged Chapter 11 bankruptcy on Wednesday morning after the plunge in oil prices left it unable to pay its debts, the company's board - supposedly with the approval of the company's creditors - approved $14.6 million in cash bonuses for top executives.

https://www.bloomberg.com/news/arti...es-got-14-6-million-bonuses-before-bankruptcy

Iran &Venezuela are not relevant US is crushing them with sanctions. They can't realy sell on much on openmarkets

Cheap oil is good for everyone but ones pumping oil.

But like US gov bailed out Boeing ,Airlines,Cruise lines (even tough they are registered offshore) bunch of folks(political donors and potential donors) are pushing for Oil industry bailout , the big investors that would lose out in Chapter 11.

Chapter 11 is actualy one of better solutions , here in Europe we don't have anything similar , our eqivalents take years and cost a lot of $$ that is spent on lawyers,auditors not realy aimed at getting anything up any running etc.

I guess good times right up to Chapter 11

Whiting Petroleum Corp.’s board approved $14.6 million in cash bonuses for top executives days before the shale oil producer filed for bankruptcy.

''Just days Whiting Petroleum it became the first shale casualty of the current oil price crash, when it filed for prepackaged Chapter 11 bankruptcy on Wednesday morning after the plunge in oil prices left it unable to pay its debts, the company's board - supposedly with the approval of the company's creditors - approved $14.6 million in cash bonuses for top executives.

https://www.bloomberg.com/news/arti...es-got-14-6-million-bonuses-before-bankruptcy

I mean if you know anything about Whiting...it just sounds like Whiting being Whiting. How it took this long to go tits up is baffling.

Cheap oil also hurts the farmers. Has to be balance as anything.

We really shouldnt be turning corn into shitty fuel by govt mandate.

Is there a single cruise line that is American owned and has American employees? None that I know of...Cruise lines haven’t received a bail out.

Similar threads

- Replies

- 56

- Views

- 2K

- Replies

- 338

- Views

- 6K