I think JD Vance just took a personal spanking from Trump over this (not voting). Trump just went on X telling all R senators to show up for their votes!

Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

PortaJohn

- Thread starter Lowlight

- Start date

-

- Tags

- sniper's hide

I wonder if he has made any statements about the jab?

He's just Transphobic!!!!! *sarcasm*

Also, my google fu sucks. I was looking for a Trans meme that would work, but couldn't find one that would be funny.

We need to treat gender dysphoria the way it was back in DSM-IV:

as a mental illness. Compassion, not wokeness.

Except the pedophiles and those that make death threats. Death penalties for the pedophiles!

Another border patrol agent just testified the numbers over 500,000!

The funny thing is the Socialist/Communist are armed and make the same comments about liberals.

she probably despises cute kids and wants to destroy every one she can.

The Republicans aren't doing shit and haven't the last 3 1/2 years.Well the current DOJ is still going after J6 protesters, and using Lawfare to do it. Existing J6 prisoners aren't getting necessary medical care, from that same DOJ insisting on trans medical care for their beloved prisoner constituents that committed murder, rape, and pedophilia. It's an illogical double standard being repeated over and over.

i head he's a mask/vax nazi piece of shit.

Likely, he isn't what I'd call a true conservative.Wonder if he got the real thing?

Told you he's not to be trusted...

I have an idea on social security, but first some cut and paste.

It was always setup so you could not get to it. As time advanced and medicine got better people started living longer. In the 1950's they did the "early retirement" thing and lowered the age. But for the first 20 years they did not want anyone to get it. Typical socialist FDR bullshit. Top 5 most shitty pres in history.

So how to fix it, it will be a long term fix, it will take some time to get it back in the black. And I think people might go for it.

Anyone born after 2025 can not get social security until they are 75, or pick your number, but I think that is a good one. People live past that on average today, but I think that might fly.

Social security theft.....err.....deduction form your check will be frozen at the current level. Not .1% more.

Anyone born after 2025 will have half the current rate stolen from their checks.

This will not effect anyone currently on the planet, or any buns in the oven. After those born after 25, they will not take such a hard hit on their checks.

I am sure there are flaws to this idea, but I can't think of one.

becerra belongs in prison with mayorkas and the rest.

Much easier solutions but people will NEVER go for it:I have an idea on social security, but first some cut and paste.

View attachment 8550613

View attachment 8550614

It was always setup so you could not get to it. As time advanced and medicine got better people started living longer. In the 1950's they did the "early retirement" thing and lowered the age. But for the first 20 years they did not want anyone to get it. Typical socialist FDR bullshit. Top 5 most shitty pres in history.

So how to fix it, it will be a long term fix, it will take some time to get it back in the black. And I think people might go for it.

Anyone born after 2025 can not get social security until they are 75, or pick your number, but I think that is a good one. People live past that on average today, but I think that might fly.

Social security theft.....err.....deduction form your check will be frozen at the current level. Not .1% more.

Anyone born after 2025 will have half the current rate stolen from their checks.

This will not effect anyone currently on the planet, or any buns in the oven. After those born after 25, they will not take such a hard hit on their checks.

I am sure there are flaws to this idea, but I can't think of one.

Option #1 - within 3 to 5 years (on average) a retiree has collected all of the money they paid into SS. Tie everyone's SS tax paid to their SS number. When they have drawn out all of the money they paid then the payments stop.

Option #2 - same as #1 but the payer has the option of investing the money in a few very safe options and that return goes to their account. When all of the money paid had been paid out the tap shuts off.

Some information on how the return on SS works:

What Happens to Interest on Social Security Contributions?

Social Security doesn’t work like a savings account for individuals, but pooled interest from contributions helps fund the trust that pays beneficiaries.

Variance in money paid in vs paid out:

- A single man who earned an average income ($66,100) and reaches average life expectancy will pay $498,000 into Social Security and Medicare and receive $692,000 in benefits. ($194,000 more collected then paid)

- A single woman in that situation will pay $498,000 into the programs and receive $775,000 in benefits (the projection is higher because women live longer). ($277,000 more collected then paid)

- A married couple consisting of an average earner and a low earner ($95,800 in combined income) will pay a combined $723,000 and receive about $1.3 million in benefits. ($577,000 more collected then paid)

The RNC raked in over 200M for "election fraud" in 2020. IMHO, every cent not used directly for fraud litigation then should've gone to the J6ers defense. Instead, it was used to elect non-MAGA RINOS in 2022.The Republicans aren't doing shit and haven't the last 3 1/2 years.

This is what just got us in the World War III!

Remember back to our war, the first gulf war. They shot missles into Israel hoping to get them to shoot back, and then have the coalition fall apart. I think quite a few calls got made and said just hang on, we will take care of this just give us some time.

I have a feeling the same calls are being made, I would not doubt for a second we see a regime change in Ukraine.

Patriot Front changed their uniforms!

Are those issued by the FBI directly?

Or do the “special agents” have to turn the receipts for them on their expense reports?

Or how about instead of giving the government $500-750k of your money, you become allowed to put it in a Retirement account like a Roth IRA, etc and have it invested into the market your whole life. Then your 500-750k investment Gets turned into millions and create generational wealth instead of having the government dole out meager Payments.Much easier solutions but people will NEVER go for it:

Option #1 - within 3 to 5 years (on average) a retiree has collected all of the money they paid into SS. Tie everyone's SS tax paid to their SS number. When they have drawn out all of the money they paid then the payments stop.

Option #2 - same as #1 but the payer has the option of investing the money in a few very safe options and that return goes to their account. When all of the money paid had been paid out the tap shuts off.

Some information on how the return on SS works:

What Happens to Interest on Social Security Contributions?

Social Security doesn’t work like a savings account for individuals, but pooled interest from contributions helps fund the trust that pays beneficiaries.www.aarp.org

Variance in money paid in vs paid out:

Other than the GOV raiding SS to pay for non-SS shit this is a major problem with the way the system is set up.

- A single man who earned an average income ($66,100) and reaches average life expectancy will pay $498,000 into Social Security and Medicare and receive $692,000 in benefits. ($194,000 more collected then paid)

- A single woman in that situation will pay $498,000 into the programs and receive $775,000 in benefits (the projection is higher because women live longer). ($277,000 more collected then paid)

- A married couple consisting of an average earner and a low earner ($95,800 in combined income) will pay a combined $723,000 and receive about $1.3 million in benefits. ($577,000 more collected then paid)

With a 7k yearly contribution, (11% of a 60k income) for 40 years with a average of an 8% return every year, you end up with 1.8 million in the bank account. You put in 280k and and receive 1.5 mil after taxes, gov makes 300k. AND the economy grows due to constant investment in the market.

Remind me why the fuck we need the government here at all? Give me my fucking money back and let me invest the shit myself. I don’t want social security. I don’t want Medicare. I want to invest my own damn money.

WINNING! Ellen DeGeneres Moves to England After Trump Wins Landslide Election... "Never Coming Back" | The Gateway Pundit | by Cristina Laila

Ellen DeGeneres has left Hollywood behind for England, vowing never to return after Trump's election victory. Discover the intriguing details behind her dramatic move and its implications.

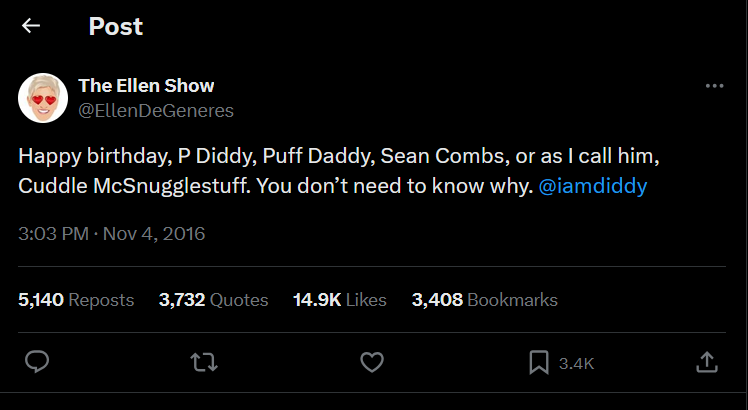

Just like Eva Longoria, she isn't running because of Trump. She's running because she's on both the Epstein island and Diddy party lists!!

even if the money didn't grow for those 40+ years, $750k could probably pay more in monthly interest than the ssi stipend.Or how about instead of giving the government $500-750k of your money, you become allowed to put it in a Retirement account like a Roth IRA, etc and have it invested into the market your whole life. Then your 500-750k investment Gets turned into millions and create generational wealth instead of having the government dole out meager Payments.

With a 7k yearly contribution, (11% of a 60k income) for 40 years with a average of an 8% return every year, you end up with 1.8 million in the bank account. You put in 280k and and receive 1.5 mil after taxes, gov makes 300k. AND the economy grows due to constant investment in the market.

Remind me why the fuck we need the government here at all? Give me my fucking money back and let me invest the shit myself. I don’t want social security. I don’t want Medicare. I want to invest my own damn money.

Senate Democrats Confirm Another Two Radical Judges Because Two GOP Senators Did Not Show Up | The Gateway Pundit | by Jim Hᴏft

The U.S.

The U.S. Senate on Wednesday confirmed two more of Joe Biden’s radical judicial nominees to federal district courts—thanks in part to the absence of key GOP senators.

With Kamala Harris conveniently vacationing in Hawaii, the GOP had a golden opportunity to block these nominations. Instead, their failure to show up handed Democrats another victory.

Democrats confirmed Rebecca L. Pennell to the Eastern District of Washington in a 50-48 vote.

Republican firebrand Senator Ted Cruz (R-TX) inexplicably missed the vote, joining Braun in the hall of shame, while Senator Joe Manchin (I-WV) voted against the confirmation.

WINNING! Ellen DeGeneres Moves to England After Trump Wins Landslide Election... "Never Coming Back" | The Gateway Pundit | by Cristina Laila

Ellen DeGeneres has left Hollywood behind for England, vowing never to return after Trump's election victory. Discover the intriguing details behind her dramatic move and its implications.www.thegatewaypundit.com

Just like Eva Longoria, she isn't running because of Trump. She's running because she's on both the Epstein island and Diddy party lists!!

That is the best option but will never happen. The few have to support the many for the betterment of society or some such bullshit.Or how about instead of giving the government $500-750k of your money, you become allowed to put it in a Retirement account like a Roth IRA, etc and have it invested into the market your whole life. Then your 500-750k investment Gets turned into millions and create generational wealth instead of having the government dole out meager Payments.

With a 7k yearly contribution, (11% of a 60k income) for 40 years with a average of an 8% return every year, you end up with 1.8 million in the bank account. You put in 280k and and receive 1.5 mil after taxes, gov makes 300k. AND the economy grows due to constant investment in the market.

Remind me why the fuck we need the government here at all? Give me my fucking money back and let me invest the shit myself. I don’t want social security. I don’t want Medicare. I want to invest my own damn money.

This a-hole and his democrat party cut SS a long time ago when they voted to start taxing it.

This is why I. Don't like his plan. If the money was left in my pocket it would have grown to many times that amount, but I am different from most, that vacation or new truck would be where the money went and they would be broke at the end. Nanny gov to the rescueOr how about instead of giving the government $500-750k of your money, you become allowed to put it in a Retirement account like a Roth IRA, etc and have it invested into the market your whole life. Then your 500-750k investment Gets turned into millions and create generational wealth instead of having the government dole out meager Payments.

With a 7k yearly contribution, (11% of a 60k income) for 40 years with a average of an 8% return every year, you end up with 1.8 million in the bank account. You put in 280k and and receive 1.5 mil after taxes, gov makes 300k. AND the economy grows due to constant investment in the market.

Remind me why the fuck we need the government here at all? Give me my fucking money back and let me invest the shit myself. I don’t want social security. I don’t want Medicare. I want to invest my own damn money.

early on but the mistake of having those 2 in any power is obvious. didn't have to wait long.So let's see:

1) J.D Vance for starters....let's say that's letdown #1 of what I'm sure is going to be a number in the high 4 digits.

2) Rubio - all talk, has been since 2010 when he got in. Not a true conservative bone in his body. He's out for one thing...that's Little Itty Bitty Marco.

3) The rest....no shocker either...These people are NOT representing you. Yes, JD is VPOTUS elect; but you still have to do your f'ing job and this was a BIGGIE JD...

She can ekscape to Africa

Is from a Canadian comic strip that was also syndicated in the U.S. "For Better or For Worse". Made enough of an impression that I still remember that panel 26 years later.

The story arc starts here if anyone cares to read the rest:

This should make it pretty obvious that the two parties are really only one party with different names. Do you believe that it wasn't already planned?

Senate Democrats Confirm Another Two Radical Judges Because Two GOP Senators Did Not Show Up | The Gateway Pundit | by Jim Hᴏft

The U.S.www.thegatewaypundit.com

The U.S. Senate on Wednesday confirmed two more of Joe Biden’s radical judicial nominees to federal district courts—thanks in part to the absence of key GOP senators.

With Kamala Harris conveniently vacationing in Hawaii, the GOP had a golden opportunity to block these nominations. Instead, their failure to show up handed Democrats another victory.

Democrats confirmed Rebecca L. Pennell to the Eastern District of Washington in a 50-48 vote.

Republican firebrand Senator Ted Cruz (R-TX) inexplicably missed the vote, joining Braun in the hall of shame, while Senator Joe Manchin (I-WV) voted against the confirmation.

There's a position in the each party called the "Whip". Look up what the responsibility for this job title is.

All the world is a stage.

I think the only missing part of this is that option, in particular, isn't taking into account earned value of money over time - like how much could I have now if I only was getting 5% on my return inflation adjusted. That is if I'm understanding it. Because folks that worked primarily in the 1970s - 1990s really would get the shaft.Much easier solutions but people will NEVER go for it:

Option #1 - within 3 to 5 years (on average) a retiree has collected all of the money they paid into SS. Tie everyone's SS tax paid to their SS number. When they have drawn out all of the money they paid then the payments stop.

Option #2 - same as #1 but the payer has the option of investing the money in a few very safe options and that return goes to their account. When all of the money paid had been paid out the tap shuts off.

Some information on how the return on SS works:

What Happens to Interest on Social Security Contributions?

Social Security doesn’t work like a savings account for individuals, but pooled interest from contributions helps fund the trust that pays beneficiaries.www.aarp.org

Variance in money paid in vs paid out:

Other than the GOV raiding SS to pay for non-SS shit this is a major problem with the way the system is set up.

- A single man who earned an average income ($66,100) and reaches average life expectancy will pay $498,000 into Social Security and Medicare and receive $692,000 in benefits. ($194,000 more collected then paid)

- A single woman in that situation will pay $498,000 into the programs and receive $775,000 in benefits (the projection is higher because women live longer). ($277,000 more collected then paid)

- A married couple consisting of an average earner and a low earner ($95,800 in combined income) will pay a combined $723,000 and receive about $1.3 million in benefits. ($577,000 more collected then paid)

I was all in favor of just outright doing away with SS after a certain age (or born after date). I would have been willing, up to about age 40-45, to GIVE my SS TAX back to the kitty so long as I get 100% of that SS withdrawal money back in my paycheck and no new taxes on that money that was designated for SS (so that % of your tax that is SS would become non-taxable income for investment!!) I think one can pretty much recoup that money with conservative investments over the next 20-25 years. I never did the actual math on that; but at some point, just having the SS TAX stop would allow one to retire with more money; because that money would be in private hands making money (like a 401K).

The debate against the no SS is that people don't have enough self control....ok...so make a law that says it has to go somewhere and cannot be pulled out until 65, but the individual gets a say on where the money is invested. It's not perfect due to the FED jacking with the economy, cyclic nature of stocks, bonds, gold, etc; but it's not quite the Ponzi scheme current SS is.

FEMA Head Admits Agency Skipped 20 Homes with Trump Signs That Needed Hurricane Relief (VIDEO) | The Gateway Pundit | by Cristina Laila

Federal Emergency Management Agency (FEMA) Administrator Deanne Criswell appeared before congressional committees on Tuesday as allegations surfaced that Trump supporters’ homes were intentionally skipped during disaster aid efforts following Hurricane Milton.

Similar threads

- Replies

- 1

- Views

- 236

- Replies

- 21

- Views

- 1K

- Replies

- 0

- Views

- 532