Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Recession - 2022 / 2023 / 2024

- Thread starter Hobo Hilton

- Start date

There is a reason for that. The income group that can afford "Luxury Homes" is well versed in managing their finances, surviving a few recessions and know what it means when the storm clouds form on the horizon. Now is not the time to buy... Deja VuZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zerowww.zerohedge.com

Economy needs a recession | David Moon

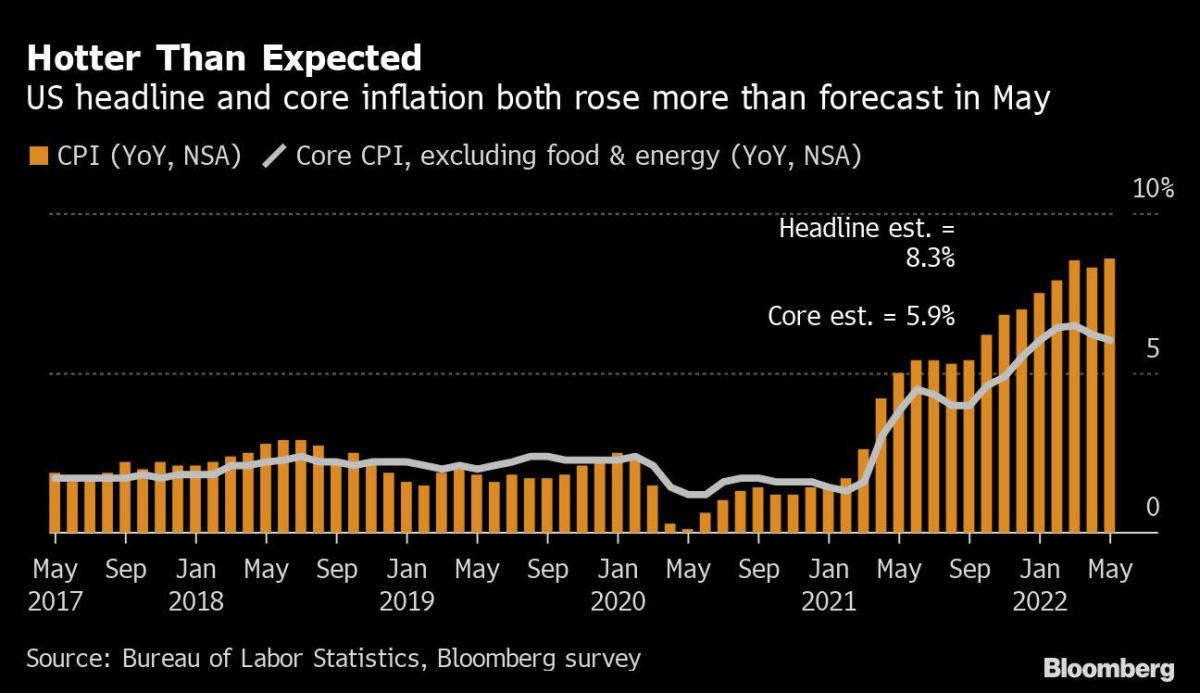

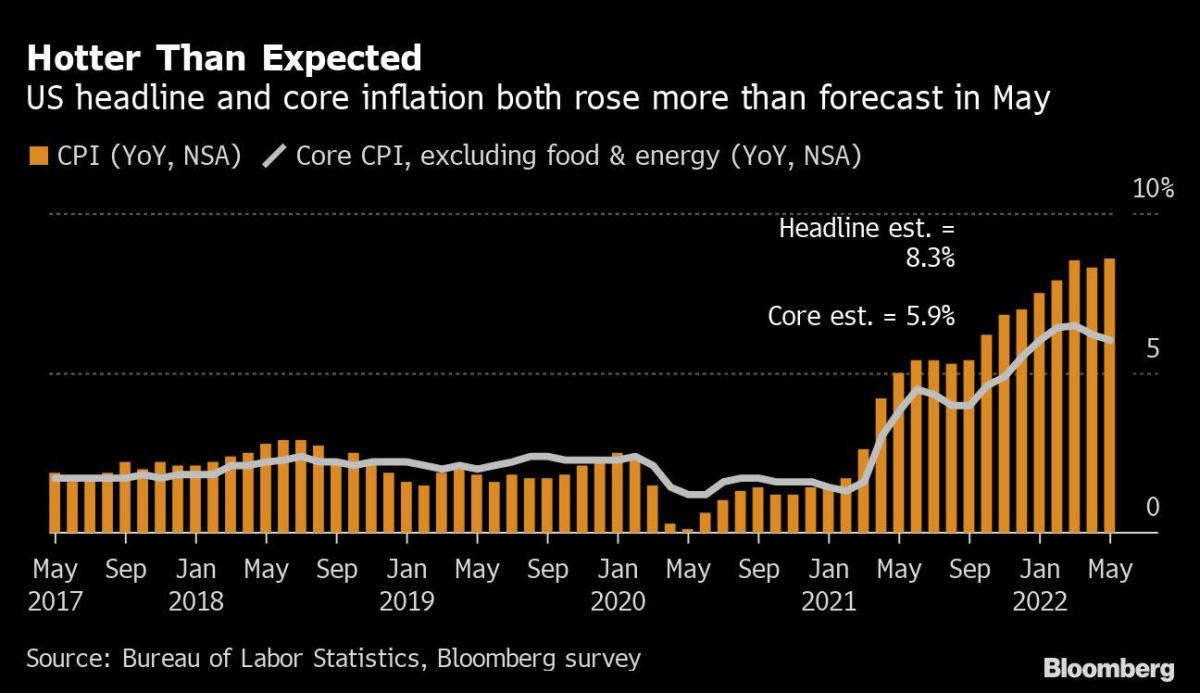

To reduce inflation, demand for goods has to cool off. For that to occur, the Federal Reserve must raise interest rates.

I mean, he’s not wrong.

It's what he did not say that speaks volumes............ He did not say 'The US Government must stop spending and giving away free money". The things he said are correct. He is like a guy bailing water our of a boat with a hole in it. The hole must be plugged before the boat can be successfully bailed out.

Economy needs a recession | David Moon

To reduce inflation, demand for goods has to cool off. For that to occur, the Federal Reserve must raise interest rates.www.yahoo.com

I mean, he’s not wrong.

A really simple equation.

One can make the argument that the majority of economic growth since the 2008 downturn has come from Fed printing. If one combines that hypothesis with the idea that inflation has been driven by the same 13 years of monetary easing (as opposed to the Fed balance sheet growth that has occurred just since Mar 2020 or Jan 2021, depending upon the political slant if the claim and claimant), then it's possible that unwinding this problem is going to have far more impact than just a few quarters of modestly declining growth.

It's also possible that what the economy lacks is not total production capacity, but rather the proper balance of capacity, and since we've gotten so far away from creating the market signals which should guide this rebalancing, we're going to play political pingpong for at least four years (the next two years of the current admin and the first two years of the next admin) deciding what we're going to incentivize and de-incentivize according to the lobbyists.

In short, I'm deeply pessimistic.

It's also possible that what the economy lacks is not total production capacity, but rather the proper balance of capacity, and since we've gotten so far away from creating the market signals which should guide this rebalancing, we're going to play political pingpong for at least four years (the next two years of the current admin and the first two years of the next admin) deciding what we're going to incentivize and de-incentivize according to the lobbyists.

In short, I'm deeply pessimistic.

4 years ?..... That could become the "New Norm........... 2021 would be remembered as "The Good Old Days"......One can make the argument that the majority of economic growth since the 2008 downturn has come from Fed printing. If one combines that hypothesis with the idea that inflation has been driven by the same 13 years of monetary easing (as opposed to the Fed balance sheet growth that has occurred just since Mar 2020 or Jan 2021, depending upon the political slant if the claim and claimant), then it's possible that unwinding this problem is going to have far more impact than just a few quarters of modestly declining growth.

It's also possible that what the economy lacks is not total production capacity, but rather the proper balance of capacity, and since we've gotten so far away from creating the market signals which should guide this rebalancing, we're going to play political pingpong for at least four years (the next two years of the current admin and the first two years of the next admin) deciding what we're going to incentivize and de-incentivize according to the lobbyists.

In short, I'm deeply pessimistic.

I think it is going to take a lot more than the regular rebalancing from time to time we have seen in the last 40 years. I think there is going to have to be a very large shakeup. Then again, I've been thinking that for the last 20 years. Our ability to push the problem forward in time is pretty amazing really. I don't think we let the market set the tone enough. We give people safety nets that don't deserve it. We incentivize large organizations taking huge risks they would never take if not backed by taxpayer money bailing them out. We subsidize techs that aren't even close to standing on their own two feet while penalizing the crap out of the conventional energy sector. We're trying to set up the new green deal with no pathway to success. We are setting it up to run into the brick wall of limited electrical capacity.One can make the argument that the majority of economic growth since the 2008 downturn has come from Fed printing. If one combines that hypothesis with the idea that inflation has been driven by the same 13 years of monetary easing (as opposed to the Fed balance sheet growth that has occurred just since Mar 2020 or Jan 2021, depending upon the political slant if the claim and claimant), then it's possible that unwinding this problem is going to have far more impact than just a few quarters of modestly declining growth.

It's also possible that what the economy lacks is not total production capacity, but rather the proper balance of capacity, and since we've gotten so far away from creating the market signals which should guide this rebalancing, we're going to play political pingpong for at least four years (the next two years of the current admin and the first two years of the next admin) deciding what we're going to incentivize and de-incentivize according to the lobbyists.

In short, I'm deeply pessimistic.

It's literally monopoly money at this point.If we combine Social Security and Medicare’s unfunded liabilities, we get $163.2 trillion. The National Debt Clock has roughly the same figure: $161.6 trillion.

You owe more than $500,000 — and counting

At some point someone has to get serious about government spending and just say “No!”

It's literally monopoly money at this point.

You owe more than $500,000 — and counting

At some point someone has to get serious about government spending and just say “No!”thehill.com

And it's gonna get even worse after this year's rumored 8% hike in SS benefits.

4 years ?..... That could become the "New Norm........... 2021 would be remembered as "The Good Old Days"......

That's four years to get to a decision point on what needs to be done. It might take a decade or more to actually execute any sort of rebalancing, and if there is a major world conflict over that period (which I perceive as highly likely) then it'll be even longer.

That assumes we elect competent and effective leadership in 2024. It'll be even longer if we get a second Biden term or if Trump weasels his way back into the WH and drags along guys like Larry Kudlow. The idea of electing a egoless leader who plows down bureaucratic obstacles so that a series of competent cabinet members and advisors can take charge of fixing problems seems nearly impossible in today's environment.

And that is always the problem isn't it? Even if you go the nuclear option and blow it up with small scale revolution or a huge government disruption of some sort, you can't be sure the next people stepping up are what they say they are or won't be worse. The French revolution comes to mind and more recently the Bolivia thing. Beat back the communists to get people in charge that don't do much of anything but sell their spots back to the communists for cash. Central America is full of those corruption stories. I really think the most major rebalancing that needs to occur is between state and federal power. More power needs to go back to the states because things can be corrected easier on a local level. This should be an easy sell nowadays with people realizing the problems with centralized banking and the hopes of decentralized crypto coming to the forefront.That's four years to get to a decision point on what needs to be done. It might take a decade or more to actually execute any sort of rebalancing, and if there is a major world conflict over that period (which I perceive as highly likely) then it'll be even longer.

That assumes we elect competent and effective leadership in 2024. It'll be even longer if we get a second Biden term or if Trump weasels his way back into the WH and drags along guys like Larry Kudlow. The idea of electing a egoless leader who plows down bureaucratic obstacles so that a series of competent cabinet members and advisors can take charge of fixing problems seems nearly impossible in today's environment.

I keep plowing ahead at the local level and helping every honest man I can to get in place. Get people out of office when they show themselves to be wolves in sheep's clothing. We have to start sheepdogging our local communities and taking back the local power centers that have fallen to the degenerates over the years. School boards, election supervisors, sheriffs, all of it. In my area I see it happening. Even young people are taking notice and waking up. As bad as things are I have more hope it might get fixed now than at any point ever in my life. People know something is wrong, we just have to fix it.

Last edited:

I hope people bought sacks of flour instead of timeshares in Hawaii

Not just SS - lots of government pensions etc. tooAnd it's gonna get even worse after this year's rumored 8% hike in SS benefits.

Cloward Piven theory in full motion !!

Na, more like normal human greediness. There's no incentive in our system to fix problems 30 years down the road by inflecting pain in the next election cycle, so the cans get kicked down the road until eventually you simply run into a big pile of 'em.

Na, more like normal human greediness. There's no incentive in our system to fix problems 30 years down the road by inflecting pain in the next election cycle, so the cans get kicked down the road until eventually you simply run into a big pile of 'em.

That pile of cans will have an effect on every person, worldwide. One person can't have enough money, stores, good health, liquor, friends, vehicles, gasoline to avoid being effected. The morning will come when a person wakes up, ponder's their situation and comes to the conclusion - "I now am forced to deal with it".

“The chairman of the Fed doesn’t want to let the ‘r’ word slip out of his mouth in a positive way, that we need a recession,” former US central bank policy maker Alan Blinder said. “But there are a lot of euphemisms and he’ll use them.”

ca.finance.yahoo.com

ca.finance.yahoo.com

Powell Facing Choice Between Elevated US Inflation and Recession

(Bloomberg) -- Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.Most Read from BloombergChina Alarms US With Private Warnings to Avoid Taiwan Strait‘Party Like a Russian’ Turns Toxic at Putin’s Flagship ForumChina Warns of Risk of War Over Taiwan...

StagflationOK, yeah, I agree that we are pretty much on the same page on the big parts.

As far as the Fed's toolbox, there are the normal ones, basically they move interest rates and sell federal securities. They can also raise margin rates on various securities etc. Those are the ones to suck inflation out of an economy, and they are actually really effective, especially because, as you note so often, we are basically a credit economy, and the more credit makes up the total economy, the more interest rates drive everything. That is to say that obviously if we had a no lending economy, interest rates would be relatively meaningless. Furthermore, changes in interest rates not only change credit cost and availability, but they change asset values as well, since asset values are a function of expected rates. So if a fed chairman does a really good job, say as Greenspan did before he went to shit, they can make small moves to attack individual asset classes. Now, I actually think this is an awful idea because nobody is God, and that kind of foresight doesn't exist, and we saw that as Greenspan's bubble collapsed.

On the inflationary side, there are the opposite moves, plus, apparently the Bernanke playbook of buy everything you want and create as much money as you like. Those are pretty well hashed out by now. I also dislike them, but I will say that Bernanke did a masterful job as far as it went. It was basically a hail mary that got caught in the end zone.

What I mean by we have the tools on one side but not the other is pretty much what you are saying when you mention that, unlike at other times, interest rates are at lows, we still have a Fed with an enormous balance sheet, we have a huge national debt (though there are clearly strains of thought that say this doesn't matter*) and, more than that, we have real, as opposed to flaring, inflation. So basically hands are completely tied on this end.

So, what could the Fed do? Clearly, it would be easy to crash the economy and wring everything out, but that isn't going to happen. I mean, the economy could crash out, but policy makers aren't going to do it on purpose. Also, I think the Fed, and everybody else, understands that in a highly credit based economy, with lots of income and asset inequality, and plenty of anger, there is a limit to the pain that will be acceptable. So I think what they will probably do is try to finesse a scenario where we live at 4-7% inflation and 6-9% unemployment for an extended period of time. I don't know if they can do it, but it is possible. It's also an awful outcome.

*FWIW, Larry Summers, who is a partisan Democrat but smart as hell, and surprisingly honest, has commented a lot on the idea that there is a significant movement on the left to dismiss completely the importance of government debt, and he thinks it is crazy. I think what is clear is that we are a lot further out there on the plank than we ever thought existed, so there is something we probably didn't get right in our previous understanding to allow us to be out here. He also says that the fed probably needs to induce 9% unemployment to crush current inflation, but I think the term of that pain is longer than he does.

Anyway, that's about all I've got.

ETA: I guess my main point is that in a credit economy it is no secret how you stop inflation, and since rates are so minuscule, there should be no difficulty in doing so. What is problematic is that we really don't know what organic demand is like without current Fed policy, but it isn't something that they can address because they are shooting blanks at this point, so I expect them to be slower than they should be in combatting inflation because they will want to see what happens, knowing they can't really hit hard reverse. So stagflation is likely.

ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Layoff's are starting to show up more.

www.cnbc.com

www.cnbc.com

Coinbase lays off 18% of workforce as executives prepare for recession and 'crypto winter'

Coinbase is laying off almost a fifth of its workforce amid a collapse in crypto prices.

Biden says a recession is ‘not inevitable,’ rejects idea that COVID stimulus caused inflation

President Joe Biden told The Associated Press on Thursday that the American people are "really, really devastated" after two turbulent years with the coronavirus pandemic, volatility in the economy and now soaring gas prices that are wrecking family budgets.6 hours ago — President Joe Biden told The Associated Press on Thursday that the ... 'not inevitable,' rejects idea that COVID stimulus caused inflation.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/JBRF526WIJOQRBYHDK7RNZZXQY.jpg)

Analysis: Blown off course again, Fed policymakers see near-record uncertainty

Federal Reserve policymakers are less confident than at any time since the height of the pandemic about what will happen with the economy, data published alongside their forecasts and the Fed's hefty three-quarters-of-a-point rate hike this week show.

"Gettin' by".... As the recession sets in we will witness minimal amounts of disposable income spent on maintenance. History repeating / Deja Vu. Just look at the cost of a car battery or a set of tires. I can get a few more miles out of those tires... or .... I just leave the battery charger on trickle and when I drive the car, I just don't shut it off until I get back home...

www.cnbc.com

www.cnbc.com

43% of homeowners have delayed home improvements and maintenance due to inflation. Here's why that's risky

If inflation is squeezing your budget, there are steps you can take as a homeowner to help avoid costly fixes.

Does not have your best interest in mind.

___________________

Changes in monetary policy take time to work their way through the economy, and “significant and abrupt changes can be unsettling to households and small businesses as they make necessary adjustments,” Ms. George said, adding “it also has implications for the yield curve and traditional bank lending models,

CEO of the Kansas City Fed

analyzingmarket.com

analyzingmarket.com

___________________

Changes in monetary policy take time to work their way through the economy, and “significant and abrupt changes can be unsettling to households and small businesses as they make necessary adjustments,” Ms. George said, adding “it also has implications for the yield curve and traditional bank lending models,

CEO of the Kansas City Fed

George Clooney's Net Worth - Marketing Analysis

A little bit of life and career, before we move on to George Clooney's net worth. Born on May 6, 1961, in Kentucky, US, his parents were semi-celebrities.

analyzingmarket.com

analyzingmarket.com

The bottom is nowhere in sight.

_______________

Production at U.S. factories unexpectedly fell in May, the latest sign of cooling economic activity as the Federal Reserve aggressively tightens monetary policy to tame inflation.

The first decline in manufacturing output since January reported by the Fed on Friday followed news this week of a drop in retail sales last month as well as steep declines in homebuilding and permits. The weakness in production also reflects a shift in spending from goods to services.

www.cnbc.com

www.cnbc.com

_______________

Production at U.S. factories unexpectedly fell in May, the latest sign of cooling economic activity as the Federal Reserve aggressively tightens monetary policy to tame inflation.

The first decline in manufacturing output since January reported by the Fed on Friday followed news this week of a drop in retail sales last month as well as steep declines in homebuilding and permits. The weakness in production also reflects a shift in spending from goods to services.

U.S. manufacturing output unexpectedly weak in May

Production at U.S. factories unexpectedly fell in May, the latest sign of cooling economic activity as the Fed tightens monetary policy to tame inflation.

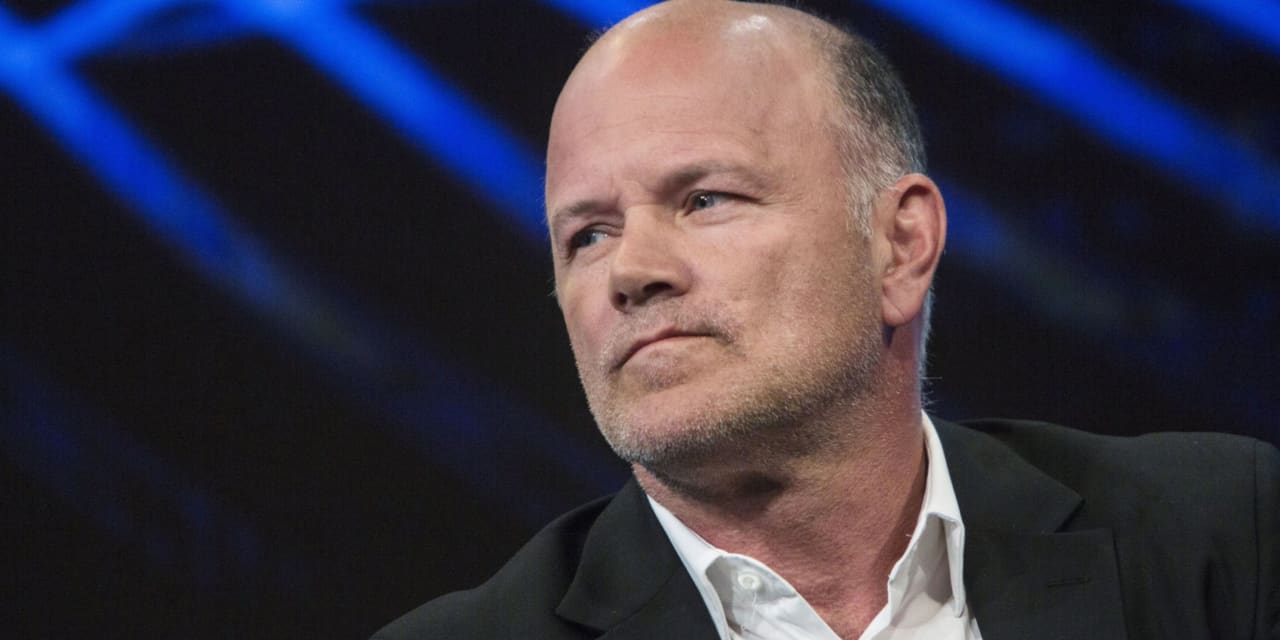

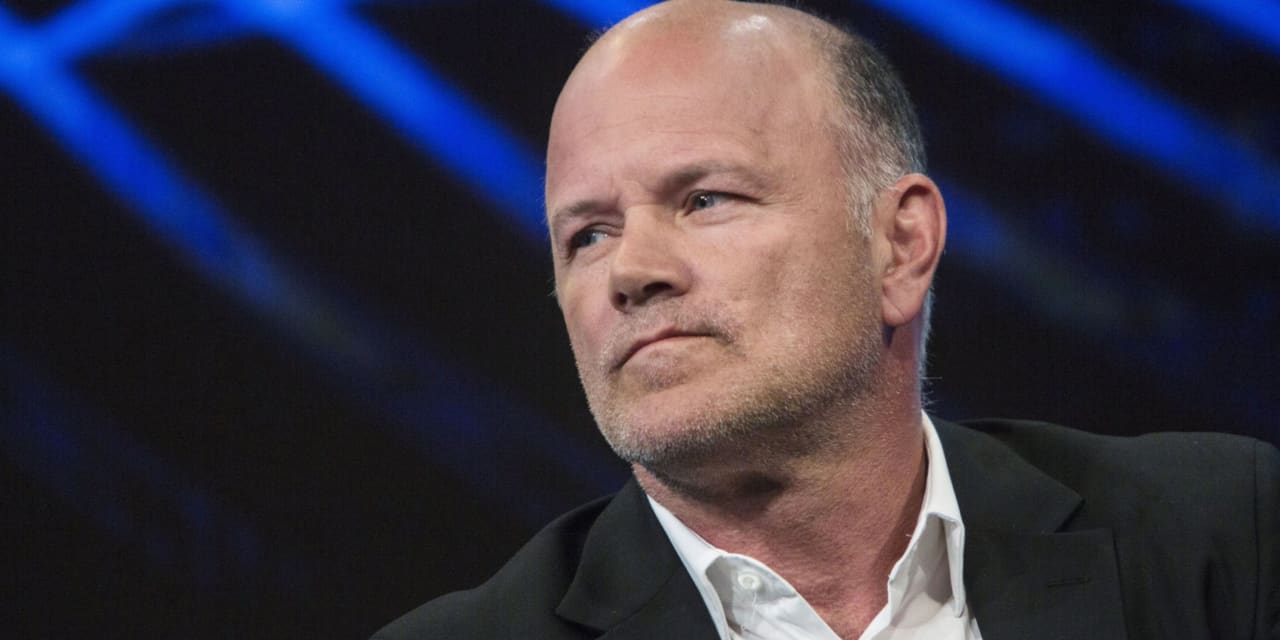

Veteran investor and bitcoin bull Michael Novogratz doesn’t have a rosy outlook on the economy, which he described as headed for a substantial downturn, with the likelihood of a “fast recession” on the horizon.

“The economy is going to collapse,” Novogratz told MarketWatch. “We are going to go into a really fast recession, and you can see that in lots of ways,” he said, in a Wednesday interview before the Federal Reserve decided to undertake its biggest interest-rate hike in nearly three decades.

www.marketwatch.com

www.marketwatch.com

“The economy is going to collapse,” Novogratz told MarketWatch. “We are going to go into a really fast recession, and you can see that in lots of ways,” he said, in a Wednesday interview before the Federal Reserve decided to undertake its biggest interest-rate hike in nearly three decades.

'The economy is going to collapse,' says Wall Street veteran Novogratz. 'We are going to go into a really fast recession.'

Veteran investor and bitcoin bull Michael Novogratz doesn't have a rosy outlook on the economy, as the Fed delivered an unusually aggressive rate increase.

A spate of layoffs is fueling recession anxiety | CNN Business

Two years ago, when the pandemic ushered in the sharpest economic downturn on record, it sparked a tidal wave of layoffs.

Over the past 18 months, America's leaders (political, economic, religious, financial, etc) have plotted a course into the future while looking over the transom. This recession is going to last until a "visionary" appears. This is not about money, it is about fabric... The fabric of America. The country is being dismanteled from the top down. It must be rebuilt from the bottom up. These are very uncertain times.

www.businesstimes.com.sg

www.businesstimes.com.sg

Nearly all of Wall Street – and the Fed – botched calls for 2022

So far, 2022 has been a year where just about everyone on Wall Street got it wrong. As did the Fed and a cadre of global central banks. Read more at The Business Times.

This recession is different, it is worldwide. America can't pull the rest of the world out of the many financial holes they have dug. Before America can pull itself out of this hole, the outflow of USD's (free money) must stop.

JAPAN ran its biggest single-month trade deficit in more than 8 years in May as high commodity prices and declines in the yen swelled imports, clouding the country’s economic outlook.

www.businesstimes.com.sg

www.businesstimes.com.sg

JAPAN ran its biggest single-month trade deficit in more than 8 years in May as high commodity prices and declines in the yen swelled imports, clouding the country’s economic outlook.

Japan posts biggest trade deficit in more than 8 years in May

JAPAN ran its biggest single-month trade deficit in more than 8 years in May as high commodity prices and declines in the yen swelled imports, clouding the country’s economic outlook. Read more at The Business Times.

Worldwide

A survey commissioned by the BBC, published yesterday, revealed that people struggling to make ends meet are cutting back on food and car journeys. More than half (56%) of the 4,011 surveyed said they had bought fewer groceries and around the same amount said they had skipped meals. The survey found people have cut back on socialising and buying clothes, with some saying concern over money was affecting their mental health.

A survey commissioned by the BBC, published yesterday, revealed that people struggling to make ends meet are cutting back on food and car journeys. More than half (56%) of the 4,011 surveyed said they had bought fewer groceries and around the same amount said they had skipped meals. The survey found people have cut back on socialising and buying clothes, with some saying concern over money was affecting their mental health.

“Leaders” are so out of touch with reality, that they believe everything is fine. The news is owned by them too.

"Reality" to a member of Congress is so frightening they have withdrawn into a state of "Denial".“Leaders” are so out of touch with reality, that they believe everything is fine. The news is owned by them too.

Like riding with a driver who is 3X over the alcohol limit. In real life someone would be taking the keys away before the crash.

Goldman Sachs plans to cut thousands of workers. Here are the other major US companies that have made cuts in 2022, from Amazon to Twitter.

Goldman Sachs has become the latest major company with plans to slash its headcount as business growth slows and costs increase.

You have exposed the tip of the iceberg.

Goldman Sachs plans to cut thousands of workers. Here are the other major US companies that have made cuts in 2022, from Amazon to Twitter.

Goldman Sachs has become the latest major company with plans to slash its headcount as business growth slows and costs increase.www.businessinsider.com

The reassuring thing is those with a skill / trade / craft will have a job after those with only a degree are gone. Those with both a degree and a craft can open their own small business. History repeating.

A sustainable homestead will soon be more valuable than a house in the burb's.

Perhaps. But consider that those who are being laid off still made and spent money. That restriction in funds will trickle down to the demand for those in the trades. What the article is failing to point out is that these are mainly internet, services and real estate companies. IOW, mostly companies that rely upon disposable income and a positive view of the ongoing economy. The trades will soon follow due to the follow on impacts of restricted overall income and a general souring of the population's mood about the future.You have exposed the tip of the iceberg.

The reassuring thing is those with a skill / trade / craft will have a job after those with only a degree are gone. Those with both a degree and a craft can open their own small business. History repeating.

A sustainable homestead will soon be more valuable than a house in the burb's.

The big thing to keep in mind is that just like (almost) everyone moved like lemmings in the face of Covid, the general mood of the masses will move in same direction. The lessons of tulip mania are still around and viable.

-“Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, and one by one.”

-“the dangerous practice of stockjobbing, and would divert the genius of the nation from trade and industry. It would hold out a dangerous lure to decoy the unwary to their ruin, by making them part with the earnings of their labour for a prospect of imaginary wealth.”

― Charles MacKay, Extraordinary Popular Delusions & the Madness of Crowds

I wonder what Charles MacKay would have to say about our world today?Perhaps. But consider that those who are being laid off still made and spent money. That restriction in funds will trickle down to the demand for those in the trades. What the article is failing to point out is that these are mainly internet, services and real estate companies. IOW, mostly companies that rely upon disposable income and a positive view of the ongoing economy. The trades will soon follow due to the follow on impacts of restricted overall income and a general souring of the population's mood about the future.

The big thing to keep in mind is that just like (almost) everyone moved like lemmings in the face of Covid, the general mood of the masses will move in same direction. The lessons of tulip mania are still around and viable.

-“Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, and one by one.”

-“the dangerous practice of stockjobbing, and would divert the genius of the nation from trade and industry. It would hold out a dangerous lure to decoy the unwary to their ruin, by making them part with the earnings of their labour for a prospect of imaginary wealth.”

― Charles MacKay, Extraordinary Popular Delusions & the Madness of Crowds

Charles Mackay was a Scottish poet, journalist, author, anthologist, novelist, and songwriter, remembered mainly for his book Extraordinary Popular Delusions and the Madness of Crowds.

Probably the exact same thing, updated with the new names. Human psychology doesn’t change.I wonder what Charles MacKay would have to say about our world today?

Charles Mackay was a Scottish poet, journalist, author, anthologist, novelist, and songwriter, remembered mainly for his book Extraordinary Popular Delusions and the Madness of Crowds.

Ayn Rand would do the same thing...Probably the exact same thing, updated with the new names. Human psychology doesn’t change.

"Not my fault" seems to be the # 1 phrase for the month.

oilprice.com

oilprice.com

Yellen: Government Policies On Energy Not To Blame For Sky-High Prices | OilPrice.com

Treasury Secretary Janet Yellen explained that the government’s policies on energy were not to blame for sky-high energy prices

May be time to change professions for many:

Goldman Sachs plans to cut thousands of workers. Here are the other major US companies that have made cuts in 2022, from Amazon to Twitter.

Goldman Sachs has become the latest major company with plans to slash its headcount as business growth slows and costs increase.www.businessinsider.com

Labor Shortage Stymies Construction Work as $1 Trillion Infrastructure Spending Kicks In

Contractors are dangling an array of benefits—from signing bonuses to housing allowances—to attract and retain workers.

20% is hopeful but I see further

Housing future's is difficult for me to grasp. As prices drop and inflation continues upwards, it may simply be a "wash".... Similar to packaging in the grocery store. A smaller package and an increased price to buy. We have seen all of this before in previous recessions. America is no longer a world leader. It is simply one of the dogs running in the pack. A lot is going to depend on which dog (country) is going to lead the pack.... China, Russia, EU... IDK

housing needs a 50% correction as it's become too unaffordableHousing future's is difficult for me to grasp. As prices drop and inflation continues upwards, it may simply be a "wash".... Similar to packaging in the grocery store. A smaller package and an increased price to buy. We have seen all of this before in previous recessions. America is no longer a world leader. It is simply one of the dogs running in the pack. A lot is going to depend on which dog (country) is going to lead the pack.... China, Russia, EU... IDK

agree on the pack, our leaders who are globalists don't want us to lead but instead be part of the pack. sickening

Maybe it is time for a state's right Constitutional convention and pass a balanced budget amendment.

Well, I can dream can't I?

Well, I can dream can't I?

Can't balance the budget without wrecking fiat based fractional reserve banking. See episode four of Mike Maloney's Hidden Secrets of Money. Heck, watch all ten (they're relatively short). What took me two years of book reading to learn and understand Mike Maloney explains in a ten lessons.

Worldwide

“As consumers move from purchasing stuff to buying services, importers continue to work on balancing order flow with sales expectations,” said Alan Baer, CEO of OL USA. “Some industries are forecasting purchase order reductions of 20 to 30 percent, while others see no interruptions in their order flow. Overall, the risk appears to be to the downside. The decrease appears tied to economic uncertainty and not the migration of operations out of China.”

www.cnbc.com

www.cnbc.com

“As consumers move from purchasing stuff to buying services, importers continue to work on balancing order flow with sales expectations,” said Alan Baer, CEO of OL USA. “Some industries are forecasting purchase order reductions of 20 to 30 percent, while others see no interruptions in their order flow. Overall, the risk appears to be to the downside. The decrease appears tied to economic uncertainty and not the migration of operations out of China.”

Chinese manufacturing orders decline by 20-30%, according to shippers, as consumers pull back on buying goods

As consumers shift spending from goods to services, some shippers are seeing Chinese manufacturing orders drop by as much as 30%, logistics sources tell CNBC.

JPMorgan starts cutting jobs in mortgage unit as homebuying demand cools

More than 1,000 employees will be affected and about half of them will be moved to different divisions within the bank, according to Bloomberg News, which first reported https://www.bloomberg.com/news/articles/2022-06-22/jpmorgan-lays-off-hundreds-in-mortgage-business-after-rate-surge the...

Wow, imagine that......... Certainly a shocker. Appears that The FED Reserve has been asleep at the wheel. And today, it becomes obvious just how "politicized" the FED reserve is with Elizabeth Warren trying to give orders to Jerome Powell..... A puppet show run by Puppets.

JPMorgan starts cutting jobs in mortgage unit as homebuying demand cools

More than 1,000 employees will be affected and about half of them will be moved to different divisions within the bank, according to Bloomberg News, which first reported https://www.bloomberg.com/news/articles/2022-06-22/jpmorgan-lays-off-hundreds-in-mortgage-business-after-rate-surge the...www.yahoo.com

Maybe it is time for a state's right Constitutional convention and pass a balanced budget amendment.

Well, I can dream can't I?

No, the time for that was 20 years ago. We had about $6 trillion in national debt just prior to starting the GWOT. This grew to around $10 trillion after we bailed out the banks; somewhere in-between, Cheney claimed "deficits don't matter" and this basically became religion. Obama nearly doubled it during his time in office, despite "sequestration". Trump added almost $10 trillion in only four years (about $1T/yr in "normal" spending plus Covid stimulus). Potato Joe has added a few trillion of his own in less than two years with much more to come as the infrastructure bill spending ramps.

We're so far down the hole that it does little good to pass such an amendment at this point. It's tilting at windmills.

This can all be lumped under the political-economic theory called "Ron Paul Was Right".

Similar threads

- Replies

- 82

- Views

- 3K

- Replies

- 26

- Views

- 2K

- Replies

- 39

- Views

- 2K