Speaking of . I keep meaning to look up unplugging that cellular antenna

Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Recession - 2022 / 2023 / 2024

- Thread starter Hobo Hilton

- Start date

Talk to an ex-con. I'm sure that is covered in Prison 101Speaking of . I keep meaning to look up unplugging that cellular antenna

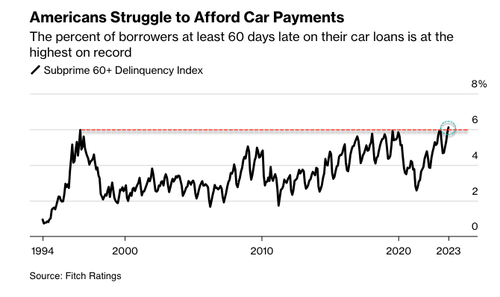

Subprime Auto Loan Delinquency Erupts, Reaching Highest Rate On Record

We have been dutifully tracking the auto sector, considered a leading economic indicator, to pinpoint the arrival of the crushing auto loan crisis and even the possibility of the onset of the next recession. In late January, we cited data from Fitch that revealed consumers are falling behind on auto payments – the most since the peak of the Great Financial Crisis. Fast forward nine months later, to September, that rate just hit the highest level in nearly three decades.

FIRST DOMINO TO FALL

So it begins. As we’ve seen in the Big Short movie/book, the timing of financial implosions is always difficult to predict, but the inevitable outcome of loaning money to people who can’…

www.theburningplatform.com

The trap has been baited.

www.foxbusiness.com

www.foxbusiness.com

Retail credit card rates hit record high

Consumers who shop with an in-store credit card are getting squeezed even more, according to new data that shows a spike in annual percentage rates for those who carry a balance.

Noticing a few changes in some local dealings. There are many good used cars being advertised by "Individual's". An individual is not going to offer a buyer a loan package like a used car lot dealer.

The result is a buyer who has just enough cash (or credit card) to put a down payment on a used car is going to finance it. Chances are that vehicle is going to die or need major repair before the loan get's paid off. In order to take that risk, the loan is going to be on the high end of the interest rate for the date of purchase.

Every recession presents this situation. Deja Vu

www.bankrate.com

www.bankrate.com

The result is a buyer who has just enough cash (or credit card) to put a down payment on a used car is going to finance it. Chances are that vehicle is going to die or need major repair before the loan get's paid off. In order to take that risk, the loan is going to be on the high end of the interest rate for the date of purchase.

Every recession presents this situation. Deja Vu

Auto Loan Rates & Financing in October 2023 | Bankrate

Compare auto loan rates. See rates for new and used car loans and find auto loan refinance rates from lenders.

After Over 100 Years, Gillette Is Pulling Up Stakes in ‘Southie’

title is a bit misleading.........

About 450 manufacturing employees will be offered jobs in Andover and an estimated 750 corporate, engineering and research and development jobs will stay in Boston

IMO - after the move, expect those 750 corp jobs to get cut

Probably an "Accounting Matrix" situation. Valuable land, tax incentives and of course the Politician's.After Over 100 Years, Gillette Is Pulling Up Stakes in ‘Southie’

title is a bit misleading.........

About 450 manufacturing employees will be offered jobs in Andover and an estimated 750 corporate, engineering and research and development jobs will stay in Boston

IMO - after the move, expect those 750 corp jobs to get cut

“I think the U.S. consumer is walking towards a cliff, basically,” Chris Watling, chief executive of financial advisory firm Longview Economics, told CNBC’s “Squawk Box Europe” on Tuesday.

www.cnbc.com

www.cnbc.com

The U.S. consumer is 'walking towards a cliff,' strategist warns

Trouble is brewing for the U.S. consumer, according to one strategist, and a substantial labor market downturn could kick-start a recession.

after

Just need to print more $$.. it's all good, trust the gov“I think the U.S. consumer is walking towards a cliff, basically,” Chris Watling, chief executive of financial advisory firm Longview Economics, told CNBC’s “Squawk Box Europe” on Tuesday.

The U.S. consumer is 'walking towards a cliff,' strategist warns

Trouble is brewing for the U.S. consumer, according to one strategist, and a substantial labor market downturn could kick-start a recession.www.cnbc.com

after

Just need to print more $$.. it's all good, trust the gov

Doing the same thing.... over and over and over, again. Expecting a different result.

More lies from the FED's on inflation. The one truthful line:

Jeffrey Roach, chief economist at LPL Financial. “Eventually, spending will moderate after several months of consumers spending more than they earn.”

www.cnbc.com

www.cnbc.com

Jeffrey Roach, chief economist at LPL Financial. “Eventually, spending will moderate after several months of consumers spending more than they earn.”

Key Fed inflation gauge rose 0.3% as expected in September; spending tops estimate

The core personal consumption expenditures price index was expected to increase 0.3% in September.

Great commentary on current situation: https://www.theepochtimes.com/opini...NYetOOAxLvMfHvF+h0gAW8Y74jUVqGSlOD6b25zJhPg==

Nevertheless, the Treasury recently praised what should have been described as a horrific annual report as proof that "Bidenomics" is working, "building the economy from the middle out and bottom up." Have they not noticed that the middle has imploded, and the bottom has fallen out?

www.foxbusiness.com

www.foxbusiness.com

Treasury just dropped a financial bomb, but Bidenomics means the worst is yet to come

The Biden administration is promising more government spending and multi-trillion-dollar deficits forever.

Great commentary on current situation: https://www.theepochtimes.com/opinion/you-cant-eat-the-gdp-5517535?utm_source=Morningbrief&src_src=Morningbrief&utm_campaign=mb-2023-10-27&src_cmp=mb-2023-10-27&utm_medium=email&cta_utm_source=Morningbrief&est=3TDHE4yqhUrcgcBdwvlMgXpO0ug47WqNYetOOAxLvMfHvF+h0gAW8Y74jUVqGSlOD6b25zJhPg==

But, but, but....

The "Government" does not want you listening at the barbershop. They have no control over that "Free Speech".

Stream in a movie, watch Public Broadcasting Service (PBS) or just surf on that new iPhone... Something safe and controlled.

This sounds crazy but, the "Silver Lining" to this dark cloud is this.... The Government's plans are not sustainable.

Soon the hard landing will take place... No where to escape.

Economists have warned for months that at some point the march higher in bond yields, and the corresponding rise in borrowing costs for everyone from households to governments, will start to bite. This awkward reality of the higher-for-longer interest rate environment is now becoming clearer.

www.ft.com

www.ft.com

Cracks in the credit market are starting to widen

Bankers and investors are wondering when something will snap

www.ft.com

www.ft.com

American cardholders paid a record $130 billion in interest and fees in 2022, according to a new government report.

The study released Tuesday by the Consumer Financial Protection Bureau (CFPB) was part of the government watchdog’s biennial report to Congress. The breakdown: Credit card companies charged consumers more than $105 billion in interest and some $25 billion in fees last year. Overall, it was the "highest amount" recorded in the CFPB’s data history.

The CFPB report comes at a time when outstanding credit card debt has surpassed a record $1 trillion — and pressure from the Federal Reserve’s fight on inflation has continued to push interest rates higher.

For many Americans, the combination of rising debt and interest rates has been hard to manage.

More Americans face 'persistent debt' as interest rates and fees rise, report shows

American cardholders paid a record $130 billion in interest and fees in 2022, according to a new CFPB report.

American cardholders paid a record $130 billion in interest and fees in 2022, according to a new government report.

The study released Tuesday by the Consumer Financial Protection Bureau (CFPB) was part of the government watchdog’s biennial report to Congress. The breakdown: Credit card companies charged consumers more than $105 billion in interest and some $25 billion in fees last year. Overall, it was the "highest amount" recorded in the CFPB’s data history.

The CFPB report comes at a time when outstanding credit card debt has surpassed a record $1 trillion — and pressure from the Federal Reserve’s fight on inflation has continued to push interest rates higher.

For many Americans, the combination of rising debt and interest rates has been hard to manage.

More Americans face 'persistent debt' as interest rates and fees rise, report shows

American cardholders paid a record $130 billion in interest and fees in 2022, according to a new CFPB report.ca.finance.yahoo.com

In December 2021 my card companies all increased my limits by 30%-50% for no reason. I didn’t ask for the increases, and some of the cards hadn’t been used for years. It was just out of the blue.

I remember calling my mom in December 2021 and asking her if her credit card limits got an increase. All of hers did.

We then lol’d about how people were going to spend on credit to the new limits and then be unable to pay, especially if interest rates went up.

Here we are today.

Increasing credit is a valuable indicator of a coming recession... That has happened in the previous 3 - 4 recessions.

That old saying of "Don't bet the farm" came about long before credit cards. The deed for many a farm has gone to the bank when credit collapse.

That old saying of "Don't bet the farm" came about long before credit cards. The deed for many a farm has gone to the bank when credit collapse.

Consumers are not "buying more", they are buying the same item but paying more for it.

The FED is slowly raising interest rates and inflation is always one step ahead of the FED's move.

This is unsustainable.

Hey, Big Spender

Inflation in September rose but consumer spending came in even stronger than economists expected, numbers from the Commerce Department showed on Friday. The core personal consumption expenditures price index, the Fed’s key inflation measure, was 0.3% higher for the month, which was in line with the Dow Jones estimate. Even though prices picked up, personal spending continued, rising 0.7%, which was better than the 0.5% forecast.

www.cnbc.com

www.cnbc.com

The FED is slowly raising interest rates and inflation is always one step ahead of the FED's move.

This is unsustainable.

Hey, Big Spender

Inflation in September rose but consumer spending came in even stronger than economists expected, numbers from the Commerce Department showed on Friday. The core personal consumption expenditures price index, the Fed’s key inflation measure, was 0.3% higher for the month, which was in line with the Dow Jones estimate. Even though prices picked up, personal spending continued, rising 0.7%, which was better than the 0.5% forecast.

CNBC Daily Open: The perfect storm

Markets are looking to wrap up a brutal month, which saw the S&P 500 and Nasdaq indexes slip into correction territory.

Unsustainable

"The market has associated the rise in Treasury yields with deficit concerns and reflects worries about the sustainability of those deficits," said Guneet Dhingra, managing director and head of U.S. rates strategy at Morgan Stanley in New York.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/FFILHBUSJNKLPGKMB4GA4H6XG4.jpg)

www.reuters.com

www.reuters.com

"The market has associated the rise in Treasury yields with deficit concerns and reflects worries about the sustainability of those deficits," said Guneet Dhingra, managing director and head of U.S. rates strategy at Morgan Stanley in New York.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/FFILHBUSJNKLPGKMB4GA4H6XG4.jpg)

PREVIEW US Treasury seen boosting auction sizes as budget deficit worsens

The U.S. Treasury is likely to boost the size of auctions for bills, notes, and bonds in the fourth quarter when it announces its financing plans this week to fund a worsening budget deficit, analysts said.

For all the sheep that have been saying "Thing's can't get any worse".......

___________

The U.S. government’s borrowing needs will decline slightly in the final three months of 2023 from the prior quarter, a potentially important development during a turbulent time for the global bond market.

In a closely watched announcement Monday afternoon, the Treasury Department said it will be looking to borrow $776 billion, which is below the $1.01 trillion in privately held marketable debt the department borrowed in the July-through-September period, the highest ever for that particular quarter.

www.cnbc.com

www.cnbc.com

___________

The U.S. government’s borrowing needs will decline slightly in the final three months of 2023 from the prior quarter, a potentially important development during a turbulent time for the global bond market.

In a closely watched announcement Monday afternoon, the Treasury Department said it will be looking to borrow $776 billion, which is below the $1.01 trillion in privately held marketable debt the department borrowed in the July-through-September period, the highest ever for that particular quarter.

Treasury to borrow $776 billion in the final three months of the year

Officials attributed the lower borrowing needs to higher receipts, which were offset somewhat by greater expenses.

Read it and weep.......

Something to consider after reading the article, could Yellen be working with other central bankers to destroy the economy by design? The wealthy controlling the poor s.

Something to consider after reading the article, could Yellen be working with other central bankers to destroy the economy by design? The wealthy controlling the poor s.

Pay close attention to the last phrase. Debt is the money of slaves. Let that sink in. Even for those American's with large amounts of money in the bank, they are residing in a country that is operating on debt. Unfortunately that debt is growing by leaps and bounds. Maintaining such a tremendous debt is not sustainable.

Not long ago it was a big deal for someone to reach the level of being a millionaire. Not hearing that any more, now the big deal is to become a billionaire. Inflation....

American's are just starting to feel like a turnip...

While respondents to the CNBC Fed Survey expect no additional rate hikes from the Federal Reserve, they have fully embraced its “higher-for-longer” mantra to the point where no rate cuts are expected until the third quarter of 2024.

Markets are on board with the Fed's ‘higher for longer’ policy, CNBC survey shows

Respondents, including economists, strategists and analysts, believe the Fed is now on hold into September of next year.

The federal budget deficit, an on-again, off-again concern for the US electorate and economy, is back on and may stay that way for a while. Chronic challenges such as America’s aging population – as more people retire, the government has to shell out more in Social Security pension payments and Medicare health benefits – have been compounded in recent years by tax cuts and spending binges, swelling the gap between revenue raised and funding appropriated. By raising interest rates to their highest levels in more than 20 years to fight inflation, the Federal Reserve has made the cost of financing those deficits go up as well.

Through the first 11 months of the fiscal year ending on Sept. 30, the deficit was $1.5 trillion, up sharply from $946 billion in the comparable period a year earlier. That sort of surge would usually happen only when the government is in recession-fighting mode, not when the economy is growing at a decent clip. Even judged in the context of the US economy, the deficit is imposing. It’s expected to clock in at about 6% of gross domestic product this year – a level never reached in the six decades between the aftermath of World War II and the 2008 crash. And each annual deficit adds to an already mammoth amount of publicly held debt — $26.3 trillion as of Sept. 29, nearly the size of the economy.

www.bloomberg.com

www.bloomberg.com

Through the first 11 months of the fiscal year ending on Sept. 30, the deficit was $1.5 trillion, up sharply from $946 billion in the comparable period a year earlier. That sort of surge would usually happen only when the government is in recession-fighting mode, not when the economy is growing at a decent clip. Even judged in the context of the US economy, the deficit is imposing. It’s expected to clock in at about 6% of gross domestic product this year – a level never reached in the six decades between the aftermath of World War II and the 2008 crash. And each annual deficit adds to an already mammoth amount of publicly held debt — $26.3 trillion as of Sept. 29, nearly the size of the economy.

Why Americans Are Concerned About the Budget Deficit – Again

The federal budget deficit, an on-again, off-again concern for the US electorate and economy, is back on and may stay that way for a while. Chronic challenges such as America’s aging population – as more people retire, the government has to shell out more in Social Security pension payments and...

The plan to bankrupt America. Dig a financial hole so deep that it can never climb out.

Debt is the money of slaves.

Billionaire investor Stanley Druckenmiller said the federal government has been spending recklessly and failed to issue debt at low rates in past years, mistakes that will ultimately lead to some tough choices in the future like cutting Social Security.

“We are spending like drunken sailors,” Druckenmiller said on CNBC’s “Squawk Box” Wednesday. “Don’t forget pre-Covid ... the federal government was 20% of GDP in spending. Now it’s 25% of GDP ... My father told me if you’re in a hole, stop digging Stan.”

The legendary investor, who now runs Duquesne Family Office, said he was disappointed to find out that the White House is seeking another $56 billion in emergency spending for disaster relief and childcare programs, in addition to the $106 billion the administration wants for Israel and Ukraine.

www.cnbc.com

www.cnbc.com

Debt is the money of slaves.

Billionaire investor Stanley Druckenmiller said the federal government has been spending recklessly and failed to issue debt at low rates in past years, mistakes that will ultimately lead to some tough choices in the future like cutting Social Security.

“We are spending like drunken sailors,” Druckenmiller said on CNBC’s “Squawk Box” Wednesday. “Don’t forget pre-Covid ... the federal government was 20% of GDP in spending. Now it’s 25% of GDP ... My father told me if you’re in a hole, stop digging Stan.”

The legendary investor, who now runs Duquesne Family Office, said he was disappointed to find out that the White House is seeking another $56 billion in emergency spending for disaster relief and childcare programs, in addition to the $106 billion the administration wants for Israel and Ukraine.

Stanley Druckenmiller says government needs to stop spending like 'drunken sailors,' cut entitlements

Stanley Druckenmiller said the federal government has been spending recklessly and failed to issue debt at low rates in past years.

Construction wise, America is building less. Dollar wise, America is spending more. Unsustainable.

Inflation marches on.

Construction data matched expectations on Wall Street

Construction spending rose in September, as companies and the government continued to ramp up projects across the U.S.

Spending on construction projects rose 0.4% in September to nearly $2 trillion, the Commerce Department reported Wednesday.

The figure matched expectations on Wall Street. Economists were expecting construction spending to rise 0.4% in September.

Construction spending reveals how much the government and private companies spend on projects, from housing to highways. The more the U.S. spends on construction, the higher the level of economic activity.

The government revised spending on construction in August to 1% from an initial read of a 0.5% increase.

www.morningstar.com

www.morningstar.com

Inflation marches on.

Construction data matched expectations on Wall Street

Construction spending rose in September, as companies and the government continued to ramp up projects across the U.S.

Spending on construction projects rose 0.4% in September to nearly $2 trillion, the Commerce Department reported Wednesday.

The figure matched expectations on Wall Street. Economists were expecting construction spending to rise 0.4% in September.

Construction spending reveals how much the government and private companies spend on projects, from housing to highways. The more the U.S. spends on construction, the higher the level of economic activity.

The government revised spending on construction in August to 1% from an initial read of a 0.5% increase.

U.S. construction spending rises for the ninth month in a row in September

Worldwide

For the thirteenth month in a row, manufacturing firms continued cutting jobs, the survey showed, although the rate slowed slightly compared to previous months.

oilprice.com

oilprice.com

For the thirteenth month in a row, manufacturing firms continued cutting jobs, the survey showed, although the rate slowed slightly compared to previous months.

UK Manufacturing Faces Worst Downturn Since 2008 | OilPrice.com

The UK's manufacturing sector is experiencing its worst downturn since the 2008 financial crisis, with challenges including decreased demand and market uncertainties.

Shipping giant Maersk, a bellwether for global trade, on Friday announced plans to reduce its workforce by more than 10,000 people and said it expected profit to be at the low end of prior guidance.

The firm’s Denmark-listed shares had fallen 18% by early afternoon to their lowest level since October 2020.

“Our industry is facing a new normal with subdued demand, prices back in line with historical levels and inflationary pressure on our cost base,” CEO Vincent Clerc said in a statement, adding that overcapacity in most regions had driven down prices.

www.cnbc.com

www.cnbc.com

The firm’s Denmark-listed shares had fallen 18% by early afternoon to their lowest level since October 2020.

“Our industry is facing a new normal with subdued demand, prices back in line with historical levels and inflationary pressure on our cost base,” CEO Vincent Clerc said in a statement, adding that overcapacity in most regions had driven down prices.

Shares of Maersk plunge 18% as shipping giant announces 10,000 job cuts, says profit will be at lower-end of guidance

Maersk, a bellwether for global trade, said it was facing subdued demand and inflationary pressures.

This is an example of a "very nice article telling American's not to worry, the Government is here and everything will be OK".

The fallacy is the numbers, graphs and forecast all came from "The Government". Not one quote from a guy who's home owner's insurance and his electric bill both went up 20% from one year ago. Not one quote from a worker who just got laid off. Not one quote from a Mom with a credit card balance of $10k from buying food to feed her family or to keep an old beater running. American's are either ignoring or in denial of how things are deteriorating.

Hoping for a soft landing is an unattainable mirage.

WASHINGTON, Nov 3 (Reuters) - The October jobs report likely was a relief to Federal Reserve officials who hope the U.S. economy can edge down softly from a period of high inflation and torrid job growth without rolling over into recession under the weight of their own rate hikes and overall tougher credit conditions.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/7SZOVWX33ZNVPHMJRCSFA3GVQI.jpg)

www.reuters.com

www.reuters.com

The fallacy is the numbers, graphs and forecast all came from "The Government". Not one quote from a guy who's home owner's insurance and his electric bill both went up 20% from one year ago. Not one quote from a worker who just got laid off. Not one quote from a Mom with a credit card balance of $10k from buying food to feed her family or to keep an old beater running. American's are either ignoring or in denial of how things are deteriorating.

Hoping for a soft landing is an unattainable mirage.

WASHINGTON, Nov 3 (Reuters) - The October jobs report likely was a relief to Federal Reserve officials who hope the U.S. economy can edge down softly from a period of high inflation and torrid job growth without rolling over into recession under the weight of their own rate hikes and overall tougher credit conditions.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/7SZOVWX33ZNVPHMJRCSFA3GVQI.jpg)

Three job signals to console the Fed, and a yellow flag

The October jobs report likely was a relief to Federal Reserve officials who hope the U.S. economy can edge down softly from a period of high inflation and torrid job growth without rolling over into recession under the weight of their own rate hikes and overall tougher credit conditions.

When Citigroup CEO Jane Fraser announced in September that her sweeping corporate overhaul would result in an undisclosed number of layoffs, a jolt of fear ran through many of the bank’s 240,000 souls.

“We’ll be saying goodbye to some very talented and hard-working colleagues,” she warned in a memo.

www.cnbc.com

www.cnbc.com

“We’ll be saying goodbye to some very talented and hard-working colleagues,” she warned in a memo.

Citigroup considers deep job cuts for CEO Jane Fraser’s overhaul, called 'Project Bora Bora'

Citigroup CEO Jane Fraser may preside over some of Wall Street's deepest job cuts in years as she faces mounting pressure to fix the third-largest U.S. bank.

FedEx said on Monday it is encouraging pilots to seek work flying for a unit of American Airlines Group as the U.S. parcel giant grapples with a slowdown in e-commerce demand.

The global shipping downturn has been a margin drag for most operators in the logistics sector and FedEx too was met with a daunting task of matching costs to lower demand after the e-commerce bubble burst with customers returning to their pre-pandemic lifestyles.

“Given the softness in air cargo demand across the industry and current FedEx flight operations staffing levels, we shared information about this unique opportunity with our pilots,” FedEx said in a statement.

www.cnbc.com

www.cnbc.com

The global shipping downturn has been a margin drag for most operators in the logistics sector and FedEx too was met with a daunting task of matching costs to lower demand after the e-commerce bubble burst with customers returning to their pre-pandemic lifestyles.

“Given the softness in air cargo demand across the industry and current FedEx flight operations staffing levels, we shared information about this unique opportunity with our pilots,” FedEx said in a statement.

FedEx suggests pilots to fly for American Airlines as cargo demand slows

FedEx is encouraging pilots to seek work flying for a unit of American Airlines Group as the U.S. parcel giant grapples with a slowdown in e-commerce demand.

Certain segments of society never feel a recession.Nothing ever happens. Been waiting for the big crash for years.

Those in prison.

Those "Baby Mama's" who pop out another kid when they need a bit more government income.

Those on the payroll of the Federal Government get those COLA adjustments while working at the same job, year after year.

The 1 million illegal's get the free housing, medical care, education, etc and never have to pay a penny more.

Repo man stay's busy during a recession.

Many profit off of a recession.

So, you are correct... The working middle class will report on any recessions.

Certain segments of society never feel a recession.

Those in prison.

Those "Baby Mama's" who pop out another kid when they need a bit more government income.

Those on the payroll of the Federal Government get those COLA adjustments while working at the same job, year after year.

The 1 million illegal's get the free housing, medical care, education, etc and never have to pay a penny more.

Repo man stay's busy during a recession.

Many profit off of a recession.

So, you are correct... The working middle class will report on any recessions.

Oh man I wish it were only 1 million.

closer to 8m in the last 2 years.....that's more pop than the state of AZOh man I wish it were only 1 million.

WeWork, once valued at $47 billion, files for bankruptcy

Office-sharing company WeWork filed for Chapter 11 bankruptcy protection in federal court Monday.

Surprised this one lasted so long.

Inflation

Americans now owe $1.08 trillion on their credit cards, according to a new report on household debt from the Federal Reserve Bank of New York.

Credit card balances spiked by $154 billion year over year, notching the largest increase since 1999, the New York Fed found.

“Credit card balances experienced a large jump in the third quarter, consistent with strong consumer spending and real GDP growth,” said Donghoon Lee, the New York Fed’s economic research advisor.

Americans now owe $1.08 trillion on their credit cards, according to a new report on household debt from the Federal Reserve Bank of New York.

Credit card balances spiked by $154 billion year over year, notching the largest increase since 1999, the New York Fed found.

“Credit card balances experienced a large jump in the third quarter, consistent with strong consumer spending and real GDP growth,” said Donghoon Lee, the New York Fed’s economic research advisor.

The FED Reserve (Jerome Powell) have decided to just do nothing. Similar to a fireman just letting a fire burn itself out.

In both cases there will be a lot of collateral damage.

So much for the idea that a “housing recession” would reverse some of the outsized price gains in homes. The U.S. housing market had finally started slowing in late 2022, and home prices seemed poised for a correction. But a strange thing happened on the way to the housing crash: Home values started rising again.

In both cases there will be a lot of collateral damage.

So much for the idea that a “housing recession” would reverse some of the outsized price gains in homes. The U.S. housing market had finally started slowing in late 2022, and home prices seemed poised for a correction. But a strange thing happened on the way to the housing crash: Home values started rising again.

Is The Housing Market Going To Crash? | Bankrate

The market has certainly been volatile. But prices remain at record levels, and experts agree that there will be no housing market crash.

www.bankrate.com

The FED Reserve (Jerome Powell) have decided to just do nothing. Similar to a fireman just letting a fire burn itself out.

In both cases there will be a lot of collateral damage.

So much for the idea that a “housing recession” would reverse some of the outsized price gains in homes. The U.S. housing market had finally started slowing in late 2022, and home prices seemed poised for a correction. But a strange thing happened on the way to the housing crash: Home values started rising again.

Is The Housing Market Going To Crash? | Bankrate

The market has certainly been volatile. But prices remain at record levels, and experts agree that there will be no housing market crash.www.bankrate.com

Jerome powell's not worried, he can still afford food.

His Sergeant's are distancing themselves from him. They all have their compounds well stocked.Jerome powell's not worried, he can still afford food.

Soft landing will be 'difficult,' says PE veteran

THL co-CEO Scott Sperling warns pulling off a soft landing — an ideal scenario in which the Federal Reserve curbs inflation without triggering a severe downturn — will be "very, very difficult."

The rise in delinquencies comes as banks have been tightening lending standards.

According to the Federal Reserve’s October Senior Loan Officer Opinion Survey on Bank Lending Practices, lending standards have tightened for residential real estate loans…

ca.finance.yahoo.com

ca.finance.yahoo.com

According to the Federal Reserve’s October Senior Loan Officer Opinion Survey on Bank Lending Practices, lending standards have tightened for residential real estate loans…

Rising delinquencies offer economic warning signs

While the overall data indicate continued economic growth, there are signs of stress developing that bear watching.

Expert details the impacts the 'Great Trucking Recession' will have on Americans

America's trucking industry serves as an indicator of the mood of consumers and their pocketbooks, and one expert warns the industry is in a dire state.

J.B. Hunt misses profit estimates as freight volumes remain depressed

J B Hunt Transport Services on Tuesday missed profit estimates for the third quarter, as the logistics provider grapples with a drop in e-commerce volumes and elevated costs.

The Trucking Bubble Has Burst

During the pandemic, the trucking industry boomed. Now, some drivers are fighting debt and homelessness.

US economy tops trucking industry’s list of challenges

The shaky U.S. economy occupied the No. 1 spot for motor carriers in the latest American Transportation Research Institute survey of top trucking issues revealed by ATRI President Rebecca Brewster.

www.freightwaves.com

www.freightwaves.com

Last edited:

Friday, after the close:

Moody’s Investors Service lowered its ratings outlook on the United States’ government to negative from stable, pointing to rising risks to the nation’s fiscal strength.

Monday morning, before the open:

Shares of Boeing Co. climbed on Monday following a flurry of deal news, and a report that the Chinese government may be close to lifting a commercial freeze on its 737 Max jetliner. The stock climbed 3.6% in premarket

A bump for the index funds.... as Rome burns

Moody’s Investors Service lowered its ratings outlook on the United States’ government to negative from stable, pointing to rising risks to the nation’s fiscal strength.

Monday morning, before the open:

Shares of Boeing Co. climbed on Monday following a flurry of deal news, and a report that the Chinese government may be close to lifting a commercial freeze on its 737 Max jetliner. The stock climbed 3.6% in premarket

A bump for the index funds.... as Rome burns

2024 will bring "More of the Same"....

Consensus forecast is for continued growth for U.S. economy, low unemployment although risks remain

Ever since the pandemic started to lose its grip on the economy in 2022, fears of a recession have waxed and waned. Most of 2023 was spent awaiting the downturn. And with less than two more months left in this calendar yet, these concerns have naturally shifted to 2024.

But gradually, a new outlook has emerged that asks "why must there be a landing at all?"

Because, due to inflation, this is not sustainable.

www.morningstar.com

www.morningstar.com

Consensus forecast is for continued growth for U.S. economy, low unemployment although risks remain

Ever since the pandemic started to lose its grip on the economy in 2022, fears of a recession have waxed and waned. Most of 2023 was spent awaiting the downturn. And with less than two more months left in this calendar yet, these concerns have naturally shifted to 2024.

But gradually, a new outlook has emerged that asks "why must there be a landing at all?"

Because, due to inflation, this is not sustainable.

Economists embrace notion of 'no landing' for economy in 2024

This situation reminds me of a guy opening his maxed out credit card bill and saying "We just need to tighten up".... No big deal.

Markets on Monday shrugged at a warning Friday from Moody’s Investor’s Service that it was lowering its ratings outlook on Treasurys.

www.cnbc.com

www.cnbc.com

Markets on Monday shrugged at a warning Friday from Moody’s Investor’s Service that it was lowering its ratings outlook on Treasurys.

Moody's warning on the massive U.S. debt burden has turned into a nonevent

There was a time when bad news about U.S. debt would send markets into a tailspin, but that time apparently has passed.

Today's mirage:

Inflation was flat in October from the previous month,

Inflation is still eating your money:

The consumer price index, which measures a broad basket of commonly used goods and services, increased 3.2% from a year ago

Inflation was flat in October from the previous month,

Inflation is still eating your money:

The consumer price index, which measures a broad basket of commonly used goods and services, increased 3.2% from a year ago

Similar threads

- Replies

- 26

- Views

- 1K

- Replies

- 0

- Views

- 56

- Replies

- 0

- Views

- 111

- Replies

- 7

- Views

- 882