Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Recession - 2022 / 2023 / 2024

- Thread starter Hobo Hilton

- Start date

All quiet as the "Bubble" is being pumped up.Soft landing or calm before the storm?

The CNBC writer is making an attempt to "Put Lipstick On A Pig". Always a few morning headlines about how there is a possibility of a "Soft Landing". As 2023 comes to an end, all the airplane has done is to circle the airport. Americans are running out of cash and will fund meager holiday purchases with a Credit Card. Both the FED Reserve and this Administration continue to lead the country farther down this rabbit hole. Unfortunate,

Target on Wednesday topped Wall Street’s quarterly sales expectations and blew past earnings estimates, as purchases in high-frequency categories like food and beauty helped prop up weaker customer spending.

www.cnbc.com

www.cnbc.com

Target on Wednesday topped Wall Street’s quarterly sales expectations and blew past earnings estimates, as purchases in high-frequency categories like food and beauty helped prop up weaker customer spending.

Target shares jump after retailer posts a big earnings beat, even as sales fall again

Target is still catering to shoppers who are hungry for deals and aren't buying much more than the necessities.

As the FED Reserve sat on it's ass, inflation did what the FED should have done. As a result inflation has not been licked, Middle Class Americans are maxing out their credit cards, Government increases taxes / fees while running up the US deficit. The "Perfect Storm".. Is there going to be a new rifle under your Christmas tree along with a case of ammo ?

Retail sales, a measure of how much consumers spent on a number of everyday goods including cars, food and gasoline, fell 0.1% in October, the Commerce Department said Wednesday. That is above the 0.3% decline projected by Refinitiv economists but below the revised 0.9% gain recorded in September.

www.foxbusiness.com

www.foxbusiness.com

Retail sales, a measure of how much consumers spent on a number of everyday goods including cars, food and gasoline, fell 0.1% in October, the Commerce Department said Wednesday. That is above the 0.3% decline projected by Refinitiv economists but below the revised 0.9% gain recorded in September.

Retail sales drop in October for first time in 7 months

Retail sales fell in October for the first time in seven months as consumers pulled back on spending in the face of inflation and high interest rates.

Last edited:

Mirage...

/cloudfront-us-east-2.images.arcpublishing.com/reuters/QL4K676HCFNU5JBQUTYT76LF34.jpg)

Fed President Daly warns against calling time on rate-rising cycle too soon - FT

San Francisco Federal Reserve President Mary Daly warned against calling time on rate-rising cycle too soon, in an interview to Financial Times on Wednesday.

Wait.. since April 2023 or April 2020?U.S. retail sales in November fell for the first time in seven months,

...

It marked the first month-over-month drop since April, when the coronavirus pandemic forced businesses around the country to close and shoppers were directed to stay at home.

Wait.. since April 2023 or April 2020?

Retail sales drop in October for first time in 7 months

Retail sales fell in October for the first time in seven months as consumers pulled back on spending in the face of inflation and high interest rates.

Yeah, was trying to figure out the text you quoted about since the start of the pandemic. Looks like the article was updated to remove the obvious mistake.

The fog cleared, momentarily, today in my crystal ball.

Running a household today with inflation, 3 - 4 kids, crappy job and a maxed out credit card with an income of less than $75k is a challenge.

Walmart, today, gave America a glimpse of the next 12 months.

Merry Christmas

Pew defines “middle class” as those earning between two-thirds and twice the median American household income, which in 2021 was $70,784, according to the United States Census Bureau. That means American households earning as little as $47,189 and up to $141,568 are technically in the middle class.Jan 2, 2023

www.cnbc.com

www.cnbc.com

Running a household today with inflation, 3 - 4 kids, crappy job and a maxed out credit card with an income of less than $75k is a challenge.

Walmart, today, gave America a glimpse of the next 12 months.

Merry Christmas

Pew defines “middle class” as those earning between two-thirds and twice the median American household income, which in 2021 was $70,784, according to the United States Census Bureau. That means American households earning as little as $47,189 and up to $141,568 are technically in the middle class.Jan 2, 2023

Here's how much money it takes to be considered middle class in 20 major U.S. cities

There are countless definitions of "middle class." See which incomes qualify as middle class in the largest U.S. metros based on one calculation.

Today's headline:

www.morningstar.com

www.morningstar.com

U.S. housing starts rise for the second straight month

Welcome to the "Number's Game". This is a half-hearted attempt to make "We the People" think things are getting better. There are more apartments (multi-family) being built. The chance of a person buying / occupying a SFR is dwindling. Don't be fooled by the Government's numbers. That is what got America into this unsustainable mess.U.S. housing starts rise for the second straight month

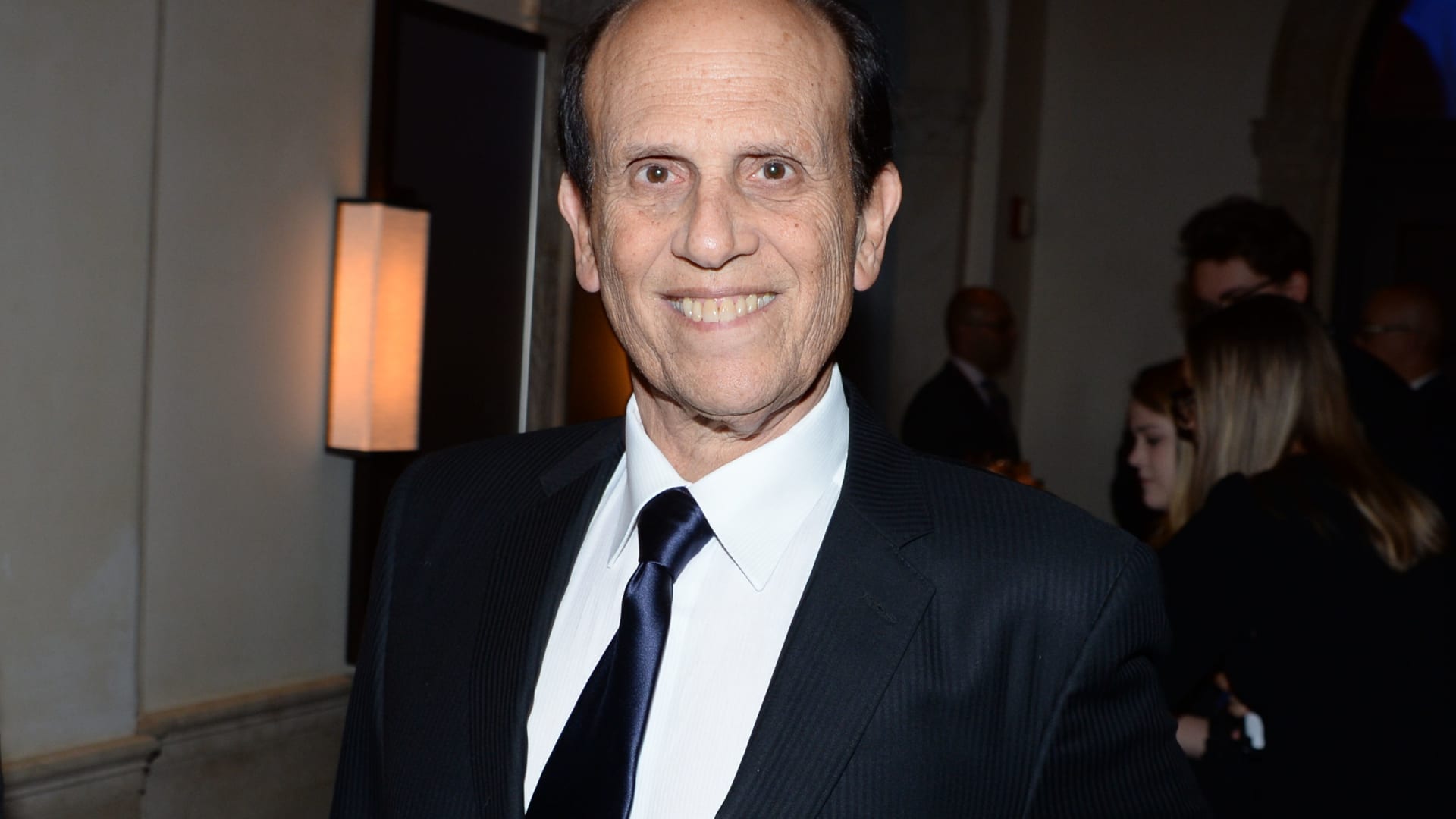

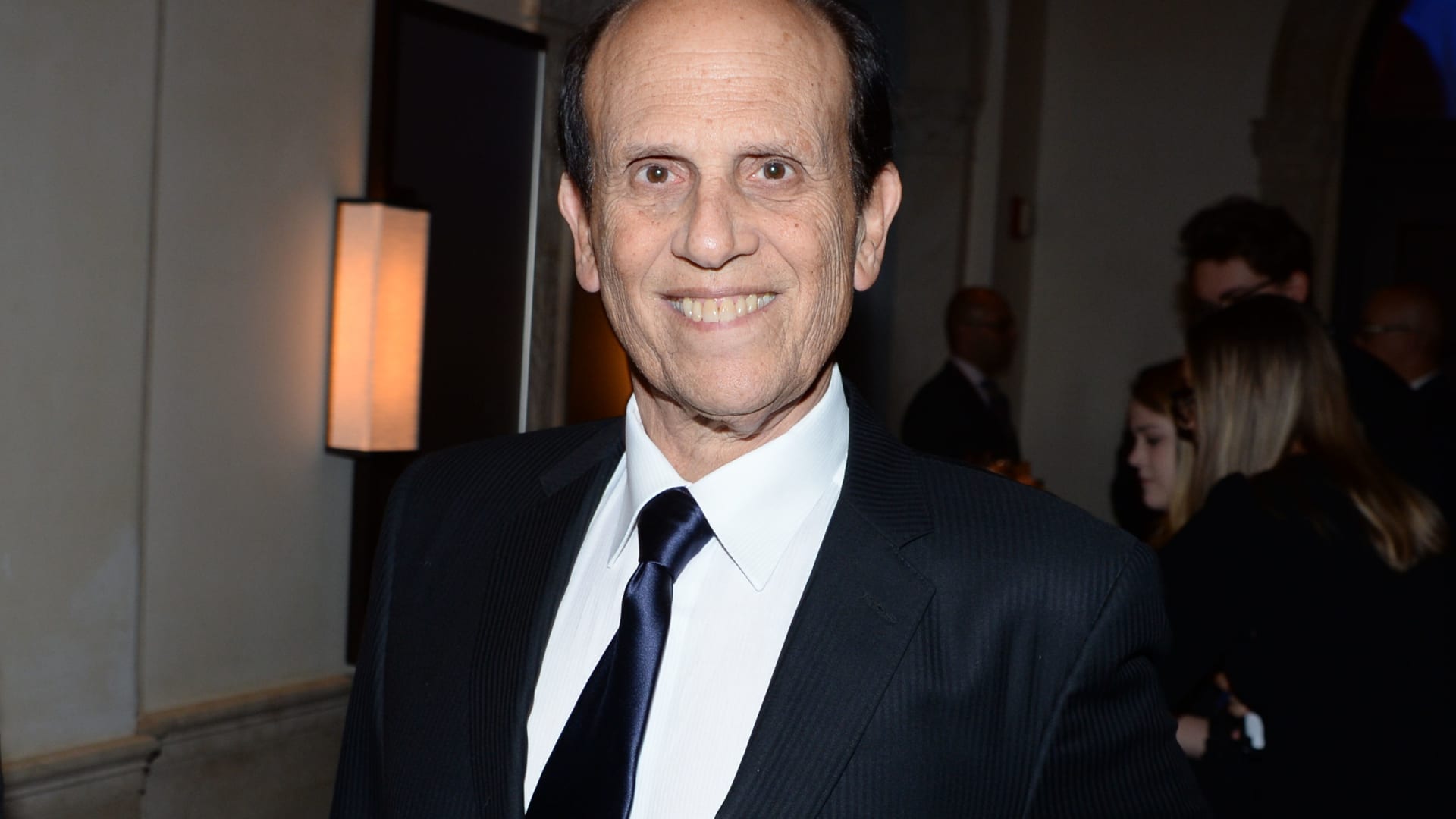

Soaring U.S. government debt is reaching a point where it will begin creating larger problems, Bridgewater Associates founder Ray Dalio said Friday.

The hedge fund titan warned during a CNBC appearance that the need to borrow more and more to cover deficits will exacerbate the political and social problems the country is facing.

“Economically strong means financially strong,” Dalio said on “Squawk Box.” “Financially strong means: do you earn more than you spend? Do you have a good income statement as a country? And do we have a good balance sheet?”

www.cnbc.com

www.cnbc.com

The hedge fund titan warned during a CNBC appearance that the need to borrow more and more to cover deficits will exacerbate the political and social problems the country is facing.

“Economically strong means financially strong,” Dalio said on “Squawk Box.” “Financially strong means: do you earn more than you spend? Do you have a good income statement as a country? And do we have a good balance sheet?”

Ray Dalio says U.S. reaching an inflection point where the debt problem quickly gets even worse

Soaring U.S. government debt is reaching a point where it will begin creating larger problems, the hedge fund titan said Friday.

The FED... Circling the airport waiting on perfect conditions for a soft landing. Running low on fuel and the weather is closing in.

apnews.com

apnews.com

Key Fed official sees possible 'golden path' toward lower inflation without a recession

Austan Goolsbee, president of the Federal Reserve Bank of Chicago, suggested that the economy appears to be on what he calls the “golden path,” another term for what economists often term a “soft landing,” in which the Fed would curb inflation without causing a deep recession.

WASHINGTON (AP) — Inflation has reached its lowest point in 2 1/2 years. The unemployment rate has stayed below 4% for the longest stretch since the 1960s. And the U.S. economy has repeatedly defied predictions of a coming recession. Yet according to a raft of polls and surveys, most Americans hold a glum view of the economy.

The disparity has led to befuddlement, exasperation and curiosity on social media and in opinion columns.

Last week, the government reported that consumer prices didn’t rise at all from September to October, the latest sign that inflation is steadily cooling from the heights of last year. A separate report showed that while Americans slowed their retail purchases in October from the previous month’s brisk pace, they’re still spending enough to drive economic growth.

Even so, according to a poll last month by The Associated Press-NORC Center for Public Affairs Research, about three-quarters of respondents described the economy as poor. Two-thirds said their expenses have risen. Only one-quarter said their income has.

apnews.com

apnews.com

The disparity has led to befuddlement, exasperation and curiosity on social media and in opinion columns.

Last week, the government reported that consumer prices didn’t rise at all from September to October, the latest sign that inflation is steadily cooling from the heights of last year. A separate report showed that while Americans slowed their retail purchases in October from the previous month’s brisk pace, they’re still spending enough to drive economic growth.

Even so, according to a poll last month by The Associated Press-NORC Center for Public Affairs Research, about three-quarters of respondents described the economy as poor. Two-thirds said their expenses have risen. Only one-quarter said their income has.

Why Americans feel gloomy about the economy despite falling inflation and low unemployment

Inflation has reached its lowest point in 2 1/2 years. The unemployment rate has stayed below 4% for the longest stretch since the 1960s.

A good summary of where Americans are, financially. A homeowner will finance a new roof but put off painting the living room.

In a news release, CEO Marvin Ellison said the company felt a “greater-than-expected pullback” by customers on discretionary projects and big-ticket purchases. Yet he said its sales to home professionals, which are accounting for a growing share of its revenue, rose in the quarter. Those pros drive about 25% of its business.

www.cnbc.com

www.cnbc.com

In a news release, CEO Marvin Ellison said the company felt a “greater-than-expected pullback” by customers on discretionary projects and big-ticket purchases. Yet he said its sales to home professionals, which are accounting for a growing share of its revenue, rose in the quarter. Those pros drive about 25% of its business.

Lowe's cuts sales outlook as homeowners take on fewer projects; shares slide

Lowe's cut its full-year sales and earnings outlook as it said homeowners were taking on fewer do-it-yourself projects.

Here is an inflation number the US Government can't bury.The credit card is maxed out.

Of the government outlays last year, some $659 billion went for net interest on the accumulated debt, up from $475 billion in fiscal 2022.

www.cnbc.com

www.cnbc.com

Of the government outlays last year, some $659 billion went for net interest on the accumulated debt, up from $475 billion in fiscal 2022.

U.S. wraps up fiscal year with a budget deficit near $1.7 trillion, up 23%

The U.S. ended up with an imbalance of $1.695 trillion, up about $320 billion, or 23.2%, from fiscal 2022.

A decent amount of low hours tractors and other equipment is hitting our local tractor dealers. New inventory isn’t moving.

I’ve started buying Romex again since it’s been hitting sales forums for $345 per 1000’ of 12/2.

Picked up a low usage 3 phase Original Saw woodcutting radial arm saw for $1,500.

I’ve been seeing a lot of blow out sales on larger woodworking equipment.

Watches are cheaper

ATV and UTV dealers dropping prices.

The signs are there. I expect the true fire sales to begin summer of 2024 after everyone has blown their tax refunds.

When JPOW talks of inflation and soft landings he is not referencing those making $200k plus. He needs the average Joe to stop buying things.

I’ve started buying Romex again since it’s been hitting sales forums for $345 per 1000’ of 12/2.

Picked up a low usage 3 phase Original Saw woodcutting radial arm saw for $1,500.

I’ve been seeing a lot of blow out sales on larger woodworking equipment.

Watches are cheaper

ATV and UTV dealers dropping prices.

The signs are there. I expect the true fire sales to begin summer of 2024 after everyone has blown their tax refunds.

When JPOW talks of inflation and soft landings he is not referencing those making $200k plus. He needs the average Joe to stop buying things.

I have a couple of local, online auctions I follow here. I have witnessed about 10% of the items go for outrageously high prices. Silver coins go for just about what the dealers are selling them for. Brand name weapons go for a premium. The other 90% goes really cheap. I think here, the deal is having to travel too far for the cheap stuff. In my case it would be a 2 hour round trip to pay and pick up an item I won with the bidding.A decent amount of low hours tractors and other equipment is hitting our local tractor dealers. New inventory isn’t moving.

I’ve started buying Romex again since it’s been hitting sales forums for $345 per 1000’ of 12/2.

Picked up a low usage 3 phase Original Saw woodcutting radial arm saw for $1,500.

I’ve been seeing a lot of blow out sales on larger woodworking equipment.

Watches are cheaper

ATV and UTV dealers dropping prices.

The signs are there. I expect the true fire sales to begin summer of 2024 after everyone has blown their tax refunds.

When JPOW talks of inflation and soft landings he is not referencing those making $200k plus. He needs the average Joe to stop buying things.

The "shocker" that I am hearing from with friends and family is the 20% increase (over the past 6 months) in the vehicle insurance. Historically the insurance has gone down as the vehicle aged. Most are upping the deductible or just going with the bare bones liability required by law.

Very few popular tractors are coming on the market. But again, I am seeing lots of brand new, top shelf skid steer loaders (with tracks) moving around here in the valley. Some will stay busy during the winter snow plowing but many are on a rental contract and will go back to the CAT dealer when things slow down.

A few examples:

2012 John Deere skid steer - farm & garden - by owner - sale - craigslist

2012 John Deere 326d skid steer for sale. Has all new tires, a new joy stick. Ac heat air ride seat radio and you can switch bucket to forks from cab. Clean machine 40000 obo text or calls only....

missoula.craigslist.org

Bobcat T450 Skid Steer Closed Cab - heavy equipment - by dealer - sale - craigslist

Bobcat T450 Closed Cab Heat and A/C (not cold) 2 Speed Travel Hydraulic Bucket Coupler New Tracks Hand and Foot Control Hours 1100 Year 2017 Snowy River Equipment Sales, LLC "Quality Machines...

missoula.craigslist.org

2020 Kubota SVL75-2 Skid Steer Loader - heavy equipment - by dealer - sale - craigslist

2020 Kubota SVL75-2 Skid Steer Loader 238 Hours 15" Rubber Tracks, 2 Speed Travel, 74.3 Horsepower, 75" Bucket, Air Conditioning, Air Suspension Seat, Auxiliary Hydraulics, Enclosed Cab, Heat, High...

missoula.craigslist.org

I switched car insurance this year and will save $1,800 per year with the same coverage. Pays to shop around.I have a couple of local, online auctions I follow here. I have witnessed about 10% of the items go for outrageously high prices. Silver coins go for just about what the dealers are selling them for. Brand name weapons go for a premium. The other 90% goes really cheap. I think here, the deal is having to travel too far for the cheap stuff. In my case it would be a 2 hour round trip to pay and pick up an item I won with the bidding.

The "shocker" that I am hearing from with friends and family is the 20% increase (over the past 6 months) in the vehicle insurance. Historically the insurance has gone down as the vehicle aged. Most are upping the deductible or just going with the bare bones liability required by law.

Very few popular tractors are coming on the market. But again, I am seeing lots of brand new, top shelf skid steer loaders (with tracks) moving around here in the valley. Some will stay busy during the winter snow plowing but many are on a rental contract and will go back to the CAT dealer when things slow down.

A few examples:

2012 John Deere skid steer - farm & garden - by owner - sale - craigslist

2012 John Deere 326d skid steer for sale. Has all new tires, a new joy stick. Ac heat air ride seat radio and you can switch bucket to forks from cab. Clean machine 40000 obo text or calls only....missoula.craigslist.org

Bobcat T450 Skid Steer Closed Cab - heavy equipment - by dealer - sale - craigslist

Bobcat T450 Closed Cab Heat and A/C (not cold) 2 Speed Travel Hydraulic Bucket Coupler New Tracks Hand and Foot Control Hours 1100 Year 2017 Snowy River Equipment Sales, LLC "Quality Machines...missoula.craigslist.org

2020 Kubota SVL75-2 Skid Steer Loader - heavy equipment - by dealer - sale - craigslist

2020 Kubota SVL75-2 Skid Steer Loader 238 Hours 15" Rubber Tracks, 2 Speed Travel, 74.3 Horsepower, 75" Bucket, Air Conditioning, Air Suspension Seat, Auxiliary Hydraulics, Enclosed Cab, Heat, High...missoula.craigslist.org

As you often say about prices, it’s regional. I’m in the southeast. This is the capital of living beyond your means until you’re broke and have to sell all of your shit.

Also, I buy mainly 3 phase power tools since they sell for so cheap.

Unsustainable

Rubino says the dollar is going to decline and, at some point, it starts to go into freefall in terms of buying power. Rubino explains, “If a currency starts to decline in a disorderly way, then you have a massive financial crisis on your hands. That is definitely where Japan is right now. The U.S. is headed that way fast. So, once we reach that point, there is no fix. Then it is only a matter of time that everybody realizes that there is no fix, and they just bail on the whole experiment, and that’s where we are headed.”

Rubino says the dollar is going to decline and, at some point, it starts to go into freefall in terms of buying power. Rubino explains, “If a currency starts to decline in a disorderly way, then you have a massive financial crisis on your hands. That is definitely where Japan is right now. The U.S. is headed that way fast. So, once we reach that point, there is no fix. Then it is only a matter of time that everybody realizes that there is no fix, and they just bail on the whole experiment, and that’s where we are headed.”

Turkey's central bank hikes interest rate by 500 basis points to 40%, well above expectations

Turkey's central bank on Thursday hiked its main interest rate by 500 basis points to 40% in a move that was larger than expected by economists.

Worldwide

Germany’s major banks need to increase their provisions for non-performing loans, as corporate insolvencies and credit risks mount, according to Bundesbank Vice-President Claudia Buch.

Europe’s largest economy has been dubbed the “sick man of Europe” by some economists, after entering a technical recession earlier this year while economic activity faces further downward pressure from a collapse in construction.

Lawmakers in Berlin are meanwhile scrambling for solutions to a developing budget crisis that could threaten the future of the country’s coalition government.

www.cnbc.com

www.cnbc.com

Germany’s major banks need to increase their provisions for non-performing loans, as corporate insolvencies and credit risks mount, according to Bundesbank Vice-President Claudia Buch.

Europe’s largest economy has been dubbed the “sick man of Europe” by some economists, after entering a technical recession earlier this year while economic activity faces further downward pressure from a collapse in construction.

Lawmakers in Berlin are meanwhile scrambling for solutions to a developing budget crisis that could threaten the future of the country’s coalition government.

The vice-president of Germany's central bank has a warning for lenders as insolvencies rise

Germany's banks must increase provisions for loan losses, as corporate insolvencies and credit risks mount, according to Bundesbank Vice-President Claudia Buch.

For some shoppers, the upcoming holiday season may lead to piling on more debt. About 25% of Americans are still paying off holiday debt from 2022, according to WalletHub’s November holiday shopping survey.

But those already carrying a balance could find themselves sinking further into the red if they don’t get a handle on their credit card debt.

www.cnbc.com

www.cnbc.com

But those already carrying a balance could find themselves sinking further into the red if they don’t get a handle on their credit card debt.

25% of Americans still have holiday debt from last year: 'If you're in a hole, stop digging,' says money expert

About a quarter of Americans are still carrying holiday debt from 2022, WalletHub reports. Three tips for avoiding piling on more debt during the holidays.

I generally have credit score over 800. Best interest rate I recall being offered is 20%! Holy shit.. can't imagine floating a balance on that kind of rate.

P.S. Just paid off my car loan which dropped my score 30 points. Ummm. Sure, ok.

P.S. Just paid off my car loan which dropped my score 30 points. Ummm. Sure, ok.

I too have an 800+ score. Their game is to get people to "chase the mirage". Lot's of propaganda about how financially rewarding a high credit score is. Once a consumer gets there those, so called, rewards disappear and that 20%+ interest rate is staring them in the face. I have walked into a dealership show room at closing time, admired a new truck on the floor and the next thing a guy is throwing me the keys and opening the drive through door. I'm telling him I want to put down a sizeable down payment and he is saying "Swing by after work" and we will take care of the paper work.I generally have credit score over 800. Best interest rate I recall being offered is 20%! Holy shit.. can't imagine floating a balance on that kind of rate.

P.S. Just paid off my car loan which dropped my score 30 points. Ummm. Sure, ok.

Caveat emptor

What are these conundrums?

1. Interest Rates surging into a slowing economy.

2. Energy prices soaring despite China and other Emerging Markets decelerating.

3. U.S. Housing prices rising in the face of plunging Mortgage demand.

amgreatness.com

amgreatness.com

1. Interest Rates surging into a slowing economy.

2. Energy prices soaring despite China and other Emerging Markets decelerating.

3. U.S. Housing prices rising in the face of plunging Mortgage demand.

The Looming Economic Cauldron › American Greatness

The current confluence of economic conundrums elevates risks massively for the prosperity of Americans, especially those of modest means. These unprecedented, concurring economic contradictions flow…

The Governments of every Country in the entire world are running on "Debt". That debt is growing exponentially.

This is unsustainable. We are being told "It is complicated". No, it is not complicated, at all. If a young couple got married and every month they spent more than they made, how long before their household budget would crash into bankruptcy ?

Think about it.

This is unsustainable. We are being told "It is complicated". No, it is not complicated, at all. If a young couple got married and every month they spent more than they made, how long before their household budget would crash into bankruptcy ?

Think about it.

The Governments of every Country in the entire world are running on "Debt". That debt is growing exponentially.

This is unsustainable. We are being told "It is complicated". No, it is not complicated, at all. If a young couple got married and every month they spent more than they made, how long before their household budget would crash into bankruptcy ?

Think about it.

They will tax their way out of it with help from AI

U.S. Steel issued layoff warnings to 1,000 employees of its Granite City, Illinois, mill this week, saying they expect to fire 60% of them due to indefinite idling of iron and steel making operations at the facility.

www.foxbusiness.com

www.foxbusiness.com

US Steel announces plans to lay off hundreds at southern Illinois mill

Up to 1,000 jobs are on the chopping block for U.S. Steel Corporation's Granite City Works mill in southern Illinois, the company announced this week.

But the news said the economy was doing well??U.S. Steel issued layoff warnings to 1,000 employees of its Granite City, Illinois, mill this week, saying they expect to fire 60% of them due to indefinite idling of iron and steel making operations at the facility.

US Steel announces plans to lay off hundreds at southern Illinois mill

Up to 1,000 jobs are on the chopping block for U.S. Steel Corporation's Granite City Works mill in southern Illinois, the company announced this week.www.foxbusiness.com

Everyone that want's your money is going to tell you how great the economy is...... Retailers, Credit Card companies and of course the US Government so they can raise your taxes. Just go out and get a higher paying job.But the news said the economy was doing well??

The path is unsustainable.

Attachments

Even the fake news can't cover up the recession any longer.

Bloomberg - Are you a robot?

www.bloomberg.com

Layoff high cost union workers through automation plus using steel from "right to work" locationsU.S. Steel issued layoff warnings to 1,000 employees of its Granite City, Illinois, mill this week, saying they expect to fire 60% of them due to indefinite idling of iron and steel making operations at the facility.

US Steel announces plans to lay off hundreds at southern Illinois mill

Up to 1,000 jobs are on the chopping block for U.S. Steel Corporation's Granite City Works mill in southern Illinois, the company announced this week.www.foxbusiness.com

Well, which is it ?

1) Addressing the economic data, Powell characterized the labor market as “very strong,” through he said a reduced pace of job creation is helping bring supply and demand back in line.

2) TEMPE, Ariz., Dec. 1, 2023 /PRNewswire/ -- Economic activity in the manufacturing sector contracted in November for the 13th consecutive month following a 28-month period of growth, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.

www.prnewswire.com

www.prnewswire.com

www.cnbc.com

www.cnbc.com

1) Addressing the economic data, Powell characterized the labor market as “very strong,” through he said a reduced pace of job creation is helping bring supply and demand back in line.

2) TEMPE, Ariz., Dec. 1, 2023 /PRNewswire/ -- Economic activity in the manufacturing sector contracted in November for the 13th consecutive month following a 28-month period of growth, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.

Manufacturing PMI® at 46.7%; November 2023 Manufacturing ISM® Report On Business®

/PRNewswire/ -- Economic activity in the manufacturing sector contracted in November for the 13th consecutive month following a 28-month period of growth, say...

Fed Chair Powell calls talk of cutting rates 'premature' and says more hikes could happen

Federal Reserve Chairman Jerome Powell on Friday pushed back on market expectations for aggressive interest rate cuts ahead.

I do not trust any of the "data" released by the Federal government nor the "cheerleading" of the media - traditional or social media.

Can we really compete against import slave labor steel?Layoff high cost union workers through automation plus using steel from "right to work" locations

Lots of examples of US made vs import competition. Besides our labor costs - most parts of world do not have the high costs of complying with EPA and similar regulations. At some point, shipping costs ultimately drive the ability of imports to compete and win. Why is the US spending so much to improve our ports and the warehousing around ports - is it to ship our products overseas or to import more?Can we really compete against import slave labor steel?

Lots of examples of US made vs import competition. Besides our labor costs - most parts of world do not have the high costs of complying with EPA and similar regulations. At some point, shipping costs ultimately drive the ability of imports to compete and win. Why is the US spending so much to improve our ports and the warehousing around ports - is it to ship our products overseas or to import more?

The Key Difference Between GDP and Prosperity

From Peter Reagan at Birch Gold Group Biden relentlessly touts how great the American economy is. But to support his case, he relies on his administration to carefully cherry-pick data to back up h…

www.theburningplatform.com

Young consumers are like meth addicts.... They just can't stop buying. Credit is driving the economy... Unsustainable.

NEW YORK (AP) — Consumers are expected to use “buy now, pay later” payment plans heavily this holiday season, a forecast that bodes well for retailers but that has credit experts again sounding alarm bells.

The short-term loans often come with consumer-friendly interest rates and allow shoppers to make an initial payment at checkout, then pay the rest in installments, typically over a few weeks, even months. That can be appealing to a shopper buying multiple gifts for family and friends during the holidays, particularly if they’re balancing other debt such as student loans or credit cards.

apnews.com

apnews.com

NEW YORK (AP) — Consumers are expected to use “buy now, pay later” payment plans heavily this holiday season, a forecast that bodes well for retailers but that has credit experts again sounding alarm bells.

The short-term loans often come with consumer-friendly interest rates and allow shoppers to make an initial payment at checkout, then pay the rest in installments, typically over a few weeks, even months. That can be appealing to a shopper buying multiple gifts for family and friends during the holidays, particularly if they’re balancing other debt such as student loans or credit cards.

More Americans are expected to 'buy now, pay later' for the holidays. Analysts see a growing risk

Consumers are expected to use “buy now, pay later” payment plans heavily this holiday season, a forecast that bodes well for retailers but that has credit experts again sounding alarm bells.

Why they have so much "college" debt - not just tuition but all the upscale dorm rooms/apartment and lots of StarbucksYoung consumers are like meth addicts.... They just can't stop buying. Credit is driving the economy... Unsustainable.

NEW YORK (AP) — Consumers are expected to use “buy now, pay later” payment plans heavily this holiday season, a forecast that bodes well for retailers but that has credit experts again sounding alarm bells.

The short-term loans often come with consumer-friendly interest rates and allow shoppers to make an initial payment at checkout, then pay the rest in installments, typically over a few weeks, even months. That can be appealing to a shopper buying multiple gifts for family and friends during the holidays, particularly if they’re balancing other debt such as student loans or credit cards.

More Americans are expected to 'buy now, pay later' for the holidays. Analysts see a growing risk

Consumers are expected to use “buy now, pay later” payment plans heavily this holiday season, a forecast that bodes well for retailers but that has credit experts again sounding alarm bells.apnews.com

October Factory Orders slid 3.6% M/M to $576.8B, compared with the 2.6% decrease expected and the 2.3% rise in September (revised from +2.8%), the U.S. Census Bureau said Monday.

Unfilled orders, up 10 of the last 11 months, rose $4.0B, or 0.3%, to $1,356.8B, after September's 1.3% increase.

Factory orders excluding transportation: -1.2% vs. +0.4% prior (revised from +0.8%).

seekingalpha.com

seekingalpha.com

Unfilled orders, up 10 of the last 11 months, rose $4.0B, or 0.3%, to $1,356.8B, after September's 1.3% increase.

Factory orders excluding transportation: -1.2% vs. +0.4% prior (revised from +0.8%).

Factory orders fall more than expected in October

October Factory Orders slid 3.6% M/M to $576.8B, compared with the 2.6% decrease expected and the 2.3% rise in September (revised from +2.8%), the U.S. Census B

Worldwide

TD chief financial officer Kelvin Tran said it was a mixed quarter in a “challenging environment,” as the bank also warned that it will be hard to meet its medium-term targets around earnings growth and return on equity.

“What we see for the following year, in 2024, is actually a quite complex environment, including continued normalizing of (provisions for credit loss)” said Tran.

“That’s why we think it’s gonna be challenging to meet that those targets.”

globalnews.ca

globalnews.ca

TD chief financial officer Kelvin Tran said it was a mixed quarter in a “challenging environment,” as the bank also warned that it will be hard to meet its medium-term targets around earnings growth and return on equity.

“What we see for the following year, in 2024, is actually a quite complex environment, including continued normalizing of (provisions for credit loss)” said Tran.

“That’s why we think it’s gonna be challenging to meet that those targets.”

TD Bank cutting thousands of jobs amid ‘challenging environment’ - National | Globalnews.ca

TD Bank says its profit and revenues were lower year-over-year in its fourth fiscal quarter, missing analyst expectations, but it raised its quarterly dividend.

The entire world is running on debt / credit.... Unsustainable

Moody’s Investors Service cut its outlook for Chinese sovereign bonds to negative, underscoring deepening global concerns about the level of debt in the world’s second-largest economy.

www.bloomberg.com

www.bloomberg.com

Moody’s Investors Service cut its outlook for Chinese sovereign bonds to negative, underscoring deepening global concerns about the level of debt in the world’s second-largest economy.

Moody’s Cuts China Credit Outlook to Negative on Rising Debt

Moody’s Investors Service cut its outlook for Chinese sovereign bonds to negative, underscoring deepening global concerns about the level of debt in the world’s second-largest economy.

Another way of saying "You will be out of a job next year".

Wells Fargo

CEO Charlie Scharf said Tuesday that low staff turnover means the company will likely book a large severance expense in the fourth quarter.

“We’re looking at something like $750 million to a little less than a billion dollars of severance in the fourth quarter that we weren’t anticipating, just because we want to continue to focus on efficiency,” Scharf told investors during a Goldman Sachs conference.

The company needs to get “more aggressive” on managing headcount because employee attrition has slowed this year, Scharf said. While the bank has made progress under his tenure, Wells Fargo is “not even close” to where it should be in terms of efficiency, he added.

www.cnbc.com

www.cnbc.com

Wells Fargo

CEO Charlie Scharf said Tuesday that low staff turnover means the company will likely book a large severance expense in the fourth quarter.

“We’re looking at something like $750 million to a little less than a billion dollars of severance in the fourth quarter that we weren’t anticipating, just because we want to continue to focus on efficiency,” Scharf told investors during a Goldman Sachs conference.

The company needs to get “more aggressive” on managing headcount because employee attrition has slowed this year, Scharf said. While the bank has made progress under his tenure, Wells Fargo is “not even close” to where it should be in terms of efficiency, he added.

Wells Fargo CEO warns of severance costs of nearly $1 billion in fourth quarter as layoffs loom

Wells Fargo CEO Charlie Scharf said low staff turnover means the company would likely book a large severance expense in the fourth quarter.

Seems there is plenty to worry about.

Inflation ?

Recession

Election ?

www.foxbusiness.com

www.foxbusiness.com

www.foxbusiness.com

www.foxbusiness.com

www.cnbc.com

www.cnbc.com

www.cnbc.com

www.cnbc.com

Inflation ?

Recession

Election ?

Inflation worries remain across income brackets, but politics is top concern for affluent: Edelman

A new survey from Edelman found inflation is still the top concern among Americans, but the No. 1 source of stress for the affluent is politics — particularly the 2024 election.

November inflation report likely to show prices cooled last month

The Labor Department on Tuesday will release the November consumer price index data, which is expected to show that inflation continued to ease last month.

Michael Milken says the Fed won’t move too early and risk massive inflation like the 1970s

The famed investor expects the central bank will be sure to tamp out inflation before starting to lower rates so as to avoid a repeat of the 1970s.

'Somebody has it wrong' on U.S. recession risks as oil, gold and Treasurys diverge, fund manager says

Falling oil prices and rising gold prices indicate growing recessionary fears — but 10-year Treasury yields jumped Friday amid hopes of a soft landing.

The Theater is being prepared for the next Broadway Show... "Soft Landing 2024"..

The Bill Boards are being printed, the stage props are being built and the writers, choreographers and lighting crews are making preparations. The script writers are altering the script as the time approaches. The tryouts for actor's is taking place. New blood will make this an exciting event.

Americans are digging their financial rabbit hole deeper by the month.

The definition of a "Soft Landing" will be changed.

The Bill Boards are being printed, the stage props are being built and the writers, choreographers and lighting crews are making preparations. The script writers are altering the script as the time approaches. The tryouts for actor's is taking place. New blood will make this an exciting event.

Americans are digging their financial rabbit hole deeper by the month.

The definition of a "Soft Landing" will be changed.

elections must be comingThe Theater is being prepared for the next Broadway Show... "Soft Landing 2024"..

The Bill Boards are being printed, the stage props are being built and the writers, choreographers and lighting crews are making preparations. The script writers are altering the script as the time approaches. The tryouts for actor's is taking place. New blood will make this an exciting event.

Americans are digging their financial rabbit hole deeper by the month.

The definition of a "Soft Landing" will be changed.

Similar threads

- Replies

- 26

- Views

- 1K

- Replies

- 0

- Views

- 56

- Replies

- 0

- Views

- 110

- Replies

- 7

- Views

- 882