Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Shorting Silver?

- Thread starter Samuel Whittemore

- Start date

im thinking silver has too much of a backing as a hard currency to be influenced much......but then again i didnt think a viking would storm the capital......stranger things have happened in 2021.

not the actual metal ....$SLV (iShares Silver Trust). Historically the highest actual metal cost was $49.45 oz in 1980.

$SLV shares could go up (currently $24.99 a share) .... short squeeze .... $1,000 a share, I would say doubtful unless someone/group shorts over 100% available share (which is what happened to GME)

$SLV shares could go up (currently $24.99 a share) .... short squeeze .... $1,000 a share, I would say doubtful unless someone/group shorts over 100% available share (which is what happened to GME)

i thought $SLV was backed by physical silver? no?not the actual metal ....$SLV (iShares Silver Trust). Historically the highest actual metal cost was $49.45 oz in 1980.

$SLV shares could go up (currently $24.99 a share) .... short squeeze .... $1,000 a share, I would say doubtful unless someone/group shorts over 100% available share (which is what happened to GME)

i dunno, been a while since i looked at it.

After reading some of the quotes in that article, some looking into who is driving this needs to be made. This is sounding more like desired intentional destruction of everything; not making money, or leveling the playing field for the peasants.

Yes, it is "supposed" to be ..... Just like there is supposed to be gold in fort knox.i thought $SLV was backed by physical silver? no?

i dunno, been a while since i looked at it.

Last edited:

Kind of like ANTFI/BLM for investing ... yes. The problem is the "big players" can be wrong quite a few times .... the peasants, not so much.After reading some of the quotes in that article, some looking into who is driving this needs to be made. This is sounding more like desired intentional destruction of everything; not making money, or leveling the playing field for the peasants.

Remember it's a two way street ... what would happen if the Reddit crowd was high on a particular stock, then "someone" shorted the shit out of it and put rumors in the financial media?....

The silver and gold markets are controlled by the kind of Elites that are able to make governments do their bidding rather quickly.

The last couple times either individuals or enthusiastic investors tried to drive silver up, they got slapped down pretty hard and fast.

I don't see it ending well for the idealistic rabble if they try to go play in the monster's toy box.

The last couple times either individuals or enthusiastic investors tried to drive silver up, they got slapped down pretty hard and fast.

I don't see it ending well for the idealistic rabble if they try to go play in the monster's toy box.

Yup, if Nelson Baker Hunt can't own the market with a billion $$ ... well ....The silver and gold markets are controlled by the kind of Elites that are able to make governments do their bidding rather quickly.

The last couple times either individuals or enthusiastic investors tried to drive silver up, they got slapped down pretty hard and fast.

I don't see it ending well for the idealistic rabble if they try to go play in the monster's toy box.

Ah...bumma I thought it too good to be true. Coming from Zero Hedge I'm not surprised. As one of many obesssions I started buying 1oz ingots years ago.... thanks

You don't own it unless it's in your hands. SVLs are for suckers. There's no proof that your SVL has enough real precious metals to cover the paper that it's printed on.

Nuttin wrong with buying it and holding it. Also look at buying 1/10th ounce gold american eagles. You pay a bit of a premium going 1/10th ounce, but you can always sell couple coins if needed without selling a 1 oz coin. I think gold is a better play right now, but silver is still "cheap"Ah...bumma I thought it too good to be true. Coming from Zero Hedge I'm not surprised. As one of many obesssions I started buying 1oz ingots years ago.... thanks

The trick to precious metals is diversification. A little bit of everything is what works best for me.Nuttin wrong with buying it and holding it. Also look at buying 1/10th ounce gold american eagles. You pay a bit of a premium going 1/10th ounce, but you can always sell couple coins if needed without selling a 1 oz coin. I think gold is a better play right now, but silver is still "cheap"

THAT^^^^!You don't own it unless it's in your hands. SVLs are for suckers. There's no proof that your SVL has enough real precious metals to cover the paper that it's printed on.

One would have to be a complete tar tar to buy SVLs. Sorry... but it's true. The first time I learned what SVLs were I laughed my ass off thinking 'Really? are there people that

Maybe, they're trying to drive the market of silver up, due to all them thar solar panels we'll be producing for those chicom interests?? Just kid'n! Mac

In my opinion the best silver to buy (meaning the best value) is junk 90% silver coins. Many times you can buy it for pennies over spot. A much better ratio than silver bullion coins. Like someone mentioned about 1/10 oz gold coins, junk silver coins can be found from old dimes to old silver dollars. Just make sure you're buying junk, you don't want to pay for any numismatic value.

If you thought it was bad how the billionaires were able to call in favors and bribe politicians and Janett Yellan just wait until you see what a coalition of Central Banks can do to decimate the little guy.

Hogs get fed, pigs get slaughtered. The line is hard to see. I do agree with a long silver position.

Hogs get fed, pigs get slaughtered. The line is hard to see. I do agree with a long silver position.

If you thought it was bad how the billionaires were able to call in favors and bribe politicians and Janett Yellan just wait until you see what a coalition of Central Banks can do to decimate the little guy.

Hogs get fed, pigs get slaughtered. The line is hard to see. I do agree with a long silver position.

They gonna ban precious metal ownership again?

Fuck them.

A lot of “regular” people have opened their eyes to the farce that is rule of law in this country

Silver jewelry wire is another (relatively) inexpensive way to buy bulk silver. Rio Grande and other jewelry supply houses sell it...and wire is easy to coil up into certain weights/values if you need to barter with it.In my opinion the best silver to buy (meaning the best value) is junk 90% silver coins. Many times you can buy it for pennies over spot. A much better ratio than silver bullion coins. Like someone mentioned about 1/10 oz gold coins, junk silver coins can be found from old dimes to old silver dollars. Just make sure you're buying junk, you don't want to pay for any numismatic value.

Yep. Heavy gauge wire into coils. Clip coils into jump rings. Then just link the jump rings together around a single ring, until you get the number of rings to reach a certain weight. From then on, just make these with a certain numbers of rings for each desired weight. BTW, in the jewelry world, these are called a "chainmail mobius"...Good point. That's why I started buying silver in various weights... but still, if all I needed was a loaf of bread, be hard to cut a 1oz ingot on the fly.

ETA: Here's a picture of a rosary I made using high end materials (Argentium silver and 10kt gold) that used a mobius as the primary weave.

Last edited:

Correct. Wall Street got caught with their pants down on GameStop. With all the money lost, I think they might'a got learn'd up pretty quick.Kind of like ANTFI/BLM for investing ... yes. The problem is the "big players" can be wrong quite a few times .... the peasants, not so much.

Remember it's a two way street ... what would happen if the Reddit crowd was high on a particular stock, then "someone" shorted the shit out of it and put rumors in the financial media?....

Good point. That's why I started buying silver in various weights... but still, if all I needed was a loaf of bread, be hard to cut a 1oz ingot on the fly.

That's why you buy junk silver coins. A dime is worth around $1.50. A quarter is worth about $5. A half dollar is worth about $10 and a silver dollar is worth about $21.

You can barter a lot of things with these coins. That loaf of bread may cost you a dime or as much as 3 dimes. No measuring, no weighing, just plain and simple bartering.

Silver jewelry wire is another (relatively) inexpensive way to buy bulk silver. Rio Grande and other jewelry supply houses sell it...and wire is easy to coil up into certain weights/values if you need to barter with it.

Only if you're positive it's sterling. There's a lot of that stuff that's not solid silver and has a brass or nickel core.

So, about 3 years ago when silver was $15/Oz, I told some silver investor people that in 2-3 years silver was gonna be about $30/Oz due to solar panels being made with a shit load of silver and The Powers were keeping silver prices artificially low because it's not an actual supply and demand market. It's a rigged system of whoever decides what the price of that commodity should be because Reasons (cheap silver, cheap panels, get volume sales going, politocians get bribed, reap benefits for power companies harvesting power from Little Guy producing power for the power company.... but,, "muh tax-credit for solar")

I forsee it going higher still for reasons above when panels need to be replaced and companies will offer to buy your old panels for cash and they reap the actual cost of what silver in those panels will be worth.

Change my mind.

I forsee it going higher still for reasons above when panels need to be replaced and companies will offer to buy your old panels for cash and they reap the actual cost of what silver in those panels will be worth.

Change my mind.

Hence the rings. If it's gold fill or silver fill, it'll show (the core fill) on the ends of the rings.Only if you're positive it's sterling. There's a lot of that stuff that's not solid silver and has a brass or nickel core.

Also, sterling and argentium silver have the same silver content (92.5%) they just differ in the 2% of germanium in the argentium silver (which doesn't tarnish the same as sterling, and has a yellowish tint that wipes off). Yeah, it's the same stuff thermal scope lenses are made from...

I'm keeping silver trinkets incase ammo dries up, load my musket up and give someone on the opposing side a set of grills.

I bought 100 lbs of lead almost 30 years ago. I still have over 70 lbs. I should be okay.

LEAD, SILVER, GOLD, AMMO.

If you have those 4 things, you should be able to take care of anything that comes up.

That's why I only buy sterling or fine silver supplies from Rio or another trusted source.Only if you're positive it's sterling. There's a lot of that stuff that's not solid silver and has a brass or nickel core.

@MarinePMI You're the first person ever I've known out world the professional side of casting / design that knew that.

^^^^ THAT! and guns.I bought 100 lbs of lead almost 30 years ago. I still have over 70 lbs. I should be okay.

LEAD, SILVER, GOLD, AMMO.

If you have those 4 things, you should be able to take care of anything that comes up.

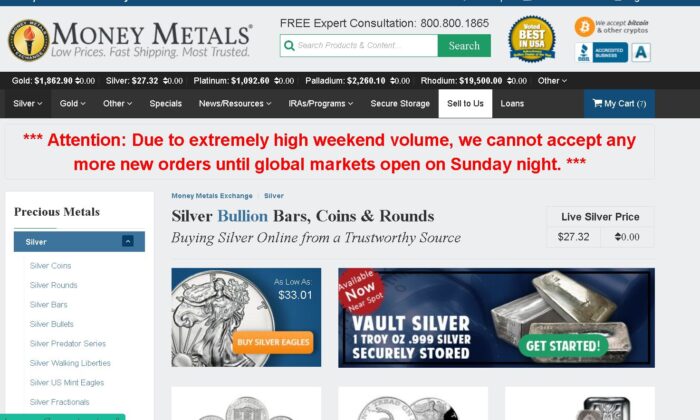

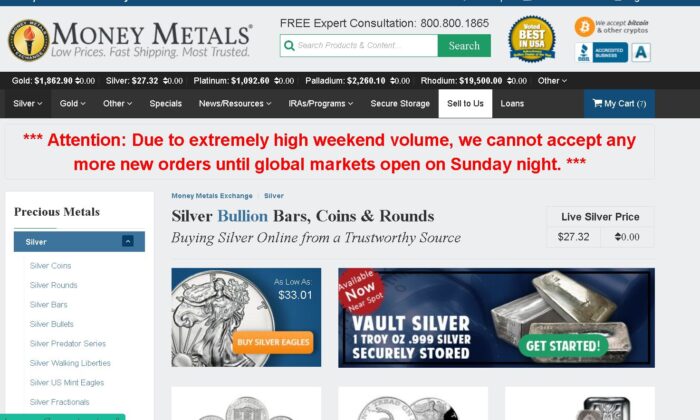

I just did a search on APMEX and they are out of Silver Eagles, 1 oz bars and junk silver. I have never seen this in the dozen years or so I've been dealing with them.

One of the reason is that the US Mint is changing the design for 2021, so the Gen 1 coins aren't being minted in the numbers they have been in the past. The new design should be available very soon. Possibly by May or no later than June.

Originally, the last year for the Gen 1 coins was 2020, but due to COVID, they had to push back the Gen 2 coin until later this year. The Gen 1 coins can still be found in the secondary market. Plenty of them for the spot plus 10% markup.

They gonna ban precious metal ownership again?

Fuck them.

A lot of “regular” people have opened their eyes to the farce that is rule of law in this country

They never stopped manipulating the precious metals. They usually just release a flood to wash away a bullrun.

"THE FREE MARKET IS ONLY FREE UNTIL RICH PEOPLE LOSE MONEY"

In my opinion the best silver to buy (meaning the best value) is junk 90% silver coins. Many times you can buy it for pennies over spot. A much better ratio than silver bullion coins. Like someone mentioned about 1/10 oz gold coins, junk silver coins can be found from old dimes to old silver dollars. Just make sure you're buying junk, you don't want to pay for any numismatic value.

This! Read Selco. He spent a year of hell under siege during the collapse of Yugoslavia.

If you're bartering with bullion or ingots, people suspect you have more and you will become a target. Not good. It's better to be the guy who is reduced to trading away his wife's wedding ring for tomorrow's meal. As far as anyone knows, you have nothing else left.

As for manipulating the markets, the trend is your friend. Never try to buck the trend. You can only hold a beach ball under water so far. It wants to be on the surface. The only reason the Reddit crowd beat the Hedge Fund bandits at their own game is because the Hedge Funds were artificially depressing the price with their own very heavy bearish positions. Long term, brick and mortar game stores is not a sustainable business model in today's world. As well, one stock is a very finite slice of the economic pie. Silver is a whole different ballgame.

I wonder is they are quoting the price per dollar of face value. I would certainly clarify before ordering. Oops of thats the case the price seems low as there are only about five quarters in an oz

One you can buy, the other will be out of stock or unable to ship at this time. Obviously a misprint.

APMEX HAs suspended sales, MOney metals suspended sales, bgasc suspended sales after 1 pm today. THE houses in the article below have also suspended sales. It's going to be an epic day tomorrow. IF Tesla or SpaceX , Samsung, amazon etc decide they are going to purchase what they will use in the next 10 years to control costs the rest have to jump in or they will be gone. THis is the move that will crush the banksters. EVery tesla uses 10kg. THE device your using has silver in it. I Was working for someone that was on BEar STerns BOD When it collapsed. I'd love to see that look on the ones like SOros and the ROthschilds as ell as the ones that facilitate their actions

Last edited:

Does anyone sell just silver coin blanks?

It'd be kind of cool to engravd some dies, to strike my own coins now that I think about it....

It'd be kind of cool to engravd some dies, to strike my own coins now that I think about it....

Who Remembers The Hunt Brothers?

:max_bytes(150000):strip_icc()/GettyImages-1404630020-e57482666dc64c748db52687423f8c9b.jpg)

www.investopedia.com

www.investopedia.com

Uncle Sam Steps In

The U.S. government became concerned over what it saw as a clear attempt at manipulating the nation's silver reserves, and the fact that this corner involved the Middle East added some venom to the government's reaction: after all, the 1970s oil crisis was still fresh in the nation's mind. Federal commodities regulators introduced special rules to prevent any more long position contracts from being written or sold for silver futures. This stopped the Hunts from increasing their positions by temporarily suspending the fundamental rules of the commodities market. With longs frozen and shorts free to pile in, the price of silver began to slide. Margin calls on the loans began to take a toll on the Hunts' reserves to the point where they were paying millions a day in calls, storage fees and interest.

Good Luck With Silver

:max_bytes(150000):strip_icc()/GettyImages-1404630020-e57482666dc64c748db52687423f8c9b.jpg)

Silver Thursday: How Two Wealthy Traders Cornered the Market

Find out how the largest speculative attempt to corner the market went awry.

Uncle Sam Steps In

The U.S. government became concerned over what it saw as a clear attempt at manipulating the nation's silver reserves, and the fact that this corner involved the Middle East added some venom to the government's reaction: after all, the 1970s oil crisis was still fresh in the nation's mind. Federal commodities regulators introduced special rules to prevent any more long position contracts from being written or sold for silver futures. This stopped the Hunts from increasing their positions by temporarily suspending the fundamental rules of the commodities market. With longs frozen and shorts free to pile in, the price of silver began to slide. Margin calls on the loans began to take a toll on the Hunts' reserves to the point where they were paying millions a day in calls, storage fees and interest.

Good Luck With Silver

Who Remembers The Hunt Brothers?

:max_bytes(150000):strip_icc()/GettyImages-1404630020-e57482666dc64c748db52687423f8c9b.jpg)

Silver Thursday: How Two Wealthy Traders Cornered the Market

Find out how the largest speculative attempt to corner the market went awry.www.investopedia.com

Uncle Sam Steps In

The U.S. government became concerned over what it saw as a clear attempt at manipulating the nation's silver reserves, and the fact that this corner involved the Middle East added some venom to the government's reaction: after all, the 1970s oil crisis was still fresh in the nation's mind. Federal commodities regulators introduced special rules to prevent any more long position contracts from being written or sold for silver futures. This stopped the Hunts from increasing their positions by temporarily suspending the fundamental rules of the commodities market. With longs frozen and shorts free to pile in, the price of silver began to slide. Margin calls on the loans began to take a toll on the Hunts' reserves to the point where they were paying millions a day in calls, storage fees and interest.

Good Luck With Silver

Assholes. (.gov)

Put this in the wrong thread. Reposted for your pleasure.

m.theepochtimes.com

m.theepochtimes.com

Major Dealers’ Websites Report Silver Shortages

The true point of doing these things is not to get noticed doing them, so the wealthy/powerfull can't undercut you since they control the reigns of power.

When the Government can step in and halt trading, you don't have a free market. Period. If they decide it is not in their interests, you are screwed. TLDR: A True free market cannot exist in this country because Congress has to power to regulate--right there Article 1. And if you think Congress has your bests interests in mind: I've got some silver shares to sell ya. One of the tradeoffs we made for a stronger central government.

When the Government can step in and halt trading, you don't have a free market. Period. If they decide it is not in their interests, you are screwed. TLDR: A True free market cannot exist in this country because Congress has to power to regulate--right there Article 1. And if you think Congress has your bests interests in mind: I've got some silver shares to sell ya. One of the tradeoffs we made for a stronger central government.

Does anyone sell just silver coin blanks?

It'd be kind of cool to engravd some dies, to strike my own coins now that I think about it....

Engraving is a big no-no with coins. They need to be stamped with a set of dies. Engraving removes metal, therefore the buyer wouldn't know exactly how much silver each coin would have.

Does anyone sell just silver coin blanks?

It'd be kind of cool to engravd some dies, to strike my own coins now that I think about it....

As creative and detailed oriented as it seems you are...

Carve your own and cast it lost wax!

Engraving is a big no-no with coins. They need to be stamped with a set of dies. Engraving removes metal, therefore the buyer wouldn't know exactly how much silver each coin would have.

Unless you got REALLY good engraving "hobo nickles!"

Eg:

What’s the story with that ? ^

Someone presenting Custom engraved coins would make me think j counterfeit/junk metal

Fun game to play as long as you don't have the expectation of making money and are happy to lose it. I might end up happily surprised, but the financial fallout won't be any worse than a weekend of good restaurants and fancy cocktails. What's going on with the markets and social media right now is fascinating and a bit of skin in the game keeps it engaging. The house always wins but that doesn't mean you can't have a good time.

Similar threads

- Replies

- 7

- Views

- 534

- Replies

- 1

- Views

- 290