I didn’t realize that was his article yesterday or I would have posted this.ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zerowww.zerohedge.com

Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

-

Win an RIX Storm S3 Thermal Imaging Scope!

To enter, all you need to do is add an image of yourself at the range below! Subscribers get more entries, check out the plans below for a better chance of winning!

Join the contest Subscribe

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock Market

- Thread starter pmclaine

- Start date

For the past several years when I would speak of the FED raising interest rates I would get beat over the head with "They can't raise interest rates because then they could not service the debt"....

Well, here we are.

Who better to lead us into the abyss than Joe Biden ?

Well, here we are.

Who better to lead us into the abyss than Joe Biden ?

Something for the Soccer Mom's

www.prnewswire.com

www.prnewswire.com

The Future is Now: Toyota Launches All-New bZ4X SUV Battery-Electric Vehicle

/PRNewswire/ -- The all-electric Toyota bZ4X SUV not only looks to further Toyota's commitment to a carbon neutral future, but it does so in style. Ready to...

Unexpected fall in CPI data. QQQ ends downward retracement, might signal peak inflation, might signal JPOW is right on inflation being transitory, and softer May FOMC. Very green open in my portfolio.

You are very optimistic... And, that's OK.. This world does need some optimism.Unexpected fall in CPI data. QQQ ends downward retracement, might signal peak inflation, might signal JPOW is right on inflation being transitory, and softer May FOMC. Very green open in my portfolio.

News bumped Brent Oil up almost 5%

Big Money is saying more American's will be buying essentials at the local Dollar Tree, Dollar General and similar discount stores. History repeating.

All of the European Markets popped up in the last hour of trading... No good news driving the market. I see it as Traders "Buying to Cover" short positions. Will watch to see if US Markets do the same. When uncertainty drives the traders out of the market, it is not a good sign.

Companies buying back their own stock with inflated USD's. No new employees, no new manufacturing plants, no new technology and no guidance in their reporting.

This is how the Dow 30 is continuing to uptick on the charts.... Magic

www.spglobal.com

www.spglobal.com

This is how the Dow 30 is continuing to uptick on the charts.... Magic

S&P 500 Buyback Index

The S&P 500® Buyback Index is designed to measure the performance of the top 100 stocks with the highest buyback ratios in the S&P 500.

There are only so few places worth putting money.Companies buying back their own stock with inflated USD's. No new employees, no new manufacturing plants, no new technology and no guidance in their reporting.

This is how the Dow 30 is continuing to uptick on the charts.... Magic

S&P 500 Buyback Index

The S&P 500® Buyback Index is designed to measure the performance of the top 100 stocks with the highest buyback ratios in the S&P 500.www.spglobal.com

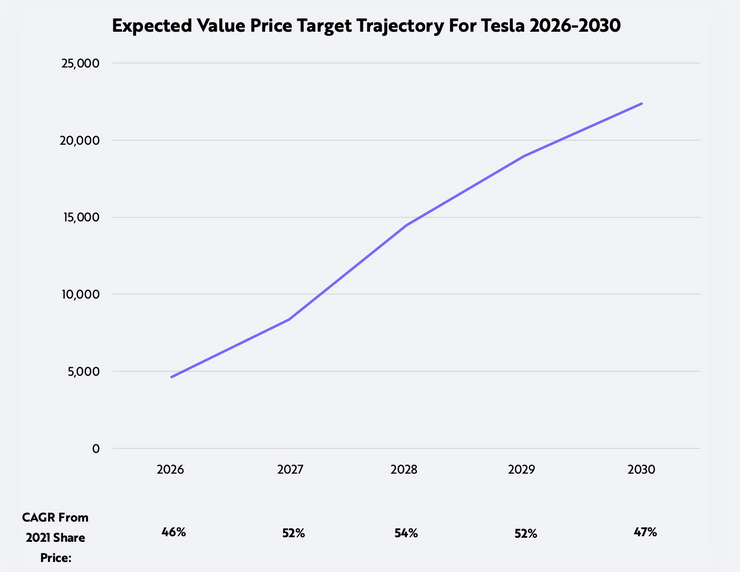

ARK released its new Tesla valuation model.

ark-invest.com

ark-invest.com

ARK’s Expected Value For Tesla In 2026: $4,600 per Share

ARK’s updated open-source Tesla model yields an expected value per share of $4,600 in 2026. Please explore and test our assumptions.

ark-invest.com

ark-invest.com

Investors rush toward stocks geared to a recession as market remains stuck in 9-month range

The S&P 500 has spent just about all of the past three months below the minus-5% threshold and finished last week at a level first reached nearly nine months ago.

Didn't know you were a Cathie Wood's fanARK released its new Tesla valuation model.

ARK’s Expected Value For Tesla In 2026: $4,600 per Share

ARK’s updated open-source Tesla model yields an expected value per share of $4,600 in 2026. Please explore and test our assumptions.ark-invest.com

View attachment 7850691

ARK Innovation ETF, ARKK Quick Chart - (PSE) ARKK, ARK Innovation ETF Stock Price - BigCharts.com

ARKK - ARK Innovation ETF Basic Chart, Quote and financial news from the leading provider and award-winning BigCharts.com.

I listened to Ken Fisher on fox business on Friday. He explained a lot of what’s going on and why. Extremely intelligent guy.

Long story short he sees this as a condensing period in a bull market and expects things to continue to grow with the exception of a black swan event.

Long story short he sees this as a condensing period in a bull market and expects things to continue to grow with the exception of a black swan event.

Staying positive is a good psychological tool for those in the market. I've lived through 3 - 4 of those condensing periods. In looking back, the investors that simply "maintained" their portfolio during those times came out well. Those that panicked when their portfolio's lost 50% did not fair so well.... But, as many have pointed out these are different times, different conditions, different players, different tools (computers / Internet / trading programs), foreign money like never before, etc. The DOW is being artificially propped up by rotating out the under performers and inserting the high fliers so it is really not an indicator of current conditions. Stock buy backs are artificially inflating share prices.I listened to Ken Fisher on fox business on Friday. He explained a lot of what’s going on and why. Extremely intelligent guy.

Long story short he sees this as a condensing period in a bull market and expects things to continue to grow with the exception of a black swan event.

Sobering to see the Black Swan's mentioned along side of the talk of Bull Markets. There are some Swan Maker's patiently awaiting an opportune time to release their bird.

I am not a fan of any fund manager.Didn't know you were a Cathie Wood's fan

ARK Innovation ETF, ARKK Quick Chart - (PSE) ARKK, ARK Innovation ETF Stock Price - BigCharts.com

ARKK - ARK Innovation ETF Basic Chart, Quote and financial news from the leading provider and award-winning BigCharts.com.bigcharts.marketwatch.com

Maybe a "stop gap" alternative until batteries improve... Green HydrogenI am not a fan of any fund manager.

Plug Power Stock Surges on Agreement to Supply Green Hydrogen to Walmart

Plug Power will deliver up to 20 tons per day of liquid green hydrogen to power Walmart's lift trucks across the retailer's distribution and fulfillment centers.

Walmart has partnered with Plug Power since 2012, when it launched a 50-fleet fuel cell pilot. That has then expanded to a fleet of 9,500 plus, the company said.Maybe a "stop gap" alternative until batteries improve... Green Hydrogen

Plug Power Stock Surges on Agreement to Supply Green Hydrogen to Walmart

Plug Power will deliver up to 20 tons per day of liquid green hydrogen to power Walmart's lift trucks across the retailer's distribution and fulfillment centers.www.barrons.com

Interesting, never knew WMT had that many hydrogen trucks.

I did not know that either... America has a "Love / Hate" relationship with Walmart that started long ago. Union's hated Walmart but when I was on a union job in the middle of nowhere, USA.... The only game in town to find groceries was a Walmart out in the middle of a gigantic corn field.....Walmart has partnered with Plug Power since 2012, when it launched a 50-fleet fuel cell pilot. That has then expanded to a fleet of 9,500 plus, the company said.

Interesting, never knew WMT had that many hydrogen trucks.

Small caps always get destroyed when rates start to move and people sell risk.Here is a good example of how the DOW is being propped up.... I'm not a big fan of the Russell 2000 but it does give a better example of a well rounded group of companies.

It's got to start somewhere... Remember the Bigger they are the Harder they fall.....Small caps always get destroyed when rates start to move and people sell risk.

We may never see "Too Big To Fail" ever again....

"Where does America shop?" We know that cycles along with the economy... A good article with the discount stores taken into consideration. For the most part they are doing well as the recession sets in.

www.finder.com

www.finder.com

11 discount stores stocks to watch in 2023 | finder.com

We've rounded up stats on some of the most popular discount stores stocks, along with information on how they compare and how to invest.

Added BIG to my watchlist. Thanks."Where does America shop?" We know that cycles along with the economy... A good article with the discount stores taken into consideration. For the most part they are doing well as the recession sets in.

11 discount stores stocks to watch in 2023 | finder.com

We've rounded up stats on some of the most popular discount stores stocks, along with information on how they compare and how to invest.www.finder.com

Tesla Q1 EPS $3.22 Adj. vs. $2.26 Est.; Q1 Revs. $18.76B vs. $17.80B Est

32.9% gross margins

81% growth YOY

$2.2B in FCF

32.9% gross margins

81% growth YOY

$2.2B in FCF

Last edited:

Interesting the stock closed down almost 5%.... Appears to be down for the month.Tesla Q1 EPS $3.22 Adj. vs. $2.26 Est.; Q1 Revs. $18.76B vs. $17.80B Est

32.9% gross margins

81% growth YOY

$2.2B in FCF

Aftermarket has it down 0.17% on the day. I'll be a buyer tomorrow if it is down.Interesting the stock closed down almost 5%.... Appears to be down for the month.

It's building a plateau.... Building momentumAftermarket has it down 0.17% on the day. I'll be a buyer tomorrow if it is down.

Here's what I was looking at. Lot of down for the candle stick and a lot of up for the volume.Down? I’m showing it up 4.5% in aftermarket.

Also almost all tech got sucked down by the Netflix shit show.

Edit: Ah. You combined the days losses with the aftermarket gains.

Was Shanghai in those results?

Those were good numbers but the stock can fluctuate that much on one stupid remark from Elon.

Don’t get me wrong. I’m hoping he has overwhelming success.

Those were good numbers but the stock can fluctuate that much on one stupid remark from Elon.

Don’t get me wrong. I’m hoping he has overwhelming success.

The stock is rallying on their best report. Highest gross margins and highest operating margins.Was Shanghai in those results?

Those were good numbers but the stock can fluctuate that much on one stupid remark from Elon.

Don’t get me wrong. I’m hoping he has overwhelming success.

Shanghai will hit Q2 numbers but management is forecasting 60%+ growth this year.

Another interesting play from a heavy hitter - Blackstone

Blackstone Inc. agreed to buy student-housing owner American Campus Communities Inc. in a deal valuing the company at about $12.8 billion, including debt, a bet that rents will continue to rise as more college students return to campus.

www.allsides.com

www.allsides.com

Blackstone Inc. agreed to buy student-housing owner American Campus Communities Inc. in a deal valuing the company at about $12.8 billion, including debt, a bet that rents will continue to rise as more college students return to campus.

Blackstone Bets on Campus Housing With $13 Billion Acquisition

Blackstone Inc. agreed to buy student-housing owner American Campus Communities Inc. in a deal valuing the company at about $12.8 billion, includ...

I guess you did not buy at the open.Aftermarket has it down 0.17% on the day. I'll be a buyer tomorrow if it is down.

Correct.I guess you did not buy at the open.

The platform is cancer and I think any company that takes over will continue the status quo. I think Google would benefit the most by purchasing.I bought some twitter for the takeover.

What’s your thoughts on that one?

It’s just a trading buy for me. I’m not hold.

I think Elon will end up with it just because he has the fuck you money.

I think Elon will end up with it just because he has the fuck you money.

For those that like utilities NEE might be worth some digging into. Down 3%+ today which is a bigger move for them.

Do your own research please.

Do your own research please.

added to my own utility... EnphaseFor those that like utilities NEE might be worth some digging into. Down 3%+ today which is a bigger move for them.

Do your own research please.

The more Yellen and Powell spoke today the faster the market dropped..... If you listen to them, you would understand why. Reminded me of a First Responder leaning over a guy shot in the heart and saying "Hang in there, you will be OK".... I think the FED's are trying to reassure themselves rather than the man on Main Street.50 bps hike for May locked in.

That 50bps does not include credit card rates, Pay Day Loans, Buy Now Pay Later (BNPL), Fuel Surcharges, Handling fees and all the other material inflation that is being passed on to the consumer....

The economy has several more months to fall before the hard landing... Biden is not helping the situation.

JMHO

Just hope it helps the bank stocks.

I did buy a fair amount today.

I would like one face ripping rally before we do the downward trend.

I did buy a fair amount today.

I would like one face ripping rally before we do the downward trend.

TSLA up 11% lol

ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

This is why I invested some into licy.ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zerowww.zerohedge.com

I would "Buy to cover" ENPH @ $155 and step away from a Friday market that looks like a train wreck... World wide.I would short ENPH @ 182.09.... Right where it is at the moment.

Last:

182.09

Change:

+23.28

Open:

160.00

High:

182.65

Low:

158.95

Volume:

4,002,931

Percent Change:

+14.66%

This is the punch bowl being taken away ( cheap money).

The market is overreacting (imo) in general. There are stocks that are down that have zero reason to drop while some that you think would drop are holding.

Re: see Apple vs Tesla

The market is overreacting (imo) in general. There are stocks that are down that have zero reason to drop while some that you think would drop are holding.

Re: see Apple vs Tesla

Similar threads

- Replies

- 38

- Views

- 2K

- Replies

- 7

- Views

- 785

- Replies

- 50

- Views

- 5K