Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Trump is back…the “Now What” thread

- Thread starter D̷e̷v̷i̷l̷D̷o̷c̷A̷Z̷

- Start date

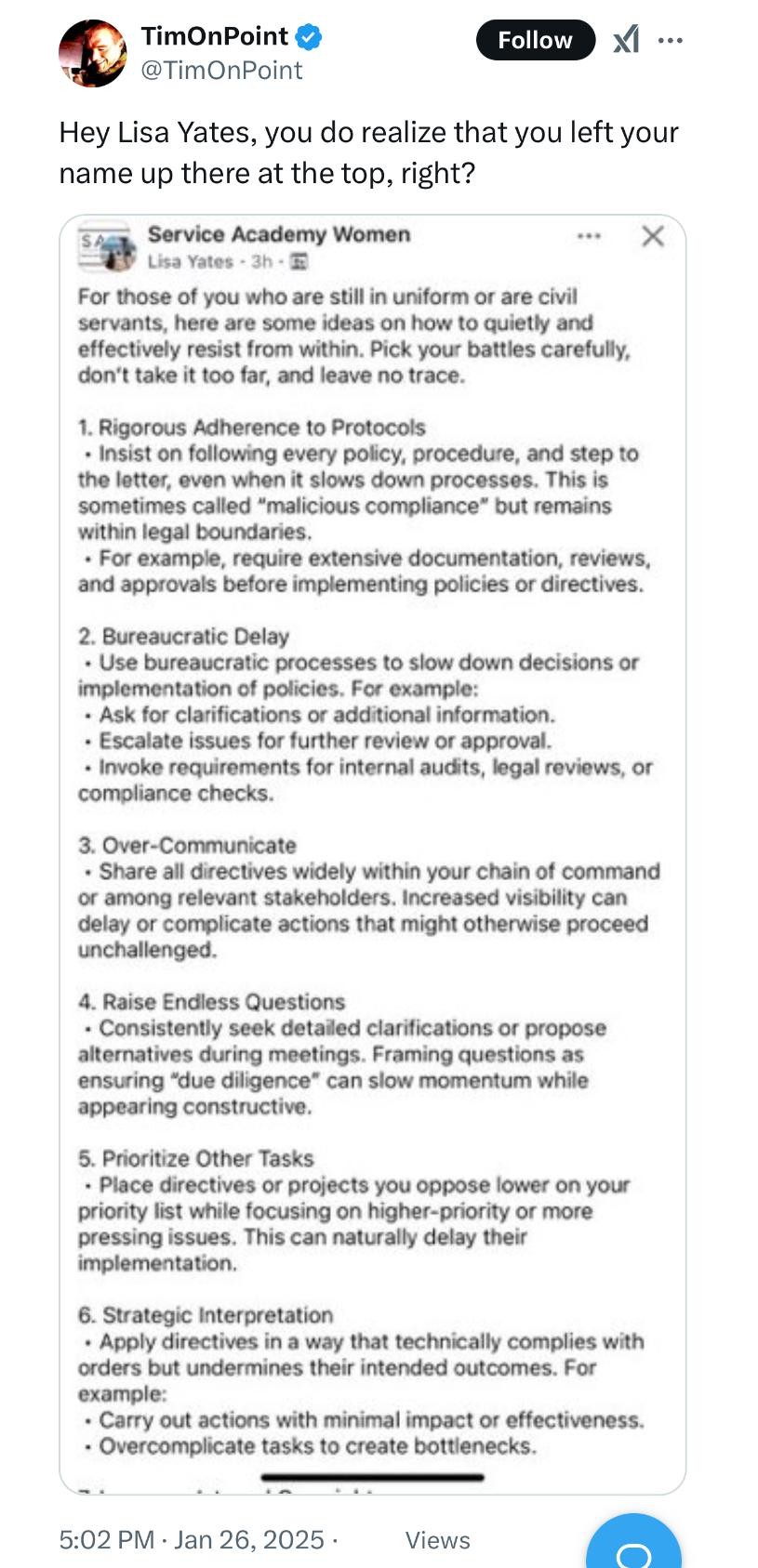

we knew they were feds. now confirmed.

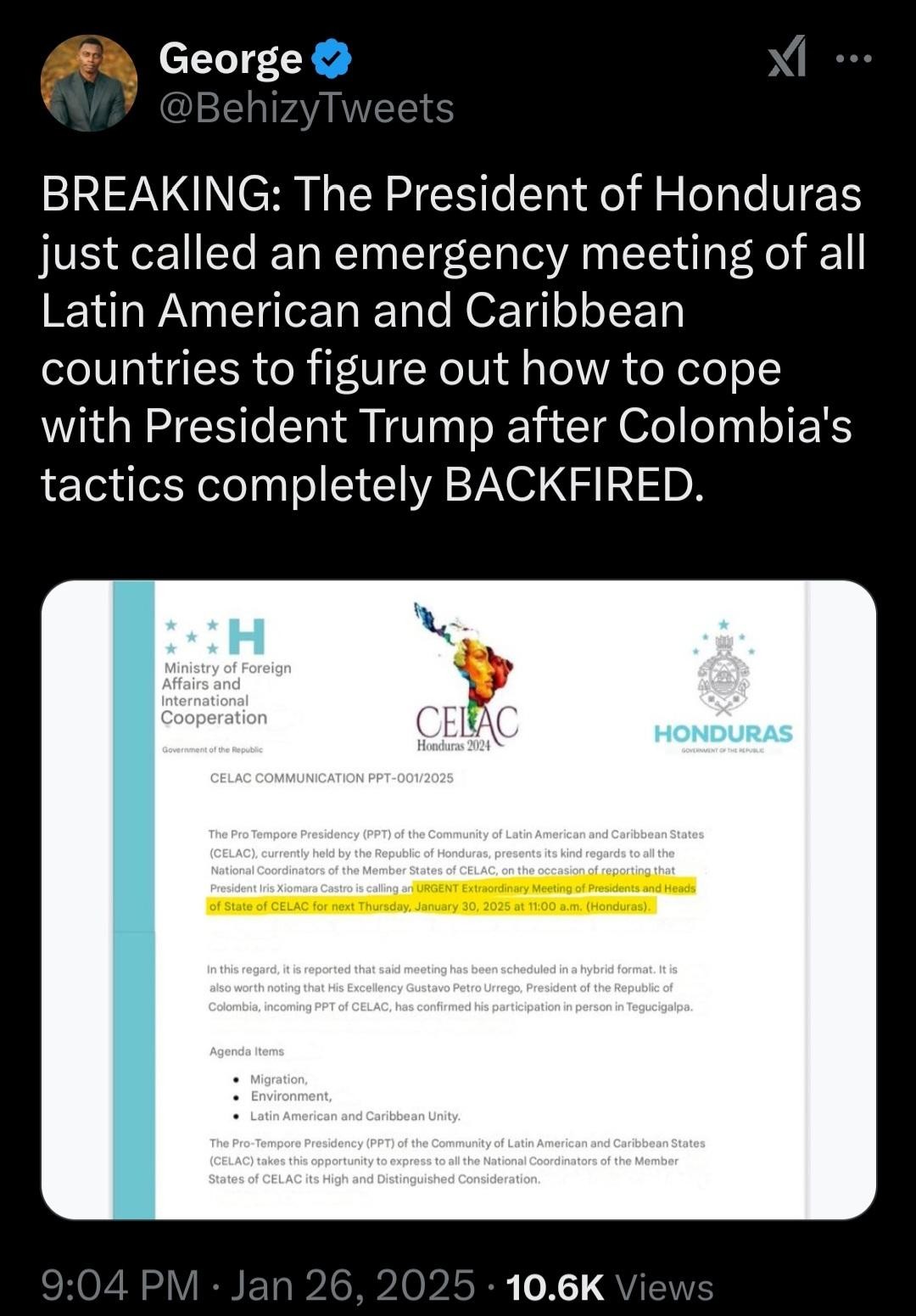

The rejects from their countries are the illegals in our country.these idiots are claiming the return of their own citizens is a "hostile" act on our part.

if we take their word for it, then they have already attacked our country by allowing these criminals to invade us.

https://www.thegatewaypundit.com/2025/01/president-trump-reinstate-more-than-8000-troops-kicked/President Trump to Reinstate More Than 8,000 Troops Kicked Out of Military by Biden For Refusing Covid Jab – With Full Back Pay and Benefits

I'm sure Kavanaugh has an axe to grind with the dems that put him through hell during his confirmation.

Clinton said he did that because of what Kavanaugh did with the Vince Foster case.I'm sure Kavanaugh has an axe to grind with the dems that put him through hell during his confirmation.

Kavanaugh was a young staffer for the Independent Counsel back from 1994-1998. They were trying to wrap up the IC after the events of 1993, because the original IC Robert Fiske resigned and didn’t want to risk his life anymore.

Kavanaugh was hot on the trail of the Vince Foster murder, because Foster was the Clintons’ bag man flying back and forth between Switzerland. Had Kavanaugh not kept the investigation open, we likely would never have learned about the other crimes.

This is why the Clintons arranged for that psycho chic to testify about imaginary gang rapes that Kavanaugh and classmates ran on her. That’s how the Clintons and Dems play ball when it comes to SCOTUS nominees. They don’t care about the person’s life, just that they don’t want any R appointed Justices, unless they are compromised already and will do their bidding.

I wonder what the proposed consumption tax rate will be? Way back when Steve Forbes had his hat in the ring for president, he mentioned going to a 17% consumption tax rate. Since then, a few others have spoken of it, but mentioned a 21% rate. Right now, I'm effectively paying a 15% federal tax rate under the current taxing structure.

If they can’t get it done with 10%, they don’t deserve to be in financial management positions.

Trump revokes order allowing transgender troops to serve in military

Trump has not instituted a new ban on transgender troops serving, but the repeal of Biden’s policy clears the way for one, advocates said.

There are an estimated 9,000 to 14,000 transgender individuals serving in the armed forces, The Associated Press reported.

Last folks that tried that were assassinated...

You can get away with a lot but the true Global Elites won't let you get away with messing with their true power which is debt and money.

I wonder what the proposed consumption tax rate will be? Way back when Steve Forbes had his hat in the ring for president, he mentioned going to a 17% consumption tax rate. Since then, a few others have spoken of it, but mentioned a 21% rate. Right now, I'm effectively paying a 15% federal tax rate under the current taxing structure.

This is from the IRS web site:

Marginal rates. For tax year 2025, the top tax rate remains 37% for individual single taxpayers with incomes greater than $626,350 ($751,600 for married couples filing jointly). The other rates are:

35% for incomes over $250,525 ($501,050 for married couples filing jointly).

32% for incomes over $197,300 ($394,600 for married couples filing jointly).

24% for incomes over $103,350 ($206,700 for married couples filing jointly).

22% for incomes over $48,475 ($96,950 for married couples filing jointly).

12% for incomes over $11,925 ($23,850 for married couples filing jointly).

10% for incomes $11,925 or less ($23,850 or less for married couples filing jointly).

So depending on how much you earn, paying a 21% consumption tax might be less of an impact than paying the marginal rate.

So for 24% and above, your tax burden would be less. Even for lower incomes the tax burden might still be less because you would be taxed on what you spend and not what you earn.

and this is a revelation? a great intelligence coup from an incompetent,back stabbing bunch of deep state thugs.

This didn't age wellLet's see from memory. Sit around collect a check. Argue and complain. Not be productive. Go to the park and play softball. Who does this sound like? Ya mean??

So not shit is going to happen.

I wonder who the first "global elite" to be unalived will be?Last folks that tried that were assassinated...

You can get away with a lot but the true Global Elites won't let you get away with messing with their true power which is debt and money.

Are any of them even touchable?I wonder who the first "global elite" to be unalived will be?

Do they ever lower themselves to walk among the people they so despise?

Laughs in PrincipAre any of them even touchable?

Do they ever lower themselves to walk among the people they so despise?

Those are brackets and do not reflect the effective tax rate. Most pay far, far less than they think in income taxes. For example, the standard deduction for a married couple is $30,000. That is effectively a 0% tax bracket that is not even reflected in that table. As a result, you have to add $30,000 to all of the numbers even to figure out which tax brackets affect you.This is from the IRS web site:

So depending on how much you earn, paying a 21% consumption tax might be less of an impact than paying the marginal rate.

So for 24% and above, your tax burden would be less. Even for lower incomes the tax burden might still be less because you would be taxed on what you spend and not what you earn.

Then there are other deductions, student loan interest, and so on, and then tax credits, like the child tax credit, 2 grand apiece, so $6000 off of your tax, not a deduction from income, but actually off your tax bill, if you have 3 kids, and so on.

I have a six figure income, but if I stuff enough into my 401(k) and HSA I sometimes get my effective tax rate down into the single digits, that is, below 10%.

What this does not consider, however, is payroll taxes, social security and medicare. Is the proposal seeking to do away with payroll taxes, too, or just the income tax?

notable only because the pedo chinese linked biden regime failed to release the findings.and this is a revelation? a great intelligence coup from an incompetent,back stabbing bunch of deep state thugs.

Everybody is touchableAre any of them even touchable?

There are roughly 55,000 of them, mapped out in the image here. They have become the fifth branch of government. These corrupt liberal NGO's are using federal taxpayers' monies to interfere with our institutions and country. To interfere at all levels, to promote the phony crap such as transgenderism, climate change, DEI, the Covid vaccine scam and so forth and so on. Now, we can see the Biden leftovers are moving into these NGO's—funded by the US Treasury—to continue to do their dirty work. President Trump: all funding needs to be cut off now.

Last edited:

we knew they were feds. now confirmed.

Really. A white supremacist group not wanting a non-white in a cabinet position. How strange.

One would think the fires would make them feel more unsafe. Ungratefulness is one of the worst characteristics a person can have.

Senate Intel Panel Reportedly Considering HIDING Their Votes on Tulsi Gabbard from the American People Following News of Susan Collins's Possible Opposition to Gabbard | The Gateway Pundit | by Cullen Linebarger

A Senate vote on Tulsi bard's DNI confirmation may be conducted in secrecy, raising serious concerns about transparency and public trust. Read more about this alarming development and its implications.

UNREAL...regardless of what one may think of Tulsi. These RINO/COMMIES like Susan Collins gotta go!!!! Not knowing how they vote is about as un-American as it gets. Founders would be practicing their boy scout manual right now.

I'm guessing the Catholics are happy to try to flood the country with people who might be willing to be at least nominal members of their Church.

They spend a bit of money and then dump them all on us to have to support and they get numbers and (they most likely hope) eventually more power and money for them...

One could look at it as yet another way of fleecing the taxpaying citizens and legal residents of our country for more money...

"Monday Afternoon Massacre": USAID Employees Placed On Leave For Allegedly Circumventing Trump's Orders | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

USAID, which notably gave Wuhan Labn collaborator EcoHealth Alliance a $4.67 million grant in 2021, then stonewalled when asked for documents - and handed Ukrainian energy giant Burisma a lucrative contract months after Hunter Biden joined its board, and gave $15 million to organizations linked to George Soros, is an 'independent' federal agency that leads US efforts on international development and 'humanitarian assistance' to other countries.

Republicans have been long critical of USAID's priorities, including providing funds to Afghanistan to distribute contraceptives.

"USAID needs to be dismantled," wrote Rep. Mike Collins (R-GA) in a Monday post on X.

Maybe. Waiting on outcomes, past a few headlines. I hope I'm wrong.This didn't age well

Similar threads

- Replies

- 56

- Views

- 2K

- Replies

- 0

- Views

- 345

- Replies

- 9

- Views

- 872

- Replies

- 90

- Views

- 4K

Precision Rifle Gear

Review: AIM FS-42 folding stock bag w/ AXSR

- Replies

- 5

- Views

- 490