$4.84 was the cheap price in Eastern Oregon. About 20 cents cheaper in the Boise area.

Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Price Check in the Gas and Diesel Aisle...

- Thread starter BullGear

- Start date

$4.84 was the cheap price in Eastern Oregon. About 20 cents cheaper in the Boise area.

$2.00 difference?$2.99 at the Phillips station in Lawton.

WTF?

- Nov 3, 2010

- 10,482

- 22,917

I'd like to know where the refineries in CA send there goods. Seems like back east.$2.00 difference?

WTF?

I'd like to know where the refineries in CA send there goods. Seems like back east.

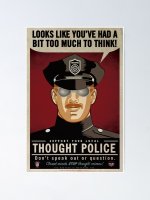

Your government does want you doing that.

Don't think!!!

Sorry my bad. What was I thinking...... oh wait.Your government does want you doing that.

Don't think!!!

Sorry my bad. What was I thinking...... oh wait.

You're just one thought away from taking a trip to a reeducation camp...

But I graduated HS. I don't need to be reeducated.You're just one thought away from taking a trip to a reeducation camp...

I'm glad to see some humor still here on the Hide. For a second it looked like the fun police was catching up with the thought police. Maybe the two will merge and hook up with the FBI and IRS. Oh dammit did that buy me a ticket to the reeducation camp?

The writing is on the wall for Europe in terms of this coming winter – It's going to get ugly. With natural gas imports from Russia cut by 80% through Nord Stream 1 along with the majority of oil shipments, the EU is going to be scrambling for whatever fuel sources they can find to supply electricity and heating through the coming winter. Two sources that were originally suggested as alternatives were Iran and Venezuela.

oilprice.com

oilprice.com

Venezuela Halts Oil Shipments To Europe, Demands New Concessions | OilPrice.com

Venezuela has halted oil shipments to Europe, saying it is no longer interested in oil-for-debt deals and instead wants refined fuels from European producers in exchange for crude

Warren is into enterprises that make money over the long haul... Oil and refining must be going to be a money maker down the road.

Maybe he will build a new refinery. Bonus is a Southern girl is the CEO

www.cnbc.com

www.cnbc.com

Maybe he will build a new refinery. Bonus is a Southern girl is the CEO

Warren Buffett gets permission to buy up to half of Occidental Petroleum, boosting the shares

Warren Buffett's Berkshire Hathaway received permission to purchase up to 50% of oil giant Occidental Petroleum.

He bought up the railroads just prior or during the Obama admin. He probably knew that admin would run the oil by trains.Warren is into enterprises that make money over the long haul... Oil and refining must be going to be a money maker down the road.

Maybe he will build a new refinery.

Warren Buffett gets permission to buy up to half of Occidental Petroleum, boosting the shares

Warren Buffett's Berkshire Hathaway received permission to purchase up to 50% of oil giant Occidental Petroleum.www.cnbc.com

He bought up the railroads just prior or during the Obama admin. He probably knew that admin would run the oil by trains.

He bought up the railroads just prior or during the Obama admin. He probably knew that admin would run the oil by trains.

Not quite.

He lobbied for the pipelines to be shutdown so his rail was the only game in town.

He gave tons to Biden's machine specifically for that purpose and got his payback almost the moment Biden was in office.

When I saw this I wondered on the play. The Inflation Reduction Act doesn't seem conducive to more oil production as they are subsidizing green renewables. I don't see Biden changing that tune before his next election as to appease his base.Warren is into enterprises that make money over the long haul... Oil and refining must be going to be a money maker down the road.

Maybe he will build a new refinery. Bonus is a Southern girl is the CEO

Warren Buffett gets permission to buy up to half of Occidental Petroleum, boosting the shares

Warren Buffett's Berkshire Hathaway received permission to purchase up to 50% of oil giant Occidental Petroleum.www.cnbc.com

However I see Russia and possibly China making their moves after the midterms. Russia alone would drive oil and especially nat gas prices up. it looks like nat gas is 30% of Occidental's production.

However I see Russia and possibly China making their moves after the midterms. Russia alone would drive oil and especially nat gas prices up. it looks like nat gas is 30% of Occidental's production.

A huge part of domestic USA electric production is reliant on natural gas for the fuel source

So is most of the domestic production of hydrogen

So is fertilizer.

So somebody is planning to push electric and maybe a few hydrogen cars in a big way guess what will become more valuable.

fertilizer shortages on a global scale thanks to the whole business blockading Russia...

Look at the big picture... Worldwide...... America is well on it's way down the rabbit hole..... The rest of the world will burn coal, oil, cow chips, wood chips and nukes.... If he can fuel his rail road as the rest of the transportation sector (diesel) struggles, he is in the cat bird seat.When I saw this I wondered on the play. The Inflation Reduction Act doesn't seem conducive to more oil production as they are subsidizing green renewables. I don't see Biden changing that tune before his next election as to appease his base.

Going to be an interesting circus to watch.

Prices are volatile, all over the board. And that is just what is being reported. A lot of oil moving without price tracking. Spot market is crazy.

| WTI Crude • | 87.76 | -3.01 | -3.32% |

| Brent Crude • | 93.84 | -2.88 | -2.98% |

Prices are only 20 cents or so less in Boise area. The whole Western US states have higher prices. Possibly because we have greater distances to drive and they're shipping the gas we produce to other states.It would appear the price for fuel in Oregon have been Californicated.

Or could it be that we're being taxed to death by a bunch of communist on the left coast.Prices are only 20 cents or so less in Boise area. The whole Western US states have higher prices. Possibly because we have greater distances to drive and they're shipping the gas we produce to other states.

It is a "number's game" on a worldwide basis. Fuel is going to the highest bidder. Any fuel (gasoline, firewood, natural gas, diesel, coal, propane, electricity) will be increasing as winter approaches.Prices are only 20 cents or so less in Boise area. The whole Western US states have higher prices. Possibly because we have greater distances to drive and they're shipping the gas we produce to other states.

Do you think the thermostats will be turned down in the White House, Post Office and other government buildings ?

There's no question that California's prices are elevated due to taxes. That doesn't really reflect Idaho's prices.Or could it be that we're being taxed to death by a bunch of communist on the left coast.

Oh I'm sure they will be. And their private jets are being converted to run on fairy dust.It is a "number's game" on a worldwide basis. Fuel is going to the highest bidder. Any fuel (gasoline, firewood, natural gas, diesel, coal, propane, electricity) will be increasing as winter approaches.

Do you think the thermostats will be turned down in the White House, Post Office and other government buildings ?

BTW citibank is projecting UK's inflation to be around 18% in 2023 first quarter. That's probably be reflected in our fuel costs. https://www.bloomberg.com/news/arti...ural-gas-crisis-will-drive-uk-inflation-to-18

US gas prices have fallen below $4 a gallon - but Americans should brace for another rally this winter, Bank of America says

Gas prices fell to $3.90 a gallon last week. But a lack of flexibility in demand means that they'll find a floor before spiking again this winter, the bank said.

peopleswatchdog.co.ke

peopleswatchdog.co.ke

Things are moving quickly. While this is not oil, it is a stepping stone.

“Gas is widely seen as the optimal product in the transition from fossil fuels to renewable energy, so controlling as much of the global flow of that will be the key to energy-based power over the next ten to twenty years", according to a senior source who works closely with Iran’s Petroleum Ministry.

oilprice.com

oilprice.com

“Gas is widely seen as the optimal product in the transition from fossil fuels to renewable energy, so controlling as much of the global flow of that will be the key to energy-based power over the next ten to twenty years", according to a senior source who works closely with Iran’s Petroleum Ministry.

Iran And Russia Move To Create A Global Natural Gas Cartel | OilPrice.com

Russia and Iran have been quietly building the foundations for a potential “OPEC of natural gas”, and it could have serious implications for global gas markets

$3.75.9 today.

They're trying to get the price down just in time for the election this year.

Every station still has the "I did that" stickers on every pump. Seems the station owners don't mind them being there.

They're trying to get the price down just in time for the election this year.

Every station still has the "I did that" stickers on every pump. Seems the station owners don't mind them being there.

He bought up the railroads just prior or during the Obama admin. He probably knew that admin would run the oil by trains.

He donated to the Democratic party to GUARANTEE that the pipeline would be stopped by Biden.

Buffett makes 100m a year on his rail lines.

Hope it goes to $150.Run up on oil, late in the day. WTI - 94.89

Oil trading has become so volatile the seasoned traders are stepping back..... I'm guessing a large amount of oil is just going at the "spot market" price.... Could get dicey this winter....Hope it goes to $150.

If oil goes to spot market and food commodities go spot market... Look out !

but you said 'SHORT' back on page 15......just curious, why you screaming short, when really you're going long?Hope it goes to $150.

Short crude for financial security.

BigFatCock said on page 15,what do you think it's going to bottom at? and over what time range?

edit - you don't thing oil sellers will use this as an excuse to try to crank the prices?

8/11/22 U.S. offshore oil producers Shell, Chevron and Equinor on Thursday halted operations at facilities pumping hundreds of thousands of barrels of oil per day, citing an onshore pipeline leak that a port official said should take about a day to fix.

- net loss of 600k barrels per day of oil production

Click to expand...

I’m looking for $75 by December to close everything out again.

World wide demand destruction due to EV’s and people being broke AF.

I’m still short, and will stay short. I have stops in place, so if I get stopped out then I will just average back into a new short position.but you said 'SHORT' back on page 15......just curious, why you screaming short, when really you're going long?

BigFatCock said on page 15,

I’m looking for $75 by December to close everything out again.World wide demand destruction due to EV’s and people being broke AF.

If you go even farther back, or it might be another thread, I entered my first short positions at $120, and even then was hoping for a fast spike to $150 so I could continue to add to my short. I was hoping to end up with an average between the mid $130-$145 area before the bottom dropped out.

Funny story is the bottom drop out before then, lol. Covered half my short at $110 and the other half at $100. Closed my SCO and DRIP LONG positions around the same time.

Re-entered my short position at $105, and my SCO and DRIP positions at the same time. Plan remains the same.

So I don’t know if you’re trying to imply that I’m trying to dupe people into shorting so I can profit on a long position or what, but I have made my positions and intentions clear throughout this whole time. I shorted when everyone was going long because some dumb analysts said oil was going to $200. Around that time was when I started building short positions on retail companies and travel as well. Talked about those here too.

with no skin in the game, my feeling is, when the strategic oil reserves run out... Oil will spike like hell, and the gov will buy it back at the spike to help China and Russia even more. My gut says oil is going up. I'm watching your words because I'm interested in your opinion.I’m still short, and will stay short. I have stops in place, so if I get stopped out then I will just average back into a new short position.

If you go even farther back, or it might be another thread, I entered my first short positions at $120, and even then was hoping for a fast spike to $150 so I could continue to add to my short. I was hoping to end up with an average between the mid $130-$145 area before the bottom dropped out.

Funny story is the bottom drop out before then, lol. Covered half my short at $110 and the other half at $100. Closed my SCO and DRIP LONG positions around the same time.

Re-entered my short position at $105, and my SCO and DRIP positions at the same time. Plan remains the same.

So I don’t know if you’re trying to imply that I’m trying to dupe people into shorting so I can profit on a long position or what, but I have made my positions and intentions clear throughout this whole time. I shorted when everyone was going long because some dumb analysts said oil was going to $200. Around that time was when I started building short positions on retail companies and travel as well. Talked about those here too.

edit - we'll see if Nancy P takes a position in the oil market

I’m firmly of the belief that all bullish analysts are either wrong or lying. I believe they are so removed from main street America, that they have no idea how broke people are.with no skin in the game, my feeling is, when the strategic oil reserves run out... Oil will spike like hell, and the gov will buy it back at the spike to help China and Russia even more. My gut says oil is going up. I'm watching your words because I'm interested in your opinion.

A lot of my canaries are dying, and what’s in the news does not add up.

However, I still continue to buy the S&P and Apple every month, and rebuilt long positions in cruise lines when NCLH was in the $10’s and CCL was in the $8’s.

Lambos or food stamps. Which will it be, lol?

I'm thinking we'll be having higher prices on oil this winter. Maybe even pushing the $150 or closer to it. Who knows these days.

Similar threads

- Replies

- 396

- Views

- 20K