It should be per capita.I am shocked... shocked, I say.

The perfect storm is brewing.

When all of the savings is spent on a roof over their head and food on the table for the kids... Reality will over rule Denial.

The administration will continue borrowing and pandering while all of the other countries who are well managed will step away from America.

View attachment 8223600

Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock Market

- Thread starter pmclaine

- Start date

Like other "trades".. Some are worth it and the majority need to go do something besides being a realtor.Maybe they shouldn't still be charging 6% commission when prices have tripled.

There are some situations when a seller needs to move a property quickly at a fair price. I have been there. I ran the stats on realtors and picked the guy who was selling the most properties. He was worth every penny. On the other hand I have had slugs that showed a property once in 4 months.

The fallout of the realtor's is starting to happen.

Difficult to put a number on the number of illegals in America.It should be per capita.

Yep... They don't want an accurate 2023 number to leak out...Is that estimate from 1990? LOFL

What's your guess ?

Yep... They don't want an accurate 2023 number to leak out...

What's your guess ?

Probably lower or not much higher. The conversion rate is probably pretty high.

2018, an MIT study put the number at 22M illegal aliens.

In 2022 alone, over 2.75M illegals crossed the border. I think that number is low.

In 2022 alone, over 2.75M illegals crossed the border. I think that number is low.

MayorkASS wants work visa's for 50 million illegals. Where did he get that number???2018, an MIT study put the number at 22M illegal aliens.

In 2022 alone, over 2.75M illegals crossed the border. I think that number is low.

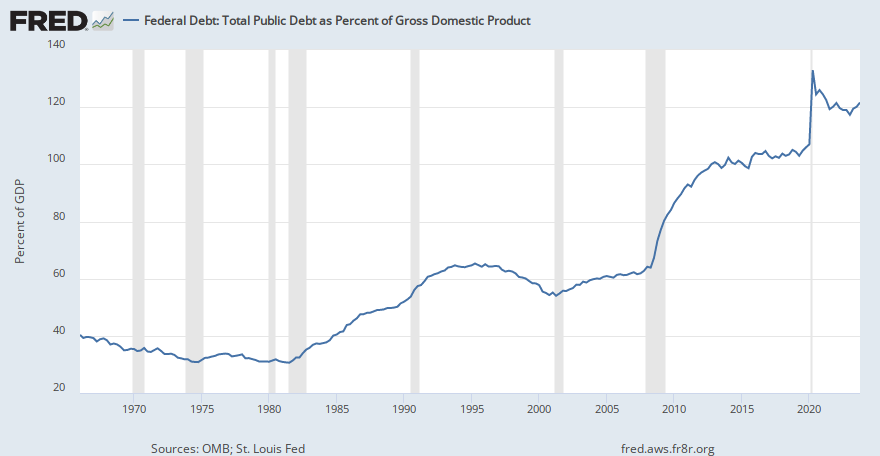

Does not look as bad..... It looks worse than it was. Moving in the wrong direction, for sure.I think that when comparing debt normalized to GDP ours does not look as bad...

Federal Debt: Total Public Debt as Percent of Gross Domestic Product

View the ratio of federal debt to the economic output of the U.S., which can indicate economic health and the sustainability of government borrowing.

fred.stlouisfed.org

"The interesting feature of the four extreme episodes reported above

is their sudden, harsh end. In each case policy was thought to be

successful, prosperity prevailed, credibility was intact or being built

up, and policy makers rode high. Then The entire strategy unraveled in

almost no time and gave way to a large realignment.Invariablyit is asked what went wrong.

Major misalignments can arise because, absenta clear and accepted

test for the right price for a currency, there is room for serious disagreement.The same is true for the stock market or in real estate. The Factors

influencing the exchange rate are diffuse and prospective, just as they

are for asset prices. Once a misalignment is in place, it is difficult to undo quickly, for both political and economic reasons. That is why it

will ultimately precipitate a collapse.

In the extreme cases discussed above, market participants differed

in their opinions of the sustainability of the policy regimes.Policymakers and much of the market had little doubt that they were sustainable,

and that reserve depletion would be short-lived. They believed (and perhaps still do) that had it not been for this or that surprising factor,

all would have been well. It was not the policy that was wrong, but the

accidental disturbance that interfered with short-termfinancing.This

interpretation is captured by the "sudden stop" in the bankers' adage

quoted at the beginning of the paper. But it is overly benign. If an exchange rate and current account position is vulnerable to disruption, then the currency is more than likely to be overvalued.

What actually goes wrong involves both the policies that created the vulnerability and the lenders who jump ship. In such situations, policy makers are invariably surprised by how the market can suddenly turn

on them, and by the extent to which they have underestimated their vulnerability. Markets, in turn, are surprised by how little liquidity

there is when all the lenders scramble to get out at the same time. The combination makes for a chaotic collapse and the disruption of finance. Moreover, because the policy regime is typically sustained by strong appeal to credibility, any action that undermines this will profoundly disorient the lenders, thus aggravating the lack of credit.

....

Why do markets keep financing a situationthat to all appearances is

vulnerable, if not outright unsustainable? Ex post this is always the question, whether in relation to the stock market, to tulip bubbles, to

real estate, or to emerging market lending. The answeris that there

are different opinions of what is happening. Moreover, there is always

a temptation to ride an unsustainable course for a little while. In fact,

the capital market was exuberantly willing to lend in the Chilean and Mexican crises. After net negative portfolio investment in 1983-89,

Latin America received an averageof $26.6 billion in portfolio capital

flows over the period 1990-94. Fora while, stock returns bore out the

wildest optimism, as table 13 shows. A dominant share of market

participants thought that the risks were small and well worth taking;

they thought that the policies were right and sustainable, and would

increasingly be vindicatedby events."

is their sudden, harsh end. In each case policy was thought to be

successful, prosperity prevailed, credibility was intact or being built

up, and policy makers rode high. Then The entire strategy unraveled in

almost no time and gave way to a large realignment.Invariablyit is asked what went wrong.

Major misalignments can arise because, absenta clear and accepted

test for the right price for a currency, there is room for serious disagreement.The same is true for the stock market or in real estate. The Factors

influencing the exchange rate are diffuse and prospective, just as they

are for asset prices. Once a misalignment is in place, it is difficult to undo quickly, for both political and economic reasons. That is why it

will ultimately precipitate a collapse.

In the extreme cases discussed above, market participants differed

in their opinions of the sustainability of the policy regimes.Policymakers and much of the market had little doubt that they were sustainable,

and that reserve depletion would be short-lived. They believed (and perhaps still do) that had it not been for this or that surprising factor,

all would have been well. It was not the policy that was wrong, but the

accidental disturbance that interfered with short-termfinancing.This

interpretation is captured by the "sudden stop" in the bankers' adage

quoted at the beginning of the paper. But it is overly benign. If an exchange rate and current account position is vulnerable to disruption, then the currency is more than likely to be overvalued.

What actually goes wrong involves both the policies that created the vulnerability and the lenders who jump ship. In such situations, policy makers are invariably surprised by how the market can suddenly turn

on them, and by the extent to which they have underestimated their vulnerability. Markets, in turn, are surprised by how little liquidity

there is when all the lenders scramble to get out at the same time. The combination makes for a chaotic collapse and the disruption of finance. Moreover, because the policy regime is typically sustained by strong appeal to credibility, any action that undermines this will profoundly disorient the lenders, thus aggravating the lack of credit.

....

Why do markets keep financing a situationthat to all appearances is

vulnerable, if not outright unsustainable? Ex post this is always the question, whether in relation to the stock market, to tulip bubbles, to

real estate, or to emerging market lending. The answeris that there

are different opinions of what is happening. Moreover, there is always

a temptation to ride an unsustainable course for a little while. In fact,

the capital market was exuberantly willing to lend in the Chilean and Mexican crises. After net negative portfolio investment in 1983-89,

Latin America received an averageof $26.6 billion in portfolio capital

flows over the period 1990-94. Fora while, stock returns bore out the

wildest optimism, as table 13 shows. A dominant share of market

participants thought that the risks were small and well worth taking;

they thought that the policies were right and sustainable, and would

increasingly be vindicatedby events."

As a currency collapse is taking place... With respect to America... Where is the "Safe Haven" ?

The asking price on a 1986 Ford F-150 has now dropped to 50% less than the asking price of a 1996 F-150. Where is the value ?CNY drops to a 16-year low against the dollar.

The Ponzi /Dollar scheme is coming into the spot light.

Gold vs DXY

oilprice.com

oilprice.com

China’s Massive Gold-Buying Spree Continues | OilPrice.com

Central banks globally continue to expand their gold reserves, with China leading the way, amidst economic concerns and seeking financial stability.

Last edited:

CNY drops to a 16-year low against the dollar.

Worth a quick read:

There is a large divergence in CNY forecast as banks try to determine China’s fiscal policy end game. The PBoC have introduced new measures as the article points out but there is doubt that these measures contain enough wherewithal to provide the fiscal boost the markets are seeking. Greater stimulus is required to support a strong CNY. Should that not actualize, (I don’t think it will to the point of getting below 7), it will drag on AUD and CLP. Banks are forecasting a large spread in rate (225bps+) when comparing to each other for 2024. I had not anticipated that it would weaken to the point of 7.30.

We are also at an interesting intersection. Mexican imports are expected to cross China for the first time ever (USA) in Q4. MXN has been strengthening (and maintaining) to a point of disbelief.

We are also at an interesting intersection. Mexican imports are expected to cross China for the first time ever (USA) in Q4. MXN has been strengthening (and maintaining) to a point of disbelief.

Lots of reasons behind this (tariffs probably being at the top of that list), but yeah it's a thing, and it's likely to continue into the foreseeable future.

Peter Zeihan predicts that the future of manufacturing looks like the US dominates really high-tech stuff (think semiconductors) and anything involving large energy inputs (raw material production), and Mexico picks up the manufacturing and assembly which sits in-between those bookends. He gets a lot of shit for various reasons, but I think that this is a solid prediction.

Obviously Mohamed El-Erian does not have a grasp on the Chinese culture. Are the Chinese saying they want to have the world's largest economy ?

After all, supposedly, America has the largest economy and look at the pickle we are in.

Ever watch an auto race where the #2 car bumps the #1 car's back bumper for the last 50 laps and when the white flag appears, #2 makes his pass on the last lap?

It will come down to the "resilience" of the populous.

Beijing Unveils Massive $40 Billion Fund To Boost Chipmaking | OilPrice.com

China unveils a $40 billion government-backed investment fund to enhance its semiconductor industry, intensifying the chip race with the U.S.

Just another Meme stock. See what tomorrow brings.

Set your "Stop Loss" tight.

www.cnbc.com

www.cnbc.com

Set your "Stop Loss" tight.

Jamie Dimon says it's a 'huge mistake' to think economy will boom with so many risks out there

Dimon cited tighter monetary policy and the Ukraine war as big risks for the economy.

Of course...

__________

Steve Forbes doesn’t expect the Federal Reserve to raise rates in upcoming meetings, but the Forbes Media chairman doesn’t see cuts in the near term either.

“I think the Federal Reserve is not going to increase interest rates in the next few months. I think they’re going to pause,” Forbes said, citing the slew of contradictory U.S. economic data.

“Some things are weakening, the labor market usually is a lagging indicator. But the services [sector] report was pretty good,” he told CNBC’s Chery Kang on the sidelines of the Forbes Global CEO Conference held in Singapore.

“So that mixed picture gives them [an] excuse finally to do nothing,” he said.

www.cnbc.com

www.cnbc.com

__________

Steve Forbes doesn’t expect the Federal Reserve to raise rates in upcoming meetings, but the Forbes Media chairman doesn’t see cuts in the near term either.

“I think the Federal Reserve is not going to increase interest rates in the next few months. I think they’re going to pause,” Forbes said, citing the slew of contradictory U.S. economic data.

“Some things are weakening, the labor market usually is a lagging indicator. But the services [sector] report was pretty good,” he told CNBC’s Chery Kang on the sidelines of the Forbes Global CEO Conference held in Singapore.

“So that mixed picture gives them [an] excuse finally to do nothing,” he said.

Steve Forbes says the Fed's not going to cut rates soon

The Fed started its aggressive rate hike campaign in March 2022 as inflation climbed to its highest levels in 40 years.

Inflation accelerated in August as oil prices surged

Consumer prices edged higher in August as a surge in oil prices contributed to an uptick in headline inflation, according to the latest data from the Bureau of Labor Statistics.

Huh - I was told that inflation is dead.

It all has to do with "mindset"..... or, that is what I am being told.... LOL

Inflation accelerated in August as oil prices surged

Consumer prices edged higher in August as a surge in oil prices contributed to an uptick in headline inflation, according to the latest data from the Bureau of Labor Statistics.finance.yahoo.com

Huh - I was told that inflation is dead.

Inflation continues to rise, but 'the year-over-year numbers are pretty meaningless at this point,' says economist—what actually matters

Although the inflation rate remains too high, it's expected to continue slowing in 2024.

I heard Biden was at 9-11 ground zero the next day.

Inflation accelerated in August as oil prices surged

Consumer prices edged higher in August as a surge in oil prices contributed to an uptick in headline inflation, according to the latest data from the Bureau of Labor Statistics.finance.yahoo.com

Huh - I was told that inflation is dead.

Met with one of the large bank’s economist today. I’m in agreement with their vision that we are headed into a recession. Anticipated to be somewhere between a 2001 and 2008 event recession, favoring 2001. IE: more of a business cycle recession and not consumer.

Other news: trimmed some Tesla and bought Enphase. Might share further insights later.

Maybe I am wrong but you appear to be tilting more towards a "trader" than an "investor".... There is nothing wrong with being either one or both.Other news: trimmed some Tesla and bought Enphase. Might share further insights later.

After watching people for a life time, I can identify when they are currently "shifting". An "investor" senses stability in his life and the world around him and can look forward 20+ years.

A "trader" senses uncertainty and shy's away from investments that could lock him in when he needs to liquidate.

I'm sure this is not the definition on Investopedia or similar sites .... Just how I read the wind, seasons and people.

As for me, I can see no compelling reason to be holding USD's in cash. A line of credit with a balance of $0.00 is all a prudent person with a good credit score needs.

This will not work for the majority of Americans, but... Get away from the USD's in the safe deposit box. There are members here with homesteads, small businesses and carrying too much debt. Invest in your health, your homestead, your business or pay off some of those credit cards.

If you feel you are going to survive (what ever is coming) and plan to step out on the other side, invest in some physical gold.

But, if you have a different "mindset" just carry on with what you are doing.

He was a day late.I heard Biden was at 9-11 ground zero the next day.

What were the ages of the group you met with ?Met with one of the large bank’s economist today. I’m in agreement with their vision that we are headed into a recession. Anticipated to be somewhere between a 2001 and 2008 event recession, favoring 2001. IE: more of a business cycle recession and not consumer.

I have recently read that China has external debt Of 17 trillion+. Knowing how they have played with yuan it is probably double that. China is still dependent on our economy here in the US, they need to push slave labor products and we are willing to ignore human rights violation for cheap stuff and corporate profit. Inflation is removing disposable income here, food and gas and bills.I am shocked... shocked, I say.

The perfect storm is brewing.

When all of the savings is spent on a roof over their head and food on the table for the kids... Reality will over rule Denial.

The administration will continue borrowing and pandering while all of the other countries who are well managed will step away from America.

View attachment 8223600

Maybe I am wrong but you appear to be tilting more towards a "trader" than an "investor".... There is nothing wrong with being either one or both.

After watching people for a life time, I can identify when they are currently "shifting". An "investor" senses stability in his life and the world around him and can look forward 20+ years.

A "trader" senses uncertainty and shy's away from investments that could lock him in when he needs to liquidate.

I'm sure this is not the definition on Investopedia or similar sites .... Just how I read the wind, seasons and people.

As for me, I can see no compelling reason to be holding USD's in cash. A line of credit with a balance of $0.00 is all a prudent person with a good credit score needs.

This will not work for the majority of Americans, but... Get away from the USD's in the safe deposit box. There are members here with homesteads, small businesses and carrying too much debt. Invest in your health, your homestead, your business or pay off some of those credit cards.

If you feel you are going to survive (what ever is coming) and plan to step out on the other side, invest in some physical gold.

But, if you have a different "mindset" just carry on with what you are doing.

I’m a long-term investor in Tesla and Enphase. I trade in my taxable and hold in my retirement. When the market is disconnected, I reevaluate my allocation and make changes where necessary. With current stock prices where they are and YTD performance, I believe there is less risk in Enphase and in a risk-on event, Enphase should benefit more. If I am wrong, then Enphase will benefit later when the cycle churns.

My coworker's husband bought a BMW i4 M50. They are now installing an at-home charging system. Soon enough, that will turn into a solar power/battery pack.

I’m no economist, but seeing what is happening with rising consumer debt and decades high interest rates, combined with the rising energy costs that affect all input costs and inflation with no more reserve to draw from, it’s going to be a consumer based recession in the next year. People are starting to break, and .gov has kicked the can down the road as far as it could to hold it off.

Despite continued “added jobs”, unemployment continues to rise because more are coming back to the job force and looking for work. Not because they want to, but because they have to. It’s only the beginning of the trend, and I believe will continue to creep upward.

But don’t listen to me. I’m just a working class bubba who talks to people and hears their stories how they have stopped buying shit and are repairing old vehicles and other stuff instead of replacing them or going on vacation. People who go to work with diamond cuff links or tennis bracelets know much more about the pulse of the American consumer than us with steel toes and name tags.

Despite continued “added jobs”, unemployment continues to rise because more are coming back to the job force and looking for work. Not because they want to, but because they have to. It’s only the beginning of the trend, and I believe will continue to creep upward.

But don’t listen to me. I’m just a working class bubba who talks to people and hears their stories how they have stopped buying shit and are repairing old vehicles and other stuff instead of replacing them or going on vacation. People who go to work with diamond cuff links or tennis bracelets know much more about the pulse of the American consumer than us with steel toes and name tags.

One was late 40s and other early 60s.What were the ages of the group you met with ?

I am no economist and I am paid to NOT take a market view. But putting on my glasses of a business cycle recession vs. consumer, I interpret this as a broad sector decline of earnings, margins, and reduced capital expenditures. However, many businesses will bear the brunt of this while keeping a headcount. A lesson learned from COVID and a belief that a shallow recession is here, many are not going to want to cycle back in their workforce when things turn. The only way I see a consumer-led recession is through significant layoffs, increasing inflation, and a higher for longer. There is also a despairing difference in class. My coworkers mention the noticeably higher cost but it has not stopped them from buying $50-$70k vehicles this week alone. One purchased a Toyota Grand Highland and has no childrenI’m no economist, but seeing what is happening with rising consumer debt and decades high interest rates, combined with the rising energy costs that affect all input costs and inflation with no more reserve to draw from, it’s going to be a consumer based recession in the next year. People are starting to break, and .gov has kicked the can down the road as far as it could to hold it off.

Despite continued “added jobs”, unemployment continues to rise because more are coming back to the job force and looking for work. Not because they want to, but because they have to. It’s only the beginning of the trend, and I believe will continue to creep upward.

But don’t listen to me. I’m just a working class bubba who talks to people and hears their stories how they have stopped buying shit and are repairing old vehicles and other stuff instead of replacing them or going on vacation. People who go to work with diamond cuff links or tennis bracelets know much more about the pulse of the American consumer than us with steel toes and name tags.

I agree with much of what you say, but I’m seeing the opposite with my own co-workers. These are $130k single income to $200k and up dual income households in a relatively low cost of living area. New vehicles are frugal and most are buying used. A few talk about needing new trucks for their part time ranching and they’re not buying them, instead repairing 20+ year old vehicles. None are buying toys like boats and SxS as they are tightening up their own budgets in their households. Vacations are shorter road trips instead of cruises and flying. Some empty nesters are picking up slack for their kids because they’re nicer than the wife and I are, who tells our adult kids to relish being poor or work more because we’re not stopping funding our retirement accounts to pay their bills.I am no economist and I am paid to NOT take a market view. But putting on my glasses of a business cycle recession vs. consumer, I interpret this as a broad sector decline of earnings, margins, and reduced capital expenditures. However, many businesses will bear the brunt of this while keeping a headcount. A lesson learned from COVID and a belief that a shallow recession is here, many are not going to want to cycle back in their workforce when things turn. The only way I see a consumer-led recession is through significant layoffs, increasing inflation, and a higher for longer. There is also a despairing difference in class. My coworkers mention the noticeably higher cost but it has not stopped them from buying $50-$70k vehicles this week alone. One purchased a Toyota Grand Highland and has no children

Those in layoff sensitive crafts with lower seniority are stacking cash and paying off any debt they have, as they see the train traffic diminishing and crew assignments dropping. Consumer goods have a double digit Y/Y percentage drop on what we’re moving with no sign of coming back yet. Coal vs natural gas may be a saving grace for them with oil going back up and NG sometimes following that trend, as well as hopefully a colder than usual winter being a good possibility.

I’m looking at macro and micro factors in my little neck of the prairie, and I’m seeing a lot of consumer pullback that is not ebbing in the least.

Understood.One was late 40s and other early 60s.

1973 oil embargo and price of oil increased 300%

1979 was the second "oil shock".. Gasoline was rationed by the last number on your license plate.

1991 was the S&L crash / recession

2008 was the Great Recession

Those folks probably don't remember the effects of these past recessions.

Comparing the Government bailouts after the Pandemic to the previous recessions is like comparing apples to oranges.

That is one of the many, many differences of this current recession.

During the previous recessions the impact / recovery was measured in Millions of dollars. Everything today is in Billions of dollars.

The government pulled out it's VISA card and charged the COVID recovery. That was not done in previous recoveries.

This one is different, It will catch the majority off guard. There are very, very few on Wall Street who see what is coming. Jamie Dimon (age 67) see's it and has been vocal about the future. Jerome Powell (age 70) see's it but 1) is degreed in a politics from Princeton University in 1975 and is 2) politicizing this recession. Europe / UK when calculating inflation is "calling a spade" and pegging it at 8.5%. Today the Government released their inflation numbers. My take on the link below is this: It's all good, until it's not.

OK S3th I am going to concede to you on something. Around my homestead a situation came up where battery powered has out weighted gasoline powered.

Converted my weed sprayer to 12 volt after dealing with a rusty gas tank for the past few springs.

Ready to do my fall weed spraying.

Converted my weed sprayer to 12 volt after dealing with a rusty gas tank for the past few springs.

Ready to do my fall weed spraying.

I'm in the same boat. My household income is around 200k depending on bonuses. I have been wanting a tractor for over a year now, but I can't make myself turn loose of the money. I already have a garden, fruit trees/ bushes, chickens, ect. I haven't really made any big purchases this year, just piling up cash in case things go bad. I'm 35 and my wife is 33 so we were really too young to understand '08. I have talked too several mid sized business owners and hear all the horror stories. I really thought this would have hit 2 years ago, now it looks like next year. I just trying to be patient.I agree with much of what you say, but I’m seeing the opposite with my own co-workers. These are $130k single income to $200k and up dual income households in a relatively low cost of living area. New vehicles are frugal and most are buying used. A few talk about needing new trucks for their part time ranching and they’re not buying them, instead repairing 20+ year old vehicles. None are buying toys like boats and SxS as they are tightening up their own budgets in their households. Vacations are shorter road trips instead of cruises and flying. Some empty nesters are picking up slack for their kids because they’re nicer than the wife and I are, who tells our adult kids to relish being poor or work more because we’re not stopping funding our retirement accounts to pay their bills.

Those in layoff sensitive crafts with lower seniority are stacking cash and paying off any debt they have, as they see the train traffic diminishing and crew assignments dropping. Consumer goods have a double digit Y/Y percentage drop on what we’re moving with no sign of coming back yet. Coal vs natural gas may be a saving grace for them with oil going back up and NG sometimes following that trend, as well as hopefully a colder than usual winter being a good possibility.

I’m looking at macro and micro factors in my little neck of the prairie, and I’m seeing a lot of consumer pullback that is not ebbing in the least.

I think I know why it's rusting:OK S3th I am going to concede to you on something. Around my homestead a situation came up where battery powered has out weighted gasoline powered.

Converted my weed sprayer to 12 volt after dealing with a rusty gas tank for the past few springs.

Ready to do my fall weed spraying.

View attachment 8226702View attachment 8226703View attachment 8226704

I have had zero luck with Briggs & Stratton going the distance, and have since gone Honda for all small motors whenever possible. I can't recommend them enough.

Small tools are perfect for batteries and electric motors anyhow. But, we keep trying to push to more battery operated tools to get off hydraulics and lessen the hazard of a leak causing a hydraulic fluid injection injuries. Spike pullers/drivers, drills, impacts, all shifting to battery, and this is tens of thousands of dollars invested into this per crew. All of the battery tools have thus far shit out when the temps get above 90°F and we break back out the hydraulics.

I run a pair of Milwaukee grinders and impacts, one in the cab with the AC blowing on it to cool it off and the other in the hand burning up. When one gets hot and fails, swap them and keep at it. Batteries are handy, but still can't keep up with real power in all conditions.

I have Honda powered equipment and I prefer it. This fixed income prohibits me from buying very much "NEW" equipment. Even at the auctions and used equipment places, the Honda's draw a premium price.I think I know why it's rusting:

View attachment 8226761

I have had zero luck with Briggs & Stratton going the distance, and have since gone Honda for all small motors whenever possible. I can't recommend them enough.

Small tools are perfect for batteries and electric motors anyhow. But, we keep trying to push to more battery operated tools to get off hydraulics and lessen the hazard of a leak causing a hydraulic fluid injection injuries. Spike pullers/drivers, drills, impacts, all shifting to battery, and this is tens of thousands of dollars invested into this per crew. All of the battery tools have thus far shit out when the temps get above 90°F and we break back out the hydraulics.

I run a pair of Milwaukee grinders and impacts, one in the cab with the AC blowing on it to cool it off and the other in the hand burning up. When one gets hot and fails, swap them and keep at it. Batteries are handy, but still can't keep up with real power in all conditions.

I see what I call ‘Pocket recessions’ throughout the landscape.

It’s odd really. It’s like a creeping recession slowly invading from the bottom up. Right now I’d say the $60k and under class are really feeling it while those making more are ignorant of it at this time.

It’s odd really. It’s like a creeping recession slowly invading from the bottom up. Right now I’d say the $60k and under class are really feeling it while those making more are ignorant of it at this time.

Wall Street Breakfast article today about looming UAW strike: "Demands range from higher wages, more paid time off, reduced workweeks, a return to traditional pensions, the elimination of wage classification tiers and a shift back towards cost-of-living adjustments." Work less, paid more. Interesting that the big union sees the potential downside of 401ks - if workers do not have the self discipline and self direction to save and invest; they enter retirement with only Social Security. Wonder what percentage of Americans who have 401k opportunies use them and use them wisely?

Last edited:

1) AI getting more white collar jobs. 2) COVID showed they needed less layers of management - what do all those layers do anyway? 3) SKYNET is coming.

Again, feels like "2008". People kept going deeper and deeper in debt - when bad times hit there was a run on yachts, ski boats, jet skis, fancy pickups, jeeps, second homes...............................I see what I call ‘Pocket recessions’ throughout the landscape.

It’s odd really. It’s like a creeping recession slowly invading from the bottom up. Right now I’d say the $60k and under class are really feeling it while those making more are ignorant of it at this time.

Some provoking thoughts.Wall Street Breakfast article today about looming UAW strike: "Demands range from higher wages, more paid time off, reduced workweeks, a return to traditional pensions, the elimination of wage classification tiers and a shift back towards cost-of-living adjustments." Work less, paid more. Interesting that the big union sees the potential downside of 401ks - if workers do not have the self discipline and self direction to save and invest; they entire retirement with only Social Security. Wonder what percentage of Americans who have 401k opportunies use them and use them wisely?

The UAW members want exactly what our "Elected Official's" in Washington, DC are getting. Work less and bring in lots of $$$. That is now the American Dream.

The percentage of people in the world's society with self discipline and self direction is the same percentage as it was in Biblical times. Nothing has changed.

401k's and IRA's are controlled by the politicians. The IRA rules now are much different than at it's inception. Politician's change rules in their favor. Like taxes.

The wisest people have their asset's disconnected from the Government's of the world. Who get's the best night's sleep ?

Similar threads

- Replies

- 13

- Views

- 2K

- Replies

- 0

- Views

- 191

- Replies

- 142

- Views

- 17K