Sounds like you have a very tenuous grasp of the basic engineering of such a system. Maybe stick to rah-rah stock market timing.“The Ramcharger is not a PHEV,” Kuniskis said. “It’s a battery-electric truck with its own onboard, high-speed charger.”

Uhhh... initial thought is that this going to quickly ruin the battery lol. The 145-mile range battery will be drained to zero then a generator will kick on to charge the battery while also discharging through the battery to power the vehicle. Who would buy this over a hybrid? Guarantee that this will be significantly more expensive than hybrids currently on the market.

Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock Market

- Thread starter pmclaine

- Start date

Well, I am correct that it is a PHEV and that draining the battery to 0% would quickly ruin the battery. As the article quotes, nothing I said was incorrect. I am happy to make 50% more than my aerospace engineering older brother so I am happy to stick to my rah-rah stock market timing.Sounds like you have a very tenuous grasp of the basic engineering of such a system. Maybe stick to rah-rah stock market timing.

It’s good you are making $$$. You do understand though that an electric drive vehicle with onboard genny does not necessarily require a battery other than starting, correct? Haul trucks are a good example. A major vehicle manufacturer designing a system that destroys a critical part in short order is unlikely.Well, I am correct that it is a PHEV and that draining the battery to 0% would quickly ruin the battery. As the article quotes, nothing I said was incorrect. I am happy to make 50% more than my aerospace engineering older brother so I am happy to stick to my rah-rah stock market timing.

I would suggest you read a thread fully before commenting or at least the article.It’s good you are making $$$. You do understand though that an electric drive vehicle with onboard genny does not necessarily require a battery other than starting, correct? Haul trucks are a good example. A major vehicle manufacturer designing a system that destroys a critical part in short order is unlikely.

I would be willing to place a large bet, that the generator, connected to the power control system, which is connected to the wheels, would allow you to charge up from a dead battery and DRIVE at the same time., the gas generator in the 1500 Ramcharger is not connected to any of the driven wheels.

This statement above, while not from GM also backs my statement... by definition... would have to flow from the generator, through the power control system and to the wheels, without ever hitting the batteries.Unlike the Lightning, Ram can argue, the Ramcharger won’t run out of juice as long as you have dinosaur juice in the tank.

Ram engineers took great pains to explain that, unlike the now-dead Chevy Volt, the gas generator in the 1500 Ramcharger is not connected to any of the driven wheels.

I don't know why they would brag about such a thing. The direct-drive mode in the Voltec was the most efficient mode for high-speed travel. Last I checked, we have lots of that in the US.

This. I expect reporters and corporate press folks to lack more knowledge than the design team.I would be willing to place a large bet, that the generator, connected to the power control system, which is connected to the wheels, would allow you to charge up from a dead battery and DRIVE at the same time.

This statement above, while not from GM also backs my statement... by definition... would have to flow from the generator, through the power control system and to the wheels, without ever hitting the batteries.

Toyota takes on Tesla’s gigacasting in battle for carmaking’s future

Japanese manufacturer works on new approach as it targets big increase in electric vehicle production

www.ft.com

www.ft.com

It'd be more than a bit surprising if Tesla's biggest contribution to the industry ultimately is their manufacturing process and not their powertrain technology - but I can see hints of that narrative forming in the distance.

Hmmmm..... Imagine that. Budget's are starting to tighten up.

Shares of Sleep Number Corp. tanked 25% in the after-hours session Tuesday after the mattress maker and retailer swung to a surprise quarterly loss, predicted a loss for the full year and said it reached an agreement with a shareholder that had been pushing for change.

It was a “challenging” quarter for Sleep Number

www.marketwatch.com

www.marketwatch.com

Shares of Sleep Number Corp. tanked 25% in the after-hours session Tuesday after the mattress maker and retailer swung to a surprise quarterly loss, predicted a loss for the full year and said it reached an agreement with a shareholder that had been pushing for change.

It was a “challenging” quarter for Sleep Number

Sleep Number’s stock is plunging like it’s 2011 as demand dropped ‘abruptly’

Shares of Sleep Number Corp. tanked 25% in the after-hours session Tuesday after the mattress maker and retailer swung to a surprise quarterly loss,...

TOPLINE

Billionaire investor Warren Buffett’s Berkshire Hathaway reported a record $157.2 billion cash pile Saturday morning amid a surge in operating profit, as the conglomerate’s shares continue to climb, while its billionaire officials flirt with a potential new major acquisition.

Warren Buffett, the CEO of Berkshire Hathaway, which boasted a 40% boost in operating earnings.

COPYRIGHT 2018 THE ASSOCIATED PRESS. ALL RIGHTS RESERVED.

KEY FACTS

Berkshire Hathaway, whose subsidiaries run the gamut from insurance giant Geico to ice cream chain Dairy Queen, reporteda third-quarter operating profit of $10.76 billion in the period ending September 30, a 40.6% boost from $7.65 billion in the third quarter of 2022.The Omaha, Nebraska-based company’s cash at the end of September topped its $147.4 billion at the end of the previous quarter, and shattered the company’s previous record of $149.2 billion in the third quarter of 2021.

The company’s performance comes as it takes advantage of rising bond yields, while its soaring cash could enable the conglomerate to make a major purchase — Berkshire vice chairman Charlie Munger told the Wall Street Journal the odds of a big acquisition under his leadership with Buffett are “at least 50/50.”

Berkshire Hathaway also reported a $23.5 billion investment loss in the third quarter, due in part to a quarterly drop in shares of Apple, in which Berkshire owns a minority stake (Apple’s shares have rebounded more than 3% since September 30 and are up more than 41% on the year).

In its statement, the conglomerate also acknowledged its dealings have been impacted by geopolitical conflicts, disruptions to the supply chain, prolonged inflation and “government and private sector actions to mitigate the adverse economic effects of the Covid-19 virus and its variants.”

Forbes Daily: Get our best stories, exclusive reporting and essential analysis of the day’s news in your inbox every weekday.

Sign Up

By signing up, you accept and agree to our Terms of Service (including the class action waiver and arbitration provisions), and Privacy Statement.

TANGENT

Berkshire Hathaway’s class A stock has climbed nearly 14% year to date, with share prices skyrocketing by more than $64,600. The company’s stock had climbed roughly 6% between June 21 and mid-September to an all-time high of $563,072 on September 19, making it one of the summer’s biggest movers on Wall Street — shares have since fallen roughly 6%, to $534,132.FORBES VALUATION

We estimate Buffett’s net worth at $117.5 billion, making the 93-year-old — who has vowed to donate more than 99% of his wealth — the world’s fifth-richest person.

Billionaire Buffett’s Berkshire Hathaway Hits Record $157 Billion Cash — But Loses On Investments

Berkshire Hathaway reported a record cash pile but also a more than $20 billion investment loss for the third quarter.

www.forbes.com

www.forbes.com

Interesting, more free cash than ever. Planning on major acquisitions, and/or maybe planning for lower stock prices?

Wallstreet Breakfast: Americans' credit card debt swelled $154B Y/Y to a record $1.08T in Q3, according to the Federal Reserve Bank of New York, notching the largest increase since it began tracking household debt in 1999. Interestingly, millennials saw the most credit card delinquencies. "Credit card balances experienced a large jump, consistent with strong consumer spending and real GDP growth," said Donghoon Lee, economic research advisor at the NY Fed. Bankrate analyst Ted Rossman also noted that credit card balances have been increasing faster than any other type of debt amid high inflation and record-high credit card rates, adding that "more people are using credit cards just to get by."

The Deep State wants the news to focus on the debt of "We the People"..... No focus on the amount of debt the United States of America has.Wallstreet Breakfast: Americans' credit card debt swelled $154B Y/Y to a record $1.08T in Q3, according to the Federal Reserve Bank of New York, notching the largest increase since it began tracking household debt in 1999. Interestingly, millennials saw the most credit card delinquencies. "Credit card balances experienced a large jump, consistent with strong consumer spending and real GDP growth," said Donghoon Lee, economic research advisor at the NY Fed. Bankrate analyst Ted Rossman also noted that credit card balances have been increasing faster than any other type of debt amid high inflation and record-high credit card rates, adding that "more people are using credit cards just to get by."

Debt of the people + Debt of the country = Collapse

Hmmmm..... Imagine that. Budget's are starting to tighten up.

Shares of Sleep Number Corp. tanked 25% in the after-hours session Tuesday after the mattress maker and retailer swung to a surprise quarterly loss, predicted a loss for the full year and said it reached an agreement with a shareholder that had been pushing for change.

It was a “challenging” quarter for Sleep Number

Sleep Number’s stock is plunging like it’s 2011 as demand dropped ‘abruptly’

Shares of Sleep Number Corp. tanked 25% in the after-hours session Tuesday after the mattress maker and retailer swung to a surprise quarterly loss,...www.marketwatch.com

Tempur-Pedic (TSI) numbers looked halfway decent last week, so this strikes me more as a problem with Sleep Number than the segment or the broader market as a whole.

The entire home furnishing group started trending down 6 months ago. Probably keying off of housing fiasco and interest rates. But, those in need can put it on their CC.Tempur-Pedic (TSI) numbers looked halfway decent last week, so this strikes me more as a problem with Sleep Number than the segment or the broader market as a whole.

DORAVILLE, Ga., June 29, 2023--(BUSINESS WIRE)--Serta Simmons Bedding, LLC ("SSB" or the "company"), a leading global sleep company, today announced that it has concluded its financial restructuring and emerged from Chapter 11, marking the completion of a critical step in the company’s turnaround effort.

The handwriting is on the wall.... Like rats jumping off the sinking ship.

____________

Since last summer, there are new leaders at the Boston, Chicago, Dallas, and Kansas City regional Fed banks. The St. Louis Fed is searching for a new president to replace James Bullard, who left in August.

www.morningstar.com

www.morningstar.com

____________

Since last summer, there are new leaders at the Boston, Chicago, Dallas, and Kansas City regional Fed banks. The St. Louis Fed is searching for a new president to replace James Bullard, who left in August.

Cleveland Fed's Mester to retire next June

Don't get too excited, they will probably be Biden's diversity hires.The handwriting is on the wall.... Like rats jumping off the sinking ship.

____________

Since last summer, there are new leaders at the Boston, Chicago, Dallas, and Kansas City regional Fed banks. The St. Louis Fed is searching for a new president to replace James Bullard, who left in August.

Cleveland Fed's Mester to retire next June

www.morningstar.com

This 100 percent!!The Deep State wants the news to focus on the debt of "We the People"..... No focus on the amount of debt the United States of America has.

Debt of the people + Debt of the country = Collapse

The people that were just getting by before the massive inflation wave that has crept in following FJB’s slew of incompetent policies are now stacking up credit card debt. That article is very telling of what we see in the future.

I agree that a collapse is near. Sad

There will be many factor's to the collapse.This 100 percent!!

The people that were just getting by before the massive inflation wave that has crept in following FJB’s slew of incompetent policies are now stacking up credit card debt. That article is very telling of what we see in the future.

I agree that a collapse is near. Sad

One I was thinking of is "Trust". When a country, like America, loses the financial trust that other countries put in us... It will take 100 years of toeing the line, financially, to build back that trust.

Another is the "Fiat dollar". If America is to survive, the "currency" must backed by something tangible. Not just faith. Crypto is backed by nothing, as we have seen.

Lot's of uncertainty.

I may or may not have ordered this

I heard it was going to be bad because major historic buyers are holding back. Even so, that rates didn't jump "that much"... ?? Or I'm missing something.Woah. Bad USD bond auction...

My reaction was more so from the market selling off from equities to bonds, haha. Rates did not seem to jump much.

So, what are you getting at ?Woah. Bad USD bond auction...

In layman's terms as you look into your crystal ball.

Maybe the market sold equities and bought gold, which is up today.My reaction was more so from the market selling off from equities to bonds, haha. Rates did not seem to jump much.

Nah.

JPOW just said "Just close the fucking door" on climate protestors during his speech hahahaha

JPOW just said "Just close the fucking door" on climate protestors during his speech hahahaha

Three weeks ago, shares of Israel-based solar inverter manufacturer, SolarEdge Technologies Inc. (NASDAQ:SEDG) crashed spectacularly after the company issued weak guidance for its upcoming third quarter earnings report. SolarEdge said Q3 revenues, gross margin and operating income will all come in below the low end of the company’s prior guidance, citing "substantial unexpected cancellations and pushouts of existing backlog from our European distributors," due to higher than expected inventory in the channels as well as slower than expected installation rates.

A similar playbook played out a week ago after shares of iconic EV manufacturer Tesla Inc. (NASDAQ: TSLA) were badly hammered following the company’s less-than-stellar Q3 Report. The report revealed that Tesla not only missed Wall Street’s earnings estimates but its margins have continued to shrink at an alarming clip, suggesting the EV maker is facing stiff competition.

And now the shorts can smell blood in the water, with dozens of solar and electric vehicle stocks becoming their targets. In the solar sector, Sunrun Inc. (NASDAQ:RUN) and Sunnova Energy International (NYSE:NOVA) are among the top 10 most-crowded securities in treasury and liquidity management platform Hazeltree’s list of the most shorted small-cap stocks while Tesla, alongside luxury EV startups Rivian Automotive (NASDAQ:RIVN) and Lucid Group (NASDAQ:LCID), are among the top 10 most shorted mid- and large-cap stocks in October. Among these names, Sunnova and Lucid Motors have the highest short interest at 30.1% and 25.1%, respectively. For some perspective, the median short-interest among S&P 500 stocks usually falls in the 2.1% to 2.4% range, with small-and mid-cap stocks among the most shorted corners of the market at 2.9% and 3.6% short interest, respectively.

oilprice.com

oilprice.com

A similar playbook played out a week ago after shares of iconic EV manufacturer Tesla Inc. (NASDAQ: TSLA) were badly hammered following the company’s less-than-stellar Q3 Report. The report revealed that Tesla not only missed Wall Street’s earnings estimates but its margins have continued to shrink at an alarming clip, suggesting the EV maker is facing stiff competition.

And now the shorts can smell blood in the water, with dozens of solar and electric vehicle stocks becoming their targets. In the solar sector, Sunrun Inc. (NASDAQ:RUN) and Sunnova Energy International (NYSE:NOVA) are among the top 10 most-crowded securities in treasury and liquidity management platform Hazeltree’s list of the most shorted small-cap stocks while Tesla, alongside luxury EV startups Rivian Automotive (NASDAQ:RIVN) and Lucid Group (NASDAQ:LCID), are among the top 10 most shorted mid- and large-cap stocks in October. Among these names, Sunnova and Lucid Motors have the highest short interest at 30.1% and 25.1%, respectively. For some perspective, the median short-interest among S&P 500 stocks usually falls in the 2.1% to 2.4% range, with small-and mid-cap stocks among the most shorted corners of the market at 2.9% and 3.6% short interest, respectively.

Short Sellers Circling The Clean Energy Sector | OilPrice.com

After some downgrades in earnings outlooks, dozens of solar and electric vehicle stocks are becoming targets for short-seller

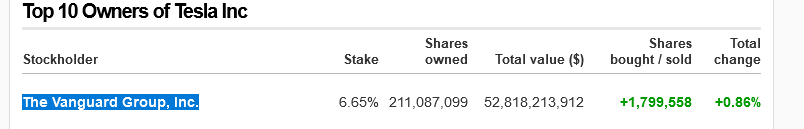

Tesla, largest fund share holder

Those funds can't turn a profit with a stock only gaining 0.86%

Down 25% over the past 2 months

Those funds can't turn a profit with a stock only gaining 0.86%

Down 25% over the past 2 months

LOL... How many shares did you buy in 1992 ?

Moody’s cuts USA outlook to negative, citing higher interest rates and deficits

Moody's cuts U.S. outlook to negative, citing deficits and political polarization

The ratings agency cut its outlook on the U.S. government to negative from stable.

Last edited:

LOL... How many shares did you buy in 1992 ?

You grasp at straws comparing tickers.

I agree... You and I view the world from different perspectives.You grasp at straws comparing tickers.

An example. A "Lifetime Warranty" means very little to me. But a young man like you finds value in a "Lifetime Warranty".

I have experienced how quickly life can end and dodged several bullets along the way.

Tesla Model X Slides Down Boat Ramp, Ignites And Burns Underwater | Carscoops

The extreme flammability of EV batteries was recently proven in Florida after a Tesla Model X slid down a boat ramp and was left to burn by firefighters

This is Jimmy Carter 2.0. Let’s just hope we get Reagan 2.0 afterwards.

Mortgage rate races toward 8% after hitting a high not seen since late 2000

Mortgage rates follow loosely the yield on the 10-year Treasury, which has been climbing this week.www.cnbc.com

Much different now. There is no Paul Volcker now who can tame inflation. The national debt is much higher now. We now have proxy wars.This is Jimmy Carter 2.0. Let’s just hope we get Reagan 2.0 afterwards.

I don't think Carter or Reagan would consider running for President in this situation.

The gradual increase in interest rates by the FED Reserve is simply throwing gasoline on the inflation fire.

Speaking only for myself... Life was much better during the Carter and Reagan years.

The largest offshore wind farm developer, Orsted, just pulled the plug on New Jersey’s wind farm - Atlantic Shores, citing massive losses. One of the worlds largest wind turbine manufacturers, Siemens, just asked Germany for bailout money so they can stay in business after suffering massive losses.It's bigger than a union issue. They're seeing problems with the business case of mass-market EV adoption.

Meanwhile China dominates the mining of most of the rare earth metals needed in the production of EV’s. Next to capitalism, the invention which has most greatly benefited society and helped more poor people gain wealth is the gas combustion engine. Politicians who are trying to flush it into the toilet bowl of history must have ulterior motives.

He's right, you know.......

Friday’s rally, like most of the S&P gains so far this year, was likely driven by just 10 stocks and, as Zero Hedge noted on Friday, NASDAQ breadth is at all time lows while just a handful of companies keep pushing the index higher.

In other words, for the people in the back, the nation’s last AAA rating is at risk and the stock market is an air pocket reliant on just a handful of stocks.

www.zerohedge.com

www.zerohedge.com

Friday’s rally, like most of the S&P gains so far this year, was likely driven by just 10 stocks and, as Zero Hedge noted on Friday, NASDAQ breadth is at all time lows while just a handful of companies keep pushing the index higher.

In other words, for the people in the back, the nation’s last AAA rating is at risk and the stock market is an air pocket reliant on just a handful of stocks.

Moody's Next To Slash U.S. Debt Rating | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

My first mortgage was 6.25, a rate I thought historically not bad.

I told myself if I could ever get below 5 that would be so cool.

Im at 3.25 now.

I know the sound idea of maintaining a mortgage and we will do so on the rental but I want the primary paid off.....the sooner the better.

Looking at page 1-2 of this thread.

With my wife getting fired this past week I won’t remind her of goal 1 and my adamant, but useless argument, that taking money out on the refinance to get below 3.25% would be the worst financial decision we could ever make.

I have tiny balls.

Last edited:

China Took Delivery of US Based Gold Last Month | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Exxon aims to become a top lithium producer for electric vehicles with Arkansas drill operation

Exxon aims to supply enough of lithium to support the manufacture of 1 million electric vehicles by 2030.

This is Jimmy Carter 2.0. Let’s just hope we get Reagan 2.0 afterwards.

When Reagan took office, the national debt was less than $1 trillion - about 32.5% of the GDP at that time. I don't know how the debt was structured at that time, but my guess is that it was a healthy mix of short- and long-term notes. This gave Voelker substantial flexibility.

JPow is painted into a corner with the current debt level, and Yellen made the mess worse by failing to roll over short-term notes into longer-dated Tbills when rates were historically low. The federal government probably can't afford to pay the rates demanded by investors, so the Fed will almost certainly need to monetize the debt.

On the political side, I don't see any hope for a Reagan-type to take office.

Fisker reports wider-than-expected losses, underwhelming deliveries for the third quarter

Electric vehicle startup Fisker on Monday reported a third-quarter loss that was wider than Wall Street expected.

Li-Cycle earnings must have been worse than expected. I believe their cost overrun was not a 10%-20% but 100%. Either way, CPI data came out bullish for financing products like Enphase.

ENPH and SEDG and now just meme stocks... The entire "sustainable" / Go Green sector will fail without government's propping them up.Li-Cycle earnings must have been worse than expected. I believe their cost overrun was not a 10%-20% but 100%. Either way, CPI data came out bullish for financing products like Enphase.

Similar threads

- Replies

- 104

- Views

- 5K

- Replies

- 7

- Views

- 804

- Replies

- 50

- Views

- 5K