Tomorrow may very well be the next opportunity to acquire more shares.

Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock Market

- Thread starter pmclaine

- Start date

Control

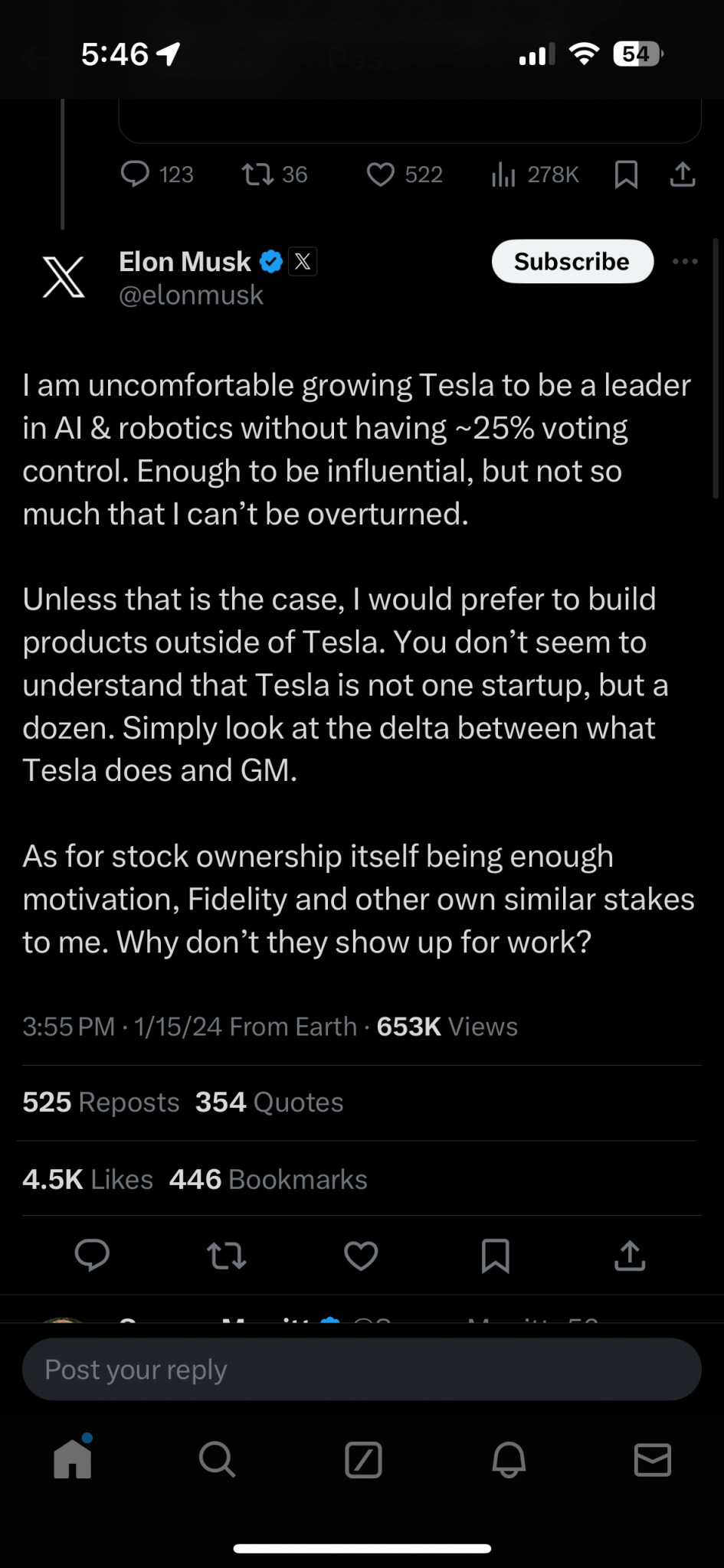

Elon allowed the Investment Bankers to gain control over him. Lesson learned.

This is as much a damning of our monetary policy as it is an endorsement for gold.LOL... Obviously you don't deal in gold or you would not ask those questions.

View attachment 8322120

There is always the option of CryptoThis is as much a damning of our monetary policy as it is an endorsement for gold.

Many LLMs can write papers for you and that will be run of the mill soon if not already. Open AI, Anthropic. Google. Apple before long.who is their closest competitor would you say?

-----

Currently - yes

Im betting they get bought in ~4yrs by Google, Microsoft, Oracle or even Meta.

it is an over reaction on my part but Im interested....

I am interested in perplexity.ai, for serious scientific research that is transparently sourced they are the best. They could be a serious threat to Google for search eventually. Google has turned into a shitshow for search.

Last edited:

Happy to see Tesla green. BOD seems open to a new comp plan. Elon currently “owns/has the ability to own” ~22% of TSLA. A new plan for an additional ~3% or repurchase program would cross his 25% target.

With Tesla green, happy to roll options weekly again.

With Tesla green, happy to roll options weekly again.

Closed out my weeklies with a 58% gain… time to go enjoy lunch and re-evaluate weeklies tomorrow.

Appearing the "rates" could remain the same for 2024. This could become the norm.

www.morningstar.com

www.morningstar.com

No rates cuts in 2024? Why investors should think about the 'unthinkable'

Th

That’s what this uneducated knuckle dragger thinks too. Nothing has changed except the economy is obviously crumbling and inflation is getting even worse. When deflation occurs, then I expect rate cuts. In order for that to happen, most consumer and business debt needs to be defaulted on. Until then, or a big war, nothing will change.Appearing the "rates" could remain the same for 2024. This could become the norm.

No rates cuts in 2024? Why investors should think about the 'unthinkable'

www.morningstar.com

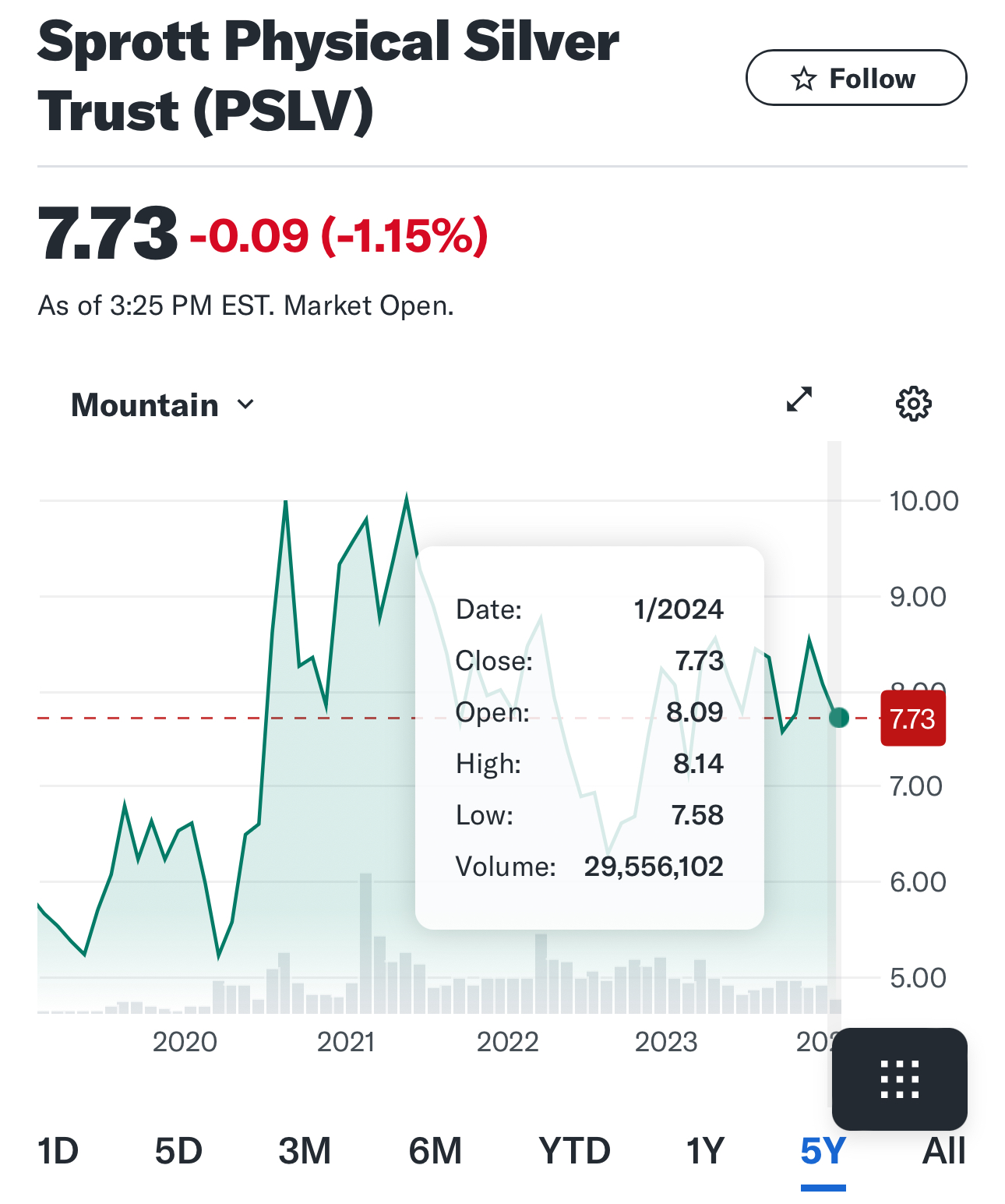

How are we feeling about precious metal trusts/stock these days?

I prefer physical coins/bars of course, but just bought a bunch more of Sprott silver on today’s dip

I prefer physical coins/bars of course, but just bought a bunch more of Sprott silver on today’s dip

I tend to look at "debt". At one point, around 2008, I allowed a credit card to run up a high balance. That period in time was labeled "The Great Recession". It took me years to pay that card off after I cut it in half.Th

That’s what this uneducated knuckle dragger thinks too. Nothing has changed except the economy is obviously crumbling and inflation is getting even worse. When deflation occurs, then I expect rate cuts. In order for that to happen, most consumer and business debt needs to be defaulted on. Until then, or a big war, nothing will change.

Currently debt (personal, business and Government) is at a record high. To speak in round numbers, that working class family paying $100 month in credit card interest is not going to be spending that money at the mall, grocery store or gas station.

With the FED holding interest rates high, there will be no refinancing to lower the payment on that house bought at the peak of home prices.

Banks are in the cross hairs and are being forced to hold more cash to back up the risky loans.

Inflation is continuing to lower the buying power of the USD.

The frenzy created in 2023 is not sustainable.

Corporate debt defaults soared 80% in 2023 and could be high again this year, S&P says

The number of companies that failed to make required payments on their debt totaled 153 for 2023, up from 85 the year before.

Last edited:

Albemarle Corp. announced Wednesday cost-cutting actions, including job cuts, in an effort to boost cash flow as a result of changing market conditions, particularly in the lithium value chain.A wide decision.

"Our engagement with the Liontown team has been meaningful and productive. We appreciate the level of cooperation we have received, and we thank the entire team for their efforts," said Kent Masters, CEO of Albemarle. "That said, moving forward with the acquisition, at this time, is not in Albemarle's best interests."

ALBEMARLE WITHDRAWS NON-BINDING OFFER TO ACQUIRE LIONTOWN RESOURCES

/PRNewswire/ -- Albemarle Corporation (NYSE: ALB), a global leader in providing essential elements for mobility, energy, connectivity and health, announced...www.prnewswire.com

The company said it is looking to reduce costs by about $95 million a year, by cutting expenses, reducing its workforce and lowering spending on contracted services. More than $50 million in savings are expected to be realized in 2024, as it pursues additional cash-management actions.

LOL

Total industrial production rose by 0.1% last month, after remaining perfectly stable (revised from +0.3%) in November.

When industrial production change is basically zero.......... Now it is called "stability". It is getting worse.

Total industrial production rose by 0.1% last month, after remaining perfectly stable (revised from +0.3%) in November.

When industrial production change is basically zero.......... Now it is called "stability". It is getting worse.

Every traditional car maker (GM, Ford, etc.) has reduced their EV projections for 2024 = less batteriesAlbemarle Corp. announced Wednesday cost-cutting actions, including job cuts, in an effort to boost cash flow as a result of changing market conditions, particularly in the lithium value chain.

The company said it is looking to reduce costs by about $95 million a year, by cutting expenses, reducing its workforce and lowering spending on contracted services. More than $50 million in savings are expected to be realized in 2024, as it pursues additional cash-management actions.

The six currencies included in the USDX are often referred to as America's most significant trading partners, but the index has only been updated once: in 1999 when the euro replaced the German mark, French franc, Italian lira, Dutch guilder, and Belgian franc.1 Consequently, the index does not accurately reflect present-day U.S. trade.Gold is nice. $2053.00 per oz right now so a 30% drop would hardly leave you broke, and that’s if you bought it at today’s price.

If you’ve been buying physical gold for a decent amount of time then you are definitely not overly concerned about a 30% drop in value from current prices.

Time, time, time.

It’s like when people say I’m nuts for still buying the S&P 500 in the $470’s. I have time. They also said I was nuts for buying S&P tops while working at Hardee’s in the early 90’s.

The companies and commodities I like I have bought consistently over time.

Time is your friend. If you’re over 40 and just now starting out, you are a long way behind the curve.

If you’re young, start now and reinvest dividends and enjoy swoll pockets in the future.

I keep seeing these headlines talking about the "Strength of the USD".

When looking at what the USD is being compared to, this thought crosses my mind.

Having a strong USD is similar to winning an event at the "Special Olympics".

Look at how little a USD buys today.

Every traditional car maker (GM, Ford, etc.) has reduced their EV projections for 2024 = less batteries

Largest Lithium Deposit in the World Suspends Output

Largest Lithium Deposit in the World Suspends Output | OilPrice.com

Chile's SQM has announced that it has suspended operations at the Atacama salt flat due to widespread protests by an indigenous community.

Elon Musk’s losing streak is heading for Tesla

The market is sitting on a hair trigger. Any bad news is brutal.

I've dabbled in the market for 40 years. Some good, some bad... Lesson's learned.

As each of the past 4 - 5 recessions were forming up, I remember the Snake Oil Salesmen start to push people to buy into the market.

I can see that push shaping up today when I go here..... Buy, buy, buy

www.morningstar.com

www.morningstar.com

As each of the past 4 - 5 recessions were forming up, I remember the Snake Oil Salesmen start to push people to buy into the market.

I can see that push shaping up today when I go here..... Buy, buy, buy

Morningstar | Empowering Investor Success

Our independent research, ratings, and tools are helping people across the investing ecosystem write their own financial futures.

From Wallstreet Breakfast: Major Wall Street indices have notched new record highs, with gains lifting the blue-chip Dow Jones Industrial Average (DJI) above 38K for the first time ever, while the S&P 500 (SP500) ended at an all-time high for the second day in a row. Investing Group Leader Victor Dergunov expects this uptrend to continue, predicting that the S&P500 could reach 5,200-5,500 and the Nasdaq around 18,000-20,000 before year-end. While the Federal Reserve takes a backseat as it enters a blackout period ahead of its first meeting of 2024, earnings will dominate headlines this week, with results from Netflix (NFLX) and Baker Hughes (BKR) due out today.

But, why? Why are markets hitting new record highs? Really, what is so great about the economy, the business world, etc.?

But, why? Why are markets hitting new record highs? Really, what is so great about the economy, the business world, etc.?

Are they actual highs, or just inflated numbers because every $$ is now worth less than it was before? A loaded new truck was $3K, now $130K, almost like it’s just priced in pennies now.From Wallstreet Breakfast: Major Wall Street indices have notched new record highs, with gains lifting the blue-chip Dow Jones Industrial Average (DJI) above 38K for the first time ever, while the S&P 500 (SP500) ended at an all-time high for the second day in a row. Investing Group Leader Victor Dergunov expects this uptrend to continue, predicting that the S&P500 could reach 5,200-5,500 and the Nasdaq around 18,000-20,000 before year-end. While the Federal Reserve takes a backseat as it enters a blackout period ahead of its first meeting of 2024, earnings will dominate headlines this week, with results from Netflix (NFLX) and Baker Hughes (BKR) due out today.

But, why? Why are markets hitting new record highs? Really, what is so great about the economy, the business world, etc.?

OK, sounds right, but how does the market hit these highs in order to make the masses happy?To keep the masses believing all is financially sound.

My hypothesis is simple; the stock market currently by design is to fleece the working peoples wealth and return it to the elites, people that have built a retirement nest egg end up with nothing whereas the richest elites continue to show a gain/profit.

Similar to those elected to Congress that always seem to know how to make money buying & selling in the stockmarket, always at the right time. If the unseen hand is guiding the market and you are connected with that hand all is well. (Chris Collins)

How is it Warren Buffet Berkshire Hathaway only go in one direction?

Similar to those elected to Congress that always seem to know how to make money buying & selling in the stockmarket, always at the right time. If the unseen hand is guiding the market and you are connected with that hand all is well. (Chris Collins)

How is it Warren Buffet Berkshire Hathaway only go in one direction?

If you bring up charts of the different markets all you will see is "inflation". Increases of 20% - 30% are nothing more than inflation from the low man on the totem pole to the "middle man" to the government fee / tax increases to the bean counters in the back room at the corporate head quarters. GDP is going nowhere, only new jobs are "government jobs", no new factories, no new products, no new exports... Nothing but inflation increasing the numbers and the national debt. Unsustainable.From Wallstreet Breakfast: Major Wall Street indices have notched new record highs, with gains lifting the blue-chip Dow Jones Industrial Average (DJI) above 38K for the first time ever, while the S&P 500 (SP500) ended at an all-time high for the second day in a row. Investing Group Leader Victor Dergunov expects this uptrend to continue, predicting that the S&P500 could reach 5,200-5,500 and the Nasdaq around 18,000-20,000 before year-end. While the Federal Reserve takes a backseat as it enters a blackout period ahead of its first meeting of 2024, earnings will dominate headlines this week, with results from Netflix (NFLX) and Baker Hughes (BKR) due out today.

But, why? Why are markets hitting new record highs? Really, what is so great about the economy, the business world, etc.?

If you listen to the first3/4 minutes I believe davidwebb gives a cliffnote on how the market gets manipulated. A few books behind in my reading starting PeterZeihan’s The End Of The World Is Just The Beginning. (17:00-20:30)

Last edited:

On a Friday, an hour after close, that leads into a 3 day holiday weekend. That gives the oligarchs a head start, gives the fund managers some "before the bell" time to do some damage control. The foreign markets get a head start. Those people who worked a lifetime and put it all in a managed fund will take the hit. History repeating itself.When is the bubble gonna pop?

Memorial Day: Last Monday in May ?

Last edited:

Will any "savings" be passed on to the consumer ?

I saw nothing that will enhance the repair challenges when a vehicle is damaged in an accident. (Plug and play parts).

No mention of improving the battery / charging challenges ?

Will this assembly process reduce the cost of insurance, government taxes and financing ?

A buyer really has no concept or interest in how a product is assembled as long as it is economical, easy to maintain and is still serviceable after the final payment is made.

Appears that a Tesla is written off as "salvage" much quicker than a Honda, Toyota or Ford.

Yes, quick and dirty is that this is the assemble line for the $25k Tesla.

When it becomes a "throw away car" the cost of the replacement insurance will cost as much as the replacement battery.Yes, quick and dirty is that this is the assemble line for the $25k Tesla.

Similar to the Dewalt battery powered tools.

When one new model is introduced, the next model is on the drawing board...

A page from the play book of Apple.

The average cost to insure a 2022 Tesla model with full coverage is $3,007 annually or $251 per month, which is 50% higher than the national average. Many Tesla owners choose to purchase third-party protection for their Teslas rather than opting for the company's own coverage.Dec 25, 2023

"We are simultaneously ramping new products, building or ramping manufacturing facilities on three continents, piloting the development and manufacture of new battery cell technologies, expanding our Supercharger network and investing in autonomy and other artificial intelligence enabled training and products, and the pace of our capital spend may vary depending on overall priority among projects, the pace at which we meet milestones, production adjustments to and among our various products, increased capital efficiencies and the addition of new projects," the company said.Yes, quick and dirty is that this is the assemble line for the $25k Tesla.

Tesla expects capex to exceed $10 billion in 2024

I keep buying SPY and getting sweet gains over time.

You got shit figured out... Not just in the market...I keep buying SPY and getting sweet gains over time.

You hedging on those can's of beans ?

Finally, some believable news. Backed by logic. This is where we are headed.

www.cnbc.com

www.cnbc.com

Walmart announces 3-for-1 stock split as shares hover below all-time high

Walmart's shares hit their all-time high last year.

Bought a SPY 460 call that expires 2024-03-15 back in November 2023 for $6.11 (that's $611 for those not aware how options work). SPY is now hitting 490 and that 460 call is worth $35.96 ($3596 for options newbs). That's a $2985 profit over a 3 month period so far. Imagine if I'd have bought 10.

NiceBought a SPY 460 call that expires 2024-03-15 back in November 2023 for $6.11 (that's $611 for those not aware how options work). SPY is now hitting 490 and that 460 call is worth $35.96 ($3596 for options newbs). That's a $2985 profit over a 3 month period so far. Imagine if I'd have bought 10.

Tesla is recalling nearly all its US vehicles,Tesla is the stock market, bro.

WASHINGTON, Feb 2 (Reuters) - U.S. safety regulators have upgraded their probe into Tesla (TSLA.O)

, opens new tab vehicles over power steering loss to an engineering analysis - a required step before the agency could demand a potential recall.

The National Highway Traffic Safety Administration (NHTSA)said on Friday the investigation covers about 334,000 Model 3 and Model Y vehicles from the 2023 model year.

Similar threads

- Replies

- 117

- Views

- 6K

- Replies

- 7

- Views

- 817

- Replies

- 50

- Views

- 5K