Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Maggie’s What's Your View II

- Thread starter 1J04

- Start date

0

This one bangs on the window in the morning if there's No food out.

Crap! That's what I forgot to add to the damn pics. The big ass bag of Walnuts in the Shell! LMFAO Deplorables at work!

This one bangs on the window in the morning if there's No food out.

Thanks dude, mines pretty flat still, I need to have a fire

I know all about the brown inside of a walnut. Many days helping my grandfather pick then up in the yard before mowing and sitting in the driveway with with the walnut board. 5 wholes drilled in it knock the walnut through taking off the outer part.

Taking 5 gallon buckets to the basement to set them out to dry. Bring up last year's crack them and dig out the meat.

Taking 5 gallon buckets to the basement to set them out to dry. Bring up last year's crack them and dig out the meat.

Easier than using a board. Dump walnuts in driveway. Drive over them until hulls come off. Pick up and crack.I know all about the brown inside of a walnut. Many days helping my grandfather pick then up in the yard before mowing and sitting in the driveway with with the walnut board. 5 wholes drilled in it knock the walnut through taking off the outer part.

Taking 5 gallon buckets to the basement to set them out to dry. Bring up last year's crack them and dig out the meat.

This was actually yesterday... Thought I posted it already...

Was only able to get about a dozen or so shots off... neighbor came outside cutting it short.

Was only able to get about a dozen or so shots off... neighbor came outside cutting it short.

Last edited:

It's not stopping! This was in the mailbox.

And then Brown showed up!

I/We really hope you guys got this outta your systems now.

And then Brown showed up!

I/We really hope you guys got this outta your systems now.

Who did you piss off? Can I send something too?

Send bags of farts.

My kid is dying to.

Farts for Uncle Schartz has a nice ring to it.

My kid is dying to.

Farts for Uncle Schartz has a nice ring to it.

Who did you piss off? Can I send something too?

I'm uncertain exactly what happened.

Had too make sure my sons didn't run off to @1J04 house.

Yes that is a .22 hole behind him.

My dad did it when he was young.

Yes he shot the 22 in his bedroom.

Yes he had the wall fixed before grandpa got home.

Hi,

@1J04

Did some of your hotel guests chip in and get a Lexus Nexus account and find out your address then send your address to all their pen pals, lol.

Sincerely,

Theis

@1J04

Did some of your hotel guests chip in and get a Lexus Nexus account and find out your address then send your address to all their pen pals, lol.

Sincerely,

Theis

This is so squirrelly.This is so creepy....

Hi,

@1J04

Did some of your hotel guests chip in and get a Lexus Nexus account and find out your address then send your address to all their pen pals, lol.

Sincerely,

Theis

I'm pretty certain thee offending scoundrels are all right here!

Bastards didn't even ask me to help!I'm pretty certain thee offending scoundrels are all right here!

Cool, grey morning. Checking 100 zero now that my can is out of jail.

Well,,,,,,,,,,,,,,,,,, the High School football season got started last Friday night. They say it is week-to-week. We have already been moved to a different game for next Friday as one of the teams we were to work has the Covid.

This season is going to be jacked up.

BTW ; It appears that stripes add several pounds.

Work finally gave up arguing and bought me the Turbo T 500 fractionating still kit, picked it up today. Looks like the new workbench Pam bought me last week is going to become "moonshine central". 2 gallons of Bourbon a week should keep me going. Anyone got any ideas for labels for Barney's Bourbon??? Squirrels need not apply.....

Barney’s Bourbon does have a good ring to it!

@barneybdb - perhaps a couple more of these stills and you can run a little retirement side gig?

Of course your thirst may ding up profits a touch

Of course your thirst may ding up profits a touch

Need to be real careful, even for personal use our government expects us to pay excise....

Is it illegal to distil alcohol in Australia?

NO! It is NOT illegal to distil alcohol in Australia. Distilling is like driving, it's perfect legal so long as you have a license.

People presume the license has to do with safety, that the government wants to make sure we're distilling spirits safely. This could not be further from the truth. The license is actually issued by the Australian Tax Office (ATO). It's completely free, and the catch? You have to pay tax on the alcohol you produce, even if it's for personal consumption in your own home. This is because of a law passed in 1901 where the government at the time decided it was OK for beer, cider and wine to be produced tax free at home for personal use, but spirits were not. Crazy right? But hey, the law is the law and taxes are important.

This tax is built into every bottle of spirits you buy so it's not a special tax on home made spirits. If you do the calculations, you'll find your favourite spirits cost up to 90% less when you take the tax off. Based on the February 2018 excise rate of $83.84 (it goes up every 6 months) a 700mL bottles of 40% alcohol has $23.48 of excise attached to it. If that bottle costs $30, there is also $3 GST. Total tax is $26.48 which means the distiller, distributor and retailer share the remaining $3.52. That's how much that bottle of liquor actually costs.

There are a couple things to go over here. This first is permission for your still. If you buy a still 5L or under, you don't need permission from the ATO to buy it. We also don't need permission from the ATO to sell it. That's why we only sell one still, the Air Still, which is 5L. If you intend on using the Air Still to distil water, make essential oils, herbal tinctures or anything else that is not for drinking, you don't need a license from the ATO. Go for gold. If you use the Air Still to produce alcohol for drinking, you need an excise manufactures license from the ATO and you need to pay tax on that alcohol.

But 5L is pretty small right? As our mothers always said, if you're going to do something, do it properly. That's why we sell 25L boilers and condensers that can be attached to each other to make a still, like the Turbo 500. Because these two things are not attached when you purchase them, you don't need permission to buy them and we don't need permission to sell them. You will however need permission to "manufacture" a still before attaching a condenser to a boiler over 5L. You will need this permission even if you're not using the still to produce drinking alcohol. If you're going to use the still to produce drinking alcohol, you need an excise manufactures license from the ATO and you need to pay tax on that alcohol.

There is some good news. From 1st July 2017, you can claim a refund of 60% of the excise duty you have paid on spirits you have distilled. The maximum refund you can claim is $30,000 per financial year and it must be made within 12 months of paying the excise duty.

In summary:

Is it illegal to distil alcohol in Australia?

NO! It is NOT illegal to distil alcohol in Australia. Distilling is like driving, it's perfect legal so long as you have a license.

People presume the license has to do with safety, that the government wants to make sure we're distilling spirits safely. This could not be further from the truth. The license is actually issued by the Australian Tax Office (ATO). It's completely free, and the catch? You have to pay tax on the alcohol you produce, even if it's for personal consumption in your own home. This is because of a law passed in 1901 where the government at the time decided it was OK for beer, cider and wine to be produced tax free at home for personal use, but spirits were not. Crazy right? But hey, the law is the law and taxes are important.

This tax is built into every bottle of spirits you buy so it's not a special tax on home made spirits. If you do the calculations, you'll find your favourite spirits cost up to 90% less when you take the tax off. Based on the February 2018 excise rate of $83.84 (it goes up every 6 months) a 700mL bottles of 40% alcohol has $23.48 of excise attached to it. If that bottle costs $30, there is also $3 GST. Total tax is $26.48 which means the distiller, distributor and retailer share the remaining $3.52. That's how much that bottle of liquor actually costs.

There are a couple things to go over here. This first is permission for your still. If you buy a still 5L or under, you don't need permission from the ATO to buy it. We also don't need permission from the ATO to sell it. That's why we only sell one still, the Air Still, which is 5L. If you intend on using the Air Still to distil water, make essential oils, herbal tinctures or anything else that is not for drinking, you don't need a license from the ATO. Go for gold. If you use the Air Still to produce alcohol for drinking, you need an excise manufactures license from the ATO and you need to pay tax on that alcohol.

But 5L is pretty small right? As our mothers always said, if you're going to do something, do it properly. That's why we sell 25L boilers and condensers that can be attached to each other to make a still, like the Turbo 500. Because these two things are not attached when you purchase them, you don't need permission to buy them and we don't need permission to sell them. You will however need permission to "manufacture" a still before attaching a condenser to a boiler over 5L. You will need this permission even if you're not using the still to produce drinking alcohol. If you're going to use the still to produce drinking alcohol, you need an excise manufactures license from the ATO and you need to pay tax on that alcohol.

There is some good news. From 1st July 2017, you can claim a refund of 60% of the excise duty you have paid on spirits you have distilled. The maximum refund you can claim is $30,000 per financial year and it must be made within 12 months of paying the excise duty.

In summary:

- Want a still over 5L? You'll need to Get Permission

- Planning to produce alcohol to drink? You need an Excise Manufacturer License

- Want to claim 60% of your excise back? Here's information on the Refund Scheme

Hmmmm.

Sounds about like any govt really.

If you choose to be independent and take care of stuff yourself, you have to pay us for that privilege.

Sounds about like any govt really.

If you choose to be independent and take care of stuff yourself, you have to pay us for that privilege.

So it's basically a Form 4 for their 5l and under and a Form 1 for their bigger one?Need to be real careful, even for personal use our government expects us to pay excise....

Is it illegal to distil alcohol in Australia?

NO! It is NOT illegal to distil alcohol in Australia. Distilling is like driving, it's perfect legal so long as you have a license.

People presume the license has to do with safety, that the government wants to make sure we're distilling spirits safely. This could not be further from the truth. The license is actually issued by the Australian Tax Office (ATO). It's completely free, and the catch? You have to pay tax on the alcohol you produce, even if it's for personal consumption in your own home. This is because of a law passed in 1901 where the government at the time decided it was OK for beer, cider and wine to be produced tax free at home for personal use, but spirits were not. Crazy right? But hey, the law is the law and taxes are important.

This tax is built into every bottle of spirits you buy so it's not a special tax on home made spirits. If you do the calculations, you'll find your favourite spirits cost up to 90% less when you take the tax off. Based on the February 2018 excise rate of $83.84 (it goes up every 6 months) a 700mL bottles of 40% alcohol has $23.48 of excise attached to it. If that bottle costs $30, there is also $3 GST. Total tax is $26.48 which means the distiller, distributor and retailer share the remaining $3.52. That's how much that bottle of liquor actually costs.

There are a couple things to go over here. This first is permission for your still. If you buy a still 5L or under, you don't need permission from the ATO to buy it. We also don't need permission from the ATO to sell it. That's why we only sell one still, the Air Still, which is 5L. If you intend on using the Air Still to distil water, make essential oils, herbal tinctures or anything else that is not for drinking, you don't need a license from the ATO. Go for gold. If you use the Air Still to produce alcohol for drinking, you need an excise manufactures license from the ATO and you need to pay tax on that alcohol.

But 5L is pretty small right? As our mothers always said, if you're going to do something, do it properly. That's why we sell 25L boilers and condensers that can be attached to each other to make a still, like the Turbo 500. Because these two things are not attached when you purchase them, you don't need permission to buy them and we don't need permission to sell them. You will however need permission to "manufacture" a still before attaching a condenser to a boiler over 5L. You will need this permission even if you're not using the still to produce drinking alcohol. If you're going to use the still to produce drinking alcohol, you need an excise manufactures license from the ATO and you need to pay tax on that alcohol.

There is some good news. From 1st July 2017, you can claim a refund of 60% of the excise duty you have paid on spirits you have distilled. The maximum refund you can claim is $30,000 per financial year and it must be made within 12 months of paying the excise duty.

In summary:

The most important thing is, don't be scared! The ATO are really friendly and helpful. Make sure you buy the right equipment and use the right ingredients to ensure you're distilling safely. Using our equipment and distilling yeasts, you'll only be producing safe to drink ethanol, rather than poisonous methanol.

- Want a still over 5L? You'll need to Get Permission

- Planning to produce alcohol to drink? You need an Excise Manufacturer License

- Want to claim 60% of your excise back? Here's information on the Refund Scheme

Barney’s Bourbon does have a good ring to it!

Squirrel nut bourbon.

Imagine the image possibilities...

View attachment 7413345

Well,,,,,,,,,,,,,,,,,, the High School football season got started last Friday night. They say it is week-to-week. We have already been moved to a different game for next Friday as one of the teams we were to work has the Covid.

This season is going to be jacked up.

BTW ; It appears that stripes add several pounds.

Good thing you wear longitude not latitude.

I am somewhat peeved. I know I have been scarce lately due to trying to finish the cabin, but one of you assholes could have advised me about the skwerling of Larry. Hell, I might have been able to send a live one!

I was gonna put a roadkill one in a vacuum lock bag and send it, but the little inside voices said “way too far rooster, way too far.”I am somewhat peeved. I know I have been scarce lately due to trying to finish the cabin, but one of you assholes could have advised me about the skwerling of Larry. Hell, I might have been able to send a live one!

Hi

Squirreling away his deliveries???

Sincerely,

Theis

Maybe rubbin soft stuffy squirrel fur on his nuts????

No, no that’s called balls deep. We were taking “up to your nuts,” there is a differenceMaybe rubbin soft stuffy squirrel fur on his nuts????

I'm still not seeing the propane tank in pics of the new man cave and winter in SW WA is coming on before you know it.

My view today....

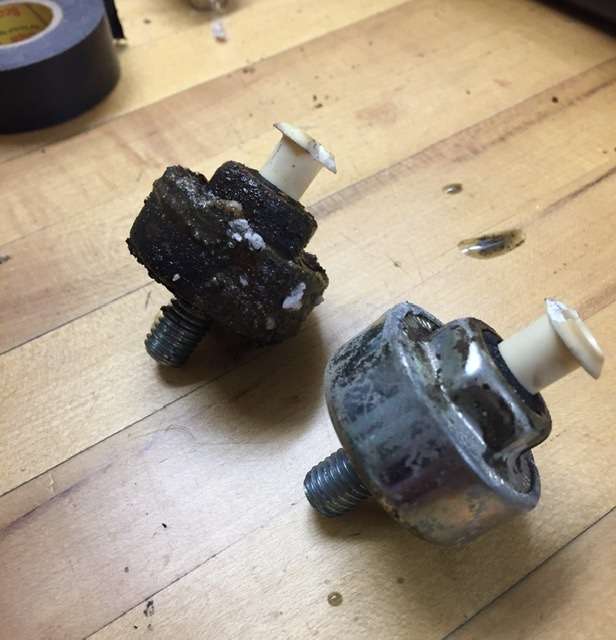

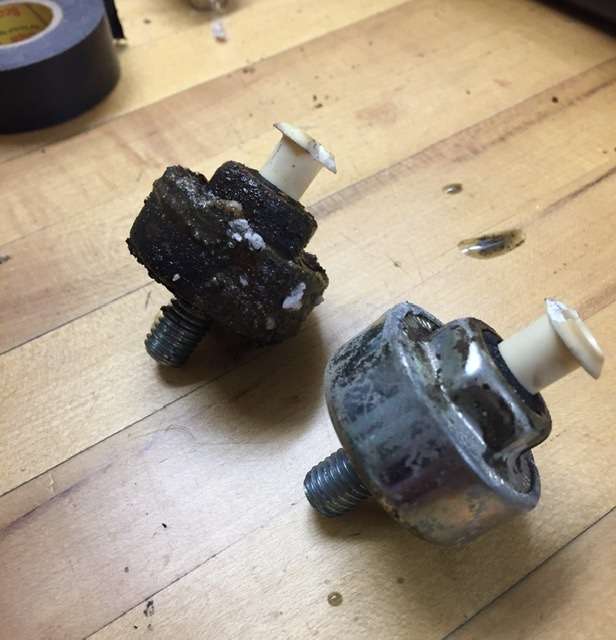

ahhhhhh, yep that’ll throw a P0332 error code.....

I‘d have the thing done by now if not for Almost Auto Parts (NAPA) not being competent enough to actually order all the parts on the list I provided them.......

ahhhhhh, yep that’ll throw a P0332 error code.....

I‘d have the thing done by now if not for Almost Auto Parts (NAPA) not being competent enough to actually order all the parts on the list I provided them.......

Last edited:

Cool, grey morning. Checking 100 zero now that my can is out of jail.

View attachment 7413299

crazy badass

Had training down in Vantuckey today. Hate the drive down but got paid for it. At least the drive was nice. Had a wake up call at 5:30 this morning when a herd of elk ran across the road in front of me. Got to do a good test on my service truck brakes lol.

Did you pay your taxes.

Have been paying them since 1971, time for a break.....

Fancy. Around here they're propane fired with a gravity spring line to a water jacket (large tin bucket) around the worm. Or so I'm told.

Try apples. Might need a mother to get them started.

Just another day at work. First gotta get the shaft out then start freshing up the engines...

Shaft is accessed in the galley (off to the left in the picture above). This is how you get to the shaft on the STBD side:

Coupling access:

I hate boats. Especially sail boats...

Shaft is accessed in the galley (off to the left in the picture above). This is how you get to the shaft on the STBD side:

Coupling access:

I hate boats. Especially sail boats...

Similar threads

- Replies

- 2

- Views

- 205