If you time it right, you should die with $0 and your credit maxed out.

Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

DEBT

- Thread starter Hobo Hilton

- Start date

spot on actually, you stupid fk are morons for buying that coffee at that price and paying 1k or more for a fking phoneIn for the boomers to say stop buying Starbucks and you don’t need an iPhone.

We won't have to worry about it much longer. You can hire 5 Indians per 1 American salary. Slowly watching a company you work for make the transition is disheartening.

This. My 43 yo son lost his premium tech job last year. Whole department was suddenly shifted to India. My daughter is now worried about her job that she’s had for 20 years. She’s the best in her field, but companies were forced to allow their employees to work from home during lockdownWe won't have to worry about it much longer. You can hire 5 Indians per 1 American salary. Slowly watching a company you work for make the transition is disheartening.

Of course the changes are happening. Why are people not noticing it ? Because there are 1,000's of diversions placed in front of American's every day. Go to most websites and it "Rainbows and Unicorns"..... Super bowl / Swifties...... Terrible weather, somewhere....... Volcano eruptions..... Airplane crashes .... Just not enough hours in the day to hear what the plan is to pay off the national debt.This. My 43 yo son lost his premium tech job last year. Whole department was suddenly shifted to India. My daughter is now worried about her job that she’s had for 20 years. She’s the best in her field, but companies were forced to allow their employees to work from home during lockdown. Then they realized that hey, we not only save on office space, but if Americans can do this from home, then so can anyone anywhere.

You failed to mention whose fucking who & did you she her tits? Then there all those cat fits that are a must see & read up on, all while taking it bent over w/no pain do to the level of lubricant being used. Please msssteeerr give me another.Of course the changes are happening. Why are people not noticing it ? Because there are 1,000's of diversions placed in front of American's every day. Go to most websites and it "Rainbows and Unicorns"..... Super bowl / Swifties...... Terrible weather, somewhere....... Volcano eruptions..... Airplane crashes .... Just not enough hours in the day to hear what the plan is to pay off the national debt.

It's all about the "culture". First Starbucks opened in 1971 and first IPhone came out in 2007...... Dial up Internet in the 80's.In for the boomers to say stop buying Starbucks and you don’t need an iPhone.

After a couple of generations grew up with these things, it's now part of the culture. These things will be around until the day of the collapse.

Improvise, Adapt and Survive.

The iPhone (retroactively referred to as the iPhone 2G, iPhone 1, or original iPhone) is the first iPhone model and the first smartphone designed and marketed by Apple Inc. After years of rumors and speculation, it was officially announced on January 9, 2007, and was released in the United States on June 29, 2007.

If banks weren't making serious bucks from credit cards they'd shitcan them in a second.

This ^^^ is a clue.

Years ago I remember much talk about the gov making it a law that they couldn't charge more than 15% after the initial

"grace" period on the CC balances.

LOL, how'd that go?

They have learned from the loan sharks.

They don't need Pauley, Petey, Pussy to come down and break a leg.

They'll fuck with your income/credit/assets at will, using the LEO.

The credit score system damned near requires the use of a CC to top out 850ish.

Another clue ^^^.

R

This ^^^ is a clue.

Years ago I remember much talk about the gov making it a law that they couldn't charge more than 15% after the initial

"grace" period on the CC balances.

LOL, how'd that go?

They have learned from the loan sharks.

They don't need Pauley, Petey, Pussy to come down and break a leg.

They'll fuck with your income/credit/assets at will, using the LEO.

The credit score system damned near requires the use of a CC to top out 850ish.

Another clue ^^^.

R

I couldn't imagine doing just the bit I have done today. I bought my house for 250 in 2020. It is 600 all day long right now.I’m old millennial. Worked hard, went to college, payed off my student loans, payed off my credit cards, bought a home, lived modestly. I don’t think if I’d been born 10 years later I’d be where I am today with the same ethics and ideals. I can’t imagine being 15-20 years younger and dealing with starting out today. It’s got to feel impossible. Maybe it is. I don’t even know if I could afford the house I live in today if I had to buy it today without the equity I have in it. Kinda scary to think about.

Yep. My friend is 10 years younger than me and I am trying to help him start out. I tell him to not even try to settle down for about 10 years. Just work your ass off and try to break out from the pack so you have a chance.I feel bad for younger guys here as well. I have a decent job but purchased my home when I had an ok paying job. Have kept the ok paying home with my 15 year 3% loan even though I could upgrade

You see the new guys coming in looking at base prices of $175,000-$250,000. For houses that cost $120,000-$150,000 not long ago. In order to afford that they must do a 30 year loan. At 6-8% or whatever it is.

Then while they try to save for that purchase their current rent goes up, insurance goes up, groceries go up etc. Like having your head pushed under water when you finally come up for air

Won’t be long and they’ll be giving 35 and 40 year fixed loans just so people can afford to make a payment

I’ve gotten back every dime of every fraud charge ever made to my account. Every last dime, including a lot of overseas shit that seemed to happen every time I traveled through Dubai.

Get a new bank.

This is experience talking right here. I travel internationally for work in some odd places and I don't own a single credit card.

I have never met Bill, I've planted trees over there about 15 years ago and have rented a shotgun and shot a few timesOver the years I spent a ton of money in your A/O at the "Dollar" as that is what we called the silver dollar gun club back when Bill Jacobsen first built that place. My last ATA shoot over there was in 92 IIRC. Shot many a bird at Bills, mostly clay, but also the other kind back in the woods. The statute of limitations is long past now, & don't think they do it any more. Went back in 2004 for a doubles marathon & it had changed so much I got lost trying to find the place. Don't know what ever happened to Bill, but he always treated me great. In the old days got to squad & shoot with those who were Trap Gods in the ATA as well as those at Skyway, Cigar city & the Dollar.

edit to add, was on the same squad as captain with Dan B on # 2 station. He dropped the first two birds (16yd) and when he came off the trap I went to pick up the score sheet but was watching him. The huge oak tree in front of the club house is where to rapped that $10K K-gun around. He walked over to the K gun booth and they handed him a new one. He ran the rest of the birds but like any big shoot you drop a single bird you're out. He was one pissed dude as he went in large in the Calcutta bidding, buying his self.

I love the place.

But...

I heard because of encroaching neighborhoods, my God you wouldn't believe how this place was destroyed through development, I heard they are closing the range.

Did you know Mike that had the gun shop at the dollar??? It's closed now and he's working from his house on tarpon springs road.Over the years I spent a ton of money in your A/O at the "Dollar" as that is what we called the silver dollar gun club back when Bill Jacobsen first built that place. My last ATA shoot over there was in 92 IIRC. Shot many a bird at Bills, mostly clay, but also the other kind back in the woods. The statute of limitations is long past now, & don't think they do it any more. Went back in 2004 for a doubles marathon & it had changed so much I got lost trying to find the place. Don't know what ever happened to Bill, but he always treated me great. In the old days got to squad & shoot with those who were Trap Gods in the ATA as well as those at Skyway, Cigar city & the Dollar.

edit to add, was on the same squad as captain with Dan B on # 2 station. He dropped the first two birds (16yd) and when he came off the trap I went to pick up the score sheet but was watching him. The huge oak tree in front of the club house is where to rapped that $10K K-gun around. He walked over to the K gun booth and they handed him a new one. He ran the rest of the birds but like any big shoot you drop a single bird you're out. He was one pissed dude as he went in large in the Calcutta bidding, buying his self.

No, as I never bought anything from/in that gunshop. Some of my stuff came from either Bullseye in Brooksville, or Neal in Dade city, but the bulk came from our own club, Dade City Rod & gun club back then. In 2004 I was there & Oh how it had changed, not for the better either. Went to talk to the RSO for just a few, that turned into 3 hrs. All the old guys were gone & the new crop was a different breed altogether. The so called "overhead" they installed on the R&P range was interesting and ineffective but they thought it was sliced bread.Did you know Mike that had the gun shop at the dollar??? It's closed now and he's working from his house on tarpon springs road.

so it's the banks fault people take out credit cards and use them like monopoly money at a casino?If banks weren't making serious bucks from credit cards they'd shitcan them in a second.

This ^^^ is a clue.

Years ago I remember much talk about the gov making it a law that they couldn't charge more than 15% after the initial

"grace" period on the CC balances.

LOL, how'd that go?

They have learned from the loan sharks.

They don't need Pauley, Petey, Pussy to come down and break a leg.

They'll fuck with your income/credit/assets at will, using the LEO.

The credit score system damned near requires the use of a CC to top out 850ish.

Another clue ^^^.

R

Are you a banker?so it's the banks fault people take out credit cards and use them like monopoly money at a casino?

The point is they have a monopoly on the money.

R

I want to put something in perspective. I finished college with a bachelor degree in IT, starting out making 38k a year. My brother and I rented a 2 bedroom 2 bath apartment for a little less than $850 a month. This was around 10 years ago

Today, that same apartment has the same 2 bedroom, 2 bath apartments going for $1420 a month minimum. These aren't the greatest apartments to live, these aren't upscale or luxury apartments. Same apartments, 67% increase in cost.

Today, that same apartment has the same 2 bedroom, 2 bath apartments going for $1420 a month minimum. These aren't the greatest apartments to live, these aren't upscale or luxury apartments. Same apartments, 67% increase in cost.

I want to put something in perspective. I finished college with a bachelor degree in IT, starting out making 38k a year. My brother and I rented a 2 bedroom 2 bath apartment for a little less than $850 a month. This was around 10 years ago

Today, that same apartment has the same 2 bedroom, 2 bath apartments going for $1420 a month minimum. These aren't the greatest apartments to live, these aren't upscale or luxury apartments. Same apartments, 67% increase in cost.

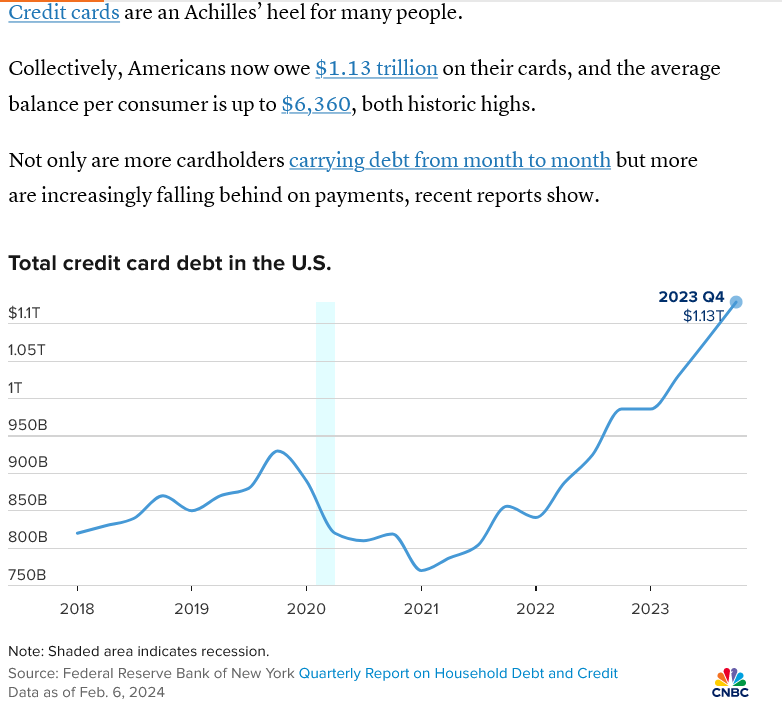

Thank you for sharing your perspective. I post a lot of similar charts during conversations to give a visual effect.

I entered the work force around 1970 and remember the old guy's and their sayings. One was "It's not how much money you make, it's how much you hold on to". There was wisdom in those words. I did not hold on to enough. Today, a working middle class family man makes a lot more than I did in 1970. The challenge today is much greater to "hold on to it". I see this with my son and his family.

Glance back up at this chart. Take note of the "angle of decline". This is unsustainable. The very worst place for an American to "park his money" is in a bank in the form of USD's. The rest of the world never left "the gold standard".

The stock markets are nothing more than a balloon near the point of bursting. That will wipe out the majority of retirement programs. Some are hedged against a crash but in the end they will pay out in USD's to their clients.

# 1 - Stay out of debt. It will only get worse with indexing interest rates.

# 2- When the FED eventually reduces interest rates, beware of the increase of inflation. Cheap money is one reason we are in this situation.

# 3 - Build yourself a "financial safe room".

:max_bytes(150000):strip_icc()/122574802-5bfc2b8d46e0fb0026016ef5.jpg)

What Is the Gold Standard? Advantages, Alternatives, and History

Learn more about the gold standard, including its complicated global history and its connection to the fiat system and the U.S. dollar today.

It's just history repeating itself. The the "Oil Embargo of the 70's", the S&L crash of 80's, the "Great Recession of 2008"....so it's the banks fault people take out credit cards and use them like monopoly money at a casino?

The entire financial world took hits during those times.

"We the People" did not react quick enough to the storms that were brewing.

Today another storm is brewing. Once again, 90% of Americans will continue on their merry way until the storm sinks their boat.

The "Investment Banker's" will also take the hit... but they are playing with other people's money. Their money is building retreats to ride out the storm.

I hope I am wrong.

Fortified Homes - Get a Fortified Home at Hardened Structures Inc

Fortified Homes. A fortified home that is safe and secure against a variety of threats is an excellent way to protect your investment and your family

There is a combat tactic that well bring everyone out of those kinds of places within 60 seconds, or they will never come out alive. Everything you need can be had at Walmart, Lowes or homo depot.

Fortified Homes - Get a Fortified Home at Hardened Structures Inc

Fortified Homes. A fortified home that is safe and secure against a variety of threats is an excellent way to protect your investment and your familywww.hardenedstructures.com

you're missing the pointAre you a banker?

The point is they have a monopoly on the money.

R

and no, there is no monopoly on money as you choose how you spend and save

spending is about choice and you choose to use those rates and agreements or not. You being universal here but if your only defense of your comment is 'are you a banker' well then you've already lost because the concept behind behind choice is lost on you

No one forces you to spend above your means, use credit cards like monopoly money, or not save or even pay off your spending. that choice is the consumer

I've zero sympathy for 'adult's that can't manage their finances

this is NO different than college debt

If you'd look closely I never said the patrons aren't without fault.you're missing the point

and no, there is no monopoly on money as you choose how you spend and save

spending is about choice and you choose to use those rates and agreements or not. You being universal here but if your only defense of your comment is 'are you a banker' well then you've already lost because the concept behind behind choice is lost on you

No one forces you to spend above your means, use credit cards like monopoly money, or not save or even pay off your spending. that choice is the consumer

I've zero sympathy for 'adult's that can't manage their finances

this is NO different than college debt

How many institutions print money, IE disperse it, to banking of any sort?

Not trying to win or lose.

The banking cartels are in bed with our Gov.

BTW the Fed is a private business.

Areas of grey more than black and white.

Your strawman addition of school debt isn't the subject.

Tell me all about the spending for groceries, added cost, being a choice.

For that matter any and all goods as they print trillions?...

R

if you only knew just how lost you were here. First of all, only the Fed controls money supply and the Fed mandates all sorts of provisions that you and joe public doesn't have a clue about. No other institution prints money, that is one of the dumber things I've read in a long time. did you know that every tier 1 bank increased their reserves over the 15 mos not once, not twice but 3x? Did you know that Amex just increased their reserves 40%? Banks and money lenders/credit extenders don't do this to fk you, they do it to protect their balance sheet from irresponsible parties in the event of economic loss. This is part of doing business and has zero to do uncle sam or joe q public, it's self interest. If the banks were in bed with gov't, they'd be reducing reserves and extending more credit to generate for fees etc.. You just simply don't have a clue how credit or banking worksIf you'd look closely I never said the patrons aren't without fault.

How many institutions print money, IE disperse it, to banking of any sort?

Not trying to win or lose.

The banking cartels are in bed with our Gov.

BTW the Fed is a private business.

Areas of grey more than black and white.

Your strawman addition of school debt isn't the subject.

Tell me all about the spending for groceries, added cost, being a choice.

For that matter any and all goods as they print trillions?...

R

and my college debt isn't a strawman, it's analogous. Respectfully, you swim in the shallow end and are now in the deep end. you won't last here

LOL, let's hear your dissertation on the TARP bailout.if you only knew just how lost you were here. First of all, only the Fed controls money supply and the Fed mandates all sorts of provisions that you and joe public doesn't have a clue about. No other institution prints money, that is one of the dumber things I've read in a long time. did you know that every tier 1 bank increased their reserves over the 15 mos not once, not twice but 3x? Did you know that Amex just increased their reserves 40%? Banks and money lenders/credit extenders don't do this to fk you, they do it to protect their balance sheet from irresponsible parties in the event of economic loss. This is part of doing business and has zero to do uncle sam or joe q public, it's self interest. If the banks were in bed with gov't, they'd be reducing reserves and extending more credit to generate for fees etc.. You just simply don't have a clue how credit or banking works

and my college debt isn't a strawman, it's analogous. Respectfully, you swim in the shallow end and are now in the deep end. you won't last here

I noticed you've neglected to answer if you work in banking.

List the reasons why they increased their reserves.

List the irresponsible parties and why they'd take the risks with these customers.

Skipped the inflationary parts as well.

R

They still do not have enough reserves. Those increases you quoted are nothing more than adjusting for inflation.if you only knew just how lost you were here. First of all, only the Fed controls money supply and the Fed mandates all sorts of provisions that you and joe public doesn't have a clue about. No other institution prints money, that is one of the dumber things I've read in a long time. did you know that every tier 1 bank increased their reserves over the 15 mos not once, not twice but 3x? Did you know that Amex just increased their reserves 40%? Banks and money lenders/credit extenders don't do this to fk you, they do it to protect their balance sheet from irresponsible parties in the event of economic loss. This is part of doing business and has zero to do uncle sam or joe q public, it's self interest. If the banks were in bed with gov't, they'd be reducing reserves and extending more credit to generate for fees etc.. You just simply don't have a clue how credit or banking works

and my college debt isn't a strawman, it's analogous. Respectfully, you swim in the shallow end and are now in the deep end. you won't last here

Keeping "reserves" cost them money, in the long run.

A run on a bank will not take more than one day.

incorrect but it's a logical assumption base on where we are but it's incorrect. The reserves are more than enough, at least for tier 1 banks, to withstand a liquidity run by mid major bank runs which is vital to the health of the economy. The reserves are meant to protect non liquid assets on the balance sheet as well provide funding for various mkt stresses. One other thing those reserves are meant for; they are meant to help fund bailouts of the smaller regional banks that are very poorly run. That should piss everyone offThey still do not have enough reserves. Those increases you quoted are nothing more than adjusting for inflation.

Keeping "reserves" cost them money, in the long run.

A run on a bank will not take more than one day.

contrary what the ignoramous who said banks print money said earlier, banks have the same concerns you and I do, only scale and scope is different.

My concern in all of this housing and a FED that is involved in too many things outside of it's mandate which puts a very visible hand in the markets most notibly, the reduction of risk. No risk leads to bigger issues for instance, last year the FED basically insured ALL deposits which will lead to more regional bank failures which in turn leads to more reserves kept by bigger banks which in turn reduces economic activity which will ultimately lead to more printing of money by the FED to increase money supply BECAUSE WE ALL KNOW ONLY TH E FED PRINTS MONEY AND NOT BANKS lol

Last edited:

TARP holy shit you are all over the place. you're just angry and throwing spitballs at the wall you know nothing about which speak save some talking points from whatever shithead blog you read. you fail and anyone that thinks banks print money is beyond educating. TARP lolLOL, let's hear your dissertation on the TARP bailout.

I noticed you've neglected to answer if you work in banking.

List the reasons why they increased their reserves.

List the irresponsible parties and why they'd take the risks with these customers.

Skipped the inflationary parts as well.

R

Never said banks print money.TARP holy shit you are all over the place. you're just angry and throwing spitballs at the wall you know nothing about which speak save some talking points from whatever shithead blog you read. you fail and anyone that thinks banks print money is beyond educating. TARP lol

Still haven't answered my question about working in banking.

The reason it's applicable is you are painting a picture of benevolent banking when clearly that's a fucking lie.

You broadened the subject now call foul.

I've been a patron of the system for several decades.

7 figure line of credit.

Perfectly clear how it works on this end.

Simple question, do you working in banking?

R

There is a lot of smoke and mirror's in the credit / interest arena. The American family making 4.35% interest on savings while paying 36% on credit card interest is in an unsustainable situation. It is becoming more obvious, by the day, that paying off debt far out weighs keeping cash in the bank.

The obvious solution is to STOP running up debt. A difficult choice for many American's.

The current highest credit card interest rate is 36% on the First PREMIER® Bank Mastercard Credit Card. The next highest credit card interest rate seems to be 35.99%, charged by the Total Visa® Card and the Milestone® Mastercard®

__________________________________________

wallethub.com

wallethub.com

www.cbsnews.com

www.cbsnews.com

The obvious solution is to STOP running up debt. A difficult choice for many American's.

The current highest credit card interest rate is 36% on the First PREMIER® Bank Mastercard Credit Card. The next highest credit card interest rate seems to be 35.99%, charged by the Total Visa® Card and the Milestone® Mastercard®

__________________________________________

10 best 6-year CD rates for February 2024 (up to 4.35% APY)

If you want to lock in a CD rate for a full six years, there are a handful of good options to consider, including:- First National Bank of America — 4.35% APY: This CD requires a minimum opening deposit of $1,000 and the maximum deposit amount is $1 million; the early withdrawal penalty is equal to 540 days of interest

Highest Credit Card Interest Rates - 2023 & All-Time

10 best 6-year CD rates for February 2024 (up to 4.35% APY)

Don't pass up the opportunity to earn a great interest rate on one of today's best 6-year CD accounts.

BNPL is just one more debt trap.

Pay-in-four BNPL loans are often interest-free if you pay them on time. However, longer-term buy now, pay later loans can have interest rates as high as 30%, rivaling the highest credit card rates. Make sure you understand the rates before applying, because what you don't know can cost you.

Pay-in-four BNPL loans are often interest-free if you pay them on time. However, longer-term buy now, pay later loans can have interest rates as high as 30%, rivaling the highest credit card rates. Make sure you understand the rates before applying, because what you don't know can cost you.

Tracker: 31% Considering Buy Now, Payer Later Loans | LendingTree

31% of consumers say they’re at least considering using a buy now, pay later loan this month, according to the February 2024 LendingTree BNPL Tracker.

www.lendingtree.com

My only debt is a home loan at 2.99%, while my bank is paying me 5.3% on their CDs.

Anyone with credit card debt should be working as hard as they can to eliminate it as soon as possible. It is one of the worst kinds of debt to hold.

Anyone with credit card debt should be working as hard as they can to eliminate it as soon as possible. It is one of the worst kinds of debt to hold.

Are you taxed on CD interest ?My only debt is a home loan at 2.99%, while my bank is paying me 5.3% on their CDs.

Anyone with credit card debt should be working as hard as they can to eliminate it as soon as possible. It is one of the worst kinds of debt to hold.

The challenge is to be happy while living your final years. Most American's can't do that.If you time it right, you should die with $0 and your credit maxed out.

Invest in Bankruptcy.

www.cnbc.com

www.cnbc.com

Americans have $1.13 trillion in credit card debt. Here are some expert tips to help pay yours off

Cardholders are carrying more credit card debt than ever before and paying record high interest rates. Here are the best ways to jump-start debt repayment.

I'm sorry but those are, make believe Americans. You know the kind that spends on wants vs needs, & vote for the worst of the two evils hoping their share of .gov tit milk will be increased to them,...after its stolen via taxes from true Americans who don't roll that way.Invest in Bankruptcy.

View attachment 8347398

Americans have $1.13 trillion in credit card debt. Here are some expert tips to help pay yours off

Cardholders are carrying more credit card debt than ever before and paying record high interest rates. Here are the best ways to jump-start debt repayment.www.cnbc.com

This. My 43 yo son lost his premium tech job last year. Whole department was suddenly shifted to India. My daughter is now worried about her job that she’s had for 20 years. She’s the best in her field, but companies were forced to allow their employees to work from home during lockdown. Then they realized that hey, we not only save on office space, but if Americans can do this from home, then so can anyone anywhere.

We won't have to worry about it much longer. You can hire 5 Indians per 1 American salary. Slowly watching a company you work for make the transition is disheartening.

Trying to Multi-quote here. I have been in the IT business over 30 years

My company had talked about outsourcing to India for 10 years, it came up at budget time every year

one year they said fuck it, we have to save money and these IT people get paid ridiculous money for not doing any real work

Yes, that is how they viewed us. We didn't do "any real work" because we didn't go out and find customers and find work and bring in profit to the company. It really was that misdirected. They assumed computers had progressed to a point where they just worked auto-magically.

So they got some bids from India, got salesman that told them anything they wanted to hear, they bought in, outsourced us to India

I was marked as a key person to make the transition a success, so I got a HUGE MEGA bonus if I agreed to stay on board and make the transition as smooth as possible. Yes, that meant I was terminated and became an employee of the India based company and now had an India based boss, and my old boss was now my customer, so lol. I also had India based benefits, which shockingly were significantly better than my US company benefits.

Long story short, the outsource to India was a total failure. The India people are cheap, but they don't know shit and they don't give a fuck about your deadlines or your customer deliverables. My company learned a hard lesson that cost them millions. They fired the India company and for those of us that were left (not many) they hired us back (yes with a raise and another bonus)

The India outsource for IT only works if you have a super simple IT environment and you are willing to live to your written SLAs (like 10 days for a simple printer problem to be resolved). Some companies don't care if shit never works right again, mine learned exactly how hard working, smart, and valuable we all were when shit no longer worked and they couldn't get anyone to even respond to them in days

The short term sucks if they end up without a job, long term, India isn't ready to take over a complex IT environment.

FedEx Founder Fred Smith: U.S. record debt ‘unsustainable’

FedEx founder Fred Smith tells FOX News' "Special Report" the U.S. national debt is "unsustainable," adding to growing list of business leaders sounding the alarm

You need to look at balances carried over 60 days and as a % of income... and maybe % of net wealth.

I routinely charge and payoff $5K/month just for points. It's a rounding error on my net wealth.

This will likely paint a much harsher picture for younger people.

I do the same thing, but pay it off weekly. Just better for me and to keep me "under control of my spending".

Takes 10min on the phone to do.

Trying to Multi-quote here. I have been in the IT business over 30 years

My company had talked about outsourcing to India for 10 years, it came up at budget time every year

one year they said fuck it, we have to save money and these IT people get paid ridiculous money for not doing any real work

Yes, that is how they viewed us. We didn't do "any real work" because we didn't go out and find customers and find work and bring in profit to the company. It really was that misdirected. They assumed computers had progressed to a point where they just worked auto-magically.

So they got some bids from India, got salesman that told them anything they wanted to hear, they bought in, outsourced us to India

I was marked as a key person to make the transition a success, so I got a HUGE MEGA bonus if I agreed to stay on board and make the transition as smooth as possible. Yes, that meant I was terminated and became an employee of the India based company and now had an India based boss, and my old boss was now my customer, so lol. I also had India based benefits, which shockingly were significantly better than my US company benefits.

Long story short, the outsource to India was a total failure. The India people are cheap, but they don't know shit and they don't give a fuck about your deadlines or your customer deliverables. My company learned a hard lesson that cost them millions. They fired the India company and for those of us that were left (not many) they hired us back (yes with a raise and another bonus)

The India outsource for IT only works if you have a super simple IT environment and you are willing to live to your written SLAs (like 10 days for a simple printer problem to be resolved). Some companies don't care if shit never works right again, mine learned exactly how hard working, smart, and valuable we all were when shit no longer worked and they couldn't get anyone to even respond to them in days

The short term sucks if they end up without a job, long term, India isn't ready to take over a complex IT environment.

When I worked for Bank of America in IT the manager told me, to my face that I was nothing but grease. I don't do any real work, I just make the machine run better. Someone had to drag me out of his office, they thought I was going to kill him.

Like everyone else, we have a couple of CC's. I'm lucky, meaning we are in a position to use them just for monthly purchases (groceries), to pay utility bills, and to put gas in the car. Extemporaneous crap is paid with cash. All other big items are owned outright (very modest lifestyle). At the end of the month, the wifey pays it off, then in a couple months, we redeem our "Rewards Points". They pay us to use their money. IF, it wasn't for the cost of living, we'd be debt free. We worked hard, we put up with sh%t jobs, sh%t hours, ect., and finally, learned to stay within a budget. Took us damn near 30+ years to learn it, but we did.

Mac

Mac

You have applied "Old School" logic to your situation. I have done the same thing. But, I am in the "squeeze" chute.... Income is above the poverty level and way below the $60,575 average income. Probably explains why I pay close attention to inflation and all the little things that mount up.Like everyone else, we have a couple of CC's. I'm lucky, meaning we are in a position to use them just for monthly purchases (groceries), to pay utility bills, and to put gas in the car. Extemporaneous crap is paid with cash. All other big items are owned outright (very modest lifestyle). At the end of the month, the wifey pays it off, then in a couple months, we redeem our "Rewards Points". They pay us to use their money. IF, it wasn't for the cost of living, we'd be debt free. We worked hard, we put up with sh%t jobs, sh%t hours, ect., and finally, learned to stay within a budget. Took us damn near 30+ years to learn it, but we did.

Mac

What is the average income of a U.S. citizen?

The average salary in the U.S. is $60,575, according to the latest data from the Social Security Administration. How your salary compares will depend on your industry and skilI set, as you'd expect.

...we are both retired, and both retirements net below avg. yearly earnings (according to some stats.). but, with both combined, we eeck out a comfortable life. Average sized home (not 10 rooms/20 baths type), a decent car. I'm the "impulse" buyer of the family. Always have been, always will be. I've learned to curb my habits/hobbies somewhat (that probably helps). We've learned to make it work, as long as nothing drastic happens. We'll see.You have applied "Old School" logic to your situation. I have done the same thing. But, I am in the "squeeze" chute.... Income is above the poverty level and way below the $60,575 average income. Probably explains why I pay close attention to inflation and all the little things that mount up.

What is the average income of a U.S. citizen?

The average salary in the U.S. is $60,575, according to the latest data from the Social Security Administration. How your salary compares will depend on your industry and skilI set, as you'd expect.

If not, I guess I'll be just as F'd as everyone else. Mac

We will never be F'd.......... We are the ones that concern them the most....we are both retired, and both retirements net below avg. yearly earnings (according to some stats.). but, with both combined, we eeck out a comfortable life. Average sized home (not 10 rooms/20 baths type), a decent car. I'm the "impulse" buyer of the family. Always have been, always will be. I've learned to curb my habits/hobbies somewhat (that probably helps). We've learned to make it work, as long as nothing drastic happens. We'll see.

If not, I guess I'll be just as F'd as everyone else. Mac

We are gettin' by with the least right now.

Neither of us "need" anything at this moment.

LOL

My old equation - What I want, What I need, What can I afford = _______________

My daughter is 22, her and her fiance make good money but here in the Tampa, Clearwater area, you can't find a house for under 350k.

That's almost impossible for a young couple.

When I did it in the 90s , same house or condo was 40-75k, very very easily doable. It's stacked against them.

You want to hear something fucked up? I bought my house in 2020 for around $500k and I pay $2,800 a month for my mortgage. My brother has been looking for a house and makes about as much as I do, with interest rates up a $2,800 mortgage gets him a $350k house while my house price has raised to an estimated $700k.

So in the span of less than 4 years there is a $350k swing in what a $2,800 mortgage could afford you. If I had to buy now there is simply no way I could afford the house I have now as the cost per year would be $23,000 higher than it currently is.

If banks weren't making serious bucks from credit cards they'd shitcan them in a second.

This ^^^ is a clue.

Years ago I remember much talk about the gov making it a law that they couldn't charge more than 15% after the initial

"grace" period on the CC balances.

LOL, how'd that go?

They have learned from the loan sharks.

They don't need Pauley, Petey, Pussy to come down and break a leg.

They'll fuck with your income/credit/assets at will, using the LEO.

The credit score system damned near requires the use of a CC to top out 850ish.

Another clue ^^^.

R

I knew Credit scores were bullshit when my Dad paid off a large loan early and his score dropped from 850 into the mid 700’s. It didn’t go back up until he took another loan.

True...You want to hear something fucked up? I bought my house in 2020 for around $500k and I pay $2,800 a month for my mortgage. My brother has been looking for a house and makes about as much as I do, with interest rates up a $2,800 mortgage gets him a $350k house while my house price has raised to an estimated $700k.

So in the span of less than 4 years there is a $350k swing in what a $2,800 mortgage could afford you. If I had to buy now there is simply no way I could afford the house I have now as the cost per year would be $23,000 higher than it currently is.

I knew Credit scores were bullshit when my Dad paid off a large loan early and his score dropped from 850 into the mid 700’s. It didn’t go back up until he took another loan.

A lot of us are locked into a 3% loan on property that has sky rocketed.... We can't afford to leave.

Can you explain for us all the concept of fractional reserve banking, and how it differs from "printing money" in regards to artificially inflating the money supply in the practical sense?BECAUSE WE ALL KNOW ONLY TH E FED PRINTS MONEY AND NOT BANKS

BTW: in the strict definition of the term, the treasury is the only entity that "prints" money. The fed controls the supply by adding to the .gov and "member bank" account balances, they don't "print" anything. They're just the ones who get to control/write in the ledger.

You sound knowledgeable.Can you explain for us all the concept of fractional reserve banking, and how it differs from "printing money" in regards to artificially inflating the money supply in the practical sense?

BTW: in the strict definition of the term, the treasury is the only entity that "prints" money. The fed controls the supply by adding to the .gov and "member bank" account balances, they don't "print" anything. They're just the ones who get to control/write in the ledger.

A question:

Biden has "written off" student loans.

In the private sector, where is that entered in the ledger ? In the government sector ?

Is that added to the National Debt or was it already there?

A lot of people don't realize a high credit score only reflects their continuous relationship with debt and being timely on repaying it, and has virtually nothing to do with their actual financial health. There's a whole lot of retired multi-millionaires that have a indeterminate credit score because they never use a debt device. Ford Motor Credit would turn away someone who could buy their tricked out $110K F350 forty times over in cash, but would gladly saddle someone with a $3000/mo at 96 months truck payment that has a 838 credit score and makes $85k/yr, so long as they trade in a low mileage two year old truck they're already deeply underwater on rolling that into their new loan.I knew Credit scores were bullshit when my Dad paid off a large loan early and his score dropped from 850 into the mid 700’s. It didn’t go back up until he took another loan.

I don't doubt he's a smart man, not for a second, but how many times over the last several decades have we heard "This debt is unsustainable!!!"? They said it at $5T, they said it at $10T, they said it again over and over and over. It still hasn't created an actual case for being unsustainable yet. Maybe when US Credit rating hits B grade, the government will wake the fuck up and realize the hole they dug, but they'll still point fingers at each other playing the blame game while spending what they don't have.

FedEx Founder Fred Smith: U.S. record debt ‘unsustainable’

FedEx founder Fred Smith tells FOX News' "Special Report" the U.S. national debt is "unsustainable," adding to growing list of business leaders sounding the alarmwww.foxbusiness.com

You make good points. "They" said a lot of things over the past 50 years.. Most of it's come true.A lot of people don't realize a high credit score only reflects their continuous relationship with debt and being timely on repaying it, and has virtually nothing to do with their actual financial health. There's a whole lot of retired multi-millionaires that have a indeterminate credit score because they never use a debt device. Ford Motor Credit would turn away someone who could buy their tricked out $110K F350 forty times over in cash, but would gladly saddle someone with a $3000/mo at 96 months truck payment that has a 838 credit score and makes $85k/yr, so long as they trade in a low mileage two year old truck they're already deeply underwater on rolling that into their new loan.

I don't doubt he's a smart man, not for a second, but how many times over the last several decades have we heard "This debt is unsustainable!!!"? They said it at $5T, they said it at $10T, they said it again over and over and over. It still hasn't created an actual case for being unsustainable yet. Maybe when US Credit rating hits B grade, the government will wake the fuck up and realize the hole they dug, but they'll still point fingers at each other playing the blame game while spending what they don't have.

JMHO - I think "unsustainable" will also come true. I don't know exactly when. Like driving a car with the low fuel gauge light on.

Just when we think the USG can't borrow any more money, they find a way. They always find a way to stay employed at the citizenry's expense, it's what politicians do.You make good points. "They" said a lot of things over the past 50 years.. Most of it's come true.

JMHO - I think "unsustainable" will also come true. I don't know exactly when. Like driving a car with the low fuel gauge light on.

Similar threads

- Replies

- 41

- Views

- 4K

- Replies

- 32

- Views

- 3K