Mortgage Rates Hit 6.92%, the Highest in 20 Years

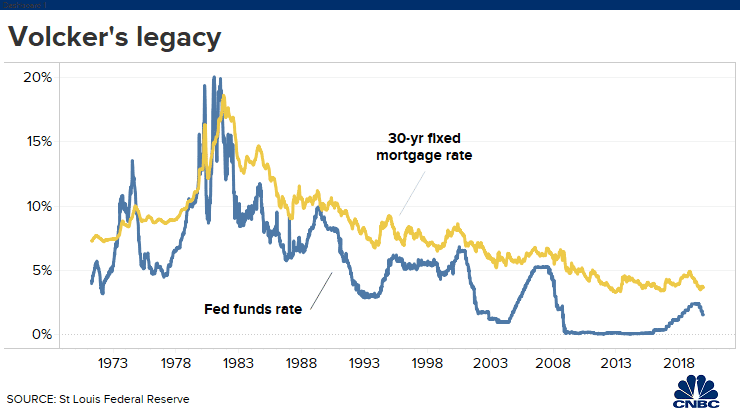

Mortgage rates have more than doubled this year as the Federal Reserve has moved to combat inflation.

s feature is powered by text-to-speech technology. Want to see it on more articles?

Give your feedback below or email [email protected].

Mortgage rates on a 30-year fixed loan are at the highest levels in 20 years.

Andrew Harrer/BloombergThe rate on a popular type of home loan increased this week to its highest level in 20 years, according to data released Thursday.

The average rate on a 30-year fixed loan increased to 6.92% as of Thursday, according to the results of Freddie Mac’s weekly Primary Mortgage Market Survey—the highest such rate since April 2002.

Mortgage rates have more than doubled this year as the Federal Reserve has moved to combat inflation. “We continue to see a tale of two economies in the data,” Sam Khater, Freddie Mac’s chief economist, said in a statement. “Strong job and wage growth are keeping consumers’ balance sheets positive, while lingering inflation, recession fears and housing affordability are driving housing demand down precipitously.”

Prospective buyers have pulled back in recent months as high mortgage rates have weighed on home loan demand. The volume of applications for a loan to purchase a home last week—a leading indicator of buyer demand—was 39% lower than the same week last year, the Mortgage Bankers Association said earlier this week.

Recent inflation news has the potential to keep rates high. Inflation measured by the Consumer Price Index in September was hotter than expected, according to data released Thursday. The 10-year Treasury yield, with which mortgage rates often move, gained following the CPI release.

:max_bytes(150000):strip_icc()/sl-crisis.asp-Final-f916747a014841a0a28e67be567ff5e6.jpg)