Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Recession - 2022 / 2023 / 2024

- Thread starter Hobo Hilton

- Start date

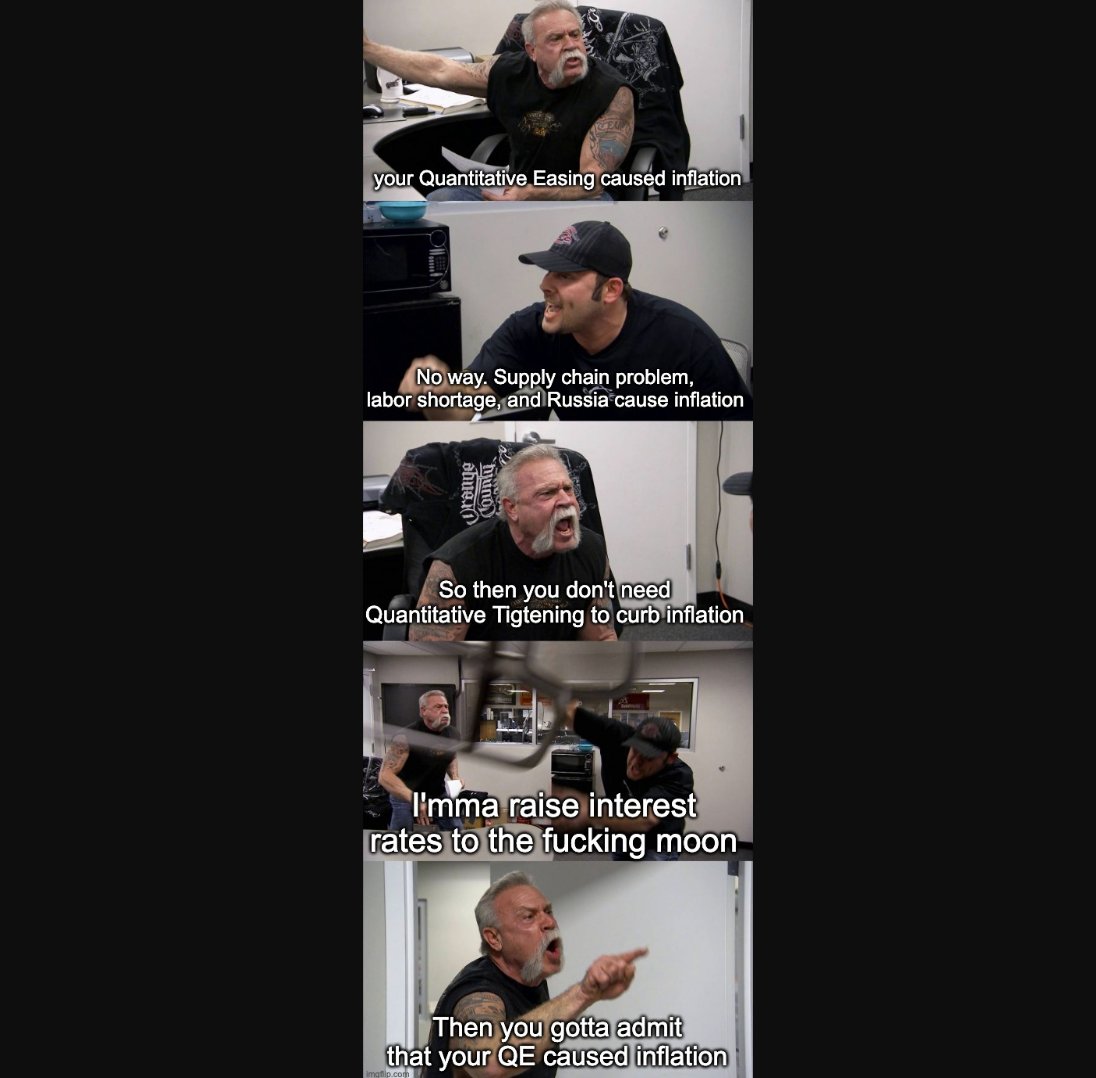

I am waiting for the Fed to open that tool box of things that @Choid said they have. Cuz all I am seeing is the same ol same ol of raising the interest rate.

Let's check in to see how those tools are doing:

ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

... the bottom line is that this is the beginning of the end for the fiat system which now faces a terminal dilemma: fight inflation and suffer market collapse and economic depression with millions laid off, or push to stabilize social order and employment with higher asset prices, runaway (hyper)inflation be damned.

Choid was right about one thing - this isn't 2008 all over again. It's much worse.

Thats about the only general economic statement he had right. I think (IMO only), we are starting to see the first steps of the financial markets seizing up/constricting for this decade's recession. You can't QE your way into positive sentiment in the market or the economy long term. QE is your clue that there is a serious fundamental problem. High inflation rates are as well. Mixing QE with inflation is a whole 'nuther level of Kamikaze.Let's check in to see how those tools are doing:

ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zerowww.zerohedge.com

Choid was right about one thing - this isn't 2008 all over again. It's much worse.

Mixing QE with inflation is a whole 'nuther level of Kamikaze.

I'm looking forward to JPow going all Leroy Jenkins when our bond market freezes.

My engineering coursework required a few econ classes, but I can't recall Prof Barry ever explaining to us anything that would be helpful in analyzing the current situation. Given that he was a hardcore libertarian from the Mises/Austrian school (but I'm being redundant), his major shortcoming was applying logic to a field that required no such constraint.

I'm curious if this thread can remain titled "Recession" before end of the year. Might have to update title to "Global financial meltdown"

People are way underplaying the significance of this mixed with world events. I mean severely. This could go incredibly bad.

People are way underplaying the significance of this mixed with world events. I mean severely. This could go incredibly bad.

I'm convinced it will go incredibly bad. I have yet to see anyone brainstorm a path, even giving a perfect daydream scenario, where they recover. UK is hosed, they have no way out. Reports are the bank of England only has about $300 billion in ammo to buy their currency, which reverses trends for a couple days until they need to do it again. I think they are closer to $250 billion now. At the current rates assuming no other world influence, it's weeks or so until they can't stave off hyper inflation/collapse of the pound.

The unknown IMO is contagion to other countries when UK implodes. Not sure how to find exposure of USA or others when it falls apart. I always assume bankers have found ways of coming up with new internationally tied derivatives that are "sure fire, safe, low risk" ways to make money which also become sure fire ways to go bankrupt. These would then permeate all kinds of other global financials which look similar to 2008. But I don't have evidence of this, only assumptions.

No one knows how big the derivative market is as far as I can tell. Quadrillions (thousands of trillions)? Which means that every big bank and hedge fund has "bets" on various things happening or not happening. And those same organizations have also taken everyone else's bets. So once it starts to go, there is truly no way to unwind it, because everybody owes everybody. Party A can't pay Party B because party C owes party A money which it can't pay until party B pays Party C. Layer after layer after layer.

No need to fact check this article. I was living in Orange County when the house of cards collapsed.No one knows how big the derivative market is as far as I can tell. Quadrillions (thousands of trillions)? Which means that every big bank and hedge fund has "bets" on various things happening or not happening. And those same organizations have also taken everyone else's bets. So once it starts to go, there is truly no way to unwind it, because everybody owes everybody. Party A can't pay Party B because party C owes party A money which it can't pay until party B pays Party C. Layer after layer after layer.

Snug up your seat belt. History will repeat.

Here’s how Orange County went broke 25 years ago

It didn’t matter that Citron had no background in accounting or investing. Or that he had never owned a single share of stock.

Thats the nightmare scenario. The debts worldwide are so interconnected that we are - right now - potentially looking at a very fast unwinding cascade if this doesn't get solved quickly, somehow. If anyone remembers LTCM, the current situation somewhat rhymes with the very real concerns of interconnectedness at that time. The fear was that the financial markets would have collapsed, and part of the problem emanated from two financial crises. The UK trying QE with monetary and price inflation is such bad juju - this will drive the middle class in the UK closer to poverty if not outright into it.I'm convinced it will go incredibly bad. I have yet to see anyone brainstorm a path, even giving a perfect daydream scenario, where they recover. UK is hosed, they have no way out. Reports are the bank of England only has about $300 billion in ammo to buy their currency, which reverses trends for a couple days until they need to do it again. I think they are closer to $250 billion now. At the current rates assuming no other world influence, it's weeks or so until they can't stave off hyper inflation/collapse of the pound.

The unknown IMO is contagion to other countries when UK implodes. Not sure how to find exposure of USA or others when it falls apart. I always assume bankers have found ways of coming up with new internationally tied derivatives that are "sure fire, safe, low risk" ways to make money which also become sure fire ways to go bankrupt. These would then permeate all kinds of other global financials which look similar to 2008. But I don't have evidence of this, only assumptions.

LTCM was a shit show, but this could be the start of our entry into the fourth level of hell. Not even kidding.

Long-Term Capital Management - Wikipedia

I don't think everyone realizes what is going on with this situation - the UK government and the seat of a major financial center in the world is looking at insolvency while being in the middle of winter without much heat, along with the rest of the EU. Once they get out of winter, it's a reduction in food due to supply chains and fertilizer, which will further push prices up. If the UK's financial issues fully come to life and extend to the rest of Europe this could be very difficult for all involved. It will affect the US.

Take a step back from it and let the whole interconnected world scenario sink in. There is a huge reason QE is on the table.

Take a step back from it and let the whole interconnected world scenario sink in. There is a huge reason QE is on the table.

Have a sip of Koolaid as you learn more about Raphael Bostic, the president of the Federal Reserve Bank of Atlanta.

View attachment 7963389

Raphael Bostic is married to Jeffrey Taylor. Bostic is the first African-American and first openly gay person selected to lead a regional Federal Reserve bank. He has no children with his husband. Bostic was named as a potential candidate for Secretary of the Treasury.

In 2020, Bostic wrote an essay for the FRB Atlanta entitled, "A Moral and Economic Imperative to End Racism."[7] In it he wrote that systematic racism drags on the economy.[

Atlanta Fed President Bostic expects job losses but says there’s a really good chance to get to 2% inflation without killing the economy

Raphael Bostic, the president of the Federal Reserve Bank of Atlanta, signaled optimism for the Fed's policies to temper inflation.www.cnbc.com

anyone shorting currency yet..I'm convinced it will go incredibly bad. I have yet to see anyone brainstorm a path, even giving a perfect daydream scenario, where they recover. UK is hosed, they have no way out. Reports are the bank of England only has about $300 billion in ammo to buy their currency, which reverses trends for a couple days until they need to do it again. I think they are closer to $250 billion now. At the current rates assuming no other world influence, it's weeks or so until they can't stave off hyper inflation/collapse of the pound.

The unknown IMO is contagion to other countries when UK implodes. Not sure how to find exposure of USA or others when it falls apart. I always assume bankers have found ways of coming up with new internationally tied derivatives that are "sure fire, safe, low risk" ways to make money which also become sure fire ways to go bankrupt. These would then permeate all kinds of other global financials which look similar to 2008. But I don't have evidence of this, only assumptions.

didn't Soros play this game before?

Take a step back from it and let the whole interconnected world scenario sink in.

Yeah, sure, there's that - but the S&P 500 is back above 3700 and the Nasdaq is just shy of 11k, so how bad can things be?

/sarc

Here's a lesson on the effects of compounding interest on long-dated instruments. Pretty basic stuff, but I get the sense that some younger investors have not seen this material before. It will be on the final exam.

Yeah, sure, there's that - but the S&P 500 is back above 3700 and the Nasdaq is just shy of 11k, so how bad can things be?

/sarc

I'm 400x leveraged long on S&P. Just bought three Lambos with 320 month loans. FREE money, man! Get back in the market!

I don't think everyone realizes what is going on with this situation - the UK government and the seat of a major financial center in the world is looking at insolvency while being in the middle of winter without much heat, along with the rest of the EU. Once they get out of winter, it's a reduction in food due to supply chains and fertilizer, which will further push prices up. If the UK's financial issues fully come to life and extend to the rest of Europe this could be very difficult for all involved. It will affect the US.

Take a step back from it and let the whole interconnected world scenario sink in. There is a huge reason QE is on the table.

On top of this, the governments don't want to solve the underlying problems you listed. They want to force their insane climate cult policy amidst the storm. Situation is about as nuts as Desantis making an order saying all vehicles now need to install sails on the roof to take advantage of the winds to reduce emissions.

Since we're all fucked and I have no solutions, it's shit posting time:

solutions are to short the shit out of everything, and cash in. Hope when you cash in, the $$ can buy some stuff to keep you fed.

SNAFU

Hypothesis on why Germany may leave the EU. Also more info on how bad the EU debt situation has become.

threadreaderapp.com

threadreaderapp.com

Thread by @jameslavish on Thread Reader App

@jameslavish: If you've never heard of TARGET2, you will soon. Why? Europe has a rapidly growing capital balance problem. Time for an ECB 🧵👇 🎯 What is TARGET2? First, TARGET is an acronym that stands for...…

As inflation takes hold, some young people that I know personally started looking for different employment at jobs paying more money. They found new jobs paying 15 % - 20% more than they were making with better benefits. I know, that is really nothing new and it's been going on since the beginning of time. Being responsible workers they gave their employer a "two week notice". Within hours of giving notice, employers came back to them and made some unbelievable offers for them to stay on and continue to work for the company. An increase in wages of almost double what they were making, private offices, more vacation / sick leave and a better medical plan.

When I hear of these kind of offer's to stay, it makes me think that we are entering the new norm. Anyone else hearing of better offers to stay than people were getting in the past ?

www.cnbc.com

www.cnbc.com

When I hear of these kind of offer's to stay, it makes me think that we are entering the new norm. Anyone else hearing of better offers to stay than people were getting in the past ?

Amazon hikes pay for warehouse and delivery workers

The wage hikes come as Amazon prepares to enter the peak holiday shopping season, and it stares down growing organizing efforts among its front-line workforce.

Absolutely. I run a small manufacturing company of a out 200 people and see this all the time. Someone will interview, that the job, and call back the next day saying they were offered more to stay.As inflation takes hold, some young people that I know personally started looking for different employment at jobs paying more money. They found new jobs paying 15 % - 20% more than they were making with better benefits. I know, that is really nothing new and it's been going on since the beginning of time. Being responsible workers they gave their employer a "two week notice". Within hours of giving notice, employers came back to them and made some unbelievable offers for them to stay on and continue to work for the company. An increase in wages of almost double what they were making, private offices, more vacation / sick leave and a better medical plan.

When I hear of these kind of offer's to stay, it makes me think that we are entering the new norm. Anyone else hearing of better offers to stay than people were getting in the past ?

Amazon hikes pay for warehouse and delivery workers

The wage hikes come as Amazon prepares to enter the peak holiday shopping season, and it stares down growing organizing efforts among its front-line workforce.www.cnbc.com

I think that is changing though. My neighbor is the CFO of a publicly traded company and they cut their guidance from 16% this week.

This. It’s a phenomenon that won’t last. The layoffs have started.Absolutely. I run a small manufacturing company of a out 200 people and see this all the time. Someone will interview, that the job, and call back the next day saying they were offered more to stay.

I think that is changing though. My neighbor is the CFO of a publicly traded company and they cut their guidance from 16% this week.

Maybe employers are finally realizing that having double-triple allocated to recruiting instead of retention is retarded. Wishful thinking has me hoping that the days of firing an employee to hire another one at 50%-75% of the salary for the same job are over.As inflation takes hold, some young people that I know personally started looking for different employment at jobs paying more money. They found new jobs paying 15 % - 20% more than they were making with better benefits. I know, that is really nothing new and it's been going on since the beginning of time. Being responsible workers they gave their employer a "two week notice". Within hours of giving notice, employers came back to them and made some unbelievable offers for them to stay on and continue to work for the company. An increase in wages of almost double what they were making, private offices, more vacation / sick leave and a better medical plan.

When I hear of these kind of offer's to stay, it makes me think that we are entering the new norm. Anyone else hearing of better offers to stay than people were getting in the past ?

Amazon hikes pay for warehouse and delivery workers

The wage hikes come as Amazon prepares to enter the peak holiday shopping season, and it stares down growing organizing efforts among its front-line workforce.www.cnbc.com

Doubtful though. The world needs a depression to put those uppity workers back in their place.

That is what I am wondering.... How long those "big pay increase to remain employed" will hold out ?... Could be a situation that bites people in the ass.... Both the employee and the employer.... Another IDKMaybe employers are finally realizing that having double-triple allocated to recruiting instead of retention is retarded. Wishful thinking has me hoping that the days of firing an employee to hire another one at 50%-75% of the salary for the same job are over.

Doubtful though. The world needs a depression to put those uppity workers back in their place.

squeaky wheel might get the grease.. but it's always the first one that gets replaced.

edit - you either have transferrable skills or you don't. Employers aren't doing this for everyone, probably just specific jobs. It's amazing how Corps scream they don't have the money to give you a raise, but if they want to KEEP you - money appears.

edit - you either have transferrable skills or you don't. Employers aren't doing this for everyone, probably just specific jobs. It's amazing how Corps scream they don't have the money to give you a raise, but if they want to KEEP you - money appears.

Wages must be coming up. Look around at what too much "free money" will actually buy.squeaky wheel might get the grease.. but it's always the first one that gets replaced.

edit - you either have transferrable skills or you don't. Employers aren't doing this for everyone, probably just specific jobs. It's amazing how Corps scream they don't have the money to give you a raise, but if they want to KEEP you - money appears.

Jobless claims hit five-month low despite Fed's efforts to slow labor market

Initial filings for unemployment claims fell last week to their lowest level in five months, a sign that the labor market is strengthening.

This. It’s a phenomenon that won’t last. The layoffs have started.

It won't last for everyone, but I think that some employees will maintain leverage even throughout a downturn. Just because thing go to shit for the next 12-18 months doesn't mean that my obligations to develop software for a MY2024 vehicle launch go away, or that universities have suddenly begun to shit out productive software engineers. Might be some rough patches ahead for those that didn't really earn their job titles, but most will come out of this with some sort of bargaining position.

The blue-collar and service workers who were fucked before the pandemic will soon be fucked again, and without any permanent upwards reset of their wages. But they'll still be paying 15% APR on a loan for a 15-year-old SUV so they can pay $4/gal for fuel and $1000/yr for insurance to drive back and forth to 2-3 jobs each day.

I agree with this assessment with a single caveat: the profitability of an industry in general and a specific company regardless of the industry. Worthless employees will go first, woke employers next (roughly the same as worthless), and the best are saved for last. The economy of the individual firms always had the last say. Unless you are in government. What we are beginning to witness is the faltering of demand in a consumer-driven economy. This will trickle down to all sectors. Housing permits coming so low is a good example - all services and trades will be affected. Higher interest rates will only add to it.It won't last for everyone, but I think that some employees will maintain leverage even throughout a downturn. Just because thing go to shit for the next 12-18 months doesn't mean that my obligations to develop software for a MY2024 vehicle launch go away, or that universities have suddenly begun to shit out productive software engineers. Might be some rough patches ahead for those that didn't really earn their job titles, but most will come out of this with some sort of bargaining position.

The blue-collar and service workers who were fucked before the pandemic will soon be fucked again, and without any permanent upwards reset of their wages. But they'll still be paying 15% APR on a loan for a 15-year-old SUV so they can pay $4/gal for fuel and $1000/yr for insurance to drive back and forth to 2-3 jobs each day.

I would never trust an employer who gave a huge wage incentive to stay once you give notice and I would never trust an employee who gave notice then stayed for more cash. I have seen situations where the employee stayed only to be fired or laid off after employer was able to get replacement on their terms.As inflation takes hold, some young people that I know personally started looking for different employment at jobs paying more money. They found new jobs paying 15 % - 20% more than they were making with better benefits. I know, that is really nothing new and it's been going on since the beginning of time. Being responsible workers they gave their employer a "two week notice". Within hours of giving notice, employers came back to them and made some unbelievable offers for them to stay on and continue to work for the company. An increase in wages of almost double what they were making, private offices, more vacation / sick leave and a better medical plan.

When I hear of these kind of offer's to stay, it makes me think that we are entering the new norm. Anyone else hearing of better offers to stay than people were getting in the past ?

Amazon hikes pay for warehouse and delivery workers

The wage hikes come as Amazon prepares to enter the peak holiday shopping season, and it stares down growing organizing efforts among its front-line workforce.www.cnbc.com

Your statement -........... the faltering of demand in a consumer-driven economy..........I agree with this assessment with a single caveat: the profitability of an industry in general and a specific company regardless of the industry. Worthless employees will go first, woke employers next (roughly the same as worthless), and the best are saved for last. The economy of the individual firms always had the last say. Unless you are in government. What we are beginning to witness is the faltering of demand in a consumer-driven economy. This will trickle down to all sectors. Housing permits coming so low is a good example - all services and trades will be affected. Higher interest rates will only add to it.

I think it will be worse than anyone can imagine.

An article written 10 years ago that explains why we are in this predicament:

Think Consumption Is The 'Engine' Of Our Economy? Think Again.

Think Consumption Is The 'Engine' Of Our Economy? Think Again.

What's under the hood? The real driving force of the economy is real savings and investment. (Photo credit: Digital_Third_Eye) Have you heard that the economy is like a car? It’s the most popular analogy in financial reporting and political discourse. The American people are repeatedly told by...

www.forbes.com

www.forbes.com

I have witnessed that during my working years. The difference now is there are no qualified replacements willing to work on their terms.I would never trust an employer who gave a huge wage incentive to stay once you give notice and I would never trust an employee who gave notice then stayed for more cash. I have seen situations where the employee stayed only to be fired or laid off after employer was able to get replacement on their terms.

Let me qualify ... The future could change that dramatically. But the future could shutter these businesses and it will be a moot point....

One more IDK

“We are taking decisive steps to reduce our supply growth, including a nearly 50% wafer-fab equipment capex cut versus last year, and we expect to emerge from this downcycle well-positioned to capitalize on the long-term demand for memory and storage,” said Sanjay Mehrotra, Micron’s chief executive, in a statement.

_______________

Micron... Getting ahead of the curve

www.marketwatch.com

www.marketwatch.com

_______________

Micron... Getting ahead of the curve

Micron cuts capital spending in half to stem oversupply cycle; shares slip

Micron Technology Inc. declined in the extended session Thursday after the memory-chip maker said it was taking steps to emerge from a current downcycle in...

I agree with this assessment with a single caveat: the profitability of an industry in general and a specific company regardless of the industry. Worthless employees will go first, woke employers next (roughly the same as worthless), and the best are saved for last. The economy of the individual firms always had the last say. Unless you are in government. What we are beginning to witness is the faltering of demand in a consumer-driven economy. This will trickle down to all sectors. Housing permits coming so low is a good example - all services and trades will be affected. Higher interest rates will only add to it.

If the company has its say, the best workers will leave last - but the workers get a vote, too, and the best will be the first to vote with their feet if given a reason. It's difficult to overstate the effect of this on overall morale.

I can only imagine the effects of attrition at various large employers, and am guessing we haven't yet seen the full effects of this migration.

Put simply, companies better be investing in their best workers or else they stand to lose far more than whatever they'll pay out in raises.

I would never trust an employer who gave a huge wage incentive to stay once you give notice and I would never trust an employee who gave notice then stayed for more cash. I have seen situations where the employee stayed only to be fired or laid off after employer was able to get replacement on their terms.

I don't know that I agree with your comments on employers who had out large raises (if only because this never happens), but your comment about employees who play the blackmail game is accurate.

I will say there is some nuance in that I've seen good employees who would genuinely like to say ask for a raise in a manner that's perhaps a bit clumsy, the employer interprets this as a threat, and then the guy walks the moment he gets a better offer.

In the professional workforce, it's almost like there is a need for a 3rd party (like an agent) to negotiate this stuff without emotion.

As inflation takes hold, some young people that I know personally started looking for different employment at jobs paying more money. They found new jobs paying 15 % - 20% more than they were making with better benefits. I know, that is really nothing new and it's been going on since the beginning of time. Being responsible workers they gave their employer a "two week notice". Within hours of giving notice, employers came back to them and made some unbelievable offers for them to stay on and continue to work for the company. An increase in wages of almost double what they were making, private offices, more vacation / sick leave and a better medical plan.

When I hear of these kind of offer's to stay, it makes me think that we are entering the new norm. Anyone else hearing of better offers to stay than people were getting in the past ?

Amazon hikes pay for warehouse and delivery workers

The wage hikes come as Amazon prepares to enter the peak holiday shopping season, and it stares down growing organizing efforts among its front-line workforce.www.cnbc.com

Hello

I was working at a Job A. I was making X.

I interviewed for Job B at the advice of a friend who referred me. He stood to make a $15k hiring bonus if I accepted. Job B offered me 1.5*Xplus more vacation and 100% no deductible $0 out of pocket health insurance.

I gave my notice to Job A and they offered me 2*X to stay. I stayed.

I then leveraged 2*X (I did not like Job A) to get 2.5*X at Job C. All of this happened in ~4 months.

Just want to point out I am not early in my career and a highly compensated professional. X was not a small number. 2.5*X is incredibly insane and more than I ever thought I’d make.

I’m shocked everyone hasn’t left their current job. I see people bragging about 18% raises but like 250%? Bro…

/cloudfront-us-east-2.images.arcpublishing.com/reuters/YUGKGAIWM5K4BJKAUVIFZFMY7Q.jpg)

Exclusive: China's state banks told to stock up for yuan intervention

China's central bank has asked major state-owned banks to be prepared to sell dollars for the local unit in offshore markets as it steps up efforts to stem the yuan's descent, four sources with knowledge of the matter said.

I would never trust an employer who gave a huge wage incentive to stay once you give notice and I would never trust an employee who gave notice then stayed for more cash. I have seen situations where the employee stayed only to be fired or laid off after employer was able to get replacement on their terms.

I always figured they aren't worth having if they have to give a notice to get more money. A kid I work with did that last year, but had no intentions of leaving because he knew he couldn't make it anywhere else. He's fucked with how much work he misses and he's late all the time. He was fired for attendance at his previous job as well. They panicked and gave him a pretty big raise so he would stay.

The company complains they can't find help but hasn't actually posted a job posting for the positions we need filled.

Inventory is backing up.. because the "economy is doing great"; per JB; Joe just needs to redefine what great is...

www.zerohedge.com

www.zerohedge.com

ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Budget season is in full swing at companies that have repeatable planning processes. Its a shocker if you are not in growth mode or have COLA based pricing.

For companies that don't have repeatable processes, cash flow will run out. Suddenly.

With the interest rate increases and the above, the air hose is going to run out of air and many will be sucking on an empty tank at 100 feet down.

For companies that don't have repeatable processes, cash flow will run out. Suddenly.

With the interest rate increases and the above, the air hose is going to run out of air and many will be sucking on an empty tank at 100 feet down.

Inventory is backing up.. because the "economy is doing great"; per JB; Joe just needs to redefine what great is...

ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zerowww.zerohedge.com

Hoping I can stock up on running shoes for the next five years...

Similar threads

- Replies

- 26

- Views

- 1K

- Replies

- 0

- Views

- 56

- Replies

- 0

- Views

- 110

- Replies

- 7

- Views

- 881