I assume you are talking about Albemarle.

Correct. I’m entertaining a role there but I believe their HQ is in Charlotte, NC.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

I assume you are talking about Albemarle.

Just a guess here... They must be well managed and have some old school people in their finance department. They think like Warren Buffet and when looking at smaller companies to buy, they "look at the company" and not at the stock. Seems to be working for them.Correct. I’m entertaining a role there but I believe their HQ is in Charlotte, NC.

No idea what's going to happen but some of the tweets and replies are fascinating

(the whole chatgpt.thing is interesting, gotta wonder if some AI whiz is working the financial system)

What you have asked for is "opinions". We all want "looking forward" information. There is ZERO looking forward information is this tweet / conversation / comments. Monday morning could bring big moves in the markets. Movement in the markets is how traders make money. IN a flat market, no one makes any money ( long of short, it don't matter). In this case, it appears that there will be more printing of USD's and that is supposed to be the "float". that will devalue the USD and add to inflation.I’m a lurker on this tread, I don’t understand everything you talk about, but I’m learning.

This may not be the right spot to ask this, but a lot of you are tuned into this. Can anyone break down the quoted tweets into layman’s terms for me?

Thanks

edit- Im not good with the quote function on an iPad.

edit 2- not the chatgpt tweet, the first one regarding the central banks.

I’m long banks for a minute or two along with short dated bonds. There are no doubt a few more svb-type cases but with the no-haircut fed collateral facility there is plenty of liquidity by using the underwater bond holdings. Mark to market won’t happen until after the recession is underway and the fed is cutting rates. Anyway that’s my plan.I’ll take the contrarian view.

The shorter dated swaps are there to provide greater dollar liquidity on a global scale. The dollar is a safe-haven currency so majority of foreign banks own US Bonds. Bank runs aren’t only happening in America but many other countries too. To come up with the necessary liquidity for depositors, foreign banks have to sell their bonds. But what is happening is the US dollar liquidity isn’t there to buy the bonds. The foreign bank and foreign central bank doesn’t have the dollars to exchange for their countries functional currency. The foreign central bank works with our central bank to get dollars under the terms of a swap contract. We get CAD/EUR/YEN/SEK/etc and they get dollars and in a day, week, month the central banks swap back.

This should not be viewed as QE even though the money supply is currently growing.

As America continues to tighten fiscal policy and tighten credit conditions we will see the dollar strengthen.

I like a "man with a plan". At least you are are aware that there is a game. That puts you ahead of 95% of Americans and well ahead of anyone drawing a check on Wall Street. I think a Black Jack dealer in Vegas is more savvy to how the money game is played compared to the Stock Market "experts". Unfortunate for all those building a retirement.I’m long banks for a minute or two along with short dated bonds. There are no doubt a few more svb-type cases but with the no-haircut fed collateral facility there is plenty of liquidity by using the underwater bond holdings. Mark to market won’t happen until after the recession is underway and the fed is cutting rates. Anyway that’s my plan.

I really like Mayur. I currently have my work 401k 100% in a stable fund that invest in the repo market. I'll be waiting to invest back into the S&P myself.

March 30 (Reuters) - Ford Motor Co (F.N) has raised the base price of its popular F-150 Lightning electric pickup truck again, the automaker's website showed on Thursday, the latest in a series of price hikes aimed at offsetting high costs.I am a fan of the Lightning. On the list with ~6 other vehicles I am interested in buying lol

/cloudfront-us-east-2.images.arcpublishing.com/reuters/ST23WMNM65LPTODULYRFJQRGF4.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/6A4WWHZBHVPKLLW62ZQZYCTKJQ.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/7G4XTSQI6FLB7LMWEYNULKFNRA.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/7G4XTSQI6FLB7LMWEYNULKFNRA.jpg)

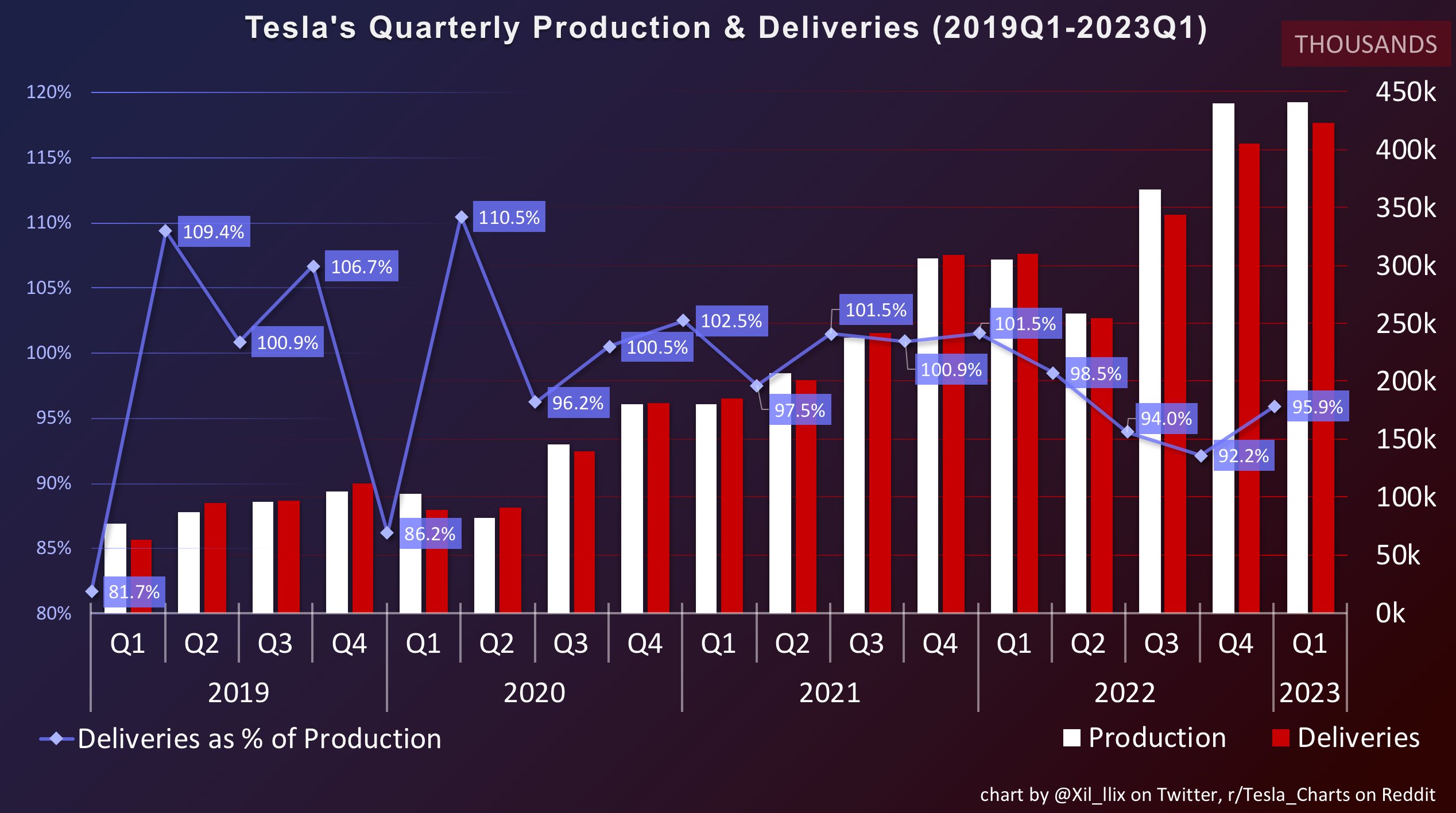

Tesla posts record quarterly deliveries after price cuts, up 4% from Q4

Tesla Inc on Sunday posted record quarterly vehicle deliveries, but quarter-on-quarter sales growth was modest despite price cuts as rising competition and a bleak economic outlook weighed.www.reuters.com

That is a poor county. I'm sure the folks there will welcome 300 good paying jobs. As stated in some of the comments, it is a "good fit".Albemarle Corporation selects Chester County for South Carolina operations | South Carolina Department of Commerce

Albemarle Corporation (Albemarle), a global leader in transforming essential resources such as lithium and bromine into critical ingredients for mobility, energy, connectivity and health, today announced plans to establish South Carolina operations in Chester County. The company will invest at...www.sccommerce.com

You would be a good fit.From what I have learned, Albemarle stood out as they use contract pricing vs. market pricing. Either way, Albemarle hedge's their FX and commodity risk. Moving to a more market price will benefit them more so than contract pricing given they can maintain customer accounts.

Here is a role they are hiring for today:

The Treasury department at Albemarle helps the company maximize shareholder value by delivering the appropriate finance solutions to our businesses. The Sr. Financial Risk Analyst has broad responsibility that includes providing support for FX, commodity and interest rate hedging and capital market activities. In addition, the role will support the global pension asset management activities. The role will interact with a variety of functional areas, including Controlling, Tax, Legal, Audit, Business finance and our banking partners. The position offers significant exposure to our global business and visibility to senior management.

I actually had a recruiter reach out about it. That is how I found out about them haha.You would be a good fit.

Go for it.

I think they have a good foundation and will ride all of this turmoil out. "Old School" is going to be around long after the "New School"... Think Enron vs Exxon.I actually had a recruiter reach out about it. That is how I found out about them haha.

From what I have learned, Albemarle stood out as they use contract pricing vs. market pricing. Either way, Albemarle hedge's their FX and commodity risk. Moving to a more market price will benefit them more so than contract pricing given they can maintain customer accounts.

Here is a role they are hiring for today:

The Treasury department at Albemarle helps the company maximize shareholder value by delivering the appropriate finance solutions to our businesses. The Sr. Financial Risk Analyst has broad responsibility that includes providing support for FX, commodity and interest rate hedging and capital market activities. In addition, the role will support the global pension asset management activities. The role will interact with a variety of functional areas, including Controlling, Tax, Legal, Audit, Business finance and our banking partners. The position offers significant exposure to our global business and visibility to senior management.

Related:Today, we are publishing Master Plan Part 3, which outlines a proposed path to reach a sustainable global energy economy through end-use electrification and sustainable electricity generation and storage. This paper outlines the assumptions, sources and calculations behind that proposal. Input and conversation are welcome.

Master Plan Part 3 | Tesla

www.tesla.com

Just vision, not motion or thermal. From what I know/believe to be true.Is the FSD sensors both motion and thermal ?

Wishful thinking, hope....