The DOW Industrials are holding up due to the input of foreign money. To people / fund managers in other countries this appears to be the last safe haven to park funds. The DOW should be dropping faster than it is, due to incoming $'s, it is holding up. All the same, the DOW is dropping. When these foreign investors get tired of having a bloody nose, they will pull their money and slink off with their tail between their legs. At that time the DOW will drop and run in line with the Russell 2000 and the other indexes with a broad holding of stocks.

Join the Hide community

Get access to live stream, lessons, the post exchange, and chat with other snipers.

Register

Download Gravity Ballistics

Get help to accurately calculate and scope your sniper rifle using real shooting data.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock Market

- Thread starter pmclaine

- Start date

Well, I guess it’s good for American firms to dump their bags on foreigners. They will be back to buy the dip after the crash nukes all the foreign countries investments.

The foreigner's are betting against the house. History repeating itself.Well, I guess it’s good for American firms to dump their bags on foreigners. They will be back to buy the dip after the crash nukes all the foreign countries investments.

BlackRock will be a bottom feeder when the foreign money leaves.

Investment Management & Financial Services | BlackRock

BlackRock is one of the world’s preeminent asset management firms and a premier provider of investment management. Find out more information here.

www.blackrock.com

Did you make 10% on TDOC ?Exited TDOC and BEAM on a nice swing trade.

They should be panicking because the dollar is dying faster and faster. You’ll wake one day and the dollar got devaluated 50% and the coming bank bail - ins are being talked about more frequentlyPeople are pretty funny and emotional about their investments.

The stock market is having a big sale right now. Rather then celebrating and buying, most people are panicking.

When you see reactions like what you are seeing now, from the general populace, it's really no wonder that most people are doing poorly in their investments and generally buying high and selling low.

Trying to capitalize on this is not part of my personal investment strategy, as I'm an Index/ETF guy that plays the long game. But there's certainly lot's of opportunities to be had if you have the knowledge and risk appetite to do so.

I just keep stacking the silver and food items

Did you make 10% on TDOC ?

TDOC was around 5% as I purchased at the higher end and around $52. BEAM was around 11%. Both are very small positions so quite meaningless. Around 1% of the portfolio.

I asked my CFP what is he doing to hedge against inflation. Crickets. Nothing..These guys make make A Lot of money for hardly any work.

Getting a Robo-advisor might be just as effective for much less money.

Getting a Robo-advisor might be just as effective for much less money.

Hedge funds have dramatically scaled back their footprint in the US stock market as sharp swings have pummelled big money managers. Funds that trade with some of the largest banks on Wall Street including Morgan Stanley, Goldman Sachs and JPMorgan Chase have rapidly cut long and short stock positions, or bets on prices rising or falling, according to interviews with traders and data that the banks have circulated to their clients. The moves accompany the worst sell-off in the $46tn US stock market since it was rocked by the coronavirus pandemic two years ago. The benchmark S&P 500 index has fallen 11 per cent this year as investors react to surging inflation, tighter monetary policy from the Federal Reserve and Russia’s invasion of Ukraine, which has helped to drive up commodity prices and thrown global growth forecasts into doubt. “This has become a ‘nowhere to hide’ market,” said Charlie McElligott, a strategist on Nomura’s trading desk. Morgan Stanley last week notified clients that they had seen one of the largest five-day periods of selling in North American stocks by hedge funds on record, noting that the size of the sales trailed only the final week of January 2021, when the retail meme-stock frenzy was roiling markets, and the onset of pandemic lockdowns in March 2020.

I moved some of my investment money to cash several months ago. What are the signs to "buy" in this market for the average individual investor?

So do you think a play into commodities might be a good move?Hedge funds have dramatically scaled back their footprint in the US stock market as sharp swings have pummelled big money managers. Funds that trade with some of the largest banks on Wall Street including Morgan Stanley, Goldman Sachs and JPMorgan Chase have rapidly cut long and short stock positions, or bets on prices rising or falling, according to interviews with traders and data that the banks have circulated to their clients. The moves accompany the worst sell-off in the $46tn US stock market since it was rocked by the coronavirus pandemic two years ago. The benchmark S&P 500 index has fallen 11 per cent this year as investors react to surging inflation, tighter monetary policy from the Federal Reserve and Russia’s invasion of Ukraine, which has helped to drive up commodity prices and thrown global growth forecasts into doubt. “This has become a ‘nowhere to hide’ market,” said Charlie McElligott, a strategist on Nomura’s trading desk. Morgan Stanley last week notified clients that they had seen one of the largest five-day periods of selling in North American stocks by hedge funds on record, noting that the size of the sales trailed only the final week of January 2021, when the retail meme-stock frenzy was roiling markets, and the onset of pandemic lockdowns in March 2020.

I moved some of my investment money to cash several months ago. What are the signs to "buy" in this market for the average individual investor?

“Buy when there's blood in the streets even if the blood is your own.”

So do you think a play into commodities might be a good move?

Probably 6-12 months ago, if my hypothesis is correct that this might play out like the 2005-09 era. I recall discussing the need for daily steel repricing in summer 2008, and six months later it was doing dead-cat bounces off the bottom because we weren't even building cars.

I may very well be wrong, but the Fed itself says that it wants to slow down the economy.

Long term = FoodSo do you think a play into commodities might be a good move?

Wheat, corn, oats, soybeans

Archer Daniels Midland (ADM) has performed well for the past few months.

Jerome Powell's first words were "No one knows where we will be at the end of this year".

I’d be looking into Gold and Silver and Uranium stocks.I moved some of my investment money to cash several months ago. What are the signs to "buy" in this market for the average individual investor?

Powell is hoping of NATO joining the war so he has something to blame other than himself.

I made a posting over in the "Recession" string...Powell is hoping of NATO joining the war so he has something to blame other than himself.

A reoccurring phrase / description Powell repeatedly uses was "Within the Federal Reserve's FRAMEWORK"..

Below is an article stating that the FED's framework is the work of Jerome Powell. It is a proven failure. It has put America behind the economic curve in comparison with the European countries and the Asian countries. They were moving while Powell was sitting on his hands. Now, America (economically) is behind the curve. Jerome had a lot of scapegoats and excuses. Now, Middle Class America will bear the brunt of this recession.

Is Jerome Powell Responsible for the Fed's New Framework?

VASANTH KUMAR - APRIL 30TH, 2021 EDITOR: SEBASTIAN MARSHALL The COVID-19 recession and subsequent policy

econreview.berkeley.edu

econreview.berkeley.edu

Ebb and Flow.... ebb flood and flood drain

European money is propping up the US Markets....Later this year, it will leave. At that time there will be many theories as to why the US Markets keep falling.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/G376JL7VHVOKBB6RU44475TUNE.jpg)

www.reuters.com

www.reuters.com

European money is propping up the US Markets....Later this year, it will leave. At that time there will be many theories as to why the US Markets keep falling.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/G376JL7VHVOKBB6RU44475TUNE.jpg)

Investors keep out of European stocks, flock to U.S., Bank of America says

Investors pulled money out of European equities for a fifth week in a row and flocked to U.S. equities as the Russian invasion of Ukraine weighed on the continent's bourses, BofA wrote on Friday in its weekly report based on EPFR data.

I'm really interested in adding LICY and UMICY. LICY is traded at too high of a valuation and waiting for a better entry into UMICY.

The worldwide recession will take it's toll.... Very few safe havens.Will TSLA close above $1,000? Great stock.

That is fine. I don't intend on ever selling TSLA.The worldwide recession will take it's toll.... Very few safe havens.

Will they ever pay a dividend? If not, I'm thinking of selling at some point. I should've sold at $1,200 & bought back in at a lower price. Rinse and repeat. DISCLAIMER: I know next to nothing about stocks.That is fine. I don't intend on ever selling TSLA.

Assuming TSLA continues to grow and achieve its goals the amount of CF they generate will be unfathomable. Their capital allocation at that time will likely include a dividend alongside a share repo plan.Will they ever pay a dividend? If not, I'm thinking of selling at some point. I should've sold at $1,200 & bought back in at a lower price. Rinse and repeat. DISCLAIMER: I know next to nothing about stocks.

Assuming TSLA continues to grow and achieve its goals the amount of CF they generate will be unfathomable. Their capital allocation at that time will likely include a dividend alongside a share repo plan.

As someone who has been in and out of TSLA multiple times over the years, I am less optimistic than you about Tesla's long term future . Tesla makes a big chunk of change from selling carbon credits to other car manufacturers that have fewer or no EV sales. As more manufacturers enter the EV market not only does Tesla's sales \ market share drop, but those credits become less valuable.

The tax credit that buyers get for buying an EV are still in place but Tesla's eligibility was phased out at the end of 2019 thus there is a $7,500 incentive for buying from another manufacturer (Porsche Taycan comes to mind). Their Powerwall sales have the opportunity to increase as more Gov incentives are created for people & businesses to move toward renewable energy, so there may be a positive there, but long term their market share will be chipped away at at a faster and faster pace. It's nice to get out of the starting gate early, but it's a long race and eventually the pack catches up. It's inevitable.

Here's every electric vehicle that qualifies for the current and upcoming US federal tax credit

Here's a comprehensive guide to help you figure out if your electric vehicle still qualifies for any federal tax credit and state incentives.

Last edited:

It's a large market with no one winner. If Tesla maintains 20% of the EV market in 2030 and continues to improve upon its margins slightly you are over $35 EPS/share (+5x from 2021). 50% CAGR over the next 4-5 years. Also, I am not really concerned about the EV market. It's the vertical integration for me.

Last edited:

Like I said, I am less optimistic than you. Maybe they can integrate a flamethrower into their model 3,

The European Council will meet today/tomorrow to discuss defense, energy, and the economy. It is very clear that the Ukraine crisis has materially accelerated the move towards a broader EU-level response to existential issues around defense and energy dependency.

You bring some valid points to the discussion. The reason the Fed turned to Larry Fink in 2007/08 was due to the total disaster they caused during the S&L crash in the late 80's and 90's.View attachment 7834449View attachment 7834450

Definitely don’t go look up Early Life on Wiki. No, don’t do it.

_____________

The Savings and Loan (S&L) Crisis was a slow-moving financial disaster. The crisis came to a head and resulted in the failure of nearly a third of the 3,234 savings and loan associations in the United States between 1986 and 1995.

:max_bytes(150000):strip_icc()/sl-crisis.asp-Final-f916747a014841a0a28e67be567ff5e6.jpg)

Understanding the Savings and Loan Crisis: Key Events and Its Impact

Discover the key events of the Savings and Loan Crisis that led to over 1,000 bank failures in the 1980s-90s, costing billions, and its lasting effects on financial regulations.

Hey Hobo, what's your opinion on Allianz funds?You bring some valid points to the discussion. The reason the Fed turned to Larry Fink in 2007/08 was due to the total disaster they caused during the S&L crash in the late 80's and 90's.

_____________

The Savings and Loan (S&L) Crisis was a slow-moving financial disaster. The crisis came to a head and resulted in the failure of nearly a third of the 3,234 savings and loan associations in the United States between 1986 and 1995.

:max_bytes(150000):strip_icc()/sl-crisis.asp-Final-f916747a014841a0a28e67be567ff5e6.jpg)

Understanding the Savings and Loan Crisis: Key Events and Its Impact

Discover the key events of the Savings and Loan Crisis that led to over 1,000 bank failures in the 1980s-90s, costing billions, and its lasting effects on financial regulations.www.investopedia.com

They are not real big with about 20 offices. Based in Germany. Have had a run of legal issues with funds that lost money or with investors (fund manager's) who did not understand risk. They have a simple Life Insurance division that only offers two types of policies... Their stock here is listed OTC... Several years ago they were skeptical of cryptocurrency... IMHO, an American with above average interest in the markets could outperform AGI for a couple of reasons. An individual can move quicker and a savvy American feel things going on that a German Investment Management company could overlook....Hey Hobo, what's your opinion on Allianz funds?

Perhaps Bill Ford is looking ahead a few years and is hedging on the recovery. I hope he is right.... IDK

________________________________________________

Ford Motor stock has slipped so far this year, and Executive Chair Bill Ford, great-grandson of company founder Henry Ford, bought a large block of shares of the auto giant.Ford (ticker: F) stock has slid 20% so far in 2022, compared with a 4% drop in the S&P 500 index. Recently target prices have been slipping for both Ford and rival General Motors (GM). Cost inflation, rising interest rates, and persistent parts shortages have been taking a toll. Not surprisingly, earnings estimates have been falling, as well.

Bill Ford paid $4.5 million on March 24 for 267,697 shares, an average price of $16.81 each. He made the purchase through a voting trust that now owns 4.2 million shares, according to a form Bill Ford filed with the Securities and Exchange Commission. He owns another 11.4 million shares through trusts for himself, his children, and annuity trusts.

Ford Motor didn’t immediately respond to a request to make Bill Ford, the great-grandson of founder Henry Ford, available for comment.

bigcharts.marketwatch.com

bigcharts.marketwatch.com

________________________________________________

Ford Motor stock has slipped so far this year, and Executive Chair Bill Ford, great-grandson of company founder Henry Ford, bought a large block of shares of the auto giant.Ford (ticker: F) stock has slid 20% so far in 2022, compared with a 4% drop in the S&P 500 index. Recently target prices have been slipping for both Ford and rival General Motors (GM). Cost inflation, rising interest rates, and persistent parts shortages have been taking a toll. Not surprisingly, earnings estimates have been falling, as well.

Bill Ford paid $4.5 million on March 24 for 267,697 shares, an average price of $16.81 each. He made the purchase through a voting trust that now owns 4.2 million shares, according to a form Bill Ford filed with the Securities and Exchange Commission. He owns another 11.4 million shares through trusts for himself, his children, and annuity trusts.

Ford Motor didn’t immediately respond to a request to make Bill Ford, the great-grandson of founder Henry Ford, available for comment.

Ford Motor Co., F Quick Chart - (NYS) F, Ford Motor Co. Stock Price - BigCharts.com

F - Ford Motor Co. Basic Chart, Quote and financial news from the leading provider and award-winning BigCharts.com.

I asked my CFP what is he doing to hedge against inflation. Crickets. Nothing..These guys make make A Lot of money for hardly any work.

Getting a Robo-advisor might be just as effective for much less money.

Wow- they actually ignored your email? (@No Degree )

I was dealing with a man today who recently sold his business and is expecting a large inheritance in the near future. He went to a well respected financial advisor who he had known many years. Asked him where to put the expected inheritance. Financial advisor pulled out his top desk drawer and came out with a loaded magazine out a 1911. Laid it on the desk and said "This is where to invest".... At least he got an answer.Wow- they actually ignored your email? (@No Degree )

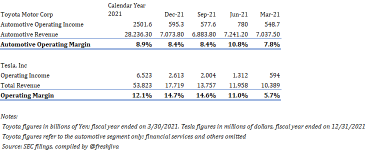

Tesla has surpassed Toyota’s TTM Operating Margin. Toyota, “one the worlds most efficient high-volume manufacturers”.

View attachment 7838245

A big part of the issue is that Toyota has simply been unable to produce and deliver vehicles in any meaningful numbers for almost a year.

Good or bad, I put 30% of my portfolio in cash about a month ago. Everything looks so expensive now. I was so close to buying TSLA a few weeks ago. That gain would have been sweet.

We have a couple of discussions going from folks in the power sports industry who say people are paying cash for a jet ski or a snowmobile and they are flying out the door....Tesla has surpassed Toyota’s TTM Operating Margin. Toyota, “one the worlds most efficient high-volume manufacturers”.

View attachment 7838245

Poked around on the Tesla demographics:

Who is the typical Tesla customer?

The typical Tesla customer is male, in their 50s, own their own home and has a high household income. The ethnicity of Tesla owners skews toward Caucasians, at 87%.

Sounds like a guy who is past the jet ski / snowmobile stage of life. Perhaps just another play toy ?

Tesla Demographics 2024 by Age, Income, Gender, Home Value

Tesla owners have a median age of 48 and an annual income of over $150,000. Learn more demographics about Tesla owners in this free report.

That is overwhelmingly skewed to Model X and S.We have a couple of discussions going from folks in the power sports industry who say people are paying cash for a jet ski or a snowmobile and they are flying out the door....

Poked around on the Tesla demographics:

Who is the typical Tesla customer?

The typical Tesla customer is male, in their 50s, own their own home and has a high household income. The ethnicity of Tesla owners skews toward Caucasians, at 87%.

Sounds like a guy who is past the jet ski / snowmobile stage of life. Perhaps just another play toy ?

Owners of the Model 3 are overwhelmingly male. Women only own 16% of Model 3s and men own 84%. Only 56% of current Tesla Model 3 owners own their own home. Tesla Model 3 owners are less likely to own their home than the general population.

With the oncoming recession he should be making some vehicles for the Soccer Moms.... But, JMHOThat is overwhelmingly skewed to Model X and S.

Owners of the Model 3 are overwhelmingly male. Women only own 16% of Model 3s and men own 84%. Only 56% of current Tesla Model 3 owners own their own home. Tesla Model 3 owners are less likely to own their home than the general population.

The rest of the auto makers have weathered the storms...

I would argue Tesla is positioned best to weather any storm from a net debt position, investment grade rating likely coming this year, no dividend, highest industry margins, and excellent market cap. Additionally, worse case, they would be bailed out with everyone else like 08.With the oncoming recession he should be making some vehicles for the Soccer Moms.... But, JMHO

The rest of the auto makers have weathered the storms...

It will be interesting to watch. In previous recessions those high paid upper level managers were let go. The rumor was, let one of those guy's go and use that pay to keep three guy's producing a product on the factory floor... The skilled workers, who are in short supply now, are positioned well to ride out the recession. Big business will be chopping a lot of dead wood. I'm not singling out TSLA,... "It's just business"...I would argue Tesla is positioned best to weather any storm from a net debt position, investment grade rating likely coming this year, no dividend, highest industry margins, and excellent market cap. Additionally, worse case, they would be bailed out with everyone else like 08.

Most companies are now "too big to fail"... But who's going to bail out the government?

I'm being sarcastic here.... Not out to hurt anyone's feelings.

__________________

Maybe the workers are just tired of working for that highly paid, White guy, Tesla owner who brags that his million dollar home is paid for. You know the ass hole that parks right up at the front door while the workers hike in a mile from the over flow parking lot. Ask me how I know... LOL

www.cnbc.com

www.cnbc.com

__________________

Maybe the workers are just tired of working for that highly paid, White guy, Tesla owner who brags that his million dollar home is paid for. You know the ass hole that parks right up at the front door while the workers hike in a mile from the over flow parking lot. Ask me how I know... LOL

Why pay raises alone won't help fill America's 11 million open jobs

Millions of American are quitting and starting new jobs at record pace while job openings remain at an all-time high.

The government thinks me and you are going to bail them out. You know, the government that can't run a two car parade.Most companies are now "too big to fail"... But who's going to bail out the government?

Similar threads

- Replies

- 13

- Views

- 2K

- Replies

- 0

- Views

- 191

- Replies

- 142

- Views

- 17K